Advanced EMA Momentum Trend Trading Strategy

Author: ChaoZhang, Date: 2024-12-11 17:50:14Tags: EMAATRRRRGMT

Overview

This strategy is a trend-following system based on Exponential Moving Average (EMA) and momentum indicators. It generates trading signals through the combination of momentum breakthrough signals and EMA trend filters, executing trades when market trends are clearly defined. The strategy includes a comprehensive risk management module, flexible trading time filters, and detailed statistical analysis functions to enhance stability and reliability.

Strategy Principles

The core logic of the strategy is based on several key elements: 1. Momentum Signal Identification: Calculates momentum values over a user-defined period, generating long signals when momentum breaks above the threshold and short signals when it breaks below. 2. EMA Trend Filter: Uses 200-period EMA as trend criterion, allowing long positions above EMA and short positions below. 3. Time Filter: Configurable trading sessions with GMT timezone adjustment support for better adaptation to different market trading hours. 4. Risk Control: Supports stop-loss and take-profit settings based on ATR or fixed percentage, with daily trade limits.

Strategy Advantages

- Strong Trend Following Capability: Effectively captures major trend movements through dual confirmation of EMA and momentum.

- Comprehensive Risk Management: Offers multiple stop-loss options, including ATR-based dynamic stops and fixed percentage stops.

- Thorough Statistical Analysis: Real-time tracking of multiple performance metrics, including long/short win rates and risk-reward ratios.

- Flexible Parameters: Key parameters can be optimized for different market characteristics.

Strategy Risks

Choppy Market Risk: May generate frequent false breakout signals in sideways markets. Suggested Solution: Add oscillator filters or increase breakthrough thresholds.

Slippage Risk: May face significant slippage during highly volatile periods. Suggested Solution: Set reasonable stop-loss ranges and avoid trading during high volatility periods.

Overtrading Risk: Frequent signals may lead to excessive trading. Suggested Solution: Set appropriate daily trade limits.

Strategy Optimization Directions

- Dynamic Parameter Optimization: Automatically adjust momentum thresholds and EMA periods based on market volatility.

- Multi-timeframe Analysis: Add trend confirmation across multiple timeframes to improve signal reliability.

- Market Environment Recognition: Incorporate volatility analysis module to adapt parameters to different market conditions.

- Signal Strength Classification: Grade breakthrough signals and adjust position sizes based on signal strength.

Summary

This is a well-designed trend-following strategy that captures market opportunities through the combination of momentum breakthrough and EMA trends. The strategy features a complete risk management system and powerful statistical analysis functions, offering good practicality and scalability. Through continuous optimization and improvement, this strategy has the potential to maintain stable performance across different market environments.

