Rata-rata Bergerak Berbilang Tahap dengan Sistem Dagangan Pengiktirafan Pola Candlestick

Penulis:ChaoZhang, Tarikh: 2024-11-12 16:39:22Tag:EMASMAMA50MA200

Ringkasan

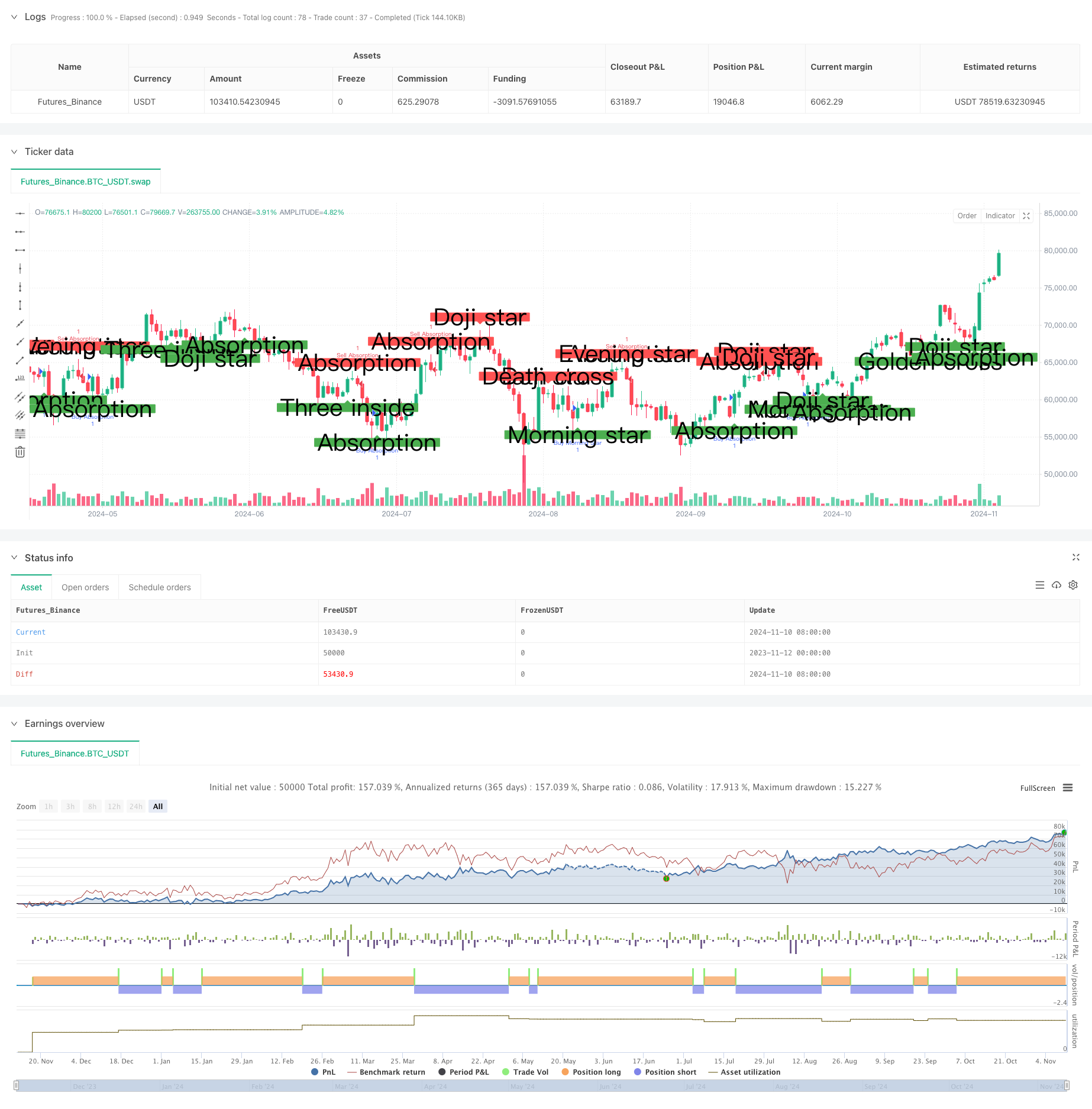

Strategi ini adalah sistem perdagangan analisis teknikal yang komprehensif yang menggabungkan pengenalan corak lilin klasik dengan analisis trend. Sistem ini terutamanya bergantung pada pengenalan pelbagai corak lilin klasik, termasuk lebih daripada sepuluh formasi yang berbeza, sambil menggabungkan purata bergerak jangka pendek dan jangka panjang untuk mengesahkan trend pasaran dan menghasilkan isyarat beli / jual. Strategi ini dapat disesuaikan dengan jangka masa yang berbeza dan sesuai untuk perdagangan jangka pendek dan memegang kedudukan jangka menengah hingga panjang.

