Advanced Dual EMA Strategy with ATR Volatility Filter System

Author: ChaoZhang, Date: 2024-11-29 16:14:30Tags: EMAATRMA

Overview

This is a quantitative trading strategy that combines Exponential Moving Average (EMA) crossovers with an Average True Range (ATR) filter. The strategy aims to identify strong trends and execute trades in high-volatility market conditions, effectively improving the Sharpe ratio and overall performance. It utilizes 50-period and 200-period EMAs to capture medium to long-term trends, while using the ATR indicator to assess market volatility, only trading when volatility exceeds a specific threshold.

Strategy Principles

The core logic consists of two main components: trend determination and volatility filtering. For trend determination, the strategy uses a 50-period EMA as the fast line and a 200-period EMA as the slow line, generating long signals when the fast line crosses above the slow line and short signals when it crosses below. For volatility filtering, the strategy calculates the 14-period ATR value and converts it to a percentage of price, only allowing positions when the ATR percentage exceeds a preset threshold (default 2%). This design ensures that the strategy only trades in markets with sufficient volatility, effectively reducing false signals in ranging markets.

Strategy Advantages

- Volatility filtering mechanism significantly improves strategy stability by trading only in high-volatility environments

- Using percentage-based ATR calculations makes the volatility filter adaptable to instruments at different price levels

- Combination of medium and long-term moving averages effectively captures major trends while reducing short-term noise

- Simple and clear strategy logic with relatively few parameters, reducing overfitting risk

- Effective risk control through appropriate position management (10% position size)

Strategy Risks

- EMA indicators have inherent lag, potentially causing delayed entry and exit timing in volatile markets

- False breakouts may still occur in ranging markets, even with ATR filtering

- Fixed ATR thresholds may not be suitable for all market conditions

- Market cyclicality is not considered, parameters may need adjustment in different market phases It is recommended to use dynamic stop-losses and gradual position building to manage these risks

Strategy Optimization Directions

- Introduce dynamic ATR thresholds that adapt to market conditions

- Add trend strength confirmation indicators like DMI or ADX

- Implement graduated position building and closing mechanisms to reduce single entry/exit risks

- Add seasonal analysis modules to use different parameters in different market cycles

- Develop adaptive moving average period selection mechanisms to improve strategy adaptability

Summary

This strategy combines classic technical indicators with modern risk management concepts. By using EMA crossovers to capture trends while employing an ATR filter to control trade timing, the strategy maintains simplicity while achieving strong practicality. While some inherent risks exist, the strategy still holds good application value through proper optimization and risk management measures. Traders are advised to adjust parameters according to specific market characteristics and their own risk preferences in practical applications.

