概述

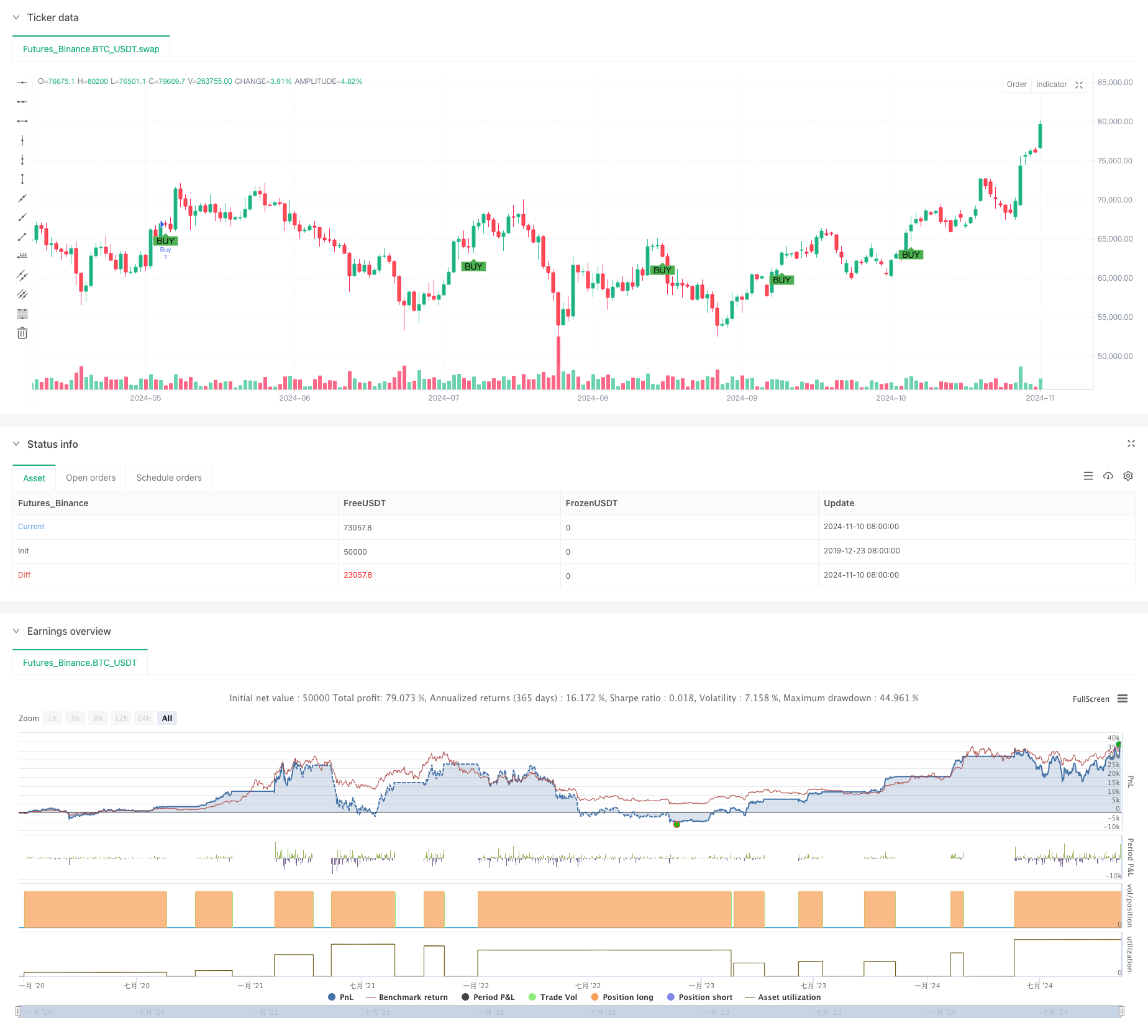

该策略是一个综合性的交易系统,结合了技术分析中的多个关键指标,包括双均线系统(SMA)、移动平均线趋同散度(MACD)、相对强弱指数(RSI)以及阻力位分析。策略的核心思想是通过多维度的技术指标来确认交易信号,同时结合市场情绪指标来优化持仓管理,最终达到提高胜率和风险收益比的目的。

策略原理

策略采用短期(10日)和长期(30日)两条简单移动平均线作为主要信号系统。当短期均线向上穿越长期均线,同时MACD指标显示多头势态(MACD线在信号线上方)时,系统会发出做多信号。卖出条件则结合了阻力位分析,当价格达到过去20个周期的最高点,且MACD显示空头信号时,系统会平仓。此外,策略还引入了RSI指标作为情绪过滤器,用于优化持仓管理:当RSI超过70且处于亏损状态时提前止损,当RSI低于30且处于盈利状态时继续持有。

策略优势

- 多重确认机制:通过均线交叉、MACD趋势和阻力位的多重验证,提高了交易信号的可靠性

- 智能持仓管理:引入RSI指标进行情绪监控,能够更好地管理持仓风险

- 自适应性强:策略参数可根据不同市场条件进行调整

- 风险控制完善:设置了多重止损机制,包括技术止损和情绪止损

- 系统化程度高:交易决策完全系统化,减少了主观判断带来的干扰

策略风险

- 均线系统在震荡市场可能产生虚假信号

- 过度依赖技术指标可能忽视基本面因素

- 参数优化可能导致过度拟合

- 在快速行情中,阻力位的识别可能滞后

- RSI指标在某些市场条件下可能失效

策略优化方向

- 引入成交量指标:可以增加对市场趋势强度的判断

- 动态调整参数:根据市场波动率自动调整均线周期和RSI阈值

- 增加趋势过滤器:引入更长期均线作为趋势过滤

- 优化阻力位计算:考虑使用动态阻力位识别算法

- 加入波动率指标:用于调整仓位大小和止损位置

总结

该策略通过组合多个经典技术指标,构建了一个完整的交易系统。策略的优势在于多重信号确认机制和完善的风险控制体系,但仍需注意市场环境对策略表现的影响。通过建议的优化方向,策略的稳定性和适应性有望得到进一步提升。在实盘应用中,建议投资者根据自身风险偏好和市场环境适当调整参数,并始终保持对市场基本面的关注。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment (Enhanced RR)", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Define buy condition based on SMA and MACD

buyCondition = ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance

sellCondition = close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance)

if (sellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Add alert for buy condition

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

// Add alert for sell condition to notify when price hits major resistance

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

// Add alert for early close condition (for losing trades)

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

// Add alert for holding winning condition (optional)

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")

相关推荐