Overview

This strategy is an automated trading system based on Simple Moving Average (SMA) crossovers and volume filtering. It utilizes the crossover of fast and slow SMAs to generate entry signals, while incorporating volume indicators to confirm trend strength. The strategy also includes dynamic stop-loss and take-profit mechanisms, as well as time-based exit conditions, aimed at optimizing risk management and enhancing profitability.

Strategy Principles

The core principles of this strategy are based on the following key components:

SMA Crossover Signals:

- Uses two Simple Moving Averages of different periods (fast SMA and slow SMA)

- Generates a long signal when the fast SMA crosses above the slow SMA

- Generates a short signal when the fast SMA crosses below the slow SMA

Volume Filtering:

- Calculates a Simple Moving Average of volume

- Long signals require current volume to be above the volume SMA

- Short signals require current volume to be below the volume SMA

Dynamic Stop-Loss and Take-Profit:

- Sets stop-loss and take-profit levels based on a percentage of the entry price

- Stop-loss and take-profit levels can be adjusted through input parameters

Time-Based Exits:

- Sets a maximum holding time (in number of bars)

- Automatically closes positions after the maximum holding time to prevent long-term adverse positions

Backtest Period Setting:

- Allows users to define a specific backtest time range

- Ensures the strategy runs only within the specified historical period

Strategy Advantages

Trend Following and Momentum Combination: By combining SMA crossovers and volume filtering, the strategy can capture strong trend movements while avoiding frequent trades in weak markets.

Flexible Risk Management: The dynamic stop-loss and take-profit mechanisms allow the strategy to automatically adjust risk exposure based on market volatility, helping to protect profits and limit potential losses.

Prevention of Overholding: The maximum holding time limit helps prevent the strategy from holding losing positions for extended periods in adverse market conditions, promoting effective use of capital.

High Customizability: Multiple adjustable parameters (such as SMA periods, stop-loss and take-profit percentages, maximum holding time, etc.) allow the strategy to be optimized for different markets and trading styles.

Visual Support: The strategy plots SMA lines and trade signals on the chart, facilitating intuitive understanding and analysis of strategy performance.

Strategy Risks

Lagging Nature: SMA indicators are inherently lagging, which may lead to delayed entries or missed opportunities in rapidly reversing markets.

False Breakout Risk: In ranging markets, SMA crossovers may produce frequent false breakout signals, leading to overtrading and increased transaction costs.

Volume Dependency: Over-reliance on volume indicators may mislead the strategy under certain market conditions, especially during periods of low liquidity or abnormal trading volumes.

Fixed Percentage Stop-Loss/Take-Profit: Using fixed percentage stop-loss and take-profit may not be suitable for all market conditions, especially during periods of dramatic volatility changes.

Limitations of Time-Based Exits: Fixed maximum holding times may lead to premature exits when favorable trends have not yet concluded, impacting potential returns.

Strategy Optimization Directions

Dynamic Parameter Adjustment: Implement dynamic adjustment of SMA periods, stop-loss and take-profit percentages, and maximum holding times to adapt to different market cycles and volatility.

Incorporate Additional Filters: Introduce other technical indicators (such as RSI, MACD, etc.) as additional filtering conditions to improve the accuracy of trade signals.

Adaptive Volume Thresholds: Develop dynamically adjusting volume threshold mechanisms to better adapt to volume characteristics in different market phases.

Improved Exit Mechanisms: Explore intelligent exit mechanisms based on market structure or momentum indicators to replace fixed-time exits, enhancing strategy adaptability.

Volatility Adjustment: Implement dynamic stop-loss and take-profit level adjustments based on market volatility to better manage risk and capture profits.

Multi-Timeframe Analysis: Integrate data analysis from multiple timeframes to improve the strategy’s ability to identify market trends and reversals.

Machine Learning Optimization: Utilize machine learning algorithms to dynamically optimize strategy parameters, improving performance across different market environments.

