Dual Moving Average Momentum Tracking Quantitative Strategy

Author: ChaoZhang, Date: 2024-11-27 15:06:57Tags: MASMAEMASMMARMAWMAVWMA

Overview

This is a quantitative trading strategy based on dual moving average crossover signals. The strategy employs two moving averages, one as the main signal line and another as a smoothing signal line. It generates trading signals by monitoring price crossovers with the smoothing signal line, enabling market trend capture and momentum tracking. The strategy’s core strength lies in its simple yet effective signal generation mechanism and flexible parameter configuration options.

Strategy Principle

The strategy utilizes two levels of moving average calculations. It first computes a basic moving average (default period of 9), followed by a secondary smoothing process (default period of 5). The strategy offers various moving average calculation methods, including Simple Moving Average (SMA), Exponential Moving Average (EMA), Smoothed Moving Average (SMMA), Weighted Moving Average (WMA), and Volume Weighted Moving Average (VWMA). Long signals are generated when the closing price crosses above the smoothing signal line, while short signals are generated when the closing price crosses below it.

Strategy Advantages

- Clear and simple signal generation mechanism, easy to understand and implement

- Effective reduction of false signals through secondary smoothing

- Multiple moving average calculation methods available for different market characteristics

- Flexible parameter configuration for different market cycles

- Clear code structure, easy to maintain and expand

- Strong trend-following capabilities

Strategy Risks

- May generate frequent trading signals in oscillating markets, increasing transaction costs

- Some inherent lag, potentially missing the beginning of market moves

- Possible significant drawdowns during rapid market reversals

- Single technical indicator strategy, lacking market environment assessment

- Risk of overfitting through excessive parameter optimization

Strategy Optimization Directions

- Introduce market environment assessment mechanisms for different parameter configurations

- Add stop-loss and take-profit mechanisms for risk control

- Implement volume filters to avoid trading in low liquidity environments

- Incorporate additional technical indicators as confirmatory signals

- Develop adaptive parameter mechanisms for dynamic market adjustments

- Add position management module for more flexible position control

Summary

This is an improved version of a classic trend-following strategy that enhances stability while maintaining simplicity through a dual-layer moving average design. The strategy offers good scalability and flexibility, adaptable to different market environments through parameter optimization and function extensions. However, users need to pay attention to transaction cost control and risk management, and it is recommended to conduct thorough backtesting before live trading.

