基于123点位反转的动态持仓期策略

Author: ChaoZhang, Date: 2024-11-12 15:15:46Tags: MASMARSILOWHIGH

概述

本策略是一个基于市场价格形态识别的量化交易系统,主要通过识别123点位反转形态来捕捉市场潜在的反转机会。策略结合了动态持仓期管理和移动平均线过滤,通过多重条件验证来提高交易的准确性。该策略采用精确的数学模型来定义入场点,并使用200日均线作为辅助退出条件,形成了一个完整的交易系统。

策略原理

策略的核心逻辑基于价格形态识别,具体包含以下关键要素:

1. 入场条件设计

- 当日最低价需低于前一日最低价

- 前一日最低价需低于3天前最低价

- 2天前最低价需低于4天前最低价

- 2天前最高价需低于3天前最高价

以上四个条件同时满足时,系统会发出做多信号。

- 退出机制设计

- 设定默认持仓期为7天

- 使用200日简单移动平均线(SMA)作为动态退出条件

- 当价格触及或超过200日均线时触发平仓信号

- 持仓时间达到设定天数后自动平仓

策略优势

- 形态识别准确性高

- 采用多重条件验证机制

- 通过价格高低点的相对位置关系严格定义入场条件

- 降低了误判概率

- 风险控制完善

- 设定固定持仓期限制最大损失

- 使用长期均线作为趋势过滤器

- 具备双重退出机制保护盈利

- 操作规则明确

- 入场退出条件清晰明确

- 参数可根据市场情况灵活调整

- 便于实盘执行和回测验证

策略风险

- 形态识别局限性

- 在震荡市场可能产生虚假信号

- 剧烈波动时段准确率下降

- 需要配合其他技术指标验证

- 参数优化风险

- 固定持仓期可能不适合所有市场环境

- 移动平均线周期选择影响策略表现

- 过度优化可能导致过拟合

- 市场适应性风险

- 在强趋势市场中反转信号可靠性降低

- 不同市场条件下表现差异较大

- 需要定期评估策略有效性

策略优化方向

- 入场信号优化

- 增加成交量确认机制

- 引入动量指标作为辅助判断

- 考虑加入波动率过滤器

- 退出机制完善

- 实现动态持仓期管理

- 增加移动止损功能

- 开发多层次利润目标

- 风险控制增强

- 建立仓位管理系统

- 设计回撤控制机制

- 添加市场情绪指标

总结

该策略通过严格的形态识别和完善的风险控制体系,为交易者提供了一个可靠的市场反转捕捉工具。虽然存在一定的局限性,但通过持续优化和适当的参数调整,该策略能够在不同市场环境下保持稳定的表现。建议交易者在实际应用中结合市场经验,对策略进行针对性调整,以获得更好的交易效果。

