Gambaran keseluruhan

Strategi ini adalah sistem perdagangan yang komprehensif berdasarkan Indeks Kekuatan Relatif (RSI), Purata Pergerakan (MA) dan momentum harga. Strategi ini terutamanya mengenal pasti peluang dagangan yang berpotensi dengan memantau perubahan arah aliran RSI, persilangan purata bergerak bagi beberapa tempoh masa dan perubahan dalam momentum harga. Strategi ini memberi perhatian khusus kepada aliran menaik RSI dan arah aliran menaik berterusan harga, dan meningkatkan ketepatan urus niaga melalui pelbagai pengesahan.

Prinsip Strategi

Logik teras strategi adalah berdasarkan komponen utama berikut:

- Analisis Trend RSI: Gunakan penunjuk RSI 13 tempoh dan purata bergeraknya untuk mengesahkan kekuatan harga

- Pengesahan momentum harga: memerlukan 3 tahap tertinggi yang lebih tinggi berturut-turut untuk mengesahkan kemampanan arah aliran menaik

- Sistem Purata Pergerakan Berbilang: Menggunakan purata bergerak 21 hari, 55 hari dan 144 hari sebagai penapis arah aliran

- Pengurusan dana: Gunakan 10% daripada ekuiti akaun untuk kawalan kedudukan bagi setiap transaksi Syarat pembelian mesti dipenuhi: RSI lebih besar daripada puratanya, harga membentuk paras tertinggi yang lebih tinggi berturut-turut, RSI mengekalkan arah aliran menaik Syarat jualan termasuk: harga jatuh di bawah purata pergerakan 55 hari atau RSI jatuh di bawah purata dan harga jatuh di bawah purata pergerakan 55 hari

Kelebihan Strategik

- Mekanisme pengesahan berbilang: Meningkatkan kebolehpercayaan isyarat dagangan melalui berbilang pengesahan RSI, momentum harga dan sistem purata bergerak

- Keupayaan penjejakan arah aliran: Strategi ini boleh menangkap arah aliran jangka sederhana dan panjang dengan berkesan serta mengelakkan pecahan palsu

- Kawalan risiko yang sempurna: mengawal risiko melalui pengurusan kedudukan dan keadaan stop loss yang jelas

- Kebolehsuaian yang kuat: boleh digunakan pada tempoh masa dan persekitaran pasaran yang berbeza

- Pengurusan dana yang munasabah: Gunakan peratusan ekuiti akaun untuk mengawal kedudukan dan mengelakkan risiko kedudukan tetap

Risiko Strategik

- Risiko ketinggalan: Purata pergerakan dan penunjuk RSI mempunyai ketinggalan tertentu, yang boleh menyebabkan sedikit kelewatan dalam masa masuk dan keluar.

- Risiko pasaran tidak menentu: Isyarat palsu yang kerap mungkin berlaku dalam pasaran mendatar dan tidak menentu

- Risiko kerugian berterusan: Anda mungkin menghadapi henti kerugian berterusan semasa tempoh turun naik pasaran Penyelesaian:

- Tambah penapis persekitaran pasaran

- Mengoptimumkan parameter penunjuk

- Memperkenalkan mekanisme penyesuaian turun naik

Arah pengoptimuman strategi

- Pengoptimuman parameter penunjuk:

- Pertimbangkan untuk menggunakan kitaran RSI adaptif

- Laraskan parameter purata bergerak mengikut kitaran pasaran yang berbeza

- Tingkatkan pengenalan persekitaran pasaran:

- Memperkenalkan Petunjuk Kemeruapan

- Tambah Penapis Kekuatan Aliran

- Meningkatkan kawalan risiko:

- Melaksanakan mekanisme stop loss dinamik

- Meningkatkan pengurusan sasaran keuntungan

- Optimumkan pengurusan jawatan:

- Laraskan saiz kedudukan berdasarkan kekuatan isyarat

- Melaksanakan mekanisme untuk membina dan mengurangkan kedudukan dalam kelompok

ringkaskan

Strategi ini membina sistem perdagangan yang agak lengkap dengan menggunakan petunjuk analisis teknikal dan kaedah analisis momentum secara menyeluruh. Kelebihan strategi terletak pada mekanisme pengesahan berganda dan kawalan risiko yang sempurna, tetapi perhatian masih harus diberikan kepada kebolehsuaian kepada persekitaran pasaran dan isu pengoptimuman parameter. Dengan pengoptimuman dan penambahbaikan yang berterusan, strategi ini berpotensi untuk menjadi sistem perdagangan yang teguh.

