Dual Moving Average RSI Trend Momentum Strategy

Author: ChaoZhang, Date: 2024-11-12 14:34:17Tags: SMARSIMA

Overview

This strategy is a trend-following trading system that combines dual moving averages with the RSI indicator. It determines market trend direction through crossovers of short-term and long-term moving averages while utilizing RSI indicator for optimal entry points in overbought and oversold areas, achieving a perfect combination of trend following and momentum reversal. The strategy employs percentage-based money management, investing 10% of the total account balance per trade for effective risk control.

Strategy Principles

The strategy uses 10-period and 50-period Simple Moving Averages (SMA) to identify trends. Buy signals are generated when the short-term MA crosses above the long-term MA and RSI is below 30, while sell signals occur when the short-term MA crosses below the long-term MA and RSI is above 70. For position closing, long positions are closed when RSI exceeds 70, and short positions are closed when RSI falls below 30. This design ensures both trend direction accuracy and timely profit-taking at price extremes.

Strategy Advantages

- Combines trend and momentum confirmation to improve trade success rate

- Implements percentage-based money management for effective risk control

- Sets clear entry and exit conditions to avoid subjective judgment

- Fully utilizes RSI indicator’s overbought and oversold characteristics

- Clear strategy logic that’s easy to understand and execute

- Adaptable to different market environments with strong versatility

Strategy Risks

- May generate excessive false signals in ranging markets

- RSI may remain in overbought/oversold zones during strong trends

- Dual MA system has inherent lag

- Fixed parameters may not suit all market conditions Risk management recommendations:

- Set stop-loss levels

- Dynamically adjust parameters

- Add trend confirmation indicators

- Control single trade size

Optimization Directions

- Introduce adaptive parameter mechanism to dynamically adjust MA periods based on market volatility

- Add trend strength filter to avoid trading in weak trends

- Optimize money management system to adjust position size based on market volatility

- Incorporate additional technical indicators for trade confirmation

- Develop dynamic stop-loss mechanism to improve capital efficiency

Summary

This is a quantitative trading strategy that perfectly combines trend following with momentum reversal. It uses dual moving averages to determine trend direction and RSI to find optimal entry points, ensuring both directional accuracy and timely profit-taking at price extremes. The key to strategy success lies in reasonable parameter settings and effective risk control. Through continuous optimization and improvement, the strategy has the potential to achieve stable returns across different market environments.

