Alligator 长期趋势跟踪交易策略

Author: ChaoZhang, Date: 2024-05-17 15:40:13Tags: SMMASMA

概述

Alligator 长期趋势跟踪交易策略是一种基于 Williams Alligator 指标的量化交易策略。该策略利用不同周期的移动平均线组合来捕捉市场的主要趋势,适用于中长期的趋势跟踪交易。策略的主要思路是通过 Alligator 指标的开口方向和价格与 Alligator 指标的相对位置来判断趋势的方向和强度,从而做出交易决策。

策略原理

Alligator 长期趋势跟踪交易策略使用了三条不同周期的移动平均线来构建 Alligator 指标,分别是:

- Jaw 线:13 周期 SMMA,向未来平移 8 根 K 线

- Teeth 线:8 周期 SMMA,向未来平移 5 根 K 线

- Lips 线:5 周期 SMMA,向未来平移 3 根 K 线

当 Alligator 指标的开口方向向上,即 Jaw 线在最下方,Teeth 线在中间,Lips 线在最上方,同时价格在 Alligator 指标上方时,策略会开仓做多。这种情况表明一个向上的趋势浪已经确认,我们希望持有该仓位直到趋势结束。

当价格跌破 Jaw 线时,策略会平掉多单。这可以保证我们不会在熊市中继续持有头寸。

策略优势

- 适用于中长期交易:该策略基于 Alligator 指标,可以有效捕捉市场的主要趋势,非常适合中长期的趋势跟踪交易。

- 交易频率低:策略只在确认趋势形成时开仓,趋势结束时平仓,交易频率相对较低,可以有效降低交易成本。

- 适用范围广:该策略可以应用于各种金融市场,如外汇、加密货币等,具有很强的适应性和灵活性。

- 无需优化参数:策略完全跟随市场趋势,无需对参数进行优化,简单易用。

策略风险

- 潜在的滑点风险:在市场剧烈波动或流动性不足的情况下,交易订单可能无法以预期价格成交,导致滑点风险。

- 缺乏固定的风险管理:该策略没有固定的风险管理设置,需要根据自身的风险偏好来调整每笔交易的仓位大小。

- 可能错过短期机会:由于策略专注于捕捉中长期趋势,可能会错过一些短期的交易机会。

策略优化方向

- 加入风险管理模块:可以考虑加入一些风险管理措施,如止损、动态仓位调整等,以更好地控制风险。

- 结合其他技术指标:可以尝试将 Alligator 指标与其他技术指标相结合,如 RSI、MACD 等,以提高策略的准确性和可靠性。

- 优化参数设置:虽然该策略无需优化参数,但可以尝试对不同的时间周期和交易标的进行回测,以找到最佳的参数组合。

总结

Alligator 长期趋势跟踪交易策略是一种简单易用、适用范围广的量化交易策略。通过利用 Alligator 指标捕捉市场主要趋势,该策略可以在中长期内获得稳定的收益。虽然策略存在一些潜在的风险,但通过加入风险管理模块、结合其他技术指标以及优化参数设置等方法,可以进一步提高策略的性能和稳定性。对于偏好中长期趋势跟踪交易的投资者来说,Alligator 长期趋势跟踪交易策略是一个值得考虑的选择。