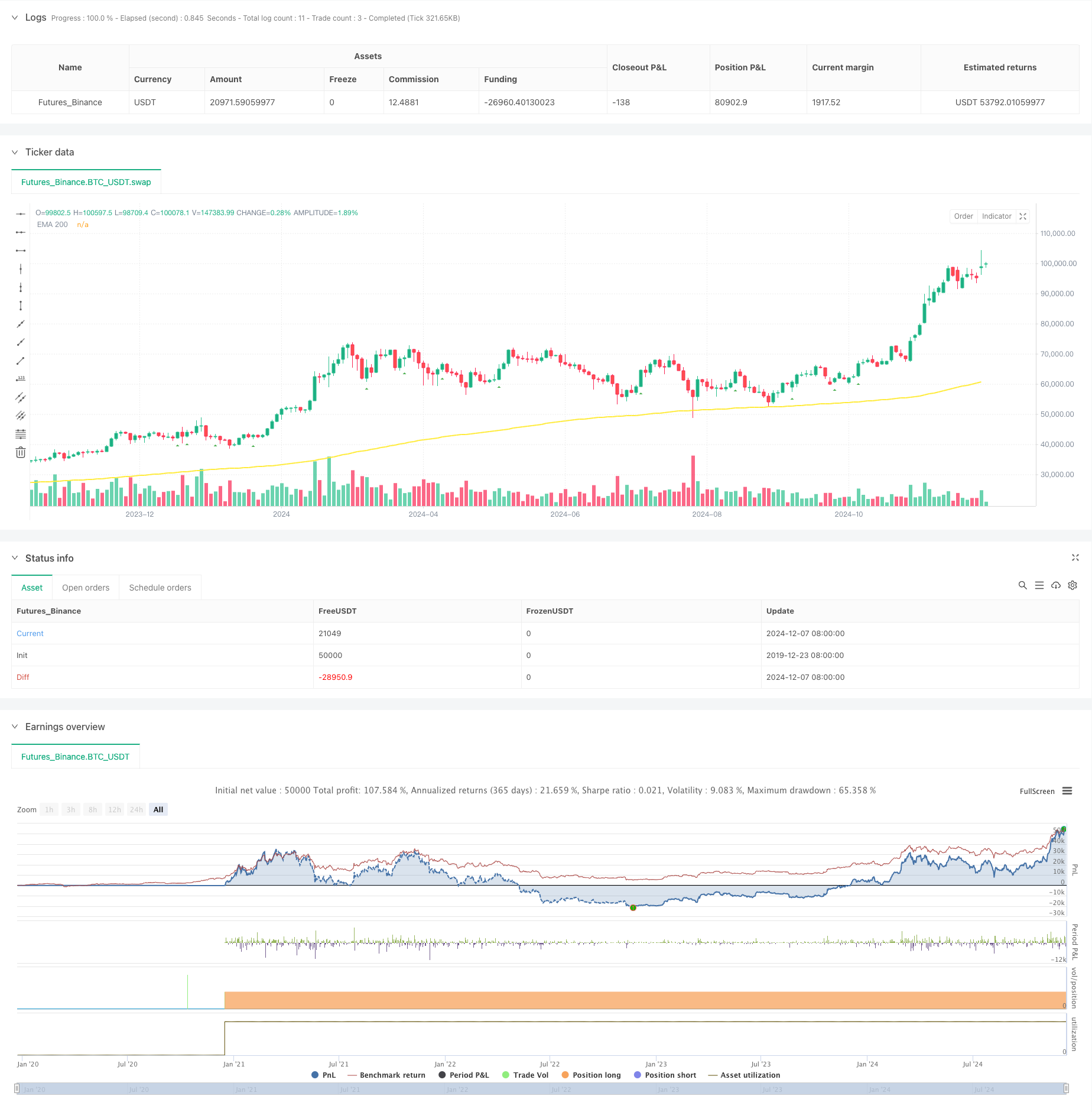

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("[Mustang Algo] EMA Momentum Strategy",

shorttitle="[Mustang Algo] Mom Strategy",

overlay=true,

initial_capital=10000,

default_qty_type=strategy.fixed,

default_qty_value=1,

pyramiding=0,

calc_on_every_tick=false,

max_bars_back=5000)

// Momentum Parameters

len = input.int(10, minval=1, title="Length")

src = input(close, title="Source")

momTimeframe = input.timeframe("", title="Momentum Timeframe")

timeframe_gaps = input.bool(true, title="Autoriser les gaps de timeframe")

momFilterLong = input.float(5, title="Filtre Momentum Long", minval=0)

momFilterShort = input.float(-5, title="Filtre Momentum Short", maxval=0)

// EMA Filter

useEmaFilter = input.bool(true, title="Utiliser Filtre EMA")

emaLength = input.int(200, title="EMA Length", minval=1)

// Position Size

contractSize = input.float(1.0, title="Taille de position", minval=0.01, step=0.01)

// Time filter settings

use_time_filter = input.bool(false, title="Utiliser le Filtre de Temps")

start_hour = input.int(9, title="Heure de Début", minval=0, maxval=23)

start_minute = input.int(30, title="Minute de Début", minval=0, maxval=59)

end_hour = input.int(16, title="Heure de Fin", minval=0, maxval=23)

end_minute = input.int(30, title="Minute de Fin", minval=0, maxval=59)

gmt_offset = input.int(0, title="Décalage GMT", minval=-12, maxval=14)

// Risk Management

useAtrSl = input.bool(false, title="Utiliser ATR pour SL/TP")

atrPeriod = input.int(14, title="Période ATR", minval=1)

atrMultiplier = input.float(1.5, title="Multiplicateur ATR pour SL", minval=0.1, step=0.1)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", minval=0.01, step=0.01)

tpRatio = input.float(2.0, title="Take Profit Ratio", minval=0.1, step=0.1)

// Daily trade limit

maxDailyTrades = input.int(2, title="Limite de trades par jour", minval=1)

// Variables for tracking daily trades

var int dailyTradeCount = 0

// Reset daily trade count

if dayofweek != dayofweek[1]

dailyTradeCount := 0

// Time filter function

is_within_session() =>

current_time = time(timeframe.period, "0000-0000:1234567", gmt_offset)

start_time = timestamp(year, month, dayofmonth, start_hour, start_minute, 0)

end_time = timestamp(year, month, dayofmonth, end_hour, end_minute, 0)

in_session = current_time >= start_time and current_time <= end_time

not use_time_filter or in_session

// EMA Calculation

ema200 = ta.ema(close, emaLength)

// Momentum Calculation

gapFillMode = timeframe_gaps ? barmerge.gaps_on : barmerge.gaps_off

mom = request.security(syminfo.tickerid, momTimeframe, src - src[len], gapFillMode)

// ATR Calculation

atr = ta.atr(atrPeriod)

// Signal Detection with Filters

crossoverUp = ta.crossover(mom, momFilterLong)

crossoverDown = ta.crossunder(mom, momFilterShort)

emaUpTrend = close > ema200

emaDownTrend = close < ema200

// Trading Conditions

longCondition = crossoverUp and (not useEmaFilter or emaUpTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

shortCondition = crossoverDown and (not useEmaFilter or emaDownTrend) and is_within_session() and dailyTradeCount < maxDailyTrades and barstate.isconfirmed

// Calcul des niveaux de Stop Loss et Take Profit

float stopLoss = useAtrSl ? (atr * atrMultiplier) : (close * stopLossPerc / 100)

float takeProfit = stopLoss * tpRatio

// Modification des variables pour éviter les erreurs de repainting

var float entryPrice = na

var float currentStopLoss = na

var float currentTakeProfit = na

// Exécution des ordres avec gestion des positions

if strategy.position_size == 0

if longCondition

entryPrice := close

currentStopLoss := entryPrice - stopLoss

currentTakeProfit := entryPrice + takeProfit

strategy.entry("Long", strategy.long, qty=contractSize)

strategy.exit("Exit Long", "Long", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

if shortCondition

entryPrice := close

currentStopLoss := entryPrice + stopLoss

currentTakeProfit := entryPrice - takeProfit

strategy.entry("Short", strategy.short, qty=contractSize)

strategy.exit("Exit Short", "Short", stop=currentStopLoss, limit=currentTakeProfit)

dailyTradeCount += 1

// Plot EMA

plot(ema200, color=color.yellow, linewidth=2, title="EMA 200")

// Plot Signals

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// // Performance Statistics

// var int longWins = 0

// var int longLosses = 0

// var int shortWins = 0

// var int shortLosses = 0

// if strategy.closedtrades > 0

// trade = strategy.closedtrades - 1

// isLong = strategy.closedtrades.entry_price(trade) < strategy.closedtrades.exit_price(trade)

// isWin = strategy.closedtrades.profit(trade) > 0

// if isLong and isWin

// longWins += 1

// else if isLong and not isWin

// longLosses += 1

// else if not isLong and isWin

// shortWins += 1

// else if not isLong and not isWin

// shortLosses += 1

// longTrades = longWins + longLosses

// shortTrades = shortWins + shortLosses

// longWinRate = longTrades > 0 ? (longWins / longTrades) * 100 : 0

// shortWinRate = shortTrades > 0 ? (shortWins / shortTrades) * 100 : 0

// overallWinRate = strategy.closedtrades > 0 ? (strategy.wintrades / strategy.closedtrades) * 100 : 0

