多指標高周波範囲取引戦略

作者: リン・ハーンチャオチャン開催日:2024年12月27日 14:18:57タグ:RSIエイマVOLN-BARTPSL

概要

この戦略は,複数の技術指標に基づいた高周波レンジの取引戦略である.この戦略は,指数移動平均値 (EMA),相対強度指数 (RSI),ボリューム分析,N期価格パターン認識からの信号を組み合わせ,短期取引における最適なエントリーポイントを特定する.事前に定義された利益とストップ損失レベルを通じて厳格なリスク管理を実施する.

戦略原則

基本論理は多次元信号確認に基づいています

- 短期トレンド方向を決定するために 8 期間の EMA と 21 期間の EMA クロスオーバーを使用します.

- 14 期間の RSI を使って市場勢いを検証する.RSI>50 は上昇勢いを確認し,RSI<50 は下落勢を確認する.

- 市場活動を確保するために,現在の量と20期間の平均量を比較します.

- 過去5個のキャンドルを前10個のキャンドルと比較して潜在的な逆転パターンを識別します トレーディング・シグナルは,すべての条件が一致するときにのみ生成される.バリーシグナルではロング・ポジションが市場価格で開かれ,ベアシグナルではショート・ポジションが開かれ.リスクは1.5%のテイク・プロフィートと0.7%のストップ・ロストレベルによって制御される.

戦略 の 利点

- 多次元信号のクロスバリダーションは誤った信号を大幅に減少させる

- トレンドフォローとモメント・トレーディングの利点を組み合わせて適応性を向上させる

- 取引量確認は,不流動期間の取引を防ぐ

- N 期間のパターン認識により,市場の逆転を及時に検出できます

- 効果的なリスク管理のための合理的な利益/損失比

- 明確な論理は,継続的な最適化とパラメータ調整を容易にする

戦略リスク

- 高波動性のある市場では,頻繁にストップ・ロスが起こる可能性があります.

- 市場関係者による値上げ遅延

- すべての指標が一致する際の機会は比較的少ない

- 連続した損失は,様々な市場で起こり得る 緩和措置

- 市場変動に基づいて,収益/損失比率を動的に調整する

- 高流動性の期間の取引

- 信号の量と質をバランスさせるパラメータを最適化

- 収益性を向上させるため,遅延停止を導入する

オプティマイゼーションの方向性

- 市場状況に基づく自動最適化のための適応パラメータ調整メカニズムを導入する

- 過剰な変動で取引を一時停止するために波動性フィルターを追加する

- より洗練されたN周期パターン認識アルゴリズムを開発

- 口座の自己資本に基づいてポジションのサイズを設定する

- シグナル信頼性の向上のために複数のタイムフレームの確認を追加する

概要

この戦略は,多次元的な技術指標協力を通じて高周波取引における高品質な取引機会を特定する. 厳格なリスク管理を通じて安定性を確保しながら,トレンド,モメンタム,およびボリュームの特徴を考慮する. 最適化のための余地がある一方で,論理的に健全で実践的な取引アプローチを表す.