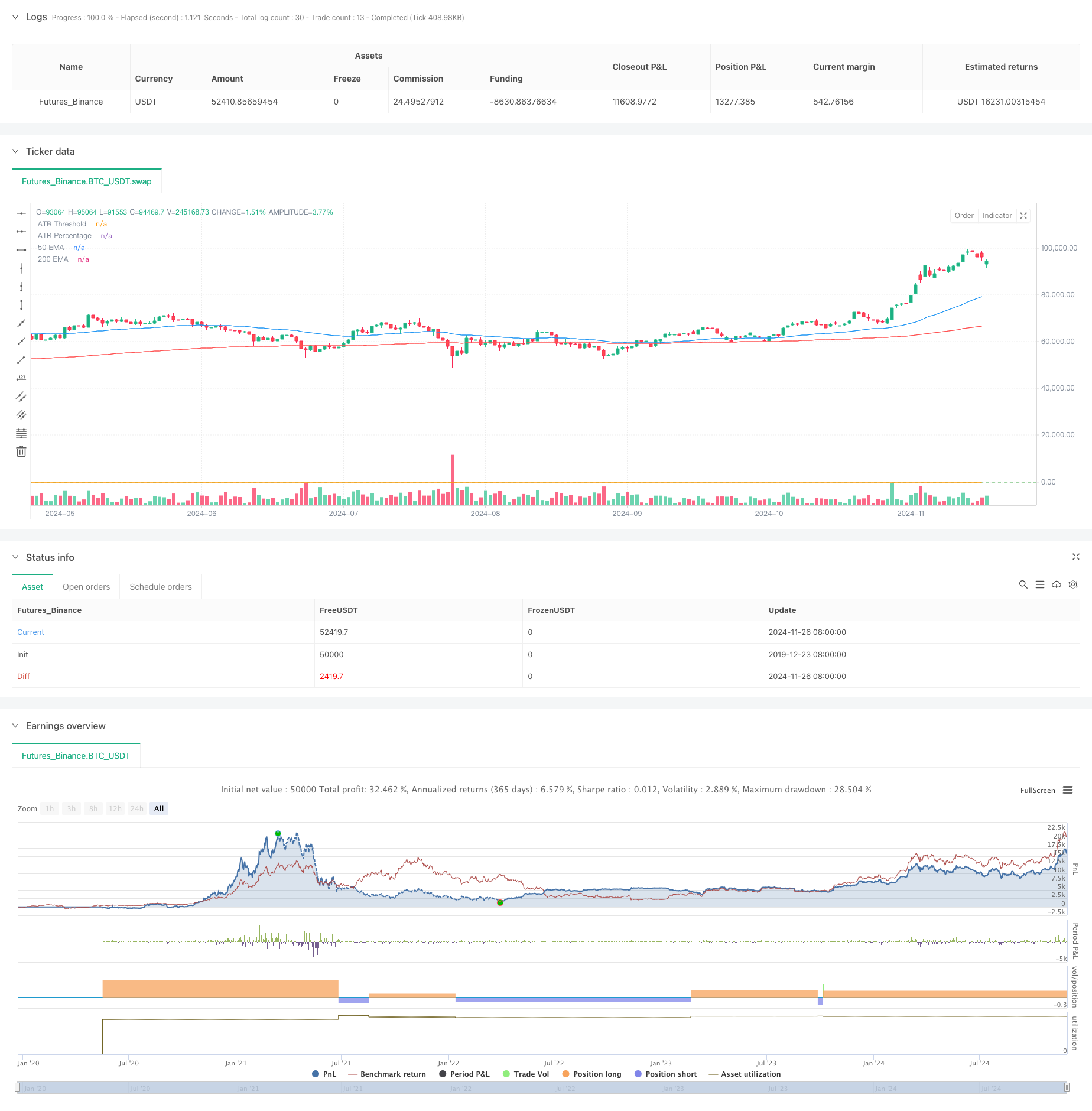

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Crossover with ATR Filter", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Inputs for Moving Averages

fastLength = input.int(50, title="Fast EMA Length")

slowLength = input.int(200, title="Slow EMA Length")

// Inputs for ATR Filter

atrLength = input.int(14, title="ATR Length")

atrMultiplier = input.float(1.5, title="ATR Multiplier")

atrThreshold = input.float(0.02, title="ATR Threshold (%)")

// Calculate EMAs

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

// Calculate ATR

atr = ta.atr(atrLength)

// Convert ATR to a percentage of price

atrPct = atr / close

// Define Long Condition (Cross and ATR filter)

longCondition = ta.crossover(fastEMA, slowEMA) and atrPct > atrThreshold / 100

// Define Short Condition

shortCondition = ta.crossunder(fastEMA, slowEMA) and atrPct > atrThreshold / 100

// Define Exit Conditions

exitConditionLong = ta.crossunder(fastEMA, slowEMA)

exitConditionShort = ta.crossover(fastEMA, slowEMA)

// Long Entry

if (longCondition)

strategy.entry("Long", strategy.long)

// Short Entry

if (shortCondition)

strategy.entry("Short", strategy.short)

// Long Exit

if (exitConditionLong)

strategy.close("Long")

// Short Exit

if (exitConditionShort)

strategy.close("Short")

// Plot EMAs for visual reference

plot(fastEMA, title="50 EMA", color=color.blue)

plot(slowEMA, title="200 EMA", color=color.red)

// Plot ATR for reference

plot(atrPct, title="ATR Percentage", color=color.orange, style=plot.style_line)

hline(atrThreshold / 100, "ATR Threshold", color=color.green)

- Magic Channel Price Action Trading Strategy

- Dynamic Trend Following ATR Multi-Period Trading Strategy

- AlphaTradingBot Trading Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- Dual EMA Trend Momentum Trading Strategy

- Adaptive Moving Average Crossover with Trailing Stop-Loss Strategy

- MACD-V and Fibonacci Multi-Timeframe Dynamic Take Profit Strategy

- Adaptive Trend Following Dynamic Trend Recognition Trading Strategy

- No Upper Wick Bullish Candle Breakout Strategy

- Multi-Indicator Composite Trend Following Strategy

- RSI and Bollinger Bands Cross-Regression Dual Strategy

- Multi-Wave Trend Following Price Analysis Strategy

- Smoothed Heikin-Ashi with SMA Crossover Trend Following Strategy

- Reflected EMA Trend Determination Strategy Based on Hull Moving Averages

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- OBV-SMA Crossover with RSI Filter Multi-Dimensional Momentum Trading Strategy

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Dynamic ATR Stop-Loss RSI Oversold Rebound Quantitative Strategy

- Dual EMA Dynamic Zone Trend Following Strategy

- Multi-MA Crossover with RSI Dynamic Trailing Stop Loss Quantitative Trading Strategy

- Dual EMA Trend Momentum Trading Strategy

- Multi-Trend Momentum Crossover Strategy with Volatility Optimization System

- Multi-Indicator Trend Breakout Quantitative Trading Strategy

- Momentum Indicator Oscillation Threshold Enhanced Trading Strategy

- Multi-Zone SMC Theory Based Intelligent Trend Following Strategy

- Dynamic Multi-Period Quantitative Trading Strategy Combining RSI and EMA

- Multi-Dimensional Technical Indicator Trend Following Quantitative Strategy

- Dual Moving Average Crossover Adaptive Parameter Trading Strategy