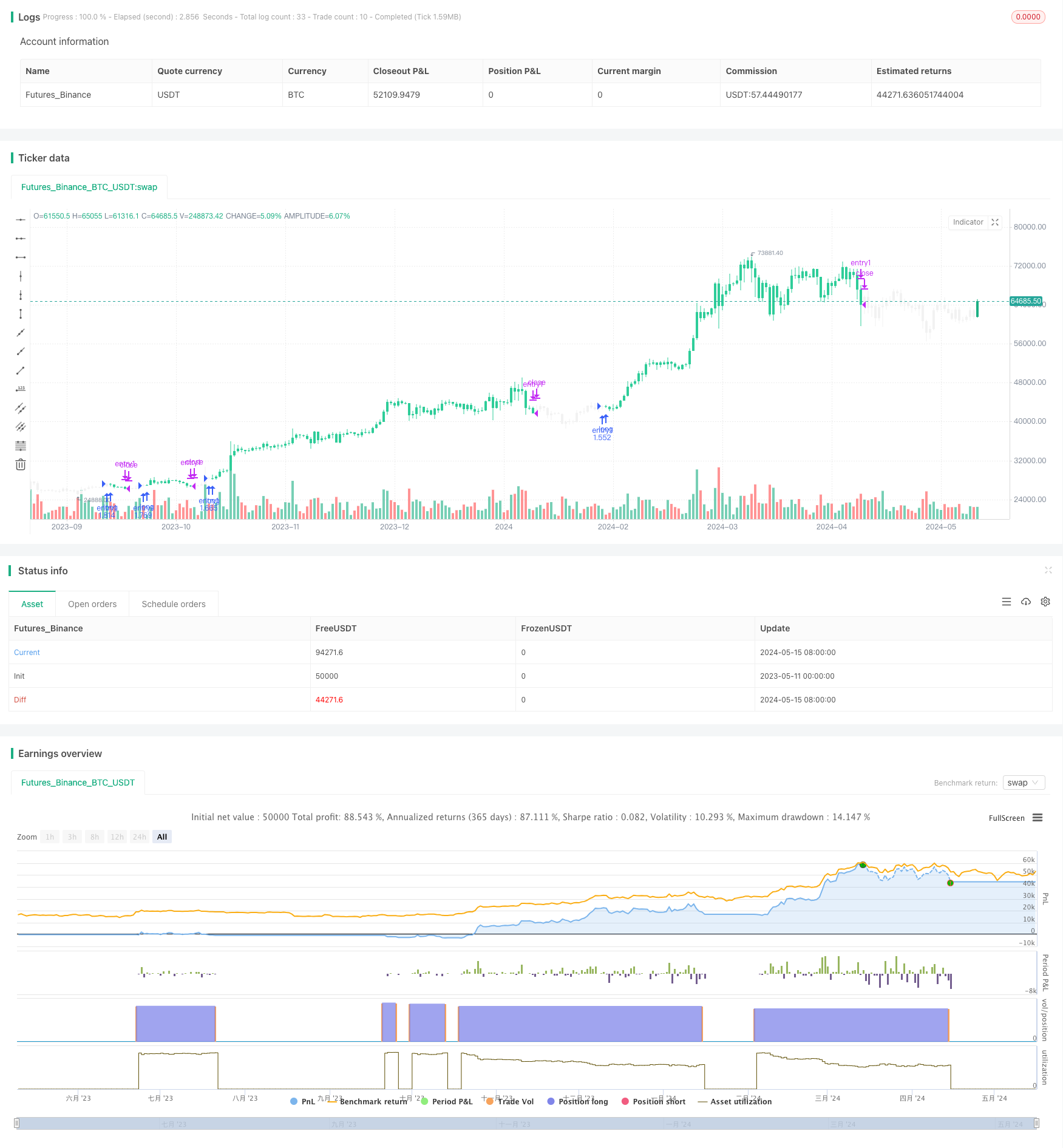

/*backtest

start: 2023-05-11 00:00:00

end: 2024-05-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//_______ <licence>

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Skyrex

//_______ <version>

//@version=5

//_______ <declaration_statement>

strategy(title = "Alligator Long Term Trend Following Strategy [Skyrex.io]",

shorttitle = "Alligator Strategy [Skyrex.io]",

overlay = true,

format = format.inherit,

pyramiding = 1,

calc_on_order_fills = false,

calc_on_every_tick = true,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

initial_capital = 10000,

currency = currency.NONE,

commission_type = strategy.commission.percent,

commission_value = 0.1,

slippage = 5)

//_______ <constant_declarations>

var color skyrexGreen = color.new(#2ECD99, 0)

var color skyrexGray = color.new(#F2F2F2, 0)

var color skyrexWhite = color.new(#FFFFFF, 0)

var color barcolor = na

//_______ <inputs>

// Trading bot settings

sourceUuid = input.string(title = "sourceUuid:", defval = "yourBotSourceUuid", group = "Trading Bot Settings")

secretToken = input.string(title = "secretToken:", defval = "yourBotSecretToken", group = "Trading Bot Settings")