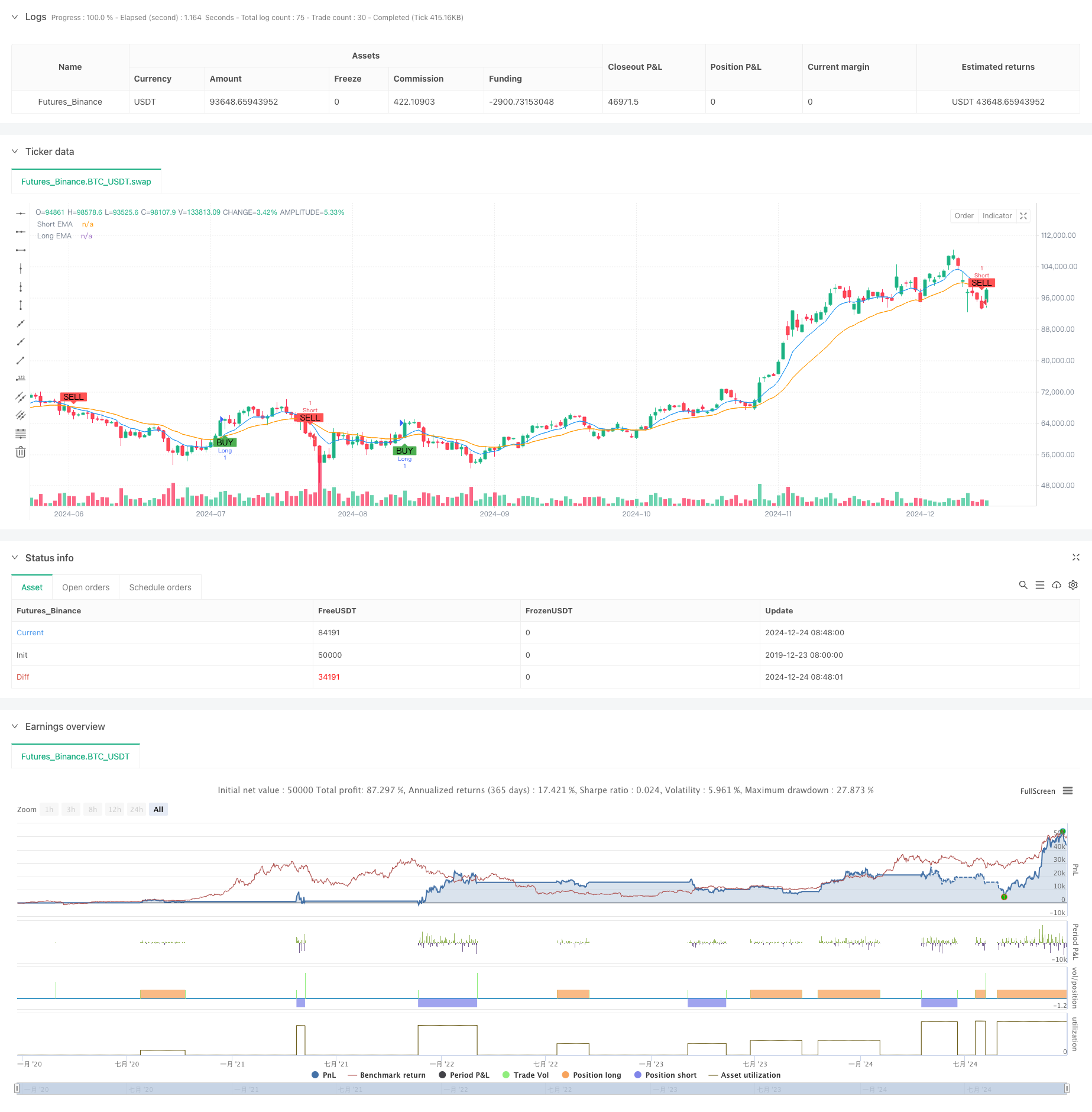

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USD Scalping Strategy with Alerts", overlay=true)

// Input parameters

ema_short = input.int(8, title="Short EMA Period")

ema_long = input.int(21, title="Long EMA Period")

rsiperiod = input.int(14, title="RSI Period")

vol_lookback = input.int(20, title="Volume Lookback Period")

n_bars = input.int(5, title="N-Bars Detection")

take_profit_perc = input.float(1.5, title="Take Profit (%)") / 100

stop_loss_perc = input.float(0.7, title="Stop Loss (%)") / 100

// Indicators

ema_short_line = ta.ema(close, ema_short)

ema_long_line = ta.ema(close, ema_long)

rsi = ta.rsi(close, rsiperiod)

avg_volume = ta.sma(volume, vol_lookback)

