概述

该策略使用MACD-V(带ATR波动率的MACD)和斐波那契回调在多个时间框架上进行交易决策。它计算不同时间框架的MACD-V和斐波那契水平,然后根据当前价格与斐波那契水平的关系以及MACD-V的值来决定开仓和平仓。该策略旨在捕捉市场的趋势和回调,同时控制风险。

策略原理

- 计算不同时间框架(如5分钟和30分钟)的MACD-V指标,MACD-V是在MACD的基础上引入ATR波动率调整,以适应不同市场状态。

- 在高级别时间框架(如30分钟)上计算过去一定周期(如9个周期)的最高价和最低价,然后基于这个区间计算斐波那契回调水平。

- 根据当前收盘价与斐波那契水平的关系,以及MACD-V的值和变化方向,来判断是否满足开仓条件。例如,当价格回调到38.2%斐波那契水平附近,且MACD-V在-50到150之间向下运动时,开空仓。

- 开仓后,使用移动止盈(trailing stop)来保护利润和控制风险。移动止盈的位置根据价格运动和策略参数动态调整。

- 如果价格触及移动止损或固定止损水平,则平仓。

优势分析

- 策略采用多时间框架分析,可以更全面地把握市场趋势和波动。

- MACD-V指标考虑了价格波动率,在趋势和震荡市中都能有效工作。

- 斐波那契水平能够很好地捕捉价格的关键支撑和阻力区域,为交易决策提供参考。

- 移动止盈可以在趋势延续时持续获利,同时在价格反转时及时平仓,控制风险。

- 策略逻辑清晰,参数可调,适应性强。

风险分析

- 策略在震荡市中可能出现频繁交易,导致高额交易成本。

- 依赖技术指标判断趋势,在市场出现假突破或持续震荡时,可能出现误判。

- 固定止损位置可能无法及时应对极端行情,导致较大亏损。

- 参数选择不当可能导致策略表现不佳。

优化方向

- 引入更多时间框架和指标,如更长周期的MA,以提高趋势判断的准确性。

- 优化仓位管理,如根据ATR或价格区间动态调整仓位大小。

- 针对不同市场状态,设置不同的参数组合,提高适应性。

- 在移动止盈的基础上,引入移动止损,更好地控制下行风险。

- 对策略进行回测和参数优化,找到最佳参数组合。

总结

该策略通过多时间框架的MACD-V和斐波那契回调水平来判断趋势和开仓时机,并使用移动止盈来动态控制风险和利润。策略逻辑清晰,适应性强,但在震荡市中可能出现频繁交易和误判风险。通过引入更多指标、优化仓位管理和止损逻辑,以及进行参数优化,可以进一步提高策略的稳健性和盈利能力。

感谢

这个策略中使用的MACD-v指标归功于原创者Alex Spiroglou。如需更多详情,您可以参考他的作品: MACD-v.

