概述

这是一个结合了交易量权重和价格波动的趋势判断系统。该系统通过计算开盘价与收盘价之间的差值(Delta值),并结合交易量进行加权,形成了一个独特的趋势指标。系统还整合了移动平均线(SMA)作为信号确认,通过比较Delta值与其SMA的关系来判断市场走势。此外,系统还引入了EMA作为辅助指标,共同构成了一个多维度的分析框架。

策略原理

- Delta值计算:使用特定周期内的开盘价与收盘价差值,并以该周期的交易量进行加权

- 信号生成机制:

- 当Delta值上穿其SMA时,系统识别为看跌信号

- 当Delta值下穿其SMA时,系统识别为看涨信号

- EMA指标配合:

- 系统使用20周期EMA作为趋势确认

- EMA颜色随Delta值与其SMA的位置关系变化

- 交易量过滤:设置交易量阈值,确保在充足的流动性条件下进行交易

策略优势

- 多维度分析:结合价格、交易量和均线系统,提供更全面的市场视角

- 信号可靠性:通过交易量加权,降低了价格波动的随机性影响

- 适应性强:可在4小时和日线等多个时间周期上运行

- 参数灵活:提供多个可调整参数,便于根据不同市场特征进行优化

- 风险控制:内置交易量过滤机制,有效规避低流动性环境

策略风险

- 趋势反转风险:在剧烈波动市场中可能产生错误信号

- 参数敏感性:不同参数组合可能导致策略表现差异较大

- 时滞风险:均线系统固有的滞后性可能导致入场时机延迟

- 市场环境依赖:在横盘整理市场中可能产生频繁交易信号

策略优化方向

- 引入动态参数:

- 根据市场波动率自动调整Delta计算周期

- 基于交易量变化动态调整交易量阈值

- 增强信号过滤:

- 添加趋势强度确认指标

- 整合价格形态识别系统

- 完善风险管理:

- 建立动态止损机制

- 引入仓位管理系统

总结

这是一个将价格动量、交易量和趋势指标有机结合的系统化策略。通过多维度分析和严格的交易条件筛选,该策略在保持较高可靠性的同时,也具备了良好的适应性和可扩展性。策略的核心优势在于其对市场趋势的立体化判断,而其最大的发展潜力在于参数的动态优化和风险管理系统的完善。

策略源码

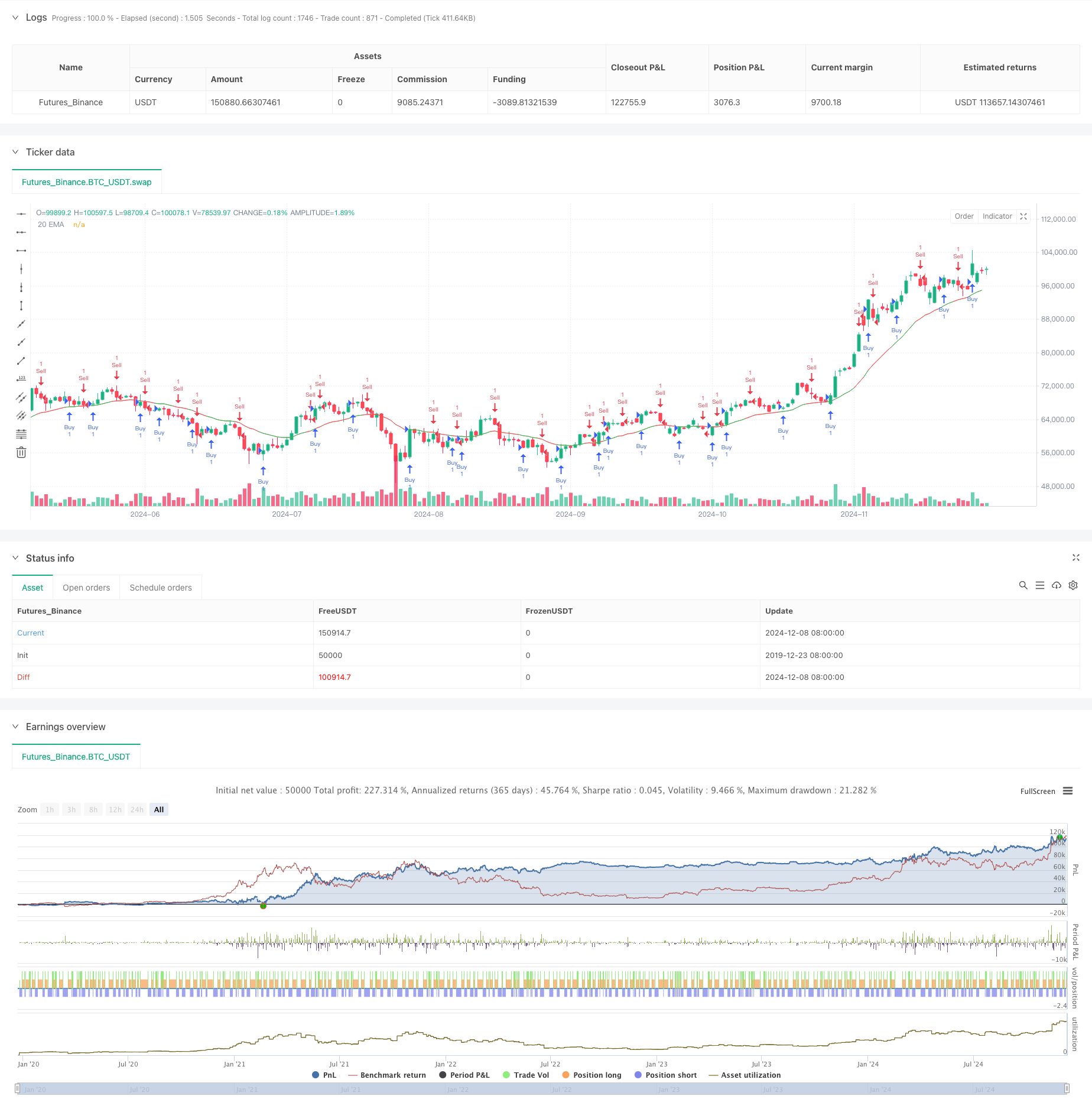

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Volume-Weighted Delta Strategy", overlay=true)

// Input-parametrit

length_delta = input.int(5, minval=1, title="Delta Length")

length_ma = input.int(5, minval=1, title="MA Length")

length_sma = input.int(5, minval=1, title="MA Length")

volume_threshold = input.float(100000, title="Volume Threshold")

// Funktio delta-arvojen laskemiseksi ja volyymin mukaan painottamiseksi

calculate_volume_weighted_delta(delta_length) =>

delta_sum = 0.0

for i = 0 to delta_length - 1

delta_sum := delta_sum + ((close[i] - open[i]) * volume[i])

delta_sum

// Laskenta

delta_value = calculate_volume_weighted_delta(length_delta)

ma_value = ta.sma(delta_value, length_sma)

ema20 = ta.ema(close, 20)

// EMA:n värin määrittely

ema_color = delta_value > ma_value ? color.green : color.red

positive = ta.crossover(delta_value, ma_value)

negative = ta.crossunder(delta_value, ma_value)

// Piirretään graafit

plot(ema20, color=ema_color, title="20 EMA")

BullishCond = ta.crossover(ma_value, delta_value)

BearishCond = ta.crossunder(ma_value, delta_value)

if (BullishCond)

strategy.entry("Sell", strategy.short)

if (BearishCond)

strategy.entry("Buy", strategy.long)

相关推荐