Multi-Timeframe EMA Trend Strategy with Daily High-Low Breakout System

Author: ChaoZhang, Date: 2024-11-28 15:20:59Tags: EMAMA

Overview

This is a quantitative trading strategy that combines daily high-low breakouts with multi-timeframe EMA trends. The strategy primarily identifies trading opportunities by monitoring price breakouts of the previous day’s high and low levels, combined with EMA trends and the Chaikin Money Flow (CMF) indicator. It utilizes 200-period EMAs on both hourly and daily timeframes to enhance trading accuracy through multiple technical indicator validation.

Strategy Principles

The core logic includes the following key elements:

- Uses request.security function to obtain previous day’s high and low prices as key support and resistance levels.

- Incorporates 24-period EMA as the baseline for trend determination.

- Implements CMF (20-period) as a comprehensive indicator of volume and price to assess market money flow.

- Calculates 200 EMAs on both current and 1-hour timeframes to determine larger trend directions.

Specific trading rules: Long Entry: Price breaks above previous day’s high + Close above EMA + Positive CMF Short Entry: Price breaks below previous day’s low + Close below EMA + Negative CMF Exit: Cross below EMA for longs, cross above EMA for shorts

Strategy Advantages

- Multiple technical indicator validation improves trading reliability

- Multi-timeframe analysis provides comprehensive trend assessment

- CMF indicator integration better captures market money flow conditions

- Previous day’s high-low levels align with market participants’ trading habits

- Clear strategy logic that’s easy to understand and execute

- Well-defined entry and exit conditions minimize subjective judgment

Strategy Risks

- May generate frequent false signals in ranging markets

- Not sufficiently responsive to instantaneous price breakouts

- Potential missed opportunities at key levels

- Lacks consideration of larger timeframe trends

- May experience significant drawdowns during extreme market volatility

Risk Control Suggestions:

- Implement appropriate stop-loss levels

- Adjust parameters based on market conditions

- Add trend filters

- Consider incorporating volatility indicators

Optimization Directions

- Implement adaptive parameter optimization mechanisms

- Add more market condition filters

- Optimize stop-loss and take-profit mechanisms

- Include volatility indicators for different market conditions

- Consider position management mechanisms

- Add volume analysis indicators

Summary

This is a complete trading system combining multiple technical indicators and multi-timeframe analysis. The strategy seeks trading opportunities through comprehensive analysis of intraday high-low breakouts, moving average trends, and money flow. While certain risks exist, the strategy holds good practical value through proper risk control and continuous optimization. Traders are advised to conduct thorough backtesting and parameter optimization before live implementation.