Prinsip Strategi

Strategi ini menggunakan mekanisme pengesahan isyarat berlapis-lapis:

- Menggunakan purata bergerak eksponen 6 tempoh (EMA) sebagai penunjuk trend jangka pendek

- Menggunakan purata bergerak mudah (SMA) 50 dan 200 tempoh untuk penilaian trend jangka panjang

- Mengenali pelbagai corak candlestick:

- Keluarga Doji (Doji biasa, Gravestone Doji, Dragonfly Doji)

- Corak palu (Palu, Hanging Man, Inverted Hammer, Shooting Star)

- Corak penyerapan

- Corak dalaman

- Bintang Pagi / Bintang Malam corak

- Tiga tentera/Tiga gagak corak

- Menghasilkan isyarat perdagangan dengan menggabungkan analisis trend dan corak

Kelebihan Strategi

- Pengesahan pelbagai dimensi: Meningkatkan kebolehpercayaan isyarat melalui pengesahan dua kali rata-rata bergerak dan corak candlestick

- Kemudahan penyesuaian yang tinggi: Sesuai dengan persekitaran pasaran yang berbeza, menangkap kedua-dua trend dan pembalikan

- Kawalan risiko yang komprehensif: Mengurangkan isyarat palsu melalui kriteria pengenalan corak yang ketat

- Logik operasi yang jelas: Setiap isyarat dagangan mempunyai syarat kemasukan tertentu

- Keupayaan skala tinggi: Kerangka strategi mudah menampung modul pengenalan corak baru

Risiko Strategi

- Kelewatan pengiktirafan corak: Pelbagai lilin yang diperlukan untuk pengesahan mungkin terlepas titik masuk yang optimum

- Tumpukan isyarat: corak serentak boleh menyebabkan isyarat yang bertentangan

- Kebisingan pasaran: Boleh menghasilkan isyarat palsu yang berlebihan di pasaran yang bergolak

- Sensitiviti parameter: Pemilihan purata bergerak tempoh memberi kesan yang ketara kepada prestasi strategi

- Kerumitan pengiraan: Pengiraan masa nyata pelbagai corak boleh mempengaruhi kecekapan pelaksanaan

Arahan Pengoptimuman Strategi

- Sistem berat isyarat:

- Melaksanakan berat boleh diselaraskan untuk corak yang berbeza

- Sesuaikan berat secara dinamik berdasarkan keadaan pasaran

- Pengiktirafan persekitaran pasaran:

- Tambah penunjuk turun naik untuk mengenal pasti keadaan pasaran

- Penyesuaian parameter strategi berdasarkan keadaan pasaran

- Pengoptimuman Stop-Loss:

- Reka bentuk stop-loss dinamik berdasarkan ciri corak

- Tambah mekanisme hentian

- Penapisan isyarat:

- Memasukkan mekanisme pengesahan jumlah

- Tambah penapis kekuatan trend

- Pengoptimuman kecekapan pengiraan:

- Mempermudah algoritma pengenalan corak

- Mengoptimumkan struktur data

Ringkasan

Strategi ini mengintegrasikan pelbagai alat analisis teknikal untuk membina sistem perdagangan yang lengkap. Kekuatannya utama terletak pada mekanisme pengesahan isyarat berbilang dimensi, walaupun ia menghadapi cabaran kelewatan isyarat dan potensi overfit. Prestasi strategi dapat ditingkatkan dengan menambah pengenalan persekitaran pasaran dan mekanisme penyesuaian parameter dinamik. Dalam aplikasi praktikal, disyorkan untuk mengoptimumkan parameter melalui pengujian belakang dan dilaksanakan bersama-sama dengan sistem pengurusan risiko.

