Multi-EMA Crossover with Time Interval Integration Strategy

Author: ChaoZhang, Date: 2024-07-30 17:14:25Tags: EMASMATA

Overview

This strategy is a quantitative trading system based on multiple Exponential Moving Average (EMA) crossovers and time interval control. It utilizes crossover signals between the 50-period EMA and both 5-period and 10-period EMAs to generate buy and sell decisions. The strategy also incorporates a 30-candle time interval mechanism to avoid overtrading and sets fixed take-profit and stop-loss levels for risk management. This approach aims to capture medium to long-term trends while improving trade quality through time filters and risk management measures.

Strategy Principles

Moving Average System: The strategy uses three EMAs - 50-period (slow), 10-period (medium), and 5-period (fast).

Entry Signals:

- Buy Signal: Triggered when both 5-period and 10-period EMAs cross above the 50-period EMA.

- Sell Signal: Triggered when both 5-period and 10-period EMAs cross below the 50-period EMA.

Time Interval Control: The strategy ensures at least 30 candle periods have passed since the last trade before executing a new one. This helps reduce noisy trades and focus on more significant trend changes.

Risk Management:

- Take Profit is set at 50 pips.

- Stop Loss is set at 30 pips.

Trade Execution:

- All existing positions are closed before opening new ones.

- Buy and sell orders are executed using market orders.

Visualization: The strategy plots the three EMA lines and trade signal markers on the chart for analysis and backtesting purposes.

Strategy Advantages

Multiple Confirmations: Using two fast EMAs (5 and 10-period) crossing the slow EMA (50-period) simultaneously provides stronger trend confirmation signals, reducing false breakouts.

Trend Following: The 50-period EMA serves as the main trend indicator, helping to capture medium to long-term market movements.

Time Filtering: The 30-candle period interval requirement effectively reduces overtrading and improves signal quality.

Risk Control: Fixed take-profit and stop-loss levels provide a clear risk-reward ratio for each trade.

Automation: The strategy is fully automated, eliminating human emotional interference.

Adaptability: While the strategy uses fixed parameters, its logic can be easily adapted to different markets and timeframes.

Visual Assistance: Graphical representation of EMA lines and trade signals aids in intuitive assessment of strategy performance.

Strategy Risks

Lag: EMAs are inherently lagging indicators and may react slowly in highly volatile markets.

Performance in Ranging Markets: The strategy may produce frequent false signals in sideways or choppy markets.

Fixed Take-Profit and Stop-Loss: While providing stable risk management, these may not be suitable for all market conditions.

Parameter Sensitivity: The choice of EMA periods and time interval can significantly affect strategy performance.

Over-reliance on Technical Indicators: The strategy does not consider fundamental factors and may underperform during major news events.

Drawdown Risk: The strategy may face significant drawdowns during strong trend reversals.

Execution Slippage: In fast markets, there may be a risk of high execution slippage.

Strategy Optimization Directions

Dynamic Parameter Adjustment: Consider dynamically adjusting EMA periods and trade intervals based on market volatility.

Incorporate Volume Indicators: Combine volume or other momentum indicators to enhance signal reliability.

Adaptive Take-Profit and Stop-Loss: Set dynamic take-profit and stop-loss levels based on market volatility or ATR.

Market State Classification: Add logic to determine market state (trending/ranging) and apply different trading strategies accordingly.

Timeframe Fusion: Consider signal confirmation across multiple timeframes to improve trade quality.

Risk Exposure Management: Introduce position sizing logic to adjust trade volume based on account risk and market volatility.

Add Filters: Such as trend strength indicators or volatility filters to reduce false signals.

Backtesting Optimization: Conduct more extensive parameter optimization and out-of-sample testing to improve strategy robustness.

