Multi-Indicator Integration and Intelligent Risk Control Quantitative Trading System

Author: ChaoZhang, Date: 2024-11-12 11:47:23Tags: EMARVIAIML

Overview

This strategy is a quantitative trading system that combines technical analysis indicators with simulated artificial intelligence. It integrates traditional technical indicators such as EMA and RVI, while incorporating simulated AI signals for trading decisions. The strategy also includes a comprehensive money management and risk control system, protecting capital through stop-loss and take-profit mechanisms.

Strategy Principle

The strategy is built on several core components: 1. Uses 20-day and 200-day Exponential Moving Averages (EMA) to determine market trends 2. Employs Relative Volatility Index (RVI) to evaluate market volatility 3. Incorporates simulated AI signals for decision support 4. Implements fixed capital allocation with 200 units per trade 5. Sets 2% stop-loss and 4% take-profit for risk control

Buy signals are generated when EMA20 crosses above EMA200 with positive RVI; sell signals occur when EMA20 crosses below EMA200 with negative RVI.

Strategy Advantages

- Multi-dimensional signal confirmation improves trading accuracy

- Comprehensive risk control system effectively manages drawdowns

- Fixed capital allocation plan facilitates money management

- Integration of AI simulation signals enhances strategy adaptability

- Adjustable parameters provide good flexibility

Strategy Risks

- EMA indicators may generate false signals in ranging markets

- Fixed stop-loss percentage may not suit all market conditions

- Random nature of simulated AI signals may affect strategy stability

- Fixed capital allocation might miss opportunities in strong trends

Optimization Directions

- Introduce additional technical indicators for signal filtering

- Develop adaptive stop-loss and take-profit mechanisms

- Optimize money management with dynamic position sizing

- Improve AI simulation algorithm for better signal quality

- Add market condition recognition mechanisms

Summary

The strategy constructs a relatively complete trading system by combining traditional technical analysis with modern quantitative methods. While certain risks exist, continuous optimization and improvement should lead to better trading results. Thorough backtesting is recommended before live trading.