/*backtest

start: 2023-11-12 00:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("hazed candles", shorttitle="hazed candles", overlay=true)

// Inputs

ema_input = input.int(6, title="EMA value to detect trend")

show_doji = input.bool(true, title="Doji star")

show_doji_grave = input.bool(true, title="Doji grave")

show_doji_dragonfly = input.bool(true, title="Doji dragonfly")

show_hammer = input.bool(true, title="Hammer")

show_hanginman = input.bool(true, title="Hanging man")

show_rhammer = input.bool(true, title="Reversed hammer")

show_falling_star = input.bool(true, title="Falling star")

show_absorption = input.bool(true, title="Absorptions")

show_tweezers = input.bool(true, title="Tweezers")

show_triple_inside = input.bool(true, title="Triple inside")

show_three_soldiers = input.bool(true, title="Three soldiers")

show_three_crows = input.bool(true, title="Three crows")

show_morning_evening_stars = input.bool(true, title="Morning / evening stars")

show_golden_death_cross = input.bool(true, title="Golden / Death cross")

// EMA calculation

prev_p_1 = ta.ema(close, ema_input)

// Variables

lowhigh_long_prop = 10

body_prop_size = 9

bar_size_h = high - close

bar_size_l = math.max(open, close) - math.min(close, open)

body_size_h = high - low

low_body_prop = close - low

high_body_prop = high - close

low_half_eq = (low_body_prop > body_size_h / 2.5 and low_body_prop < body_size_h / 1.65)

high_half_eq = (high_body_prop > body_size_h / 2.5 and high_body_prop < body_size_h / 1.65)

open_close_eq = (bar_size_l < body_size_h / body_prop_size)

///////////////// Doji star ///////////////

doji_star_up = show_doji and close <= prev_p_1 and open_close_eq and high_body_prop and low_half_eq

doji_star_down = show_doji and close > prev_p_1 and open_close_eq and high_body_prop and low_half_eq

plotshape(doji_star_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji star")

plotshape(doji_star_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji star")

// Strategy entries for Doji star

if (doji_star_up)

strategy.entry("Buy Doji Star", strategy.long)

if (doji_star_down)

strategy.entry("Sell Doji Star", strategy.short)

///////////////// Doji grave ///////////////

long_high_body = (high_body_prop > bar_size_l * lowhigh_long_prop)

open_low_eq = ((close - low) < body_size_h / body_prop_size)

doji_grave = show_doji_grave and close > prev_p_1 and open_close_eq and open_low_eq and long_high_body

plotshape(doji_grave, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji grave")

// Strategy entries for Doji grave

if (doji_grave)

strategy.entry("Sell Doji Grave", strategy.short)

///////////////// Doji dragonfly ///////////////

long_low_body = (low_body_prop > bar_size_l * lowhigh_long_prop)

open_high_eq = ((high - close) < body_size_h / body_prop_size)

doji_dragonfly = show_doji_dragonfly and close <= prev_p_1 and open_close_eq and open_high_eq and long_low_body

plotshape(doji_dragonfly, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji dragonfly")

// Strategy entries for Doji dragonfly

if (doji_dragonfly)

strategy.entry("Buy Doji Dragonfly", strategy.long)

///////////////// Hammer ///////////////

bottom_low = close - bar_size_h * 15

bottom_high = close - bar_size_h * 1.5

top_low = open + bar_size_l * 1.5

top_high = open + bar_size_l * 15

h_down = show_hammer and prev_p_1 > close and open == high and low > bottom_low and low < bottom_high

plotshape(h_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Hammer")

// Strategy entries for Hammer

if (h_down)

strategy.entry("Buy Hammer", strategy.long)

///////////////// Hanging man ///////////////

hm_down = show_hanginman and prev_p_1 < close and open == high and low > bottom_low and low < bottom_high

plotshape(hm_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Hanging man")

// Strategy entries for Hanging man

if (hm_down)

strategy.entry("Sell Hanging Man", strategy.short)

///////////////// Reversed hammer ///////////////

rh_down = show_rhammer and prev_p_1 > open and low == close and high > top_low and high < top_high

plotshape(rh_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Reversed hammer")