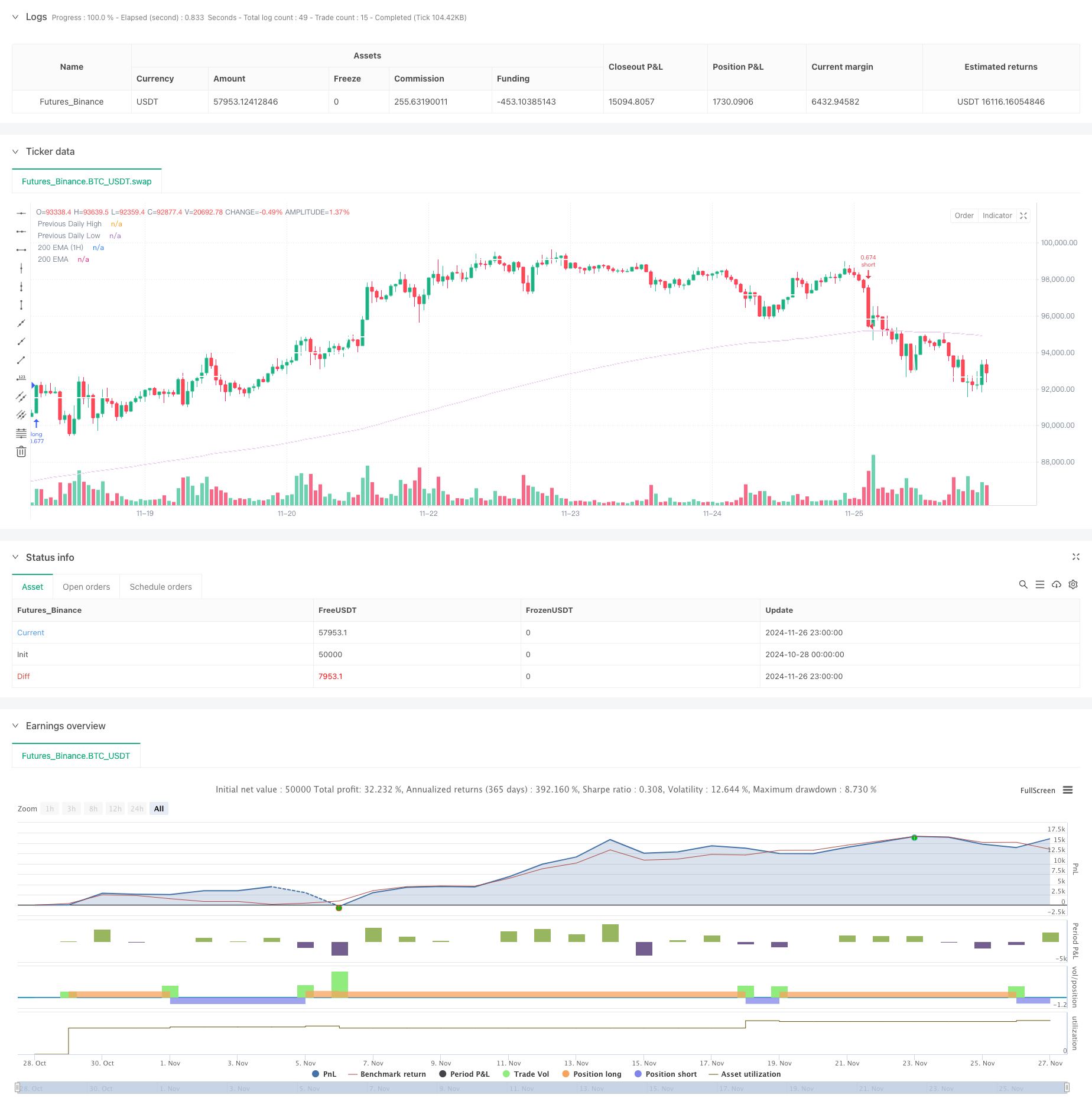

/*backtest

start: 2024-10-28 00:00:00

end: 2024-11-27 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='The security Daily HIGH/LOW strategy', overlay=true, initial_capital=10000, calc_on_every_tick=true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100,

commission_type=strategy.commission.percent, commission_value=0.1)

// General Inputs

len = input.int(24, minval=1, title='Length MA', group='Optimization parameters')

src = input.source(close, title='Source MA', group='Optimization parameters')

out = ta.ema(src, len)

length = input.int(20, minval=1, title='CMF Length', group='Optimization parameters')

ad = close == high and close == low or high == low ? 0 : (2 * close - low - high) / (high - low) * volume

mf = math.sum(ad, length) / math.sum(volume, length)

// Function to get daily high and low

f_secureSecurity(_symbol, _res, _src) =>

request.security(_symbol, _res, _src[1], lookahead=barmerge.lookahead_on)

pricehigh = f_secureSecurity(syminfo.tickerid, 'D', high)

pricelow = f_secureSecurity(syminfo.tickerid, 'D', low)

// Plotting previous daily high and low

plot(pricehigh, title='Previous Daily High', style=plot.style_linebr, linewidth=2, color=color.new(color.white, 0))

plot(pricelow, title='Previous Daily Low', style=plot.style_linebr, linewidth=2, color=color.new(color.white, 0))

// Entry Conditions

short = ta.crossunder(low, pricelow) and close < out and mf < 0

long = ta.crossover(high, pricehigh) and close > out and mf > 0

if short and barstate.isconfirmed

strategy.entry('short', strategy.short, stop=pricelow[1])

strategy.close('short', when=close > out)

if long and barstate.isconfirmed

strategy.entry('long', strategy.long, stop=pricehigh[1])

strategy.close('long', when=close < out)

// 200 EMA on 1-hour timeframe

ema_200 = ta.ema(close, 200)

ema_200_1h = request.security(syminfo.tickerid, "60", ta.ema(close, 200))

plot(ema_200_1h, color=color.purple, title="200 EMA (1H)")

plot(ema_200, color=color.white, title="200 EMA")

- G-Channel and EMA Trend Filter Trading System

- EMA Dual Moving Average Crossover Strategy

- EMA Momentum Trading Strategy

- Cross-Market Overnight Position Strategy with EMA Filter

- Multi-EMA Crossover Trend Following Strategy

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- MACD Crossover Strategy

- Multi-EMA Crossover Momentum Trend Following Strategy

- Multi-EMA Automated Trading System with Trailing Profit Lock

- Intraday Breakout Strategy Based on 3-Minute Candle High Low Points

- RSI Trend Momentum Trading Strategy with Dual MA and Volume Confirmation

- Triple EMA Crossover Trading Strategy with Dynamic Stop-Loss and Take-Profit

- Dual Momentum Squeeze Trading System (SMI+UBS Indicator Combination Strategy)

- RSI-MACD Multi-Signal Trading System with Dynamic Stop Management

- ADX Trend Breakout Momentum Trading Strategy

- Trend Following and Mean Reversion Dual Optimization Trading System(Double Seven Strategy)

- Multi-Period Moving Average and RSI Momentum Cross Strategy

- Dual Moving Average MACD Crossover Date-Adjustable Quantitative Trading Strategy

- High-Frequency Dynamic Multi-Indicator Moving Average Crossover Strategy

- Triple Exponential Moving Average Trend Trading Strategy

- Advanced Flexible Multi-Period Moving Average Crossover Strategy

- T3 Moving Average Trend Following Strategy with Trailing Stop Loss

- Multi-Technical Indicator Trend Following Strategy with Ichimoku Cloud Breakout and Stop-Loss System

- Dual Standard Deviation Bollinger Bands Momentum Breakout Strategy

- Advanced Timeframe Fibonacci Retracement with High-Low Breakout Trading System

- RSI Dynamic Exit Level Momentum Trading Strategy

- Multi-Indicator Cross-Trend Tracking and Volume-Price Combined Adaptive Trading Strategy

- Advanced Dual Moving Average Momentum Trend Following Trading System

- Dynamic Take-Profit Smart Trailing Strategy

- Multi-Timeframe Trend Following Strategy with ATR Volatility Management