MACD-RSI Dynamic Crossover Quantitative Trading System

Author: ChaoZhang, Date: 2024-12-04 15:13:26Tags: MACDRSITA

Overview

This strategy is a quantitative trading system that combines the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) indicators. The strategy identifies market trend reversal points by analyzing the crossover signals of these two technical indicators and overbought/oversold levels to make trading decisions. The system executes trades programmatically, automatically capturing market opportunities.

Strategy Principles

The core logic is based on two main technical indicators: MACD and RSI. The MACD indicator calculates the difference between fast (12-period) and slow (26-period) moving averages, comparing it with a signal line (9-period moving average) to determine trend direction. The RSI indicator calculates the relative strength over 14 periods to determine if the market is overbought or oversold.

Buy signals are generated when the MACD line crosses above the signal line and RSI is below 70 (overbought level). Sell signals are generated when the MACD line crosses below the signal line and RSI is above 30 (oversold level). This dual confirmation mechanism effectively filters out false signals.

Strategy Advantages

- High Signal Reliability: Combining MACD and RSI crossover confirmation significantly reduces the impact of false signals.

- Strong Parameter Adaptability: The strategy allows flexible adjustment of MACD and RSI parameters to adapt to different market conditions.

- High Automation Level: Fully programmatic strategy execution reduces emotional interference.

- Good Visualization: Clear buy/sell signals marked on charts facilitate analysis and backtesting.

- Comprehensive Risk Control: RSI overbought/oversold levels provide additional risk control measures.

Strategy Risks

- Choppy Market Risk: May generate frequent trading signals in sideways markets, increasing transaction costs.

- Lag Risk: Signal generation has inherent delay due to moving average calculations, potentially missing optimal entry points.

- Parameter Sensitivity: Optimal parameters may vary in different market environments, requiring periodic adjustment.

- False Breakout Risk: False breakthrough signals may occur during increased market volatility.

Optimization Directions

- Incorporate Volatility Indicators: Consider adding ATR or volatility indicators for dynamic parameter adjustment.

- Enhance Signal Confirmation: Add volume or other technical indicators as additional confirmation conditions.

- Add Trend Filters: Introduce longer-period moving averages as trend filters.

- Improve Stop Loss Mechanism: Design more flexible stop-loss strategies, such as trailing stops or time-based exits.

- Optimize Position Management: Dynamically adjust position sizes based on signal strength and market conditions.

Summary

The MACD-RSI Dynamic Crossover Quantitative Trading System is an automated trading strategy combining classic technical analysis indicators. Through the dual mechanism of MACD trend judgment and RSI overbought/oversold confirmation, it effectively captures market turning points. The strategy offers high reliability and strong adaptability, but traders must be mindful of choppy market and signal lag risks. There is significant room for improvement through the introduction of additional technical indicators and signal confirmation optimization. In practical application, investors should adjust parameters based on specific market conditions and combine with other analysis methods.