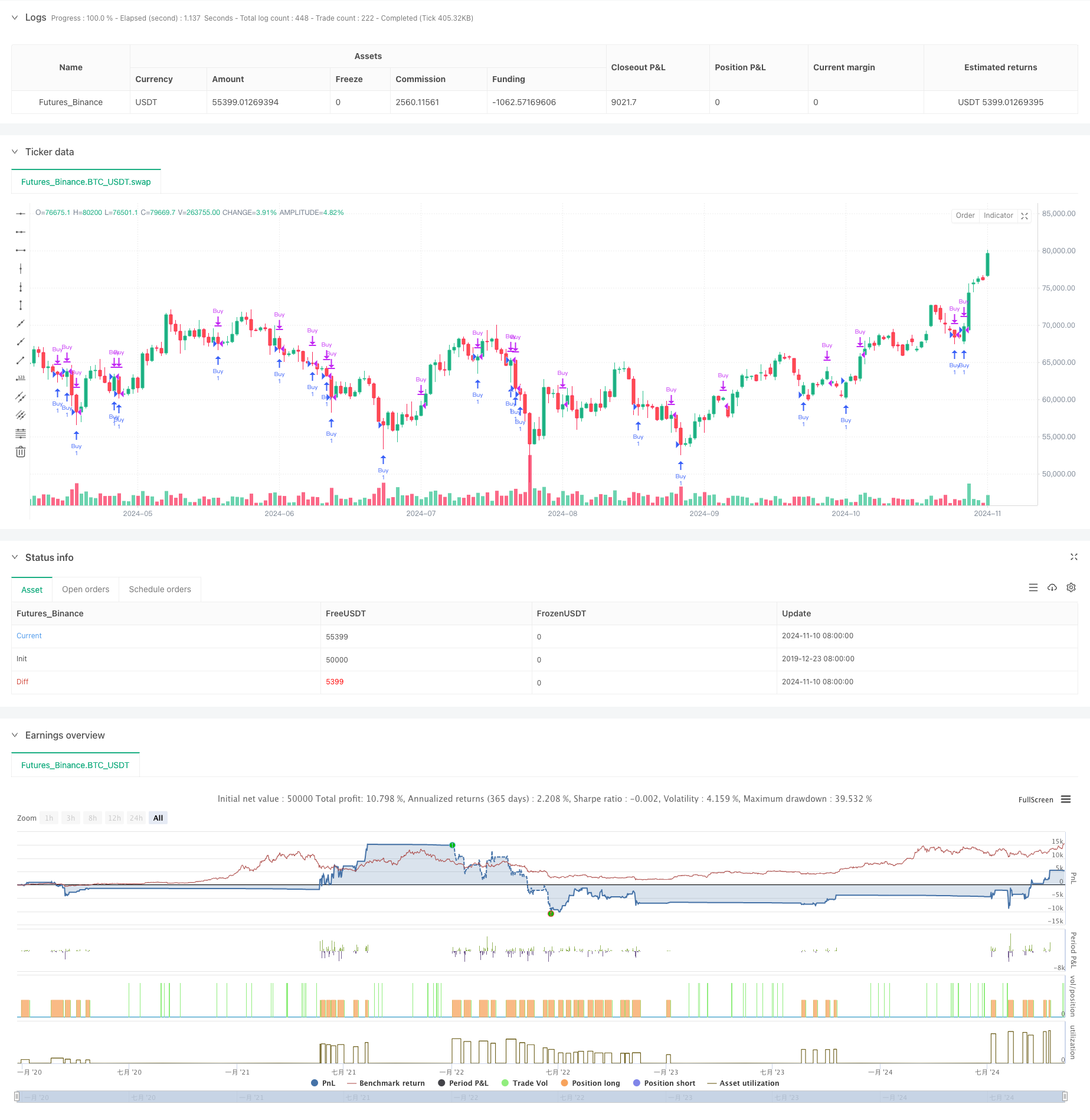

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © EdgeTools

//@version=5

strategy("123 Reversal Trading Strategy", overlay=true)

// Input for number of days to hold the trade

daysToHold = input(7, title="Days to Hold Trade")

// Input for 20-day moving average

maLength = input(200, title="Moving Average Length")

// Calculate the 20-day moving average

ma20 = ta.sma(close, maLength)

// Define the conditions for the 123 reversal pattern (bullish reversal)

// Condition 1: Today's low is lower than yesterday's low

condition1 = low < low[1]

// Condition 2: Yesterday's low is lower than the low three days ago

condition2 = low[1] < low[3]

// Condition 3: The low two days ago is lower than the low four days ago

condition3 = low[2] < low[4]

// Condition 4: The high two days ago is lower than the high three days ago

condition4 = high[2] < high[3]

// Entry condition: All conditions must be true

entryCondition = condition1 and condition2 and condition3 and condition4

// Exit condition: Close the position after a certain number of bars or when the price reaches the 20-day moving average

exitCondition = ta.barssince(entryCondition) >= daysToHold or close >= ma20

// Execute buy and sell signals

if (entryCondition)

strategy.entry("Buy", strategy.long)

if (exitCondition)

strategy.close("Buy")

相关内容

- 均线,简单移动平均线,均线斜率,追踪止损,重新进场

- 多重技术指标交叉趋势跟踪策略:RSI与随机RSI协同交易系统

- 双均线-RSI多重信号趋势交易策略

- 多重均线动量趋势跟踪策略

- 均线修正型RSI三重验证机会策略

- 多周期均线与RSI动量交叉趋势跟踪策略

- 多周期均线与RSI动量交叉策略

- 动态支撑阻力突破均线交叉策略

- 双均线RSI趋势动量策略

- 机器学习启发的双均线RSI交易策略

更多内容

- 基于ATR的多重趋势跟踪策略与止盈止损优化系统

- 基于 RSI 动量和多层级止盈止损的智能自适应交易系统

- 自适应RSI震荡阈值动态交易策略

- RSI与AO协同趋势追踪型量化交易策略

- 适应性趋势动量RSI策略结合均线过滤系统

- 双均线交叉RSI动量策略与风险收益优化系统

- 多重指标交叉动态策略系统:基于EMA、RVI和交易信号的量化交易模型

- RSI动态区间反转量化策略与波动率优化模型

- 布林带动量趋势跟踪量化策略

- 多周期技术分析与市场情绪结合的交易策略

- 多重技术指标交叉动量量化交易策略-基于EMA、RSI和ADX的整合分析

- 抛物线SAR指标背离交易策略

- 组合动量均线交叉策略结合市场情绪与阻力位优化系统

- 多周期RSI动量与三重EMA趋势跟踪复合策略

- 多重均线动量趋势跟踪策略

- E9鲨鱼32形态量化价格突破策略

- 开放市场曝光度动态调仓量化交易策略

- 高胜率趋势均值回归交易策略

- 双均线RSI趋势动量策略

- 多指标融合均值回归趋势跟踪策略