Smoothed Heikin-Ashi with SMA Crossover Trend Following Strategy

Author: ChaoZhang, Date: 2024-11-29 16:39:12Tags: SHASMAEMA

Overview

This strategy is a trend following system based on smoothed Heikin-Ashi candlesticks and Simple Moving Average (SMA) crossovers. It identifies trend changes through the intersection of EMA-smoothed Heikin-Ashi candlesticks with a 44-period SMA to capture major trend opportunities in the market. The strategy incorporates a dynamic position management mechanism that automatically closes positions when prices are too close to the long-term moving average, avoiding oscillation risks in consolidating markets.

Strategy Principles

The core logic consists of three key elements: First, converting traditional candlesticks into Heikin-Ashi candlesticks by calculating the arithmetic mean of open, high, low, and close prices to filter market noise; Second, using a 6-period EMA to smooth the Heikin-Ashi, further enhancing signal reliability; Finally, combining the smoothed Heikin-Ashi closing price with a 44-period SMA, generating long signals on upward crosses and short signals on downward crosses. The concept of a “no position threshold” is introduced, triggering position closure when the price-to-long-term-average distance is below the threshold, effectively avoiding frequent trades during consolidation phases.

Strategy Advantages

- Comprehensive signal filtering mechanism, significantly reducing false breakouts through dual smoothing with Heikin-Ashi and EMA

- Clear trend following logic capable of effectively capturing major trend movements

- Dynamic stop-loss mechanism designed to exit timely during consolidation

- Reasonable parameter settings with 11-period short-term and 44-period long-term moving averages aligning with market patterns

- Excellent visualization with clear and intuitive trading signals

Strategy Risks

- Potential lag in initial trend reversal phases leading to slightly delayed entries

- Possibility of false crossover signals in highly volatile market conditions

- Sensitivity to parameter settings requiring specific adjustments for different instruments

- Potential frequent trading in markets lacking clear trends

Strategy Optimization Directions

- Recommend adding trend strength filters like ADX indicator, trading only in clear trends

- Can introduce volume-price confirmation mechanisms to improve signal reliability

- Consider implementing anti-slippage mechanisms to avoid frequent trading near key price levels

- Can design dynamic profit/loss mechanisms that adjust automatically based on market volatility

- Suggest adding position management modules to dynamically adjust holding ratios based on trend strength

Summary

The strategy constructs a robust trend following trading system by combining Heikin-Ashi candlesticks with SMA systems. It features comprehensive signal generation mechanisms and reasonable risk control, particularly suitable for markets with distinct trend characteristics. The strategy’s practical effectiveness can be further enhanced through the suggested optimization directions. Overall, it represents a well-designed trend following strategy with clear logic.

