Advanced Dynamic Fibonacci Retracement Trend Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-12-12 14:32:18Tags: MARSI

Overview

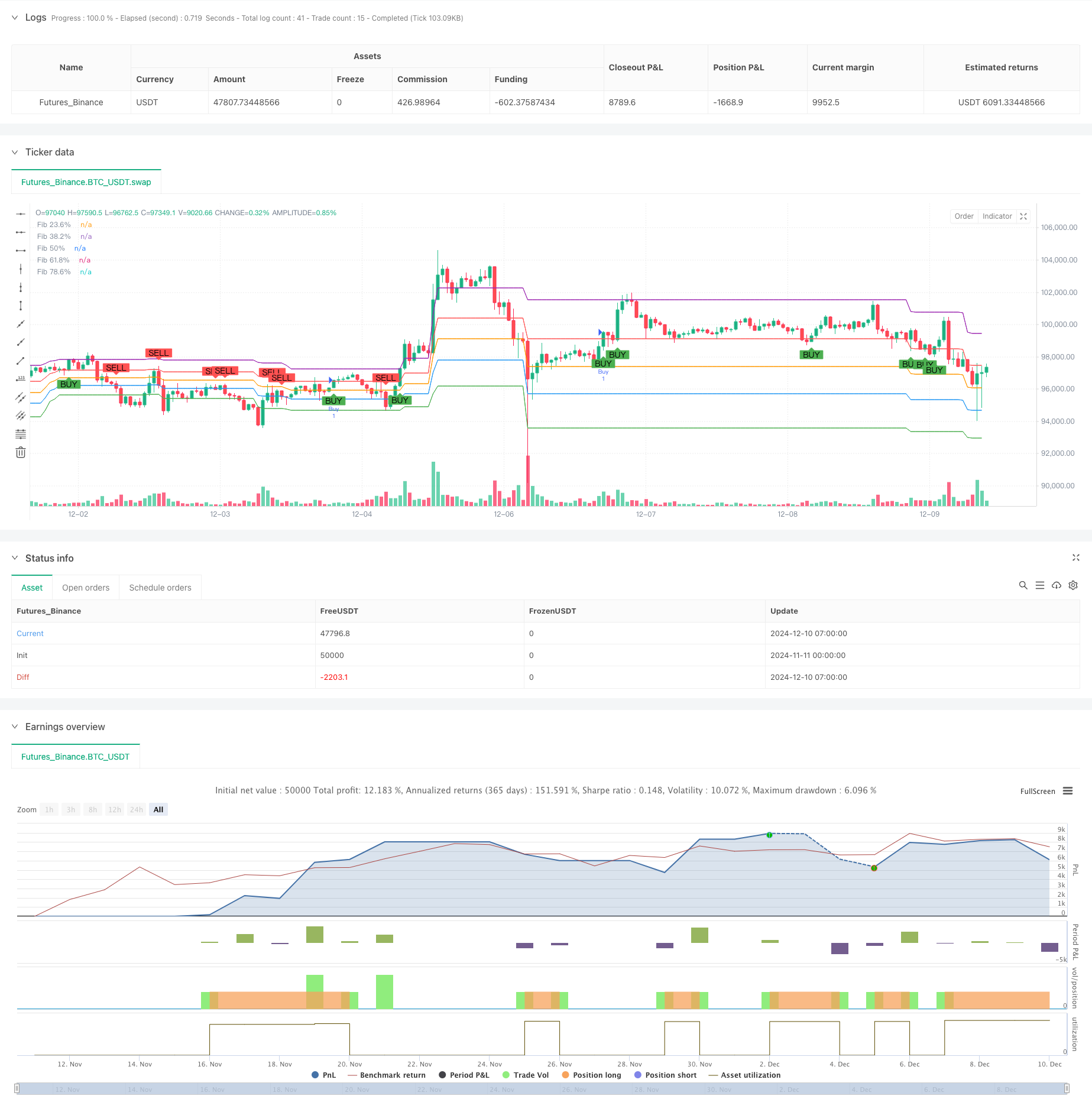

This strategy is an advanced trend-following system based on Fibonacci retracement principles. It identifies potential support and resistance zones by dynamically calculating key Fibonacci retracement levels (23.6%, 38.2%, 50%, 61.8%, 78.6%). The system uses a 100-period lookback window to determine the highest and lowest points, which serve as the basis for calculating retracement levels. The strategy incorporates precise entry signals and risk management mechanisms, triggering trading signals at key Fibonacci level breakouts.

Strategy Principles

The core logic is built on the theory that prices tend to reverse near key Fibonacci retracement levels during major trends. Specifically: 1. The system continuously calculates highs and lows through a rolling window, ensuring dynamic updates of retracement levels 2. Long signals are triggered when price breaks above the 61.8% retracement level, indicating trend continuation 3. Bearish signals are identified when price breaks below the 38.2% retracement level 4. Take-profit is set at 100% retracement (highest point), stop-loss at 0% retracement (lowest point) 5. The strategy uses plot functions to mark key levels on the chart for visual analysis

Strategy Advantages

- Strong Dynamic Adaptability - Strategy automatically adjusts retracement levels based on market conditions

- Comprehensive Risk Management - Strict risk control through preset stop-loss and take-profit levels

- Clear Objective Signals - Entry and exit signals based on objective price breakouts, reducing subjective judgment

- High Visualization - Clear display of key price levels on charts for analysis and verification

- Parameter Adjustability - Lookback period and Fibonacci levels can be flexibly adjusted as needed

Risk Analysis

- Sideways Market Risk - May generate false signals during consolidation phases

- Lag Risk - Calculations based on historical data may lead to delayed signals

- Gap Risk - Price gaps may cause stop-loss failures

- Parameter Sensitivity - Different lookback period settings affect strategy performance Recommended risk control measures:

- Confirm market environment with trend indicators

- Adjust stop-loss positions appropriately

- Implement trailing stops

- Regular parameter optimization

Strategy Optimization Directions

- Add trend filters to trade only in clear trends

- Incorporate volume confirmation signals

- Optimize stop-loss/take-profit mechanisms, such as implementing trailing stops

- Add market volatility filtering conditions

- Develop adaptive lookback period adjustment mechanisms

Summary

This is a systematic trading strategy built on classic technical analysis theory. Its programmatic implementation provides objectivity and repeatability. The core advantage lies in combining Fibonacci theory with strict risk control, suitable for trending markets. Through continuous optimization and improvement, the strategy has the potential to maintain stable performance across various market conditions.

/*backtest

start: 2024-11-11 00:00:00

end: 2024-12-10 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fibonacci Retracement Strategy", overlay=true)

// Inputs

lookback_period = input.int(100, title="Lookback Period")

level_1 = input.float(0.236, title="Fibonacci Level 1")

level_2 = input.float(0.382, title="Fibonacci Level 2")

level_3 = input.float(0.5, title="Fibonacci Level 3")

level_4 = input.float(0.618, title="Fibonacci Level 4")

level_5 = input.float(0.786, title="Fibonacci Level 5")

// Calculate highest high and lowest low over the lookback period

high_level = ta.highest(high, lookback_period)

low_level = ta.lowest(low, lookback_period)

// Calculate Fibonacci retracement levels

fib_236 = low_level + (high_level - low_level) * level_1

fib_382 = low_level + (high_level - low_level) * level_2

fib_50 = low_level + (high_level - low_level) * level_3

fib_618 = low_level + (high_level - low_level) * level_4

fib_786 = low_level + (high_level - low_level) * level_5

// Plot Fibonacci levels on the chart

plot(fib_236, color=color.green, title="Fib 23.6%")

plot(fib_382, color=color.blue, title="Fib 38.2%")

plot(fib_50, color=color.orange, title="Fib 50%")

plot(fib_618, color=color.red, title="Fib 61.8%")

plot(fib_786, color=color.purple, title="Fib 78.6%")

// Entry and Exit Conditions

buy_signal = ta.crossover(close, fib_618)

sell_signal = ta.crossunder(close, fib_382)

// Strategy Orders

if buy_signal

strategy.entry("Buy", strategy.long)

// Exit based on stop-loss and take-profit conditions

take_profit = high_level // Exit at the highest Fibonacci level (100%)

stop_loss = low_level // Exit at the lowest Fibonacci level (0%)

strategy.exit("Sell", from_entry="Buy", limit=take_profit, stop=stop_loss)

// Visualization of Signals

plotshape(series=buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

- Momentum Trend Ichimoku Cloud Trading Strategy

- Multi-Confirmation Reversal Buy Strategy

- Dual-Period RSI Trend Momentum Strategy with Pyramiding Position Management System

- Best TradingView Strategy

- RSI Dynamic Drawdown Stop-Loss Strategy

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Short-Term Trading Strategy Based on Bollinger Bands, Moving Average, and RSI

- Moving Average and Relative Strength Index Strategy

- Multi-Moving Average Momentum Trend Following Strategy

- Multi-Market Adaptive Multi-Indicator Trend Following Strategy

- Dynamic Timing and Position Management Strategy Based on Volatility

- EMA-MACD Composite Strategy for Trend Scalping

- Multi-Technical Indicator Based Trend Following and Momentum Strategy

- High-Frequency Quantitative Session Trading Strategy: Adaptive Dynamic Position Management System Based on Breakout Signals

- Enhanced Bollinger Breakout Quantitative Strategy with Momentum Filter Integration System

- Multi-EMA Crossover Momentum Trend Following Strategy

- Multi-Target Intelligent Volume Momentum Trading Strategy

- Multi-Period Bollinger Bands Touch Trend Reversal Quantitative Trading Strategy

- High-Frequency Breakout Trading Strategy Based on Candlestick Close Direction

- Variable Index Dynamic Average Multi-Tier Profit Trend Following Strategy

- Multi Moving Average Trading System with Momentum and Volume Confirmation Quantitative Trend Strategy

- Adaptive Trailing Drawdown Balanced Trading Strategy with Take-Profit and Stop-Loss

- Enhanced Trend Following System: Dynamic Trend Identification Based on ADX and Parabolic SAR

- Dual Timeframe Stochastic Momentum Trading Strategy

- Adaptive Bollinger Bands Dynamic Position Management Strategy

- Dynamic RSI Smart Timing Swing Trading Strategy

- Bidirectional Trading Strategy Based on Candlestick Absorption Pattern Analysis

- Bollinger Breakout with Mean Reversion 4H Quantitative Trading Strategy

- Trend Following Dynamic Grid Position Sizing Strategy