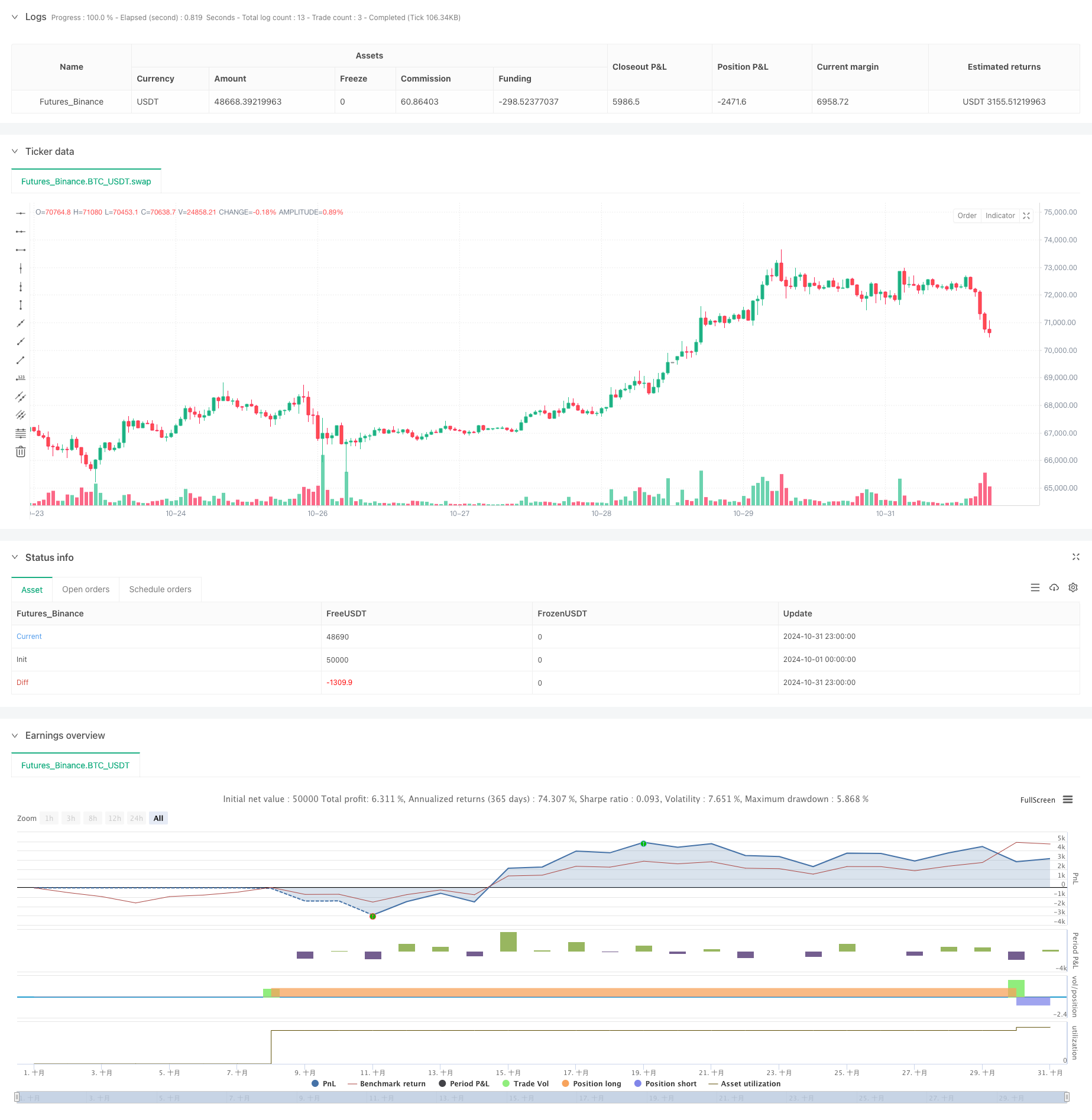

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Gold Bot with Simulated AI, Viamanchu, EMA20, EMA200, RVI, and Risk Management", overlay=true)

// Parámetros de las EMAs

ema20 = ta.ema(close, 20)

ema200 = ta.ema(close, 200)

// Relative Volatility Index (RVI)

length = input(14, title="RVI Length")

rvi = ta.rma(close - close[1], length) / ta.rma(math.abs(close - close[1]), length)

// Simulación de Viamanchu (aleatoria)

var int seed = time

simulated_vi_manchu_signal = math.random() > 0.5 ? 1 : -1 // 1 para compra, -1 para venta

// Configuración de gestión de riesgos

capital_total = 2000 // Capital total

capital_operado = 200 // Capital asignado a cada operación

stop_loss_percent = input.float(2, title="Stop Loss %", minval=0.1, step=0.1) // 2% de stop loss

take_profit_percent = input.float(4, title="Take Profit %", minval=0.1, step=0.1) // 4% de take profit

// Cálculo de stop loss y take profit en base al precio de entrada

stop_loss = close * (1 - stop_loss_percent / 100)

take_profit = close * (1 + take_profit_percent / 100)

// Condiciones de entrada

longCondition = ta.crossover(ema20, ema200) and rvi > 0 and simulated_vi_manchu_signal == 1

shortCondition = ta.crossunder(ema20, ema200) and rvi < 0 and simulated_vi_manchu_signal == -1

// Ejecutar compra

if (longCondition)

strategy.entry("Compra", strategy.long, stop=stop_loss, limit=take_profit)

// Ejecutar venta

if (shortCondition)

strategy.entry("Venta", strategy.short, stop=stop_loss, limit=take_profit)

- Intelligent Exponential Moving Average Trading Strategy Optimization System

- Multi-Indicator Cross-Trend Tracking and Volume-Price Combined Adaptive Trading Strategy

- Dynamic Moving Average Crossover Trend Following Strategy with ATR Risk Management System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- KRK aDa Stochastic Slow Mean Reversion Strategy with AI Enhancements

- KRK ADA 1H Stochastic Slow Strategy with More Entries and AI

- Dynamic Dual EMA Crossover Quantitative Trading Strategy

- Dual EMA Momentum Trend Trading Strategy with Full Body Candle Signal System

- EMA Crossover with Short-term Signals Strategy

- Multi-EMA Golden Cross Strategy with Tiered Take-Profit

- Parabolic SAR Divergence Trading Strategy

- Combined Momentum SMA Crossover Strategy with Market Sentiment and Resistance Level Optimization System

- Multi-Period RSI Momentum and Triple EMA Trend Following Composite Strategy

- Multi-Moving Average Momentum Trend Following Strategy

- E9 Shark-32 Pattern Quantitative Price Breakout Strategy

- Open Market Exposure Dynamic Position Adjustment Quantitative Trading Strategy

- High Win Rate Trend Mean Reversion Trading Strategy

- Dual Moving Average RSI Trend Momentum Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management

- Multi-Indicator Dynamic Adaptive Position Sizing with ATR Volatility Strategy

- RSI Dynamic Stop-Loss Intelligent Trading Strategy

- Triple-Validated RSI Mean Reversion with Moving Average Filter Strategy

- Adaptive Oscillation Trend Trading Strategy with Bollinger Bands and RSI Integration

- ADX (Average Directional Index) and Volume Dynamic Trend Tracking Strategy

- Multi-Volume Momentum Combined Trading Strategy

- Fibonacci Retracement and Extension Multi-Indicator Quantitative Trading Strategy

- Cross-Market Overnight Position Strategy with EMA Filter

- Multi-Technical Indicator Based Mean Reversion and Trend Following Strategy

- WebSocket Acceleration Driver