策略源码

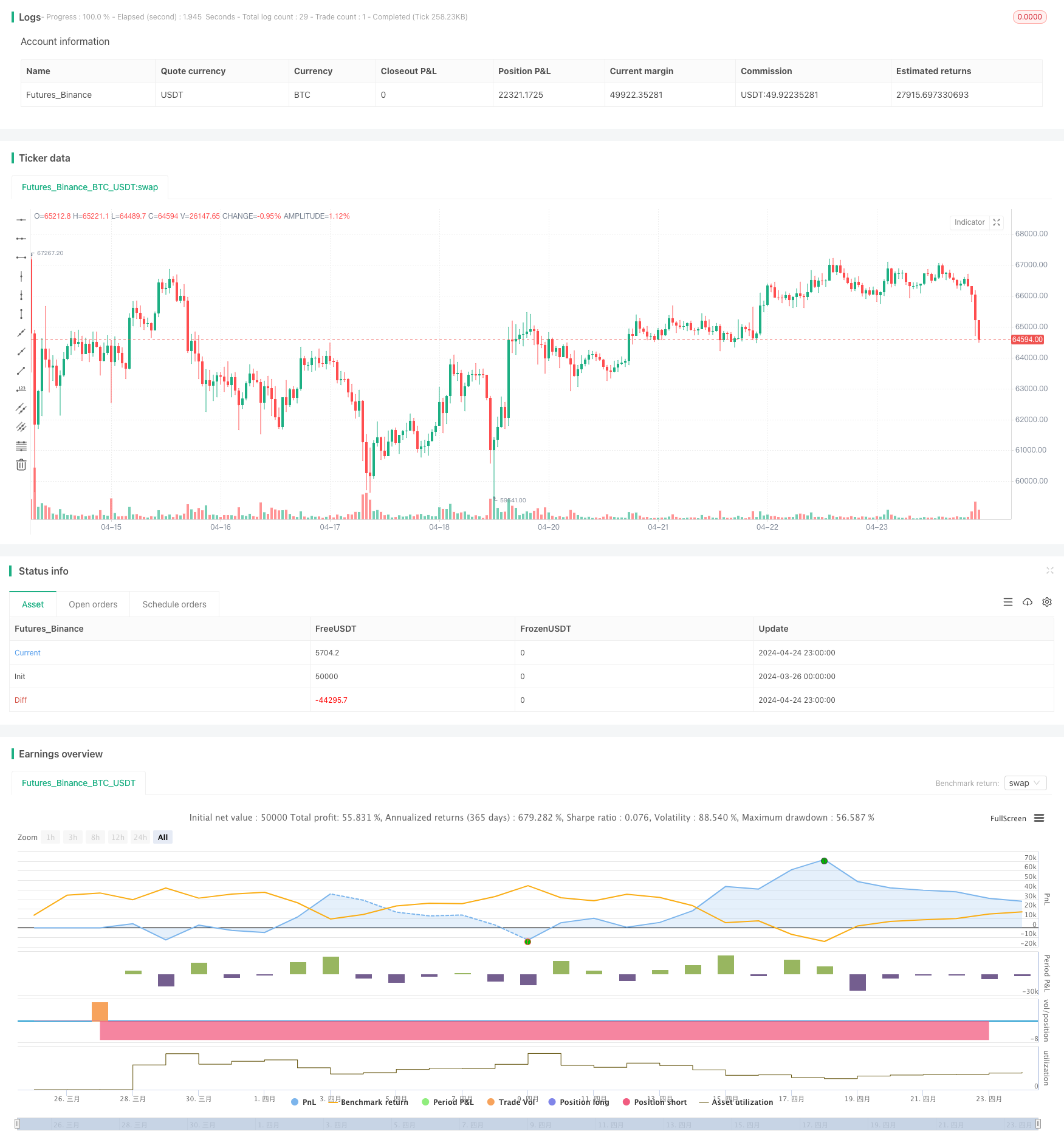

/*backtest

start: 2024-03-26 00:00:00

end: 2024-04-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © catikur

//@version=5

strategy("Advanced MACD-V and Fibonacci Strategy with EMA Trailing TP", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=1000, margin_long=1./10*50, margin_short=1./10*50, slippage=0, commission_type=strategy.commission.percent, commission_value=0.05)

// Parametreler

fast_len = input.int(12, title="Fast Length", minval=1, group="MACD-V Settings")

slow_len = input.int(26, title="Slow Length", minval=1, group="MACD-V Settings")

signal_len = input.int(9, title="Signal Smoothing", minval=1, group="MACD-V Settings")

atr_len = input.int(26, title="ATR Length", minval=1, group="MACD-V Settings")

source = input.source(close, title="Source", group="MACD-V Settings")

//ema_length = input.int(20, title="EMA Length for Trailing TP", group="Trailing TP Settings")

trailing_profit = input.float(1000, title="Trailing Profit", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

trailing_offset = input.float(30000, title="Trailing Offset", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

trailing_factor = input.float(0.01, title="Trailing Factor", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

fix_loss = input.float(20000, title="Fix Loss", minval=0.01, maxval=1000000, step=0.01, group="Trailing TP Settings")

fib_lookback = input.int(9, title="Fibonacci Lookback Periods", minval=1, group="Fibonacci Settings")

macd_tf = input.timeframe("5", title="MACD Timeframe", group="Timeframe Settings")

fib_tf = input.timeframe("30", title="Fibonacci Timeframe", group="Timeframe Settings")

//ema_tf = input.timeframe("30", title="EMA Timeframe for Trailing TP", group="Timeframe Settings")

// MACD-V Hesaplama

atr = ta.atr(atr_len)

ema_slow = ta.ema(source, slow_len)

ema_fast = ta.ema(source, fast_len)

atr_tf = request.security(syminfo.tickerid, macd_tf , atr)

ema_slow_tf = request.security(syminfo.tickerid, macd_tf , ema_slow)

ema_fast_tf = request.security(syminfo.tickerid, macd_tf , ema_fast)

macd = ( ema_fast_tf - ema_slow_tf ) / atr_tf * 100

signal = ta.ema(macd, signal_len)

hist = macd - signal

hist_prev = hist[1]

// log.info("MACD {0} ", macd)

// log.info("Signal {0} ", signal)

// log.info("Histogram {0} ", hist)

// log.info("Previous Histogram {0} ", hist_prev)

// EMA for Trailing TP

//ema_trailing_tf = ta.ema(close, ema_length)

//ema_trailing = request.security(syminfo.tickerid, ema_tf, ema_trailing_tf)

//log.info("EMA Trailing {0} ", ema_trailing)

