Beli dan Jual Heatmap Volume dengan Strategi Harga Masa Nyata

Penulis:ChaoZhang, Tarikh: 2024-05-24 17:16:58Tag:EMAVWAPSMA

Ringkasan

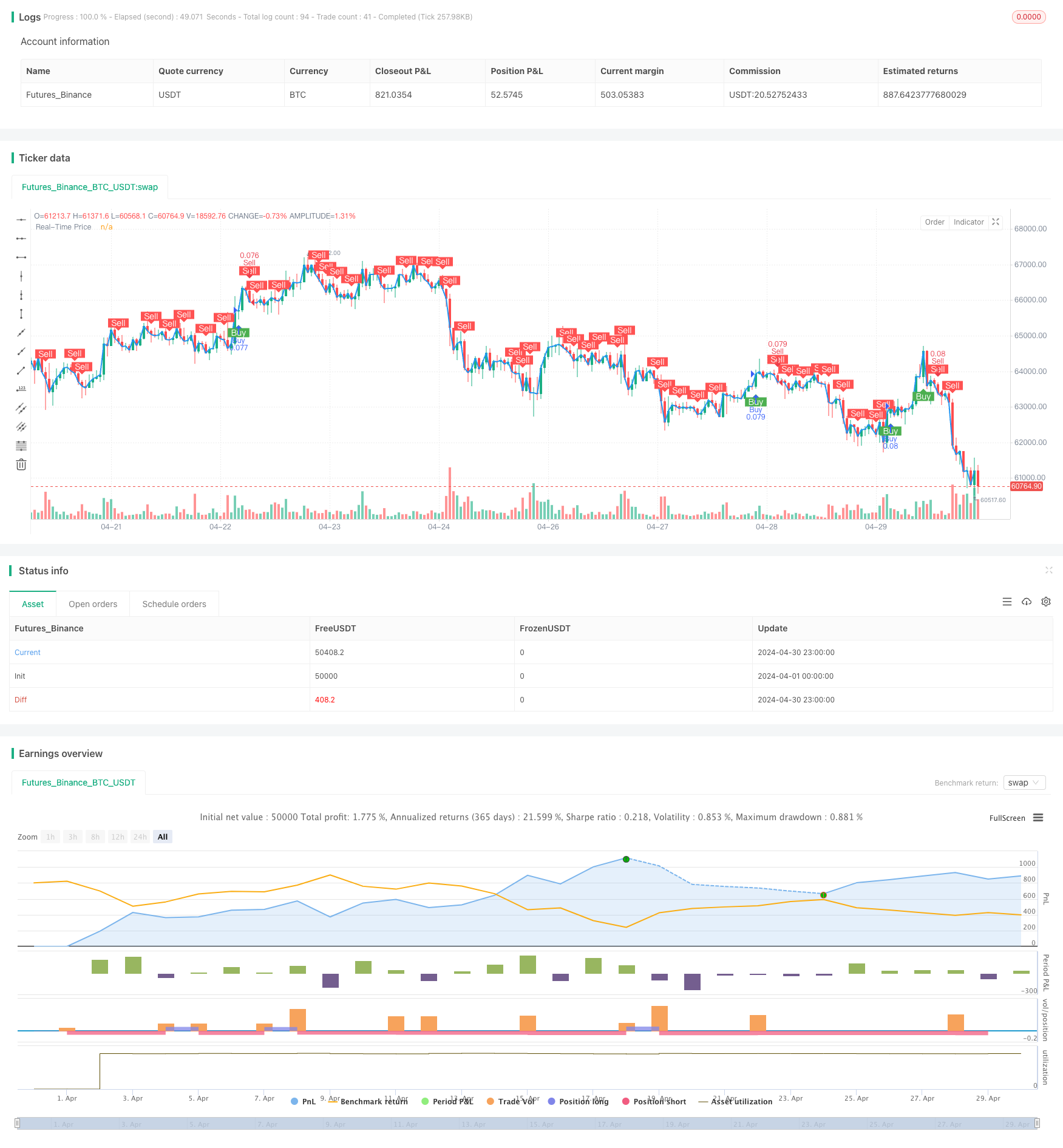

Strategi ini menggabungkan peta haba jumlah dan harga masa nyata untuk menjana isyarat beli dan jual dengan menganalisis pengedaran harga dan jumlah dalam tempoh tertentu. Strategi pertama mengira beberapa tahap harga berdasarkan harga semasa dan peratusan julat harga yang ditetapkan. Ia kemudian mengira jumlah beli dan jual pada setiap tahap harga dalam tempoh yang lalu dan mengira jumlah beli dan jual kumulatif. Warna label ditentukan berdasarkan jumlah beli dan jual kumulatif. Di samping itu, strategi merangka kurva harga masa nyata. Di samping itu, strategi menggabungkan penunjuk seperti EMA dan VWAP untuk menjana isyarat beli dan jual berdasarkan hubungan mereka dengan harga dan jumlah. Isyarat beli dihasilkan apabila syarat beli dipenuhi, dan tiada isyarat terdahulu berlaku. Isyarat jual dihasilkan apabila syarat jual dipenuhi, atau terdapat dua lilin merah berturut-turut, dan tiada isyarat terdahulu berlaku.

Prinsip Strategi

- Mengira beberapa tahap harga berdasarkan harga semasa dan peratusan julat harga yang ditetapkan.

- Mengira jumlah beli dan jual pada setiap tahap harga dalam tempoh yang lalu dan mengira jumlah beli dan jual kumulatif.

- Menentukan warna label berdasarkan jumlah pembelian dan penjualan yang terkumpul dan memaparkan label atau bentuk grafik.

- Menggambar lengkung harga masa nyata.

- Mengira penunjuk seperti EMA dan VWAP.

- Tentukan sama ada syarat beli dipenuhi berdasarkan hubungan antara harga dan penunjuk seperti EMA dan VWAP, serta syarat jumlah.

- Tentukan sama ada syarat jual dipenuhi berdasarkan hubungan antara harga dan penunjuk seperti EMA, serta syarat jumlah. Jika dipenuhi dan tiada isyarat sebelumnya berlaku, menjana isyarat jual. Jika terdapat dua lilin merah berturut-turut dan tiada isyarat sebelumnya berlaku, juga menjana isyarat jual.

- Mencatatkan keadaan keadaan beli dan jual semasa dan mengemas kini status kejadian isyarat.

Analisis Kelebihan

- Gabungan peta haba jumlah dan harga masa nyata menyediakan paparan intuitif mengenai pembahagian harga dan jumlah, berfungsi sebagai rujukan untuk keputusan perdagangan.

- Penggabungan penunjuk seperti EMA dan VWAP memperkaya penilaian keadaan strategi dan meningkatkan kebolehpercayaannya.

- Strategi ini mempertimbangkan pelbagai faktor, termasuk harga, penunjuk, dan jumlah, menjadikan isyarat beli dan jual lebih komprehensif dan kukuh.

- Strategi ini menetapkan batasan untuk penjanaan isyarat untuk mengelakkan penjanaan isyarat berulang secara berterusan, mengurangkan isyarat yang mengelirukan.

Analisis Risiko

- Prestasi strategi boleh dipengaruhi oleh tetapan parameter seperti peratusan julat harga dan tempoh melihat semula, yang memerlukan penyesuaian dan pengoptimuman berdasarkan situasi tertentu.

- Penunjuk seperti EMA dan VWAP mempunyai kelewatan dan batasan yang melekat, yang mungkin menjadi tidak berkesan dalam persekitaran pasaran tertentu.

- Strategi ini terutamanya sesuai untuk pasaran yang sedang berkembang dan boleh menghasilkan lebih banyak isyarat palsu di pasaran yang bergolak.

- Langkah-langkah kawalan risiko strategi ini agak mudah, tidak mempunyai alat pengurusan risiko seperti stop-loss dan saiz kedudukan.

Arah pengoptimuman

- Memperkenalkan lebih banyak penunjuk teknikal dan penunjuk sentimen pasaran, seperti RSI, MACD, Bollinger Bands, dan lain-lain, untuk memperkayakan asas penilaian strategi.

- Mengoptimumkan keadaan untuk menjana isyarat beli dan jual untuk meningkatkan ketepatan isyarat dan kebolehpercayaan.

- Menggabungkan langkah kawalan risiko seperti stop-loss dan saiz kedudukan, menetapkan tahap stop-loss yang munasabah dan saiz kedudukan untuk mengawal pendedahan risiko perdagangan individu.

- Melakukan pengoptimuman parameter dan pengujian semula strategi untuk mencari kombinasi parameter yang optimum dan penerapan pasaran.

- Pertimbangkan untuk menggabungkan strategi ini dengan strategi lain untuk memanfaatkan kekuatan strategi yang berbeza dan meningkatkan kestabilan dan keuntungan keseluruhan.

Ringkasan

Strategi ini menjana isyarat beli dan jual dengan menggabungkan peta haba jumlah, harga masa nyata, dan beberapa penunjuk teknikal, menyediakan nilai rujukan tertentu. Keuntungan strategi ini terletak pada kemampuannya untuk menampilkan pembahagian harga dan jumlah secara intuitif dan secara menyeluruh mempertimbangkan beberapa faktor untuk menjana isyarat. Walau bagaimanapun, strategi ini juga mempunyai beberapa batasan dan risiko, seperti kesan tetapan parameter, sifat ketinggalan indikator, dan bergantung pada pasaran trend. Oleh itu, dalam aplikasi praktikal, pengoptimuman dan peningkatan strategi yang lebih lanjut diperlukan, seperti memperkenalkan lebih banyak penunjuk, mengoptimumkan keadaan isyarat, meningkatkan kawalan risiko, dan lain-lain, untuk meningkatkan kekuatan dan keuntungan strategi.

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy and Sell Volume Heatmap with Real-Time Price Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Settings for Volume Heatmap

lookbackPeriod = input.int(100, title="Lookback Period")

baseGreenColor = input.color(color.green, title="Buy Volume Color")

baseRedColor = input.color(color.red, title="Sell Volume Color")

priceLevels = input.int(10, title="Number of Price Levels")

priceRangePct = input.float(0.01, title="Price Range Percentage")

labelSize = input.string("small", title="Label Size", options=["tiny", "small", "normal", "large"])

showLabels = input.bool(true, title="Show Volume Labels")

// Initialize arrays to store price levels, buy volumes, and sell volumes

var float[] priceLevelsArr = array.new_float(priceLevels)

var float[] buyVolumes = array.new_float(priceLevels)

var float[] sellVolumes = array.new_float(priceLevels)

// Calculate price levels around the current price

for i = 0 to priceLevels - 1

priceLevel = close * (1 + (i - priceLevels / 2) * priceRangePct) // Adjust multiplier for desired spacing

array.set(priceLevelsArr, i, priceLevel)

// Calculate buy and sell volumes for each price level

for i = 0 to priceLevels - 1

level = array.get(priceLevelsArr, i)

buyVol = 0.0

sellVol = 0.0

for j = 1 to lookbackPeriod

if close[j] > open[j]

if close[j] >= level and low[j] <= level

buyVol := buyVol + volume[j]

else

if close[j] <= level and high[j] >= level

sellVol := sellVol + volume[j]

array.set(buyVolumes, i, buyVol)

array.set(sellVolumes, i, sellVol)

// Determine the maximum volumes for normalization

maxBuyVolume = array.max(buyVolumes)

maxSellVolume = array.max(sellVolumes)

// Initialize cumulative buy and sell volumes for the current bar

cumulativeBuyVol = 0.0

cumulativeSellVol = 0.0

// Calculate colors based on the volumes and accumulate volumes for the current bar

for i = 0 to priceLevels - 1

buyVol = array.get(buyVolumes, i)

sellVol = array.get(sellVolumes, i)

cumulativeBuyVol := cumulativeBuyVol + buyVol

cumulativeSellVol := cumulativeSellVol + sellVol

// Determine the label color based on which volume is higher

labelColor = cumulativeBuyVol > cumulativeSellVol ? baseGreenColor : baseRedColor

// Initialize variables for plotshape

var float shapePosition = na

var color shapeColor = na

if cumulativeBuyVol > 0 or cumulativeSellVol > 0

if showLabels

labelText = "Buy: " + str.tostring(cumulativeBuyVol) + "\nSell: " + str.tostring(cumulativeSellVol)

label.new(x=bar_index, y=high + (high - low) * 0.02, text=labelText, color=color.new(labelColor, 0), textcolor=color.white, style=label.style_label_down, size=labelSize)

else

shapePosition := high + (high - low) * 0.02

shapeColor := labelColor

// Plot the shape outside the local scope

plotshape(series=showLabels ? na : shapePosition, location=location.absolute, style=shape.circle, size=size.tiny, color=shapeColor)

