概述

该策略结合了MACD(移动平均线收敛背离指标)、RSI(相对强弱指数)和SMA(简单移动平均线)来生成可靠的买卖信号。MACD用于捕捉价格的动量变化,RSI用于识别超买和超卖状态,而SMA用于确认趋势方向。该策略通过多重条件过滤,以减少虚假信号,为日内交易提供明确的进出场点。

策略原理

- MACD:当MACD线从下向上穿过信号线时,产生做多信号;当MACD线从上向下穿过信号线时,产生做空信号。

- RSI:当RSI低于超买水平(70)时,才考虑做多;当RSI高于超卖水平(30)时,才考虑做空。这有助于避免在已经超买或超卖的情况下进场。

- SMA:50周期SMA和200周期SMA用于确认趋势方向。只有当50周期SMA在200周期SMA上方时,才考虑做多;只有当50周期SMA在200周期SMA下方时,才考虑做空。

该策略的进场和出场条件如下:

- 做多:当MACD线向上穿过信号线,RSI低于超买水平(70),且50周期SMA在200周期SMA上方(表明上升趋势)时,进场做多。

- 平多:当MACD线向下穿过信号线或RSI超过超买水平(70)时,平仓。

- 做空:当MACD线向下穿过信号线,RSI高于超卖水平(30),且50周期SMA在200周期SMA下方(表明下降趋势)时,进场做空。

- 平空:当MACD线向上穿过信号线或RSI跌破超卖水平(30)时,平仓。

策略优势

- 多重过滤机制可以有效减少虚假信号,提高信号可靠性。

- 结合动量指标和趋势确认指标,可以在趋势方向上寻找高概率交易机会。

- 明确的进出场规则,易于实现自动化交易,可以消除交易中的情绪因素。

- 适用于日内交易,可以快速适应市场变化,把握短期交易机会。

策略风险

- 在震荡市中,该策略可能会产生较多的虚假信号,导致频繁交易和资金损失。

- 策略依赖于历史数据优化参数,在市场状态发生重大变化时,可能需要重新优化参数。

- 突发的重大利好或利空消息可能导致价格突破超买或超卖水平,而该策略可能错过这些交易机会。

- 该策略没有设置止损,在极端行情下可能面临较大风险。

策略优化方向

- 引入更多的过滤条件,如交易量、波动率等,以进一步提高信号可靠性。

- 对不同的市场状态(如趋势、震荡)使用不同的参数组合,提高策略的适应性。

- 设置合理的止损和止盈水平,以控制单笔交易的风险和收益。

- 对策略进行回测和实盘测试,不断优化和调整参数,提高策略的稳健性。

总结

该策略通过结合MACD、RSI和SMA等技术指标,形成了一个多重过滤的日内交易策略。它利用动量和趋势的变化来捕捉交易机会,同时通过明确的进出场规则来控制风险。尽管该策略可能在震荡市中面临挑战,但通过进一步优化和风险管理,它有望成为一个可靠的日内交易工具。