// Fibonacci Seviyeleri

high_val_tf = ta.highest(high, fib_lookback)

low_val_tf = ta.lowest(low, fib_lookback)

h1 = request.security(syminfo.tickerid, fib_tf, high_val_tf)

l1 = request.security(syminfo.tickerid, fib_tf, low_val_tf)

fark = h1 - l1

//Low ile fark

hl236 = l1 + fark * 0.236

hl382 = l1 + fark * 0.382

hl500 = l1 + fark * 0.5

hl618 = l1 + fark * 0.618

hl786 = l1 + fark * 0.786

//High ile fark

lh236 = h1 - fark * 0.236

lh382 = h1 - fark * 0.382

lh500 = h1 - fark * 0.5

lh618 = h1 - fark * 0.618

lh786 = h1 - fark * 0.786

hbars_tf = -ta.highestbars(high, fib_lookback)

lbars_tf = -ta.lowestbars(low, fib_lookback)

hbars = request.security(syminfo.tickerid, fib_tf , hbars_tf)

lbars = request.security(syminfo.tickerid, fib_tf , lbars_tf)

fib_236 = hbars > lbars ? hl236 : lh236

fib_382 = hbars > lbars ? hl382 : lh382

fib_500 = hbars > lbars ? hl500 : lh500

fib_618 = hbars > lbars ? hl618 : lh618

fib_786 = hbars > lbars ? hl786 : lh786

// log.info("Fibo 382 {0} ", fib_382)

// log.info("Fibo 618 {0} ", fib_618)

// Keep track of the strategy's highest and lowest net profit

var highestNetProfit = 0.0

var lowestNetProfit = 0.0

var bool sell_retracing = false

var bool sell_reversing = false

var bool buy_rebound = false

var bool buy_rallying = false

// Satış Koşulları

sell_retracing := (signal > -20) and (macd > -50 and macd < 150) and (macd < signal) and (hist < hist_prev) and (close < fib_382)

sell_reversing := (macd > -150 and macd < -50) and (macd < signal) and (hist < hist_prev) and (close < fib_618)

// log.info("Retracing var mi: {0} ", sell_retracing)

// log.info("Reversing var mi: {0} ", sell_reversing)

// Alım Koşulları

buy_rebound := (signal < 20) and (macd > -150 and macd < 50) and (macd > signal) and (hist > hist_prev) and ((fib_618 < close) or ((fib_618 > close ) and (close > fib_382)))

buy_rallying := (macd > 50 and macd < 150) and (macd > signal) and (hist > hist_prev) and (close > fib_618)

// log.info("Rallying var mi: {0} ", buy_rallying)

// log.info("Rebound var mi: {0} ", buy_rebound)

// Emirleri Yerleştirme

if (sell_retracing == true and strategy.opentrades == 0 )

strategy.entry("sell_retracing", strategy.short)

if (sell_reversing == true and strategy.opentrades == 0 )

strategy.entry("sell_reversing", strategy.short)

if (buy_rebound == true and strategy.opentrades == 0 )

strategy.entry("buy_rebound", strategy.long)

if (buy_rallying == true and strategy.opentrades == 0 )

strategy.entry("buy_rallying", strategy.long)

// log.info("open order: {0} ", strategy.opentrades )

highestNetProfit := math.max(highestNetProfit, strategy.netprofit)

lowestNetProfit := math.min(lowestNetProfit, strategy.netprofit)

// Plot the net profit, as well as its highest and lowest value

//plot(strategy.netprofit, style=plot.style_area, title="Net profit",

// color=strategy.netprofit > 0 ? color.green : color.red)

//plot(highestNetProfit, color=color.green, title="Highest net profit")

//plot(lowestNetProfit, color=color.red, title="Lowest net profit")

// Trailing Take Profit

//long_trailing_stop = ema_trailing * trailing_factor

//short_trailing_stop = ema_trailing / trailing_factor

//log.info("long trailing stop {0} ", long_trailing_stop)

//log.info("short trailing stop {0} ", short_trailing_stop)

//log.info("avg price {0} ", strategy.position_avg_price)

//trail_price1 = strategy.position_avg_price * (1 + trailing_factor)

//trail_price2 = strategy.position_avg_price * (1 - trailing_factor)

// log.info("position_size {0} ", strategy.position_size)

// Trailing Take Profit

var float long_trailing_stop = 0.0

var float short_trailing_stop = 0.0

//if (strategy.position_size > 0)

// long_trailing_stop := math.max(long_trailing_stop, close * (1 + trailing_factor)) // Yeni bir maksimum değer belirlendiğinde güncelle

//if (strategy.position_size < 0)

// short_trailing_stop := math.min(short_trailing_stop, close * (1 - trailing_factor)) // Yeni bir minimum değer belirlendiğinde güncelle

//log.info("long trailing {0} ", long_trailing_stop)

// log.info("trailing factor{0} ", trailing_factor)

//log.info("short trailing {0} ", short_trailing_stop)

if (strategy.position_size != 0 )

strategy.exit("Exit Long", from_entry="buy_rebound", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Long", from_entry="buy_rallying", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Short", from_entry="sell_retracing", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

strategy.exit("Exit Short", from_entry="sell_reversing", trail_points = trailing_profit, trail_offset = trailing_offset, loss = fix_loss)

相关推荐