Bollinger Bands and RSI Crossover Trading Strategy

Author: ChaoZhang, Date: 2024-07-26 16:16:09Tags: BBRSISMASD

Overview

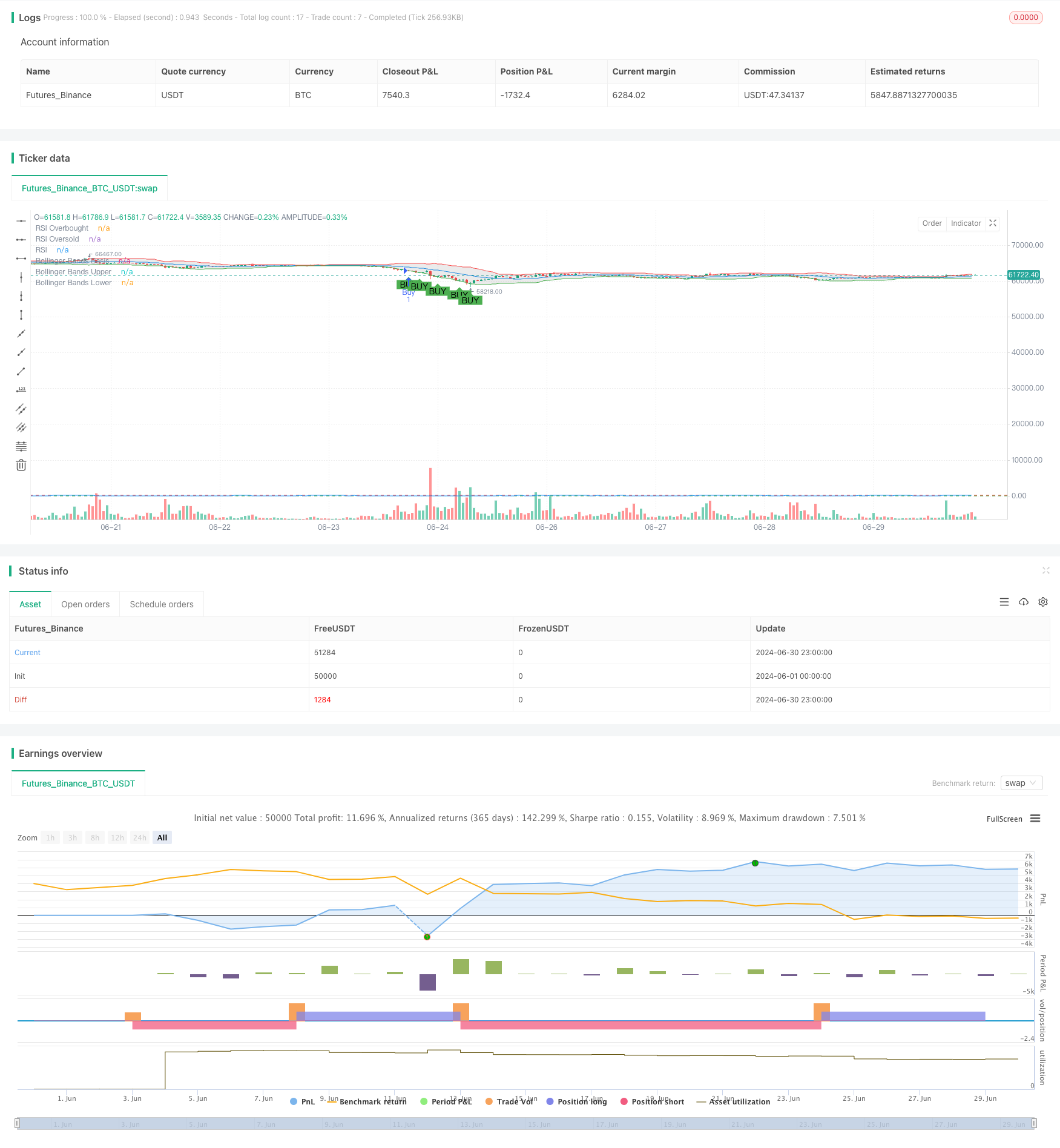

The Bollinger Bands and RSI Crossover Trading Strategy is a quantitative trading approach that combines technical analysis indicators. This strategy primarily utilizes Bollinger Bands and the Relative Strength Index (RSI) to generate trading signals. By monitoring price crossovers with Bollinger Bands and RSI overbought/oversold levels, the strategy aims to capture market reversal points and trend changes. This method seeks to identify potential buying and selling opportunities amidst market volatility while using the RSI indicator to confirm the reliability of signals.

Strategy Principles

Bollinger Bands Calculation:

- Uses a 20-day Simple Moving Average (SMA) as the middle band.

- Upper and lower bands are set at 2 standard deviations above and below the middle band.

RSI Calculation:

- Utilizes a 14-day period for RSI.

- Sets 70 as the overbought level and 30 as the oversold level.

Buy Signal Generation:

- When price crosses above the lower Bollinger Band from below.

- Simultaneously, RSI is below 30 (oversold condition).

Sell Signal Generation:

- When price crosses below the upper Bollinger Band from above.

- Simultaneously, RSI is above 70 (overbought condition).

Signal Visualization:

- Plots Bollinger Bands on the chart.

- Marks buy and sell signals at price breakout points.

Trade Execution:

- Automatically executes buy and sell operations based on generated signals.

Strategy Advantages

Multi-Indicator Integration: By combining Bollinger Bands and RSI, the strategy provides a more comprehensive market analysis, reducing false signals.

Trend and Reversal Capture: Bollinger Bands help identify price trends, while RSI assists in confirming potential reversal points.

Risk Management: Using Bollinger Bands as dynamic support and resistance levels aids in risk control.

