Enhanced Bollinger Breakout Quantitative Strategy with Momentum Filter Integration System

Author: ChaoZhang, Date: 2024-12-12 14:55:37Tags: BBRSIEMAATRRR

Overview

This strategy is an advanced quantitative trading system combining Bollinger Bands, RSI indicator, and 200-period EMA trend filter. Through the synergy of multiple technical indicators, it captures high-probability breakout opportunities in trend direction while effectively filtering false signals in oscillating markets. The system employs dynamic stop-loss and profit targets based on risk-reward ratio to achieve robust trading performance.

Strategy Principle

The core logic is based on three levels: 1. Bollinger Bands breakout signals: Using Bollinger Bands as volatility channels, price breaks above upper band signal long entries, breaks below lower band signal short entries. 2. RSI momentum confirmation: RSI above 50