// Strategy entries for Reversed hammer

if (rh_down)

strategy.entry("Buy Reversed Hammer", strategy.long)

///////////////// Fallling star ///////////////

fs_down = show_falling_star and prev_p_1 < close and low == close and high > top_low and high < top_high

plotshape(fs_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Falling star")

// Strategy entries for Falling star

if (fs_down)

strategy.entry("Sell Falling Star", strategy.short)

///////////////// Absorption ///////////////

open_1 = open[1]

close_1 = close[1]

high_1 = high[1]

low_1 = low[1]

open_2 = open[2]

close_2 = close[2]

high_2 = high[2]

low_2 = low[2]

open_3 = open[3]

close_3 = close[3]

high_3 = high[3]

low_3 = low[3]

bar_1 = math.max(open_1, close_1) - math.min(open_1, close_1)

bar_2 = math.max(open_2, close_2) - math.min(open_2, close_2)

bar_3 = math.max(open_3, close_3) - math.min(open_3, close_3)

bar_h = math.max(open, close) - math.min(open, close)

bar_size_min = bar_1 * 1.2

bar_size_f = (bar_h > bar_size_min)

absorption_up = show_absorption and bar_size_f and open_1 > close_1 and open_1 != open and open_3 > open_2 and open_2 > open_1 and open_1 > open and close > open

absorption_down = show_absorption and bar_size_f and open_1 < close_1 and open_1 != open and open_3 < open_2 and open_2 < open_1 and open_1 < open and close < open

plotshape(absorption_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Absorption")

plotshape(absorption_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Absorption")

// Strategy entries for Absorption

if (absorption_up)

strategy.entry("Buy Absorption", strategy.long)

if (absorption_down)

strategy.entry("Sell Absorption", strategy.short)

///////////////// Tweezer ///////////////

match_lows = (low_1 == low or (low_2 == low and open_2 == open_1))

sprici_up = show_tweezers and prev_p_1 > open and match_lows and open_3 > open_2 and open_2 > open_1 and open_1 > open and low != open and close_1 != low_1

plotshape(sprici_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Tweezer")

match_highs = (high_1 == high or (high_2 == high and open_2 == open_1))

sprici_down = show_tweezers and prev_p_1 <= open and match_highs and open_3 < open_2 and open_2 < open_1 and open_1 < open and high != open and close_1 != high_1

plotshape(sprici_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Tweezer")

// Strategy entries for Tweezer

if (sprici_up)

strategy.entry("Buy Tweezer", strategy.long)

if (sprici_down)

strategy.entry("Sell Tweezer", strategy.short)

///////////////// Triple inside up/down ///////////////

open_close_min = math.min(close, open)

open_close_max = math.max(close, open)

bar = open_close_max - open_close_min

open_close_min_1 = math.min(close[1], open[1])

open_close_max_1 = math.max(close[1], open[1])

open_close_min_2 = math.min(close[2], open[2])

open_close_max_2 = math.max(close[2], open[2])

body_top_1 = math.max(close[1], open[1])

body_low_1 = math.min(close[1], open[1])

triple_inside_up = show_triple_inside and open_close_min_2 == open_close_min_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close > open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three inside")

triple_inside_down = show_triple_inside and open_close_max_2 == open_close_max_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close < open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three inside")

// Strategy entries for Triple inside

if (triple_inside_up)

strategy.entry("Buy Triple Inside", strategy.long)

if (triple_inside_down)

strategy.entry("Sell Triple Inside", strategy.short)

///////////////// Triple soldiers / crows ///////////////

triple_solders = show_three_soldiers and prev_p_1 > open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close > close_1 and close_1 > close_2 and open_2 < close_2 and open_1 < close_1

plotshape(triple_solders, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three soldiers")

triple_crows = show_three_crows and prev_p_1 < open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close < close_1 and close_1 < close_2 and open_2 > close_2 and open_1 > close_1

plotshape(triple_crows, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three crows")

// Strategy entries for Three soldiers and Three crows

if (triple_solders)

strategy.entry("Buy Three Soldiers", strategy.long)

if (triple_crows)

strategy.entry("Sell Three Crows", strategy.short)

///////////////// Golden death cross ///////////////

ma_50 = ta.sma(close, 50)

ma_200 = ta.sma(close, 200)

ma_50_200_cross = ta.crossover(ma_50, ma_200) or ta.crossunder(ma_50, ma_200)

golden_cross_up = show_golden_death_cross and ma_50_200_cross and ma_50 > ma_200

plotshape(golden_cross_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Golden cross")

death_cross_down = show_golden_death_cross and ma_50_200_cross and ma_50 < ma_200

plotshape(death_cross_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Death cross")

// Strategy entries for Golden cross and Death cross

if (golden_cross_up)

strategy.entry("Buy Golden Cross", strategy.long)

if (death_cross_down)

strategy.entry("Sell Death Cross", strategy.short)

///////////////// Morning evening stars ///////////////

morning_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_min_2 > open_close_min_1 and open_close_min > open_close_min_1 and prev_p_1 > close_2 and prev_p_1 > close_1 and close > close_1 and close_3 > close_2 and close_2 > close_1 and close > body_top_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(morning_star, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Morning star")

evening_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_max_2 < open_close_max_1 and open_close_max < open_close_max_1 and prev_p_1 < close_2 and prev_p_1 < close_1 and close < close_1 and close_3 < close_2 and close_2 < close_1 and close < body_low_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(evening_star, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Evening star")

// Strategy entries for Morning star and Evening star

if (morning_star)

strategy.entry("Buy Morning Star", strategy.long)

if (evening_star)

strategy.entry("Sell Evening Star", strategy.short)

- Strategi silang purata bergerak berganda

- Strategi Crossover Multi-EMA dengan Pengesahan Trend

- MOST dan strategi silang purata bergerak berganda

- Strategi Dagangan Ambil Keuntungan Dinamik dan Hentikan Kerugian Berdasarkan Tiga Lilin Bearish Berturut-turut dan Purata Bergerak

- BMSB Breakout Strategi

- Penunjuk: WaveTrend Oscillator

- Strategi Beli / Jual Berdasarkan Bentuk Volume & Candlestick

- EMA/SMA Trend Following dengan Swing Trading Strategy Combined Volume Filter dan Peratusan Take-Profit/Stop-Loss System

- Strategi Crossover EMA yang Dinamis Mengikuti Trend

- Saluran SSL

- Strategi Dagangan Dua Arah Penembusan Volatiliti Besar: Sistem Masuk Sempadan Berasaskan Titik

- Strategi Kuantitatif Pembalikan Rata-rata Bollinger yang Ditingkatkan

- Penembusan Kotak Darvas Dinamik dengan Sistem Perdagangan Pengesahan Trend Purata Bergerak

- Strategi Dagangan Kuantitatif EMA Crossover Dinamis Take-Profit Stop-Loss

- Trend Crossover Multi-EMA Mengikut Strategi dengan Peningkatan Stop-Loss dan Take-Profit yang Dinamik

- Strategi crossover purata bergerak berganda dengan pengurusan risiko dinamik

- Strategi penyeimbangan pegangan dua platform

- Pertukaran purata bergerak berganda dengan strategi pengurusan risiko dinamik

- Mengambil kekuatan trend Multi-MA dengan strategi mengambil keuntungan momentum

- Sistem Dagangan Berpeluang Berpeluang

- Strategi Dagangan EMA Trend Momentum Multi-Timeframe

- Strategi Dagangan Berimbang Berasaskan Masa Berputar Pendek dan Lama

- Strategi Dagangan Kuantitatif Trend Dinamik MACD Lanjutan

- Sistem Dagangan Trend Breakout dengan Purata Bergerak (Strategi TBMA)

- ATR-Based Multi-Trend Following Strategy dengan Sistem Pengoptimuman Take-Profit dan Stop-Loss

- RSI Sistem Dagangan Beradaptasi Pintar Berasaskan Momentum dengan Pengurusan Risiko Berbilang Tahap

- Strategi Dagangan Dinamis RSI Osilator Beradaptasi dengan Pengoptimuman Sempadan

- RSI dan AO Trend Synergistic Berikutan Strategi Dagangan Kuantitatif

- Adaptive Trend Momentum RSI Strategy dengan Sistem Penapis Purata Bergerak

- Dual Moving Average Cross RSI Momentum Strategy dengan Sistem Pengoptimuman Risiko-Penghargaan