// N-bar detection function

bullish_nbars = ta.lowest(low, n_bars) > ta.lowest(low, n_bars * 2)

bearish_nbars = ta.highest(high, n_bars) < ta.highest(high, n_bars * 2)

// Entry conditions

long_condition = ta.crossover(ema_short_line, ema_long_line) and rsi > 50 and volume > avg_volume and bullish_nbars

short_condition = ta.crossunder(ema_short_line, ema_long_line) and rsi < 50 and volume > avg_volume and bearish_nbars

// Plot signals

plotshape(long_condition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(short_condition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy execution

if (long_condition)

strategy.entry("Long", strategy.long)

strategy.exit("TP/SL", from_entry="Long", limit=close * (1 + take_profit_perc), stop=close * (1 - stop_loss_perc))

if (short_condition)

strategy.entry("Short", strategy.short)

strategy.exit("TP/SL", from_entry="Short", limit=close * (1 - take_profit_perc), stop=close * (1 + stop_loss_perc))

// Plot EMA lines

plot(ema_short_line, color=color.blue, title="Short EMA")

plot(ema_long_line, color=color.orange, title="Long EMA")

// Create alerts

alertcondition(long_condition, title="Buy Alert", message="Buy Signal: EMA Crossover, RSI > 50, Volume > Avg, Bullish N-Bars")

alertcondition(short_condition, title="Sell Alert", message="Sell Signal: EMA Crossunder, RSI < 50, Volume > Avg, Bearish N-Bars")

関連性

- ポジションスケーリングによるマルチRSI-EMAモメントヘッジ戦略

- 超売り回転戦略のRSI

- RSIモメンタム強化取引戦略とダブルEMAクロスオーバー

- ダイナミック・ドラウダウン・コントロール・システムによる 適応傾向の戦略

- 多指標ダイナミック取引戦略

- 複数のトレンドをフォローし,構造を突破する戦略

- マルチEMA・クロスオーバーとモメンタム・インディケーターの取引戦略

- 強化された多指標トレンド逆転情報戦略

- KRK ADA 1H ストカスティック・スロー・戦略

- 多指標クロスオーバーモメンタム・トレーディング・戦略

もっと

- マルチEMA動的トレンドキャプチャ量的な取引戦略

- 固定ストップ・ロスの最適化モデルによる動的移動平均値とボリンジャー・バンドのクロス戦略

- RSIトレンド逆転取引戦略 ATRストップ損失と取引エリア制御

- オシレーターとダイナミックサポート/レジスタンスの取引戦略を持つマルチEMAクロス

- 複数のSMAとストーカスティックの組み合わせたトレンド

- 標準化されたロガリズムリターンに基づく適応動的取引戦略

- ストカスティックRSIと移動平均システムに基づく定量分析

- 多指標トレンドクロシング戦略: ブール市場サポートバンド取引システム

- マルチレベルダイナミックMACDトレンドフォロー戦略 52週間の高低延長分析システム

- 双 EMA RSI モメンタム トレンド 逆転 トレーディング システム - EMA と RSI クロスオーバー をベースにしたモメンタム 突破戦略

- 動的トレンドライン ブレイク逆転取引戦略

- EMAとSMAに基づく戦略をフォローする多指標動的傾向

- 強化されたフィボナッチトレンドフォローとリスク管理戦略

- 適性多態EMA-RSIモメントストラテジーは,ショッピネスインデックスフィルターシステム

- インテリジェント指数関数移動平均取引戦略最適化システム

- AI駆動波動性価格システム ダイバージェンス・トレーディング戦略

- ATR ベースのリスク管理による多EMA 傾向を追求するスウィング・トレーディング戦略

- Bollinger Bands と RSI 統合による強化された平均逆転戦略

- サポート/レジスタンスの量的な取引戦略による多期RSI差異

- ダイナミック・ドラウダウン・コントロール・システムによる 適応傾向の戦略