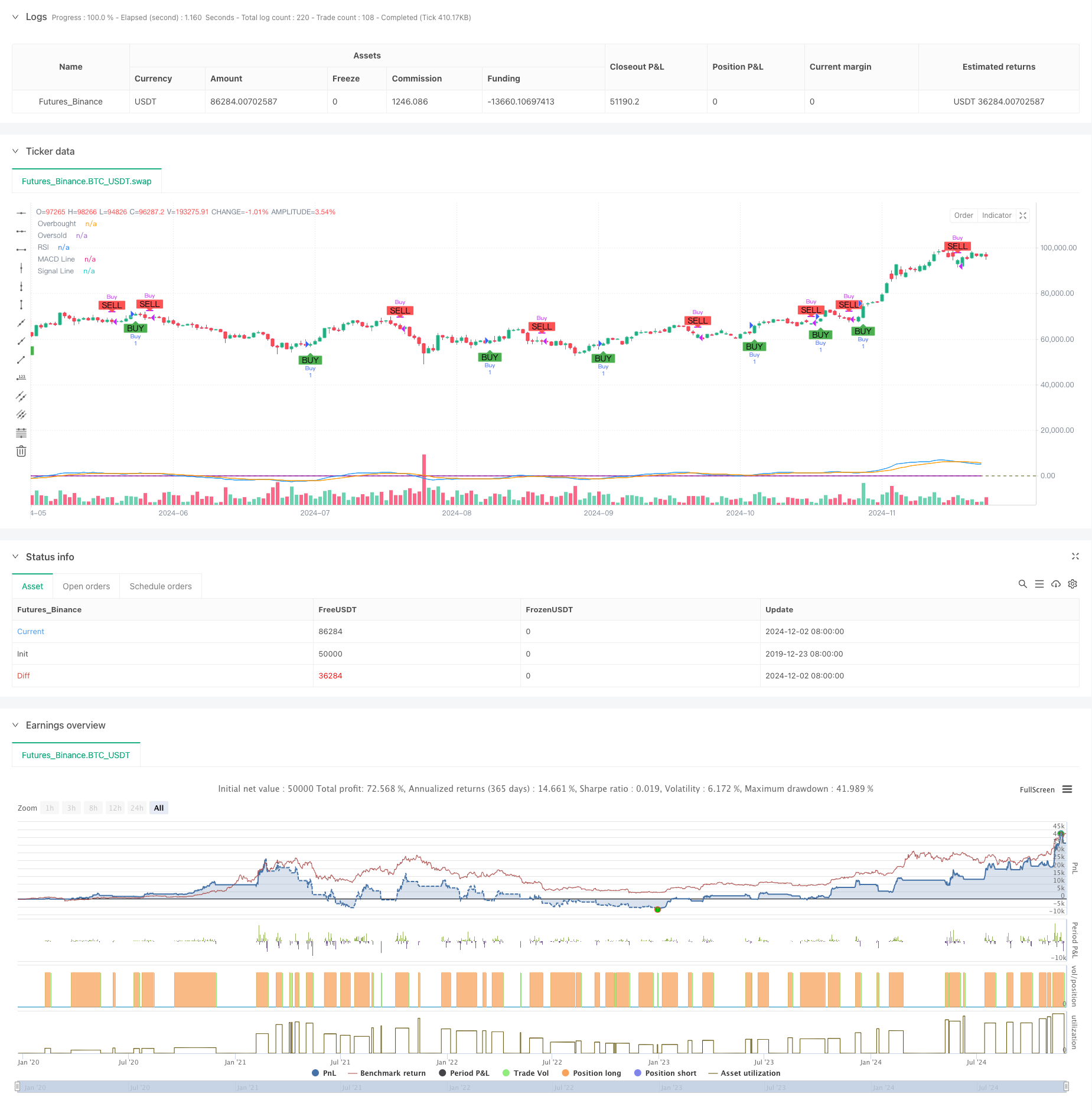

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-03 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("MACD + RSI Strategy", overlay=true)

// MACD settings

fastLength = input.int(12, title="MACD Fast Length")

slowLength = input.int(26, title="MACD Slow Length")

signalSmoothing = input.int(9, title="MACD Signal Smoothing")

// RSI settings

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.float(70, title="RSI Overbought Level")

rsiOversold = input.float(30, title="RSI Oversold Level")

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalSmoothing)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Generate buy and sell signals

buySignal = ta.crossover(macdLine, signalLine) and rsi < rsiOverbought

sellSignal = ta.crossunder(macdLine, signalLine) and rsi > rsiOversold

// Plot buy and sell signals on chart

plotshape(series=buySignal, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy entry and exit

if buySignal

strategy.entry("Buy", strategy.long)

if sellSignal

strategy.close("Buy")

// Plot MACD and Signal Line

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

// Plot RSI

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

plot(rsi, color=color.purple, title="RSI")

- Advanced Five-Day Cross-Analysis Strategy Based on RSI and MACD Integration

- Multi-Indicator Divergence Trading Strategy with Adaptive Take Profit and Stop Loss

- MACD and RSI Combined Long-term Trading Strategy

- RSI-MACD Multi-Signal Trading System with Dynamic Stop Management

- Trend-Following Cloud Momentum Divergence Strategy

- Darvas Box Breakout and Risk Management Strategy

- Dynamic Trend Momentum Optimization Strategy with G-Channel Indicator

- Price Divergence Strategy v1.0

- RSI and MACD Combined Long-Short Strategy

- EMA, RSI, TA, Multi-Indicator Trading Strategy

- EMA-MACD High-Frequency Quantitative Strategy with Smart Risk Management

- Multi-EMA Trend Momentum Trading Strategy with Risk Management System

- Historical Breakout Trend System with Moving Average Filter (HBTS)

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- Dynamic Dual EMA Crossover Quantitative Trading Strategy

- Multi-EMA Automated Trading System with Trailing Profit Lock

- High-Frequency Hybrid Technical Analysis Quantitative Strategy

- Dual EMA and Relative Strength Adaptive Trading Strategy

- Dynamic Support Resistance Price Action Trading System

- Bollinger Bands High-Frequency Quantitative Strategy Combined with High-Low Breakout System

- RSI and Supertrend Trend-Following Adaptive Volatility Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Multi-Technical Indicator Trend Following Trading Strategy

- Multi-Exponential Moving Average Crossover Strategy with Volume-Based ATR Dynamic Stop-Loss Optimization

- Dual Chain Hybrid Momentum EMA Tracking Trading System

- Dynamic Signal Line Trend Following and Volatility Filtering Strategy

- Multi-Timeframe Bollinger Momentum Breakout Strategy with Hull Moving Average

- Multi-Step Volatility-Adjusted Dynamic SuperTrend Strategy

- Triple EMA Trend Following Quantitative Trading Strategy

- Dual Hull Moving Average Crossover Quantitative Strategy