Conclusion

The Multi-EMA Crossover with Time Interval Integration Strategy is a quantitative trading system that combines technical analysis with risk management. It captures trends through multiple EMA crossovers, uses a time filter to improve signal quality, and manages risk through fixed take-profit and stop-loss levels. While the strategy shows potential for capturing medium to long-term trends, it also faces some inherent limitations of technical indicators. Through the suggested optimization directions, such as dynamic parameter adjustment, multi-indicator integration, and adaptive risk management, the strategy has the potential to further enhance its performance and adaptability. In practical application, comprehensive backtesting and forward testing are necessary, with fine-tuning based on specific market conditions and risk preferences.

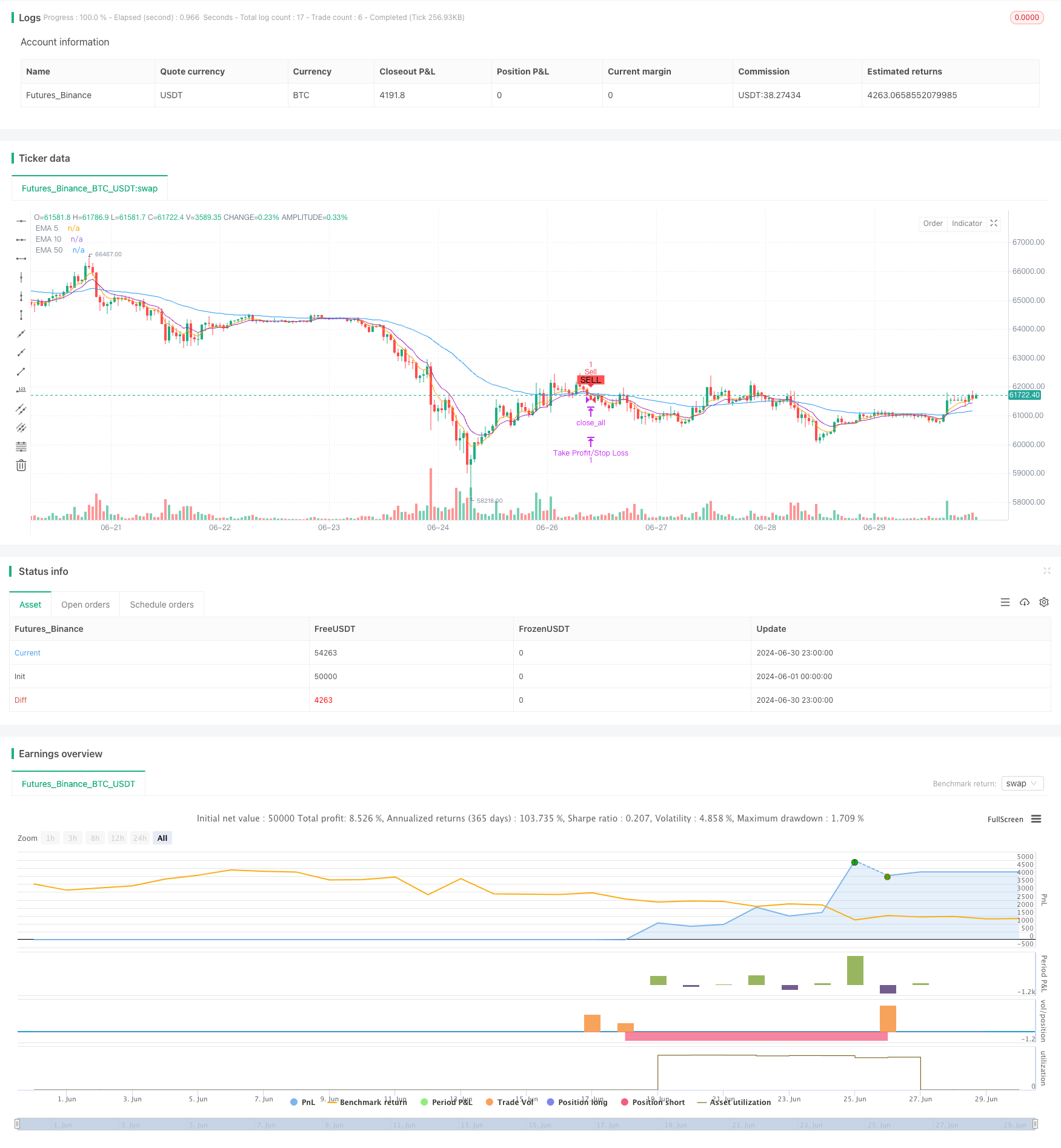

/*backtest

start: 2024-06-01 00:00:00

end: 2024-06-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Cross Strategy", overlay=true)