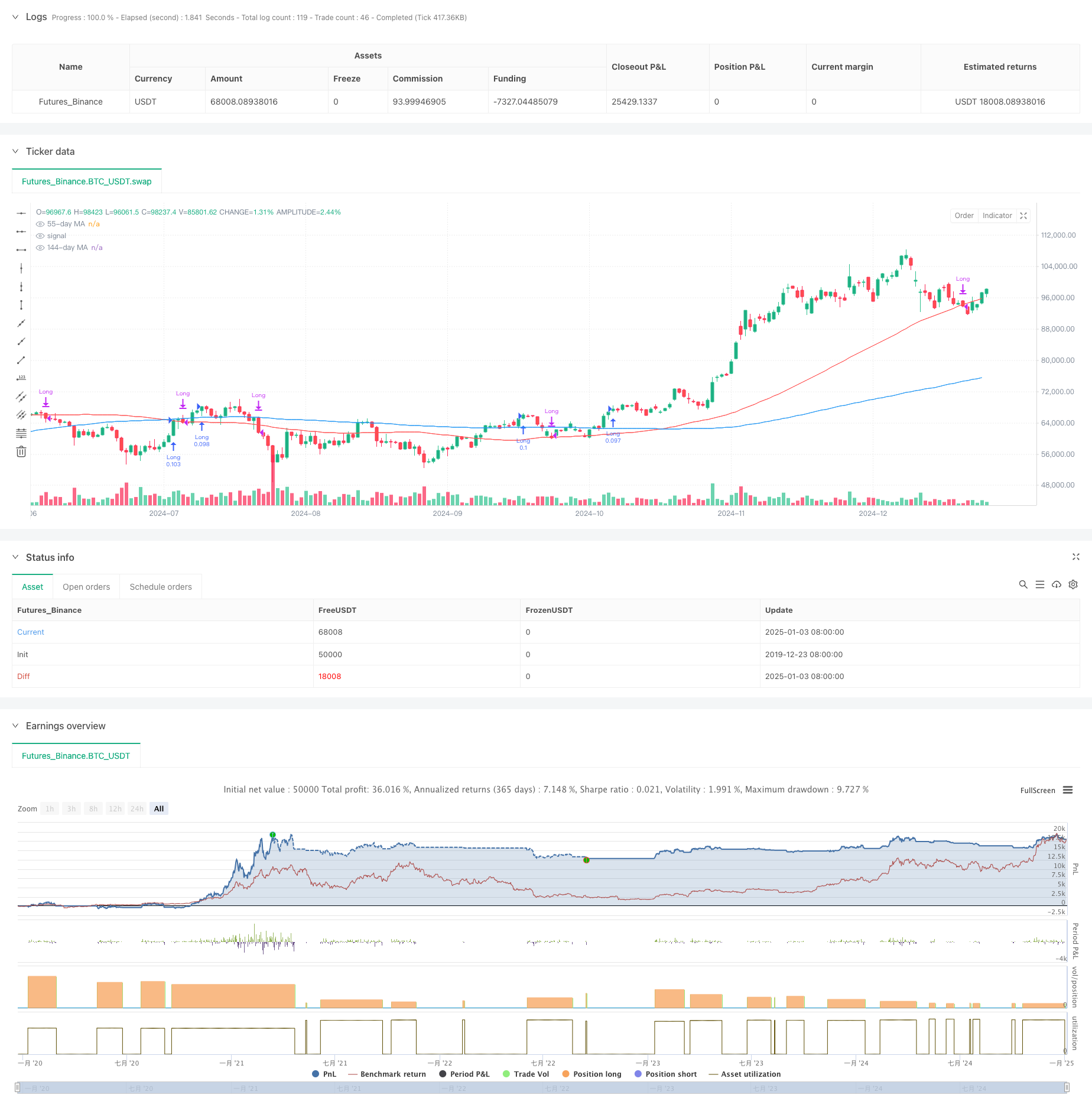

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Strategy with RSI Trending Upwards", overlay=true)

// Inputs for moving averages

ma21_length = input.int(21, title="21-day MA Length")

ma55_length = input.int(55, title="55-day MA Length")

ma144_length = input.int(144, title="144-day MA Length")

// Moving averages

ma21 = ta.sma(close, ma21_length)

ma55 = ta.sma(close, ma55_length)

ma144 = ta.sma(close, ma144_length)

// RSI settings

rsi_length = input.int(13, title="RSI Length")

rsi_avg_length = input.int(13, title="RSI Average Length")

rsi = ta.rsi(close, rsi_length)

rsi_avg = ta.sma(rsi, rsi_avg_length)

// RSI breakout condition

rsi_breakout = ta.crossover(rsi, rsi_avg)

// RSI trending upwards

rsi_trending_up = rsi > rsi[1] and rsi[1] > rsi[2]

// Higher high condition

hh1 = high[2] > high[3] // 1st higher high

hh2 = high[1] > high[2] // 2nd higher high

hh3 = high > high[1] // 3rd higher high

higher_high_condition = hh1 and hh2 and hh3

// Filter for trades starting after 1st January 2007

date_filter = (year >= 2007 and month >= 1 and dayofmonth >= 1)

// Combine conditions for buying

buy_condition = rsi > rsi_avg and higher_high_condition and rsi_trending_up //and close > ma21 and ma21 > ma55

// buy_condition = rsi > rsi_avg and rsi_trending_up

// Sell condition

// Sell condition: Close below 21-day MA for 3 consecutive days

downtrend_condition = close < close[1] and close[1] < close[2] and close[2] < close[3] and close[3] < close[4] and close[4] < close[5]

// downtrend_condition = close < close[1] and close[1] < close[2] and close[2] < close[3]

sell_condition_ma21 = close < ma55 and close[1] < ma55 and close[2] < ma55 and close[3] < ma55 and close[4] < ma55 and downtrend_condition

// Final sell condition

sell_condition = ta.crossunder(close, ma55) or (ta.crossunder(rsi, rsi_avg) and ta.crossunder(close, ma55))

// Execute trades

if (buy_condition and date_filter)

// strategy.entry("Long", strategy.long, comment="Buy")

strategy.entry("Long", strategy.long, qty=strategy.equity * 0.1 / close)

if (sell_condition and date_filter)

strategy.close("Long", comment="Sell")

// Plot moving averages

plot(ma55, color=color.red, title="55-day MA")

plot(ma144, color=color.blue, title="144-day MA")