// Trading Period Settings

lookBackPeriodStart = input(title = "Trade Start Date/Time", defval = timestamp('2023-01-01T00:00:00'), group = "Trading Period Settings")

lookBackPeriodStop = input(title = "Trade Stop Date/Time", defval = timestamp('2025-01-01T00:00:00'), group = "Trading Period Settings")

//_______ <function_declarations>

//@function Used to calculate Simple moving average for Alligator

//@param src Sourse for smma Calculations

//@param length Number of bars to calculate smma

//@returns The calculated smma value

smma(src, length) =>

smma = 0.0

smma := na(smma[1]) ? ta.sma(src, length) : (smma[1] * (length - 1) + src) / length

smma

//@function Used to decide if current candle above the Alligator

//@param jaw Jaw line of an Alligator

//@param teeth Teeth line of an Alligator

//@param lips Lips line of an Alligator

//@returns Bool value

is_LowAboveAlligator(jaw, teeth, lips) =>

result = low > jaw and low > lips and low > teeth

result

//@function Used to decide if current candle below the Alligator

//@param jaw Jaw line of an Alligator

//@param teeth Teeth line of an Alligator

//@param lips Lips line of an Alligator

//@returns Bool value

is_HighBelowAlligator(jaw, teeth, lips) =>

result = high < jaw and high < lips and high < teeth

result

//@function Used to decide if Alligator's mouth is open

//@param jaw Jaw line of an Alligator

//@param teeth Teeth line of an Alligator

//@param lips Lips line of an Alligator

//@returns Bool value

is_AlligatorHungry(jaw, teeth, lips) =>

result = lips > jaw[5] and lips > teeth[2] and teeth > jaw[3]

result

//_______ <calculations>

jaw = smma(hl2, 13)[8]

teeth = smma(hl2, 8)[5]

lips = smma(hl2, 5)[3]

jaw_o = smma(hl2, 13)

teeth_o = smma(hl2, 8)

lips_o = smma(hl2, 5)

//_______ <strategy_calls>

longCondition = is_LowAboveAlligator(jaw, teeth, lips) and is_AlligatorHungry(jaw_o, teeth_o, lips_o)

if (longCondition)

strategy.entry(id = "entry1", direction = strategy.long, alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "entry1",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

if close < jaw

strategy.close(id = "entry1", alert_message = '{\n"base": "' + syminfo.basecurrency + '",\n"quote": "' + syminfo.currency + '",\n"position": "close",\n"price": "' + str.tostring(close) + '",\n"sourceUuid": "' + sourceUuid + '",\n"secretToken": "' + secretToken + '",\n"timestamp": "' + str.tostring(timenow) + '"\n}')

//_______ <visuals>

if strategy.opentrades > 0

barcolor := skyrexGreen

else

barcolor := skyrexGray

barcolor(barcolor)

//_______ <alerts>

相关内容

- 多重均线趋势跟踪与反转模式识别策略

- SSS

- Crodl's Supertrend

- 自适应多重均线动量突破交易策略

- 灵活多周期均线交叉策略高级版

- 布林带突破动量跟踪交易策略

- 多层波动带交易策略

- RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- 基于脉冲MACD和双均线交叉的多时间尺度趋势追踪策略

- 多均线交叉辅助RSI动态参数量化交易策略

更多内容

- 五重强势移动平均策略

- 均线交叉牛市支撑带策略

- 多时间框架与200EMA过滤器的趋势跟踪策略 - 仅做多

- SMC市场高低点突破策略

- 动态趋势动量交易策略

- EMA均线交叉与短期信号策略

- 一目云和ATR策略

- BONK多因子交易策略

- 双均线交叉策略

- HalfTrend多空趋势追踪止损限价买入策略

- 基于脉冲MACD和双均线交叉的多时间尺度趋势追踪策略

- EMA5与EMA13交叉策略

- EMA SAR 中长期趋势跟踪策略

- 逆向波动率突破策略

- Nifty50三分钟开盘价突破策略

- 布林带动态止损止盈策略

- 改进型多空转换K线形态突破策略

- Laguerre RSI与ADX滤波交易信号策略

- 价量突破买入策略

- K线连续数目牛熊判断策略