// Define the EMAs

ema50 = ta.ema(close, 50)

ema5 = ta.ema(close, 5)

ema10 = ta.ema(close, 10)

// Define crossover and crossunder conditions

buyCondition = ta.crossover(ema5, ema50) and ta.crossover(ema10, ema50)

sellCondition = ta.crossunder(ema5, ema50) and ta.crossunder(ema10, ema50)

// Calculate pip values

pip = syminfo.mintick * 10

takeProfitPips = 50 * pip

stopLossPips = 30 * pip

// Track the last order time to ensure 30 candle gap

var float lastOrderTime = na

timeElapsed = (na(lastOrderTime) ? na : (time - lastOrderTime) / (1000 * syminfo.mintick))

// Close previous orders before opening new ones

if (buyCondition or sellCondition) and (na(timeElapsed) or timeElapsed >= 30)

strategy.close_all()

lastOrderTime := time

// Open buy orders

if buyCondition and (na(timeElapsed) or timeElapsed >= 30)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", limit=takeProfitPips, stop=stopLossPips)

lastOrderTime := time

// Open sell orders

if sellCondition and (na(timeElapsed) or timeElapsed >= 30)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", limit=takeProfitPips, stop=stopLossPips)

lastOrderTime := time

// Plot signals

plotshape(series=buyCondition and (na(timeElapsed) or timeElapsed >= 30), location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition and (na(timeElapsed) or timeElapsed >= 30), location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plot EMAs for visualization

plot(ema50, color=color.blue, title="EMA 50")

plot(ema5, color=color.orange, title="EMA 5")

plot(ema10, color=color.purple, title="EMA 10")

- Dual EMA Dynamic Trend Capture Trading System

- Advanced Fibonacci Retracement Trend-Following and Reversal Trading Strategy

- Confirmed SMA Crossover Momentum Strategy

- EMA, SMA, Moving Average Crossover, Momentum Indicator

- Dual EMA Volume Trend Confirmation Strategy for Quantitative Trading

- EMA Crossover Momentum Scalping Strategy

- SMA Dual Moving Average Crossover Strategy

- Trading ABC

- Multi-EMA Crossover Momentum Strategy

- Super Moving Average and Upperband Crossover Strategy

- Adaptive Dynamic Stop-Loss and Take-Profit Strategy with SMA Crossover and Volume Filter

- Dual MACD Trend Confirmation Trading System

- High/Low Breakout Strategy with Alpha Trend and Moving Average Filter

- Multi-Candlestick Pattern Recognition and Trading Strategy

- Multi-EMA Crossover Strategy with Trend Confirmation

- Momentum-Driven EMA-RSI Crossover Strategy

- Multi-Indicator Dynamic Trading Strategy

- Multi-Indicator Intelligent Pyramiding Strategy

- Multi-EMA Crossover Momentum Strategy

- Multi-Order Breakout Trend Following Strategy

- Dual Moving Average Crossover Confirmation Strategy with Volume-Price Integration Optimization Model

- Dual Dynamic Indicator Optimization Strategy

- VWAP Crossover Dynamic Profit Target Trading Strategy

- Bollinger Bands Breakout Quantitative Trading Strategy

- Fibonacci Extension and Retracement Channel Breakout Strategy

- Multi-Dimensional Order Flow Analysis and Trading Strategy

- Multi-Moving Average Trend Following and Reversal Pattern Recognition Strategy

- Advanced Composite Moving Average and Market Momentum Trend Capture Strategy

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Standard Deviation Breakout Trading Strategy: Multi-Period Optimization System Based on Dynamic Volatility