High Adaptability: Bollinger Bands automatically adjust to market volatility, allowing the strategy to adapt to different market environments.

Visual Assistance: By visually displaying signals on the chart, traders can quickly understand market dynamics.

Automated Execution: The strategy can automatically generate and execute trade signals, reducing human intervention and emotional influence.

Strategy Risks

False Breakout Risk: Markets may experience brief breakouts of Bollinger Bands followed by retracements, leading to false signals.

Underperformance in Trending Markets: In strong trend markets, the strategy may frequently generate contrary signals, resulting in losses.

Parameter Sensitivity: Strategy performance is highly dependent on Bollinger Bands and RSI parameter settings, which may require different optimizations for various markets.

Lagging Nature: As lagging indicators, Bollinger Bands and RSI may not capture rapid market changes in a timely manner.

Overtrading: In highly volatile markets, the strategy may produce excessive trading signals, increasing transaction costs.

Market Noise: In range-bound markets or low volatility periods, the strategy may be affected by market noise, generating erroneous signals.

Strategy Optimization Directions

Dynamic Parameter Adjustment:

- Implement adaptive adjustment of Bollinger Bands period and multiplier.

- Dynamically adjust RSI overbought/oversold thresholds based on market volatility.

Add Trend Filters:

- Introduce long-term moving averages or ADX indicator to assess market trends.

- Suppress counter-trend trading signals during strong trends.

Integrate Volume Analysis:

- Incorporate volume indicators into the signal confirmation process.

- Require increased volume during breakouts to enhance signal reliability.

Optimize Stop-Loss and Profit-Taking Strategies:

- Implement dynamic stop-loss based on ATR.

- Design a tiered profit-taking mechanism.

Introduce Time Filtering:

- Analyze strategy performance during different time periods.

- Execute trades only during the most effective time frames.

Multi-Timeframe Analysis:

- Combine signals from longer and shorter time periods.

- Enhance signal reliability through multi-timeframe confirmation.

Conclusion

The Bollinger Bands and RSI Crossover Trading Strategy is a quantitative trading method that combines technical analysis tools. By simultaneously leveraging the trend-following characteristics of Bollinger Bands and the overbought/oversold indications of RSI, this strategy aims to capture significant market turning points. While this approach has advantages in identifying potential trading opportunities, it also faces challenges such as false breakouts and parameter sensitivity. To enhance the strategy’s robustness and adaptability, considerations can be made to introduce dynamic parameter adjustments, trend filters, and multi-timeframe analysis. Overall, this strategy framework is worthy of further research and optimization, with the potential to generate consistent trading results across various market conditions.

//@version=5

strategy("Bollinger Bands and RSI Strategy", overlay=true)

// Define Bollinger Bands parameters

length = input(20, title="Bollinger Bands Length")

src = close

mult = input(2.0, title="Bollinger Bands Multiplier")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Define RSI parameters

rsiLength = input(14, title="RSI Length")

rsiOverbought = input(70, title="RSI Overbought Level")

rsiOversold = input(30, title="RSI Oversold Level")

rsi = ta.rsi(close, rsiLength)

// Generate Buy Signal

buySignal = ta.crossover(close, lower) and rsi < rsiOversold

// Generate Sell Signal

sellSignal = ta.crossunder(close, upper) and rsi > rsiOverbought

// Plot Bollinger Bands on Chart

plot(basis, color=color.blue, title="Bollinger Bands Basis")

p1 = plot(upper, color=color.red, title="Bollinger Bands Upper")

p2 = plot(lower, color=color.green, title="Bollinger Bands Lower")

fill(p1, p2, color=color.rgb(0, 0, 0, 90))

// Plot Buy and Sell Signals on Chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Execute Buy and Sell Orders

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.entry("Sell", strategy.short)

// Plot RSI on separate chart

hline(rsiOverbought, "RSI Overbought", color=color.red)

hline(rsiOversold, "RSI Oversold", color=color.green)

plot(rsi, color=color.blue, title="RSI")

- Adaptive Bollinger Bands Dynamic Position Management Strategy

- Bollinger Bands and RSI Combined Trading Strategy

- Bollinger Bands and RSI Combined Dynamic Trading Strategy

- Enhanced Mean Reversion Strategy with Bollinger Bands and RSI Integration

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Bollinger Bands Precise Crossover Quantitative Strategy

- Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

- Bollinger Bands Breakout Quantitative Trading Strategy

- Bollinger Bands Momentum Reversal Quantitative Strategy

- Multi-Moving Average Crossover Trend Following Strategy with Volatility Filter

- MACD Crossover Momentum Strategy with Dynamic Take Profit and Stop Loss Optimization

- Big Red Candle Breakout Buy Strategy

- Adaptive Multi-Moving Average Crossover Dynamic Trading Strategy

- Dynamic Low-Price Entry and Stop-Loss Strategy Based on RSI

- Cloud Momentum Crossover Strategy with Moving Averages and Volume Confirmation

- ATR-RSI Enhanced Trend Following Trading System

- Multi-Indicator Trend Following Strategy: Integrating SuperTrend, EMA, and Risk Management

- Multi-EMA Crossover Trend Following Strategy

- Enhanced Multi-Indicator Momentum Trading Strategy

- Confirmed SMA Crossover Momentum Strategy

- 44 SMA and 9 EMA Crossover Strategy with RSI Filter and TP/SL

- 4-Hour Timeframe Engulfing Pattern Trading Strategy with Dynamic Take Profit and Stop Loss Optimization

- Dynamic Keltner Channel Momentum Reversal Strategy

- Pairing trading strategy OKX

- Interest rate

- Charts of leverage

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- 5EMA Trend Following Strategy with Dynamic Stop-Loss and Take-Profit

- Enhanced Dynamic Bollinger Bands Trading Strategy