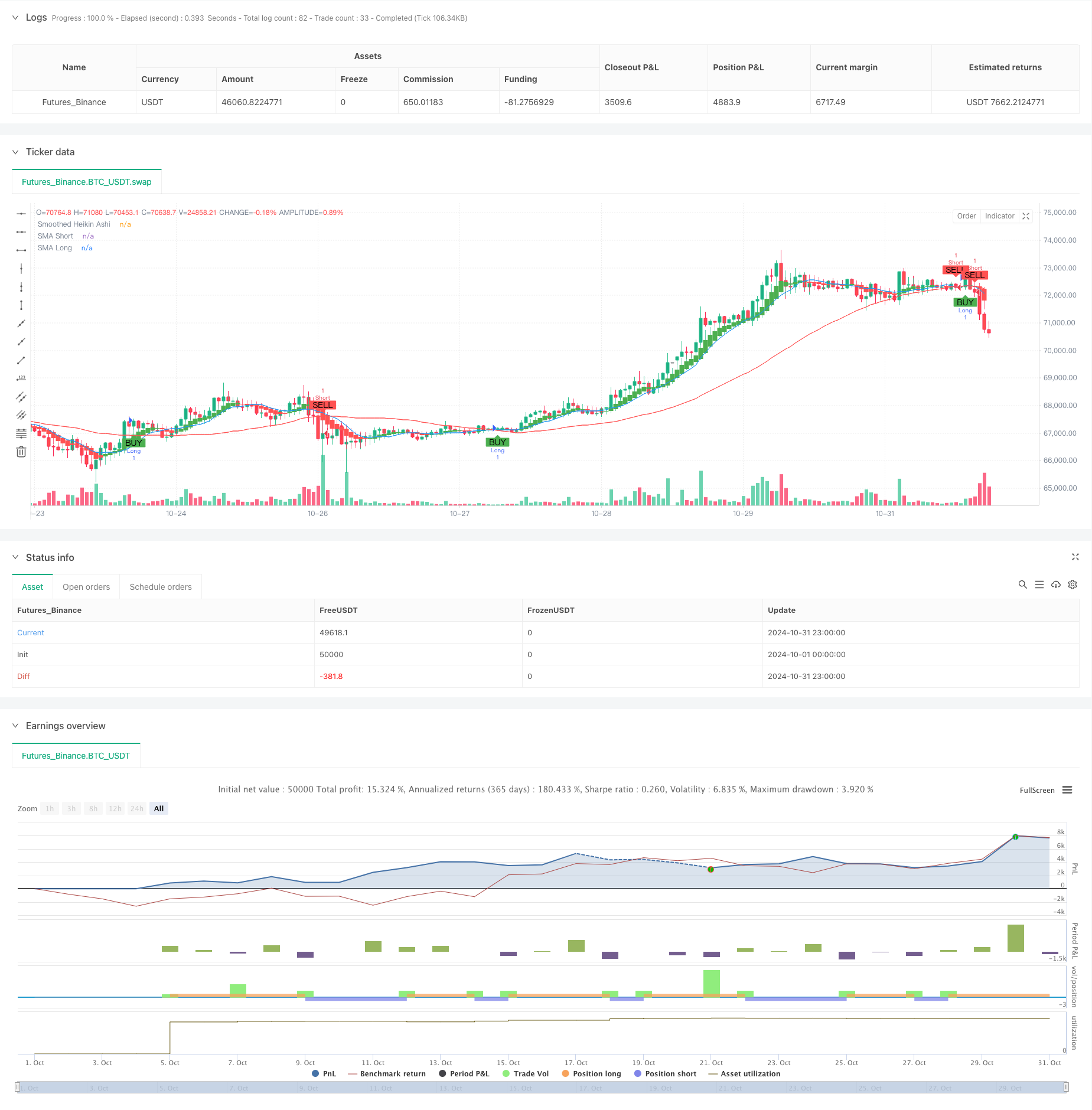

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Smoothed Heikin Ashi with SMA Strategy", overlay=true)

// Input parameters for SMAs

s1 = input.int(11, title="Short SMA Period")

s2 = input.int(44, title="Long SMA Period")

noPositionThreshold = input.float(0.001, title="No Position Threshold", step=0.0001)

// Calculate the original Heikin-Ashi values

haClose = (open + high + low + close) / 4

var float haOpen = na

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2

haHigh = math.max(high, math.max(haOpen, haClose))

haLow = math.min(low, math.min(haOpen, haClose))

// Smoothing using exponential moving averages

smoothLength = input.int(6, title="Smoothing Length")

smoothedHaClose = ta.ema(haClose, smoothLength)

smoothedHaOpen = ta.ema(haOpen, smoothLength)

smoothedHaHigh = ta.ema(haHigh, smoothLength)

smoothedHaLow = ta.ema(haLow, smoothLength)

// Calculate SMAs

smaShort = ta.sma(close, s1)

smaLong = ta.sma(close, s2)

// Plotting the smoothed Heikin-Ashi values

plotcandle(smoothedHaOpen, smoothedHaHigh, smoothedHaLow, smoothedHaClose, color=(smoothedHaClose >= smoothedHaOpen ? color.green : color.red), title="Smoothed Heikin Ashi")

plot(smaShort, color=color.blue, title="SMA Short")

plot(smaLong, color=color.red, title="SMA Long")

// Generate buy/sell signals based on SHA crossing 44 SMA

longCondition = ta.crossover(smoothedHaClose, smaLong)

shortCondition = ta.crossunder(smoothedHaClose, smaLong)

noPositionCondition = math.abs(smoothedHaClose - smaLong) < noPositionThreshold

// Strategy logic

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

if (noPositionCondition and strategy.position_size != 0)

strategy.close_all("No Position")

// Plot buy/sell signals

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", size=size.small)

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small)

plotshape(series=noPositionCondition and strategy.position_size != 0, location=location.belowbar, color=color.yellow, style=shape.labeldown, text="EXIT", size=size.small)

- AMACD - All Moving Average Convergence Divergence

- Super Moving Average and Upperband Crossover Strategy

- EMA, SMA, Moving Average Crossover, Momentum Indicator

- Multi-EMA Crossover Momentum Strategy

- Multi-EMA Trend Momentum Recognition and Stop-Loss Trading System

- SMA Dual Moving Average Crossover Strategy

- Dual EMA Volume Trend Confirmation Strategy for Quantitative Trading

- EMA5 and EMA13 Crossover Strategy

- Trading ABC

- EMA Crossover Momentum Scalping Strategy

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Dynamic Signal Line Trend Following and Volatility Filtering Strategy

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Dual Hull Moving Average Crossover Quantitative Strategy

- Statistical Deviation-Based Market Extreme Drawdown Strategy

- Four-Period SMA Breakthrough Trading Strategy with Dynamic Profit/Loss Management System

- RSI and Bollinger Bands Cross-Regression Dual Strategy

- Multi-Wave Trend Following Price Analysis Strategy

- Reflected EMA Trend Determination Strategy Based on Hull Moving Averages

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- OBV-SMA Crossover with RSI Filter Multi-Dimensional Momentum Trading Strategy

- Dynamic Volatility Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Advanced Fair Value Gap Detection Strategy with Dynamic Risk Management and Fixed Take Profit

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Dynamic ATR Stop-Loss RSI Oversold Rebound Quantitative Strategy

- Advanced Dual EMA Strategy with ATR Volatility Filter System

- Dual EMA Dynamic Zone Trend Following Strategy

- Multi-MA Crossover with RSI Dynamic Trailing Stop Loss Quantitative Trading Strategy