策略源码

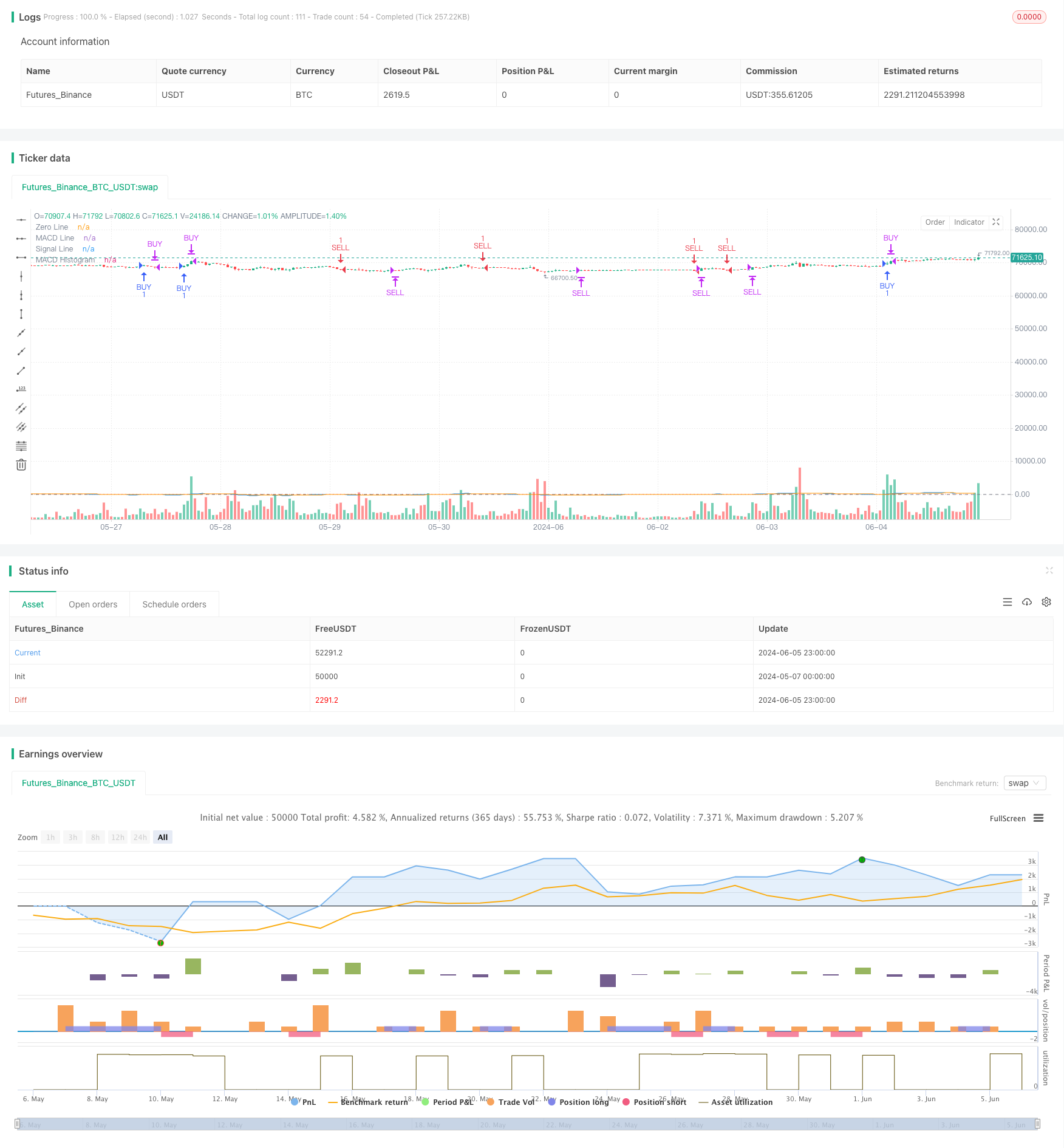

/*backtest

start: 2024-05-07 00:00:00

end: 2024-06-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Day Trading Strategy", overlay=true)

// Parametrii pentru MACD

macdLength = input.int(12, title="MACD Length")

signalSmoothing = input.int(9, title="MACD Signal Smoothing")

src = input(close, title="Source")

// Calculul MACD

[macdLine, signalLine, _] = ta.macd(src, macdLength, 26, signalSmoothing)

macdHist = macdLine - signalLine

// Parametrii pentru RSI

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

// Calculul RSI

rsi = ta.rsi(src, rsiLength)

// Filtru suplimentar pentru a reduce semnalele false

longFilter = ta.sma(close, 50) > ta.sma(close, 200)

shortFilter = ta.sma(close, 50) < ta.sma(close, 200)

// Conditii de intrare in pozitie long

enterLong = ta.crossover(macdLine, signalLine) and rsi < rsiOverbought and longFilter

// Conditii de iesire din pozitie long

exitLong = ta.crossunder(macdLine, signalLine) or rsi > rsiOverbought

// Conditii de intrare in pozitie short

enterShort = ta.crossunder(macdLine, signalLine) and rsi > rsiOversold and shortFilter

// Conditii de iesire din pozitie short

exitShort = ta.crossover(macdLine, signalLine) or rsi < rsiOversold

// Adaugarea strategiei pentru Strategy Tester

if (enterLong)

strategy.entry("BUY", strategy.long)

if (exitLong)

strategy.close("BUY")

if (enterShort)

strategy.entry("SELL", strategy.short)

if (exitShort)

strategy.close("SELL")

// Plotarea MACD si Signal Line

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

hline(0, "Zero Line", color=color.gray)

plot(macdHist, color=color.red, style=plot.style_histogram, title="MACD Histogram")

相关推荐