Conclusion

The “Adaptive Dynamic Stop-Loss and Take-Profit Strategy with SMA Crossover and Volume Filter” is a comprehensive trading system that combines trend following, volume analysis, and risk management. By leveraging SMA crossovers and volume filtering, the strategy aims to capture strong market trends, while its dynamic stop-loss and take-profit mechanisms and time-based exit features provide flexible risk control. Although there are some inherent limitations, such as signal lag and dependence on fixed parameters, the strategy offers multiple optimization directions, including dynamic parameter adjustment, introduction of additional technical indicators, and the use of machine learning techniques. Through continuous optimization and improvement, this strategy has the potential to become a powerful and flexible automated trading tool suitable for various market conditions and trading styles.

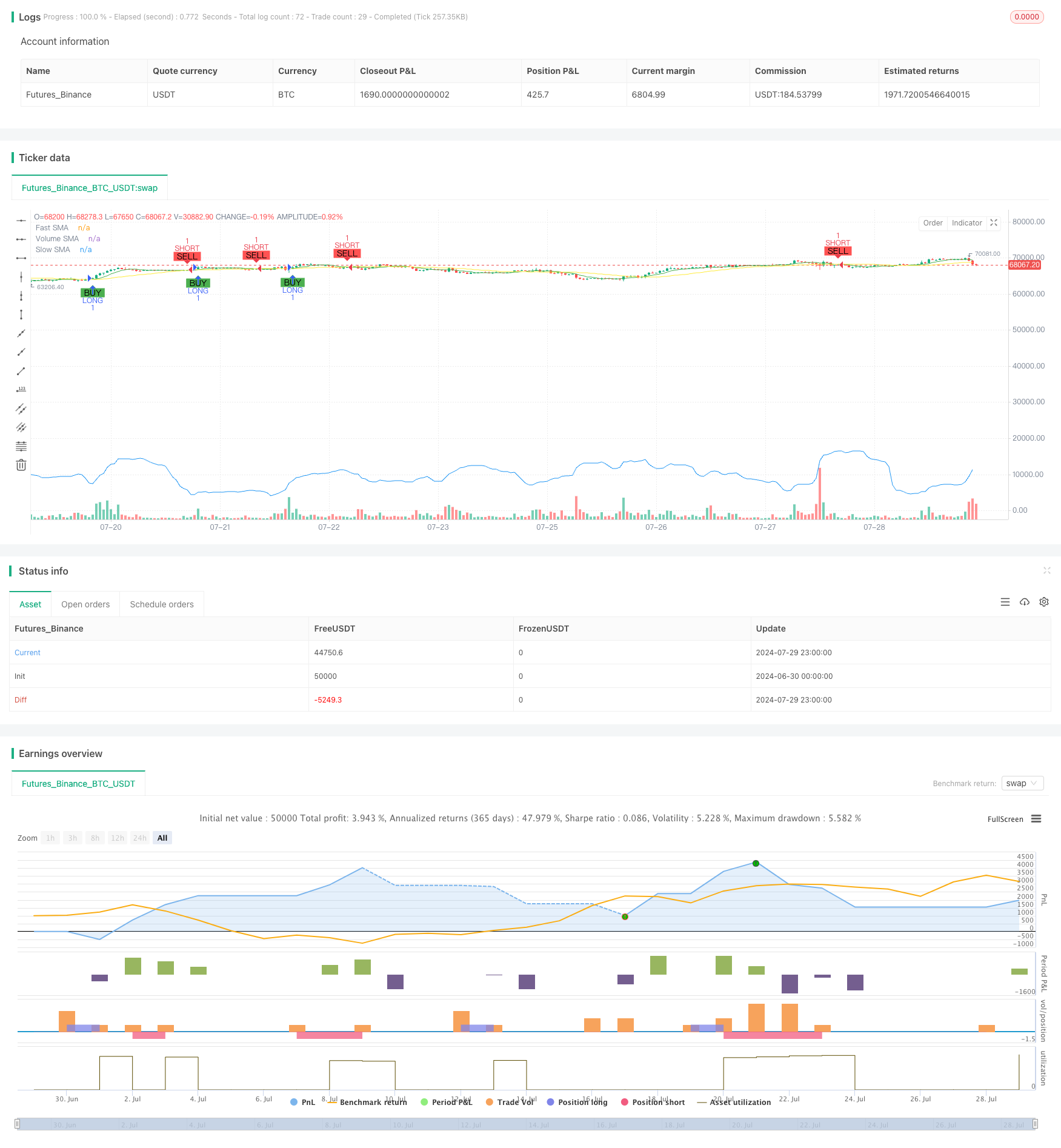

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Simple_CrossOver_Bot_V1_EBO", overlay=true)

// INPUTS

dateStart_Year = input.int(2018, title="Start Year", minval=2000)

dateStart_Month = input.int(1, title="Start Month", minval=1, maxval=12)

dateStart_Day = input.int(1, title="Start Day", minval=1, maxval=31)

dateEnd_Year = input.int(2019, title="End Year", minval=2000)

dateEnd_Month = input.int(1, title="End Month", minval=1, maxval=12)

dateEnd_Day = input.int(1, title="End Day", minval=1, maxval=31)

fast_SMA_input = input.int(7, title="SMA Fast")

slow_SMA_input = input.int(25, title="SMA Slow")

volume_SMA_input = input.int(20, title="Volume SMA")

stop_loss_percent = input.float(1.0, title="Stop Loss (%)", step=0.1) / 100

take_profit_percent = input.float(2.0, title="Take Profit (%)", step=0.1) / 100

max_bars_in_trade = input.int(50, title="Max Bars in Trade", minval=1)

// INDICATORS

fast_SMA = ta.sma(close, fast_SMA_input)