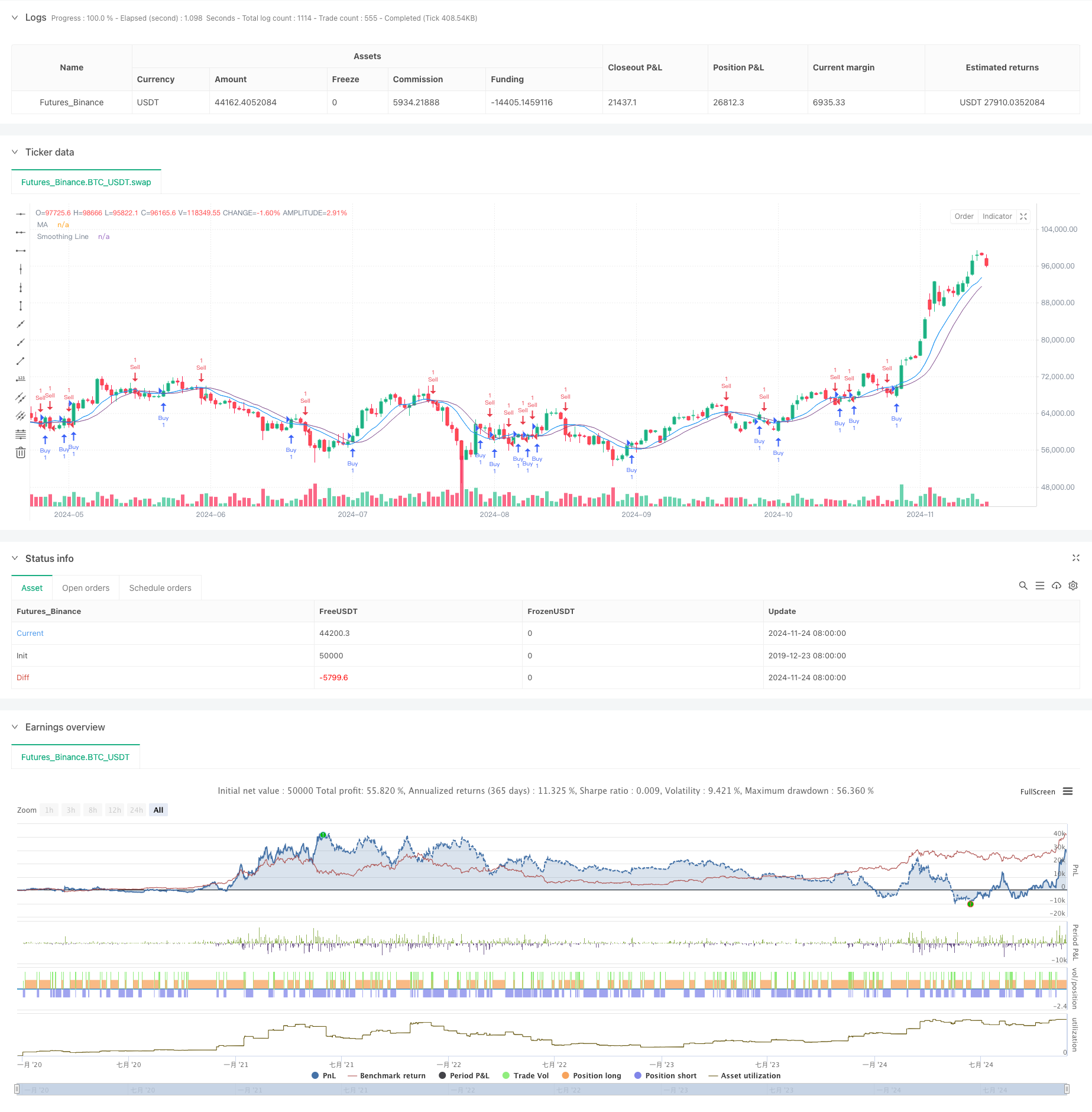

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average 1.0 Strategy", overlay=true)

// Input for Moving Average Length

len = input.int(9, minval=1, title="Length")

src = input(close, title="Source")

offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

// Calculate the Moving Average

out = ta.sma(src, len)

// Plot the Moving Average

plot(out, color=color.blue, title="MA", offset=offset)

// Function to choose the type of moving average

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Input for Smoothing Method and Length

typeMA = input.string(title="Method", defval="SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title="Smoothing Length", defval=5, minval=1, maxval=100, group="Smoothing")

// Calculate the Smoothing Line

smoothingLine = ma(out, smoothingLength, typeMA)

// Plot the Smoothing Line

plot(smoothingLine, title="Smoothing Line", color=color.rgb(120, 66, 134, 35), offset=offset)

// Strategy Logic

if (ta.crossover(close, smoothingLine))

strategy.entry("Buy", strategy.long)

if (ta.crossunder(close, smoothingLine))

strategy.entry("Sell", strategy.short)

- Adaptive Moving Average Crossover Strategy

- Multi-Moving Average Crossover Trend Following Strategy with Volatility Filter

- Multi-Period Moving Average Crossover Trend Following Strategy

- Bollinger Bands and Moving Average Crossover Strategy

- BB Breakout Strategy

- Advanced Quantitative Trading Strategy Combining RSI Divergence and Moving Averages

- Dynamic RSI Smart Timing Swing Trading Strategy

- MACD and RSI Combined Natural Trading Strategy

- Multi-Level Intelligent Dynamic Trailing Stop Strategy Based on Bollinger Bands and ATR

- VWMA-ADX Momentum and Trend-Based Bitcoin Long Strategy

- Multi-Timeframe Trend Following Strategy with ATR Volatility Management

- Dynamic Cost Averaging Strategy System Based on Bollinger Bands and RSI

- Multi-SMA Support Level False Breakout Strategy with ATR Stop-Loss System

- EMA Crossover Strategy with Stop Loss and Take Profit Optimization System

- VWAP-MACD-RSI Multi-Factor Quantitative Trading Strategy

- Triple Moving Average Trend Following and Momentum Integration Quantitative Trading Strategy

- Z-Score and Supertrend Based Dynamic Trading Strategy: Long-Short Switching System

- Adaptive Bollinger Breakout with Moving Average Quantitative Strategy System

- AI-Optimized Adaptive Stop-Loss Trading System with Multiple Technical Indicator Integration

- Multi-Period Moving Average Crossover with Volume Analysis System

- Dual Moving Average Crossover Strategy with Adaptive Stop-Loss and Take-Profit

- Adaptive Trend Following Strategy Based on Momentum Oscillator

- PVT-EMA Trend Crossover Volume-Price Strategy

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System

- MACD Dynamic Oscillation Cross-Prediction Strategy

- VWAP-ATR Dynamic Price Action Trading System

- Dynamic Trend Quantitative Strategy Based on Bollinger Bands and RSI Cross

- Mean Reversion Strategy with Bollinger Bands, RSI and ATR-Based Dynamic Stop-Loss System

- Dynamic Trading Strategy System Based on Parabolic SAR Indicator

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS)