Multi Moving Average Trading System with Momentum and Volume Confirmation Quantitative Trend Strategy

Author: ChaoZhang, Date: 2024-12-12 14:27:59Tags: MAVWMAWMARSIADX

Overview

This strategy is a comprehensive quantitative trading system that combines multiple moving averages, Relative Strength Index (RSI), Average Directional Index (ADX), and volume analysis. The strategy executes trades based on trend confirmation through multiple technical indicators, using volume and momentum filters to enhance trading reliability.

Strategy Principles

The core logic is based on several key components: 1. Multiple moving average system using Double HullMA, Volume-Weighted Moving Average (VWMA), and Basic Weighted Moving Average (WMA) 2. Trend strength assessment using ADX indicator, trading only in strong trends 3. RSI filtering to avoid extreme market conditions 4. Volume analysis requiring above-threshold volume for trade signals 5. Trade direction determination through n1 and n2 line crossovers

The multiple moving average system provides basic trend judgment, ADX ensures trading only in strong trends, RSI helps avoid chasing extremes, and volume analysis ensures trading during periods of high market activity.

Strategy Advantages

- Multiple confirmation mechanisms reduce false breakout risks

- Integration of technical indicators and volume analysis improves trading reliability

- RSI filtering avoids entering during unfavorable market conditions

- ADX usage ensures trading only in clear trends, improving win rate

- Volume requirements help confirm market consensus

- Clear strategy logic with adjustable parameters

Strategy Risks

- Multiple filters may cause missed trading opportunities

- May underperform in ranging markets

- Parameter optimization risks overfitting

- Moving average system may lag in quick reversals

- Volume filtering may limit opportunities in low liquidity markets

Risk management recommendations: - Adjust parameters based on market characteristics - Set appropriate stop-loss and take-profit levels - Control position sizing - Regular strategy backtesting

Strategy Optimization

- Introduce adaptive parameters based on market conditions

- Add volatility filters to adjust positions in high volatility periods

- Improve exit mechanisms with trailing stops

- Optimize volume filters using relative rather than absolute values

- Add time filters to avoid major news releases

- Consider adding price volatility indicators for better risk assessment

Summary

The strategy builds a relatively complete trend following system through multiple technical indicators working in concert. Its main feature is using multiple confirmations to improve trading reliability while controlling risk through various filters. While it may miss some opportunities, it generally helps improve trading stability. The suggested optimization directions provide room for further strategy enhancement.

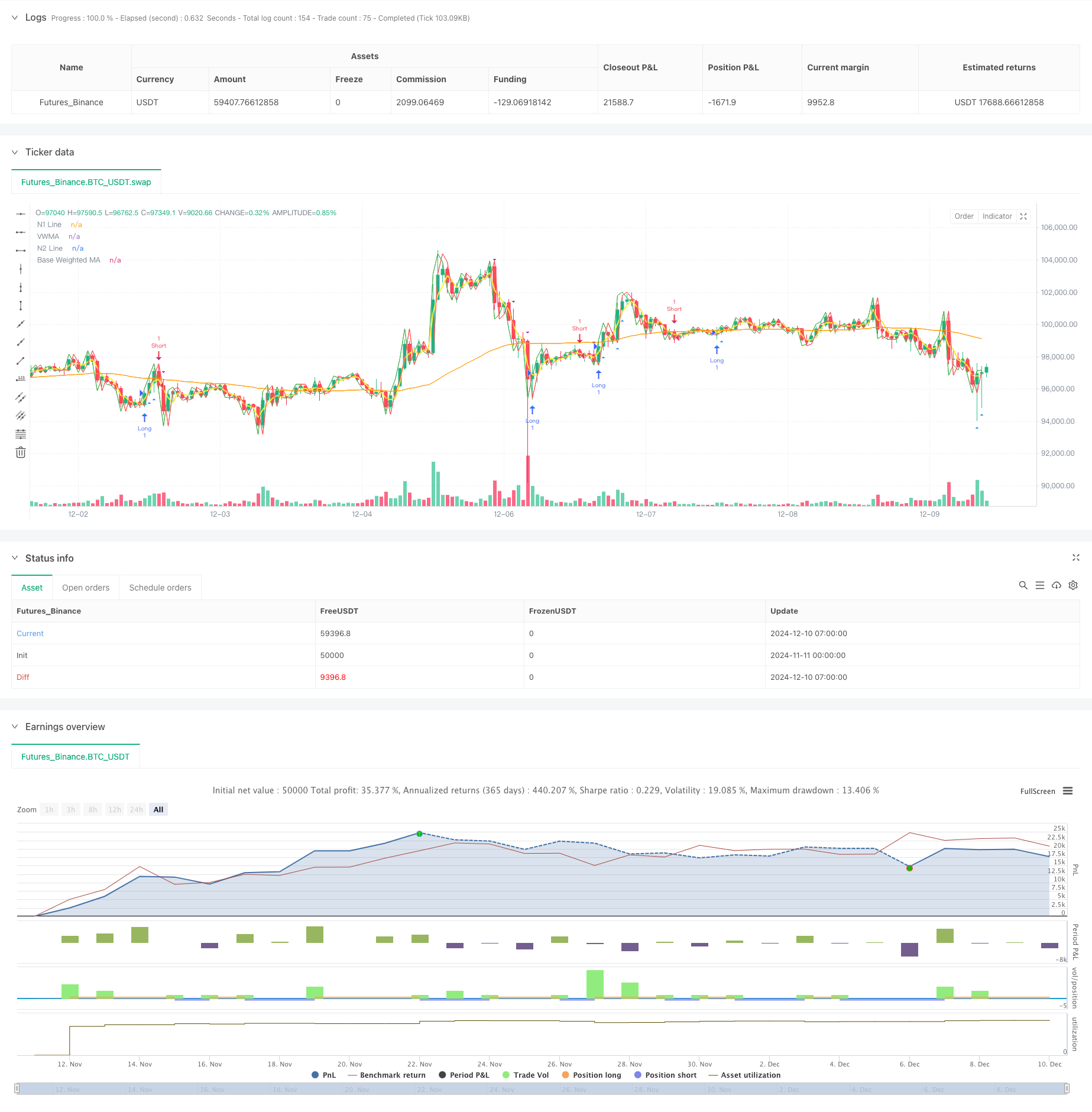

/*backtest

start: 2024-11-11 00:00:00

end: 2024-12-10 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Multi-MA Strategy with Volume, ADX and RSI", overlay=true)

// Kullanıcı Parametreleri

keh = input.int(3, title="Double HullMA", minval=1)

teh = input.int(3, title="Volume-Weighted MA", minval=1)

yeh = input.int(75, title="Base Weighted MA", minval=1)

rsiPeriod = input.int(14, title="RSI Period", minval=1)

adxPeriod = input.int(14, title="ADX Period", minval=1)

volumeLookback = input.int(10, title="Volume Lookback Period", minval=1) // Son X mumun hacmi

adxThreshold = input.int(20, title="ADX Trend Strength Threshold", minval=1) // ADX için trend gücü eşiği

// Hareketli Ortalamalar

rvwma = ta.vwma(close, teh)

yma = ta.wma(close, yeh)

n2ma = 2 * ta.wma(close, math.round(keh / 2))

nma = ta.wma(close, keh)

diff = n2ma - nma

sqrtKeh = math.round(math.sqrt(keh))

n1 = ta.wma(diff, sqrtKeh)

n2 = ta.wma(diff[1], sqrtKeh)

// ADX Hesaplaması

trueRange = ta.rma(ta.tr, adxPeriod)

plusDM = ta.rma(math.max(high - high[1], 0), adxPeriod)

minusDM = ta.rma(math.max(low[1] - low, 0), adxPeriod)

plusDI = (plusDM / trueRange) * 100

minusDI = (minusDM / trueRange) * 100

dx = math.abs(plusDI - minusDI) / (plusDI + minusDI) * 100

adx = ta.rma(dx, adxPeriod)

trendIsStrong = adx > adxThreshold

// RSI Filtreleme

rsiValue = ta.rsi(close, rsiPeriod)

rsiFilter = rsiValue > 30 and rsiValue < 70 // Aşırı alım ve aşırı satım bölgelerinin dışında olmak

// Hacim Filtresi

volumeThreshold = ta.sma(volume, volumeLookback) // Ortalama hacim seviyesi

highVolume = volume > volumeThreshold

// Sinyal Şartları (Sadece güçlü trendler ve rsi'nın aşırı bölgelerde olmaması)

longCondition = n1 > n2 and close > rvwma and trendIsStrong and rsiFilter and highVolume

shortCondition = n1 < n2 and close < rvwma and trendIsStrong and rsiFilter and highVolume

// Hacim Filtresi ile İşaretler

plotshape(series=longCondition and highVolume ? close : na, style=shape.triangleup, location=location.belowbar, color=color.blue, size=size.small, title="High Volume Long Signal")

plotshape(series=shortCondition and highVolume ? close : na, style=shape.triangledown, location=location.abovebar, color=color.purple, size=size.small, title="High Volume Short Signal")

// Strateji Giriş ve Çıkış Şartları

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Görsel Göstergeler

plot(n1, color=color.green, title="N1 Line")

plot(n2, color=color.red, title="N2 Line")

plot(rvwma, color=color.yellow, linewidth=2, title="VWMA")

plot(yma, color=color.orange, title="Base Weighted MA")

- Advanced Quantitative Trading Strategy Combining RSI Divergence and Moving Averages

- MACD and RSI Combined Natural Trading Strategy

- MA Rejection Strategy with ADX Filter

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

- Historical Breakout Trend System with Moving Average Filter (HBTS)

- Quantitative Trend Capture Strategy Based on Candlestick Wick Length Analysis

- Dynamic Trend Following Strategy - Multi-Indicator Integrated Momentum Analysis System

- Daily Range Breakout Single-Direction Trading Strategy

- Scalping EMA ADX RSI with Buy/Sell

- Bollinger Bands Breakout Momentum Trading Strategy

- EMA-MACD Composite Strategy for Trend Scalping

- Multi-Technical Indicator Based Trend Following and Momentum Strategy

- High-Frequency Quantitative Session Trading Strategy: Adaptive Dynamic Position Management System Based on Breakout Signals

- Enhanced Bollinger Breakout Quantitative Strategy with Momentum Filter Integration System

- Multi-EMA Crossover Momentum Trend Following Strategy

- Multi-Target Intelligent Volume Momentum Trading Strategy

- Multi-Period Bollinger Bands Touch Trend Reversal Quantitative Trading Strategy

- High-Frequency Breakout Trading Strategy Based on Candlestick Close Direction

- Advanced Dynamic Fibonacci Retracement Trend Quantitative Trading Strategy

- Variable Index Dynamic Average Multi-Tier Profit Trend Following Strategy

- Adaptive Trailing Drawdown Balanced Trading Strategy with Take-Profit and Stop-Loss

- Enhanced Trend Following System: Dynamic Trend Identification Based on ADX and Parabolic SAR

- Dual Timeframe Stochastic Momentum Trading Strategy

- Adaptive Bollinger Bands Dynamic Position Management Strategy

- Dynamic RSI Smart Timing Swing Trading Strategy

- Bidirectional Trading Strategy Based on Candlestick Absorption Pattern Analysis

- Bollinger Breakout with Mean Reversion 4H Quantitative Trading Strategy

- Trend Following Dynamic Grid Position Sizing Strategy

- Dual BBI (Bulls and Bears Index) Crossover Strategy

- Dynamic Long/Short Swing Trading Strategy with Moving Average Crossover Signal System