slow_SMA = ta.sma(close, slow_SMA_input)

volume_SMA = ta.sma(volume, volume_SMA_input)

// STRATEGY

LONG = ta.crossover(fast_SMA, slow_SMA) and fast_SMA > slow_SMA and volume > volume_SMA

SHORT = ta.crossunder(fast_SMA, slow_SMA) and fast_SMA < slow_SMA and volume < volume_SMA

// TRIGGERS

testPeriodStart = timestamp(dateStart_Year, dateStart_Month, dateStart_Day)

testPeriodEnd = timestamp(dateEnd_Year, dateEnd_Month, dateEnd_Day)

timecondition = true

// Track bar index for entries

var int long_entry_bar_index = na

var int short_entry_bar_index = na

if timecondition

if LONG

strategy.entry(id="LONG", direction=strategy.long)

long_entry_bar_index := bar_index

if SHORT

strategy.entry(id="SHORT", direction=strategy.short)

short_entry_bar_index := bar_index

// Exit conditions for LONG

if not na(long_entry_bar_index) and bar_index - long_entry_bar_index >= max_bars_in_trade

strategy.close("LONG")

long_entry_bar_index := na

// Exit conditions for SHORT

if not na(short_entry_bar_index) and bar_index - short_entry_bar_index >= max_bars_in_trade

strategy.close("SHORT")

short_entry_bar_index := na

// Standard exits

if LONG

strategy.exit("Exit LONG", from_entry="LONG", stop=close * (1 - stop_loss_percent), limit=close * (1 + take_profit_percent))

if SHORT

strategy.exit("Exit SHORT", from_entry="SHORT", stop=close * (1 + stop_loss_percent), limit=close * (1 - take_profit_percent))

// PLOTS

plot(fast_SMA, color=color.green, linewidth=1, title="Fast SMA")

plot(slow_SMA, color=color.yellow, linewidth=1, title="Slow SMA")

plot(volume_SMA, color=color.blue, linewidth=1, title="Volume SMA")

plotshape(series=LONG, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(series=SHORT, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)

// Uncomment the following lines for alerts

// alertcondition(LONG, title="LONG")

// alertcondition(SHORT, title="SHORT")