// Plot the real-time price on the chart

plot(close, title="Real-Time Price", color=color.blue, linewidth=2, style=plot.style_line)

// Mpullback Indicator Settings

a = ta.ema(close, 9)

b = ta.ema(close, 20)

e = ta.vwap(close)

volume_ma = ta.sma(volume, 20)

// Calculate conditions for buy and sell signals

buy_condition = close > a and close > e and volume > volume_ma and close > open and low > a and low > e // Ensure close, low are higher than open, EMA, and VWAP

sell_condition = close < a and close < b and close < e and volume > volume_ma

// Store the previous buy and sell conditions

var bool prev_buy_condition = na

var bool prev_sell_condition = na

// Track if a buy or sell signal has occurred

var bool signal_occurred = false

// Generate buy and sell signals based on conditions

buy_signal = buy_condition and not prev_buy_condition and not signal_occurred

sell_signal = sell_condition and not prev_sell_condition and not signal_occurred

// Determine bearish condition (close lower than the bottom 30% of the candle's range)

bearish = close < low + (high - low) * 0.3

// Add sell signal when there are two consecutive red candles and no signal has occurred

two_consecutive_red_candles = close[1] < open[1] and close < open

sell_signal := sell_signal or (two_consecutive_red_candles and not signal_occurred)

// Remember the current conditions for the next bar

prev_buy_condition := buy_condition

prev_sell_condition := sell_condition

// Update signal occurred status

signal_occurred := buy_signal or sell_signal

// Plot buy and sell signals

plotshape(buy_signal, title="Buy", style=shape.labelup, location=location.belowbar, color=color.green, text="Buy", textcolor=color.white)

plotshape(sell_signal, title="Sell", style=shape.labeldown, location=location.abovebar, color=color.red, text="Sell", textcolor=color.white)

// Strategy entry and exit

if buy_signal

strategy.entry("Buy", strategy.long)

if sell_signal

strategy.entry("Sell", strategy.short)

- Strategi Perdagangan Teknikal untuk Jadual 15 minit BTC

- Strategi silang EMA/WMA yang dipertingkatkan dengan syarat keluar yang komprehensif

- Multi-EMA Crossover Momentum Strategi

- Saluran SSL

- Strategi Perdagangan Semangat Zon Pecah

- EMA5 dan EMA13 Strategy Crossover

- Strategi Envelope Peratusan Saluran Dinamik

- Strategi crossover purata bergerak berganda SMA

- EMA, SMA, Moving Average Crossover, Penunjuk Momentum

- Penunjuk: WaveTrend Oscillator

- Strategi Isyarat Pendek Panjang berasaskan QQE dan RSI

- Strategi Dagangan Ganda Crossover Zero Lag MACD - Dagangan Frekuensi Tinggi Berdasarkan Penangkapan Trend Jangka Pendek

- Trend Mengikut Strategi Penangguhan Jarak Benar Purata

- Strategi SMC & EMA dengan unjuran P&L

- Nadaraya-Watson Envelope Multi-Pengesahan Strategi Stop-Loss Dinamik

- Strategi Bollinger Bands mengambil keuntungan dinamik

- CCI + MA Crossover Pullback Buy Strategi

- Strategi Jualan Pendek Jangka Pendek untuk Pasangan Mata Wang Likuiditi Tinggi

- MOST Indikator Dual Position Adaptive Strategy

- Bollinger Bands RSI Strategi Perdagangan

- Strategi Dagangan Regresi Purata Bergerak Berganda

- Strategi Perdagangan Kuantitatif Multi-Indikator - Strategi Super-Indikator 7-in-1

- SMK ULTRA TREND Strategi Crossover purata bergerak berganda

- Strategi purata bergerak lima kali lebih kuat

- EMA-SMA Crossover Bull Market Support Band Strategi

- Trend Multi-Timeframe Mengikuti Strategi dengan 200 EMA Filter - Lama sahaja

- Strategi Penembusan Pasaran SMC Tinggi-Rendah

- Strategi Dagangan Tren Dinamik Momentum

- EMA Crossover dengan Strategi Isyarat Jangka Pendek

- Ichimoku Cloud dan Strategi ATR