// avgRR = strategy.grossloss != 0 ? math.abs(strategy.grossprofit / strategy.grossloss) : 0

// // Display Statistics

// var table statsTable = table.new(position.top_right, 4, 7, border_width=1)

// if barstate.islastconfirmedhistory

// table.cell(statsTable, 0, 0, "Type", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 0, "Win", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 0, "Lose", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 0, "Daily Trades", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 1, "Long", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 1, str.tostring(longWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 1, str.tostring(longLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 1, str.tostring(dailyTradeCount) + "/" + str.tostring(maxDailyTrades), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 2, "Short", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 2, str.tostring(shortWins), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 2, str.tostring(shortLosses), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 3, "Win Rate", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 3, "Long: " + str.tostring(longWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 3, "Short: " + str.tostring(shortWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 4, "Overall", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 4, "Win Rate: " + str.tostring(overallWinRate, "#.##") + "%", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 4, "Total: " + str.tostring(strategy.closedtrades) + " | RR: " + str.tostring(avgRR, "#.##"), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 5, "Trading Hours", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 5, "Start: " + str.format("{0,time,HH:mm}", start_hour * 60 * 60 * 1000 + start_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 5, "End: " + str.format("{0,time,HH:mm}", end_hour * 60 * 60 * 1000 + end_minute * 60 * 1000), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 5, "GMT: " + (gmt_offset >= 0 ? "+" : "") + str.tostring(gmt_offset), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 0, 6, "SL/TP Method", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 1, 6, useAtrSl ? "ATR-based" : "Percentage-based", bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 2, 6, useAtrSl ? "ATR: " + str.tostring(atrPeriod) : "SL%: " + str.tostring(stopLossPerc), bgcolor=color.new(color.blue, 90))

// table.cell(statsTable, 3, 6, "TP Ratio: " + str.tostring(tpRatio), bgcolor=color.new(color.blue, 90))

- Triple Exponential Moving Average Trend Trading Strategy

- K Consecutive Candles Bull Bear Strategy

- 5-Day EMA Based Trend Following Strategy Optimization Model

- Enhanced Multi-Indicator Momentum Trading Strategy

- Multi-EMA Cross with Oscillator and Dynamic Support/Resistance Trading Strategy

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Multi-Mode Take Profit/Stop Loss Trend Following Strategy Based on EMA, Madrid Ribbon and Donchian Channel

- Volatility and Linear Regression-based Long-Short Market Regime Optimization Strategy

- EMA Dynamic Trend Following Trading Strategy

- Triple EMA Crossover Strategy

- Adaptive Bollinger Bands Dynamic Position Management Strategy

- Dynamic RSI Smart Timing Swing Trading Strategy

- Bidirectional Trading Strategy Based on Candlestick Absorption Pattern Analysis

- Bollinger Breakout with Mean Reversion 4H Quantitative Trading Strategy

- Trend Following Dynamic Grid Position Sizing Strategy

- Dual BBI (Bulls and Bears Index) Crossover Strategy

- Dynamic Long/Short Swing Trading Strategy with Moving Average Crossover Signal System

- Multi-Technical Indicator Trend Following Trading Strategy

- Advanced Volatility Mean Reversion Trading Strategy: Multi-Dimensional Quantitative Trading System Based on VIX and Moving Average

- Gold Trend Channel Reversal Momentum Strategy

- Multi-MA Trend Intensity Trading Strategy - A Flexible Smart Trading System Based on MA Deviation

- Volume-Weighted Dual Trend Detection System

- Multi-Factor Counter-Trend Trading Strategy

- Enhanced Momentum Oscillator and Stochastic Divergence Quantitative Trading Strategy

- Multi-Timeframe Fibonacci Retracement with Trend Breakout Trading Strategy

- Multi-Indicator Trend Following Strategy with Profit Optimization

- Fractal Breakout Momentum Trading Strategy with Take Profit Optimization

- Adaptive Mean-Reversion Trading Strategy Based on Chande Momentum Oscillator

- MACD-Supertrend Dual Confirmation Trend Following Trading Strategy

- Multi-Period SuperTrend Dynamic Trading Strategy