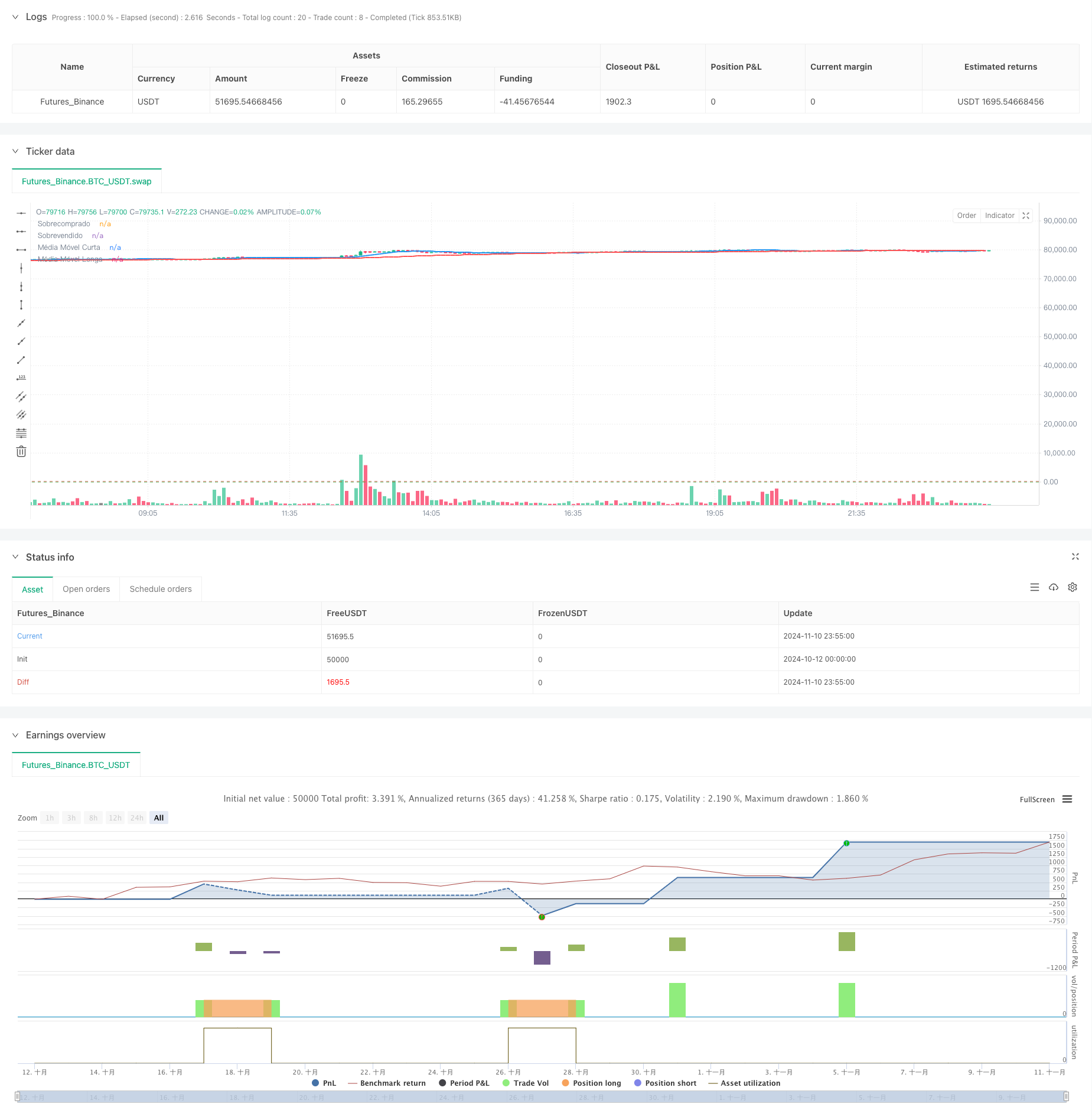

/*backtest

start: 2024-10-12 00:00:00

end: 2024-11-11 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Super Advanced Strategy", overlay=true)

// Configuração de parâmetros

shortMAPeriod = input.int(10, title="Período da Média Móvel Curta", minval=1)

longMAPeriod = input.int(50, title="Período da Média Móvel Longa", minval=1)

rsiPeriod = input.int(14, title="Período do RSI", minval=1)

// Cálculo das Médias Móveis

shortMA = ta.sma(close, shortMAPeriod)

longMA = ta.sma(close, longMAPeriod)

// Cálculo do RSI

rsi = ta.rsi(close, rsiPeriod)

// Plotando as Médias Móveis

plot(shortMA, title="Média Móvel Curta", color=color.blue, linewidth=2)

plot(longMA, title="Média Móvel Longa", color=color.red, linewidth=2)

// Adicionando linhas horizontais para os níveis de sobrecomprado e sobrevendido

hline(70, "Sobrecomprado", color=color.red, linestyle=hline.style_dashed)

hline(30, "Sobrevendido", color=color.green, linestyle=hline.style_dashed)

// Condições de entrada

buyCondition = (shortMA > longMA) and (rsi < 30)

sellCondition = (shortMA < longMA) and (rsi > 70)

// Entradas de ordens

if (buyCondition)

strategy.entry("Compra", strategy.long)

if (sellCondition)

strategy.entry("Venda", strategy.short)

// Saídas de ordens

if (rsi > 70)

strategy.close("Compra")

if (rsi < 30)

strategy.close("Venda")

// Exibir as condições de compra e venda no gráfico

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.green, size=size.small, title="Sinal de Compra", text="BUY")

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.small, title="Sinal de Venda", text="SELL")

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Triple-Validated RSI Mean Reversion with Moving Average Filter Strategy

- Dual Moving Average-RSI Multi-Signal Trend Trading Strategy

- Multi-Moving Average Momentum Trend Following Strategy

- Multi-Period Moving Average and RSI Momentum Cross Strategy

- Multi-Period Moving Average and RSI Momentum Cross Trend Following Strategy

- Multi-Technical Indicator Cross-Trend Tracking Strategy: RSI and Stochastic RSI Synergy Trading System

- Dynamic Support-Resistance Breakout Moving Average Crossover Strategy

- Machine Learning Inspired Dual Moving Average RSI Trading Strategy

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Multi-Period Technical Analysis and Market Sentiment Trading Strategy

- Dynamic Holding Period Strategy Based on 123 Point Reversal Pattern

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

- Parabolic SAR Divergence Trading Strategy

- Combined Momentum SMA Crossover Strategy with Market Sentiment and Resistance Level Optimization System

- Multi-Period RSI Momentum and Triple EMA Trend Following Composite Strategy

- Multi-Moving Average Momentum Trend Following Strategy

- E9 Shark-32 Pattern Quantitative Price Breakout Strategy

- Open Market Exposure Dynamic Position Adjustment Quantitative Trading Strategy

- High Win Rate Trend Mean Reversion Trading Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management

- Multi-Indicator Integration and Intelligent Risk Control Quantitative Trading System

- Multi-Indicator Dynamic Adaptive Position Sizing with ATR Volatility Strategy

- RSI Dynamic Stop-Loss Intelligent Trading Strategy

- Triple-Validated RSI Mean Reversion with Moving Average Filter Strategy

- Adaptive Oscillation Trend Trading Strategy with Bollinger Bands and RSI Integration

- ADX (Average Directional Index) and Volume Dynamic Trend Tracking Strategy

- Multi-Volume Momentum Combined Trading Strategy

- Fibonacci Retracement and Extension Multi-Indicator Quantitative Trading Strategy