Ichimoku Cloud dan Strategi Purata Bergerak

Penulis:ChaoZhang, Tarikh: 2024-05-17 10:55:29Tag:MASMAICHIMOKU

Ringkasan

Strategi ini menggabungkan Awan Ichimoku, jangka pendek (55) dan jangka panjang (200) Purata Bergerak Sederhana (SMA) untuk mengenal pasti isyarat beli dan jual yang berpotensi. Isyarat beli memerlukan harga berada di atas awan dan SMA jangka panjang, dan untuk menguji semula SMA jangka pendek selepas melintasi di atasnya. Isyarat jual memerlukan harga berada di bawah awan dan SMA jangka panjang, dan untuk menguji semula SMA jangka pendek selepas melintasi di bawahnya. Strategi ini mengelakkan menghasilkan isyarat semasa pasaran berkisar atau peristiwa berita tinggi, kerana tempoh ini cenderung mempunyai lebih banyak palsu.

Prinsip Strategi

Strategi ini berdasarkan prinsip-prinsip berikut:

- Apabila harga berada di atas awan dan SMA jangka panjang, pasaran berada dalam trend menaik.

- Apabila harga di bawah awan dan SMA jangka panjang, pasaran berada dalam trend menurun.

- Crossover SMA jangka pendek mengesahkan trend, dan ujian semula SMA jangka pendek memberikan peluang kemasukan berisiko rendah.

- Pasaran yang berbeza dan peristiwa berita utama mempunyai lebih banyak palsu dan harus dielakkan.

Kod ini mula-mula mengira komponen Ichimoku Cloud yang diperlukan (Garis Penukaran, Garis Asas, Leading Span A dan B), serta SMA jangka pendek dan jangka panjang. Kemudian ia menentukan pelbagai syarat untuk mengenal pasti kedudukan harga berbanding awan dan purata bergerak. Apabila semua syarat beli / jual dipenuhi, kod menghasilkan isyarat beli dan jual masing-masing.

Kelebihan Strategi

- Menggabungkan pelbagai penunjuk untuk mengesahkan trend, meningkatkan kebolehpercayaan isyarat. Awan Ichimoku menapis bunyi bising, sementara silang SMA mengesahkan trend.

- Mencari peluang masuk berisiko rendah pada ujian semula purata bergerak dalam trend yang disahkan.

- Lebih lanjut mengurangkan risiko pemalsuan dengan mengelakkan perdagangan semasa pasaran yang berbeza dan peristiwa berita utama.

- Sesuai untuk perdagangan jangka menengah hingga panjang pada jangka masa 1 jam dan 2 jam, menangkap trend besar dengan potensi keuntungan yang besar.

Risiko Strategi

- Kemerosotan mungkin berlaku semasa pembalikan trend. Walaupun crossover purata bergerak dan pecah awan mengesahkan trend, mereka masih tertinggal.

- Kekurangan tahap stop-loss yang jelas. Keadaan semasa memberi tumpuan kepada masa kemasukan tetapi tidak menentukan titik keluar tertentu.

- Pilihan parameter adalah subjektif dan tidak pasti. Pilihan parameter awan yang berbeza, panjang purata bergerak, dll akan mempengaruhi prestasi strategi.

Arahan Pengoptimuman Strategi

- Memperkenalkan tahap stop-loss yang jelas, seperti pelanggaran tinggi/rendah sebelumnya, kelipatan ATR, dan lain-lain, untuk mengurangkan risiko perdagangan tunggal.

- Perbandingan silang dengan penunjuk pengesahan trend lain, seperti MACD, DMI, dan lain-lain, untuk membentuk kombinasi isyarat yang lebih kukuh.

- Mengoptimumkan parameter untuk mencari kombinasi terbaik yang meningkatkan kemampuan strategi untuk menyesuaikan diri dengan pelbagai keadaan pasaran.

- Membezakan antara pasaran trend dan julat, secara aktif masukkan kedudukan dalam trend sambil mengurangkan kekerapan perdagangan dalam julat.

Ringkasan

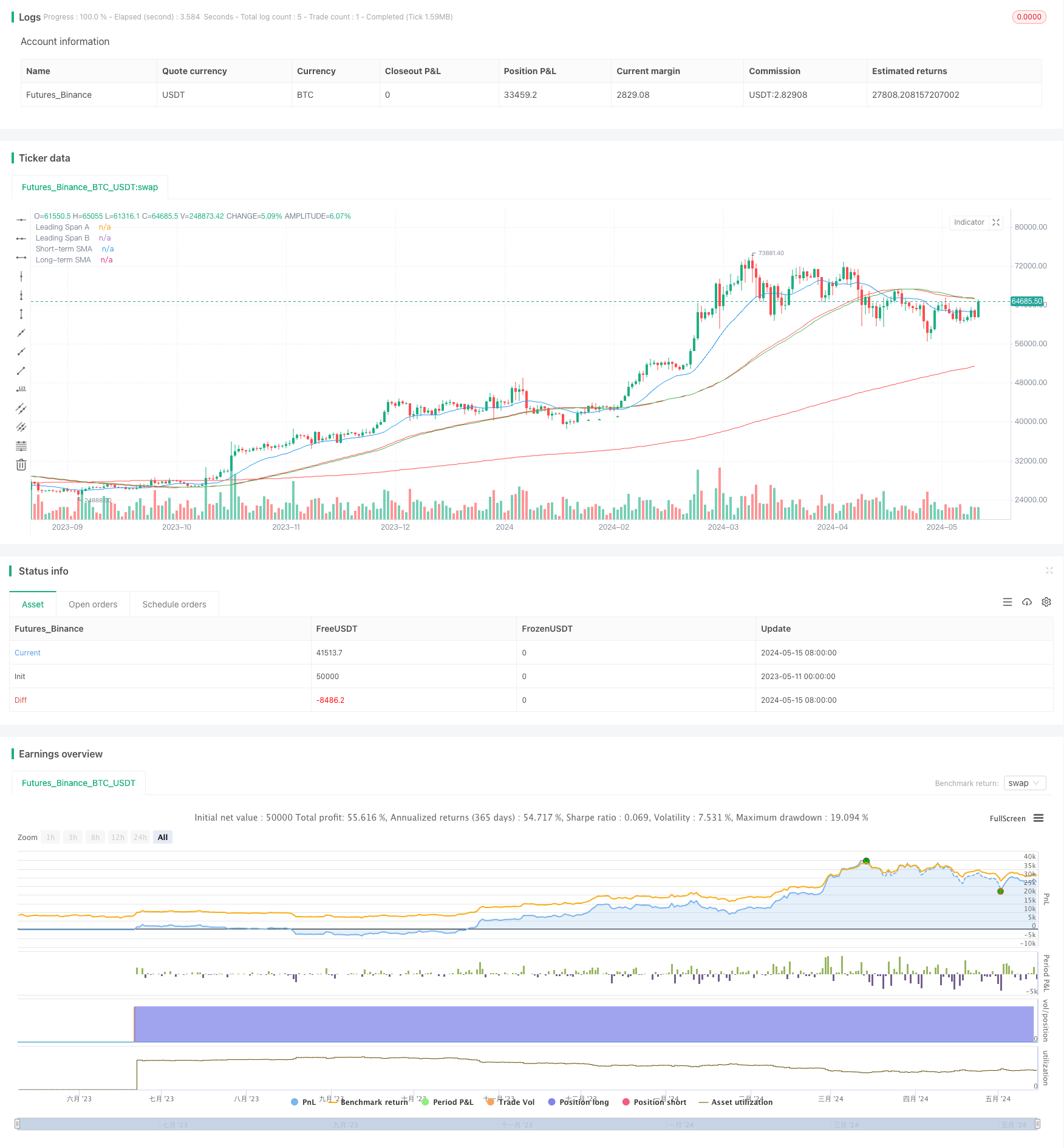

/*backtest

start: 2023-05-11 00:00:00

end: 2024-05-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Cloud and Moving Average Strategy", shorttitle="ICMA", overlay=true)

// Input parameters

shortMA = input.int(55, title="Short-term Moving Average Length")

longMA = input.int(200, title="Long-term Moving Average Length")

// Calculate moving averages

shortSMA = ta.sma(close, shortMA)

longSMA = ta.sma(close, longMA)

// Ichimoku Cloud settings

conversionPeriod = input.int(9, title="Conversion Line Period")

basePeriod = input.int(26, title="Base Line Period")

spanBPeriod = input.int(52, title="Span B Period")

displacement = input.int(26, title="Displacement")

// Calculate Ichimoku Cloud components

conversionLine = ta.sma(high + low, conversionPeriod) / 2

baseLine = ta.sma(high + low, basePeriod) / 2

leadSpanA = (conversionLine + baseLine) / 2

leadSpanB = ta.sma(high + low, spanBPeriod) / 2

// Plot Ichimoku Cloud components

plot(leadSpanA, color=color.blue, title="Leading Span A")

plot(leadSpanB, color=color.red, title="Leading Span B")

// Entry conditions

aboveCloud = close > leadSpanA and close > leadSpanB

belowCloud = close < leadSpanA and close < leadSpanB

aboveShortMA = close > shortSMA

aboveLongMA = close > longSMA

belowShortMA = close < shortSMA

belowLongMA = close < longSMA

// Buy condition (Price retests 55 moving average after being above it)

buyCondition = aboveCloud and aboveLongMA and close[1] < shortSMA and close > shortSMA

// Sell condition (Price retests 55 moving average after being below it)

sellCondition = belowCloud and belowLongMA and close[1] > shortSMA and close < shortSMA

// Strategy entry and exit

strategy.entry("Buy", strategy.long, when = buyCondition)

strategy.entry("Sell", strategy.short, when = sellCondition)

// Plot moving averages

plot(shortSMA, color=color.green, title="Short-term SMA")

plot(longSMA, color=color.red, title="Long-term SMA")

// Plot buy and sell signals

plotshape(series=buyCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(series=sellCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

- MA, SMA, MA Slope, Trailing Stop Loss, Masuk semula

- Strategi Dagangan Rata-rata Bergerak Ganda SMA

- Strategi Pengurusan Risiko Beradaptasi Berdasarkan Purata Bergerak Gelas Emas Berganda

- Strategi crossover purata bergerak berdasarkan purata bergerak berganda

- Strategi Merentasi MA

- Strategi Crossover Cloud Momentum dengan purata bergerak dan pengesahan jumlah

- Pertukaran purata bergerak dengan strategi keuntungan mengambil berbilang

- MA,SMA Dual Moving Average Crossover Strategi

- Strategi silang purata bergerak berganda

- Strategi Crossover Purata Bergerak

- Strategi Penembusan Volatiliti Berbalik

- Nifty 50 3-Minute Pembukaan Julat Breakout Strategi

- Strategi Stop Loss dan Ambil Keuntungan Bollinger Bands yang dinamik

- Strategi Swing High/Low Breakout yang dipertingkatkan dengan corak Bullish dan Bearish Engulfing

- Laguerre RSI dengan Strategi Isyarat Dagangan Disaring ADX

- Strategi Beli Penembusan Harga dan Jumlah

- K Lilin berturut-turut Bull Bear Strategi

- Super Moving Average dan Upperband Crossover Strategi

- Trend pelbagai faktor mengikut Strategi Dagangan Kuantitatif Berdasarkan RSI, ADX, dan Ichimoku Cloud

- Strategi RSI dan MACD Bergabung Pendek Panjang

- William Alligator Moving Average Trend Catcher Strategi

- MACD Dinamik dan Strategi Dagangan Awan Ichimoku

- Strategi Penolakan MA dengan Penapis ADX

- Strategi Bollinger Bands: Perdagangan ketepatan untuk keuntungan maksimum

- Strategi Penembusan Purata ATR

- Strategi Pembelajaran Mesin KNN: Sistem Dagangan Ramalan Trend Berdasarkan Algoritma Jiran K-Pusat

- CCI+RSI+KC Trend Filter Strategi Dagangan Dua Arah

- BMSB Breakout Strategi

- SR Strategi Penembusan

- Bollinger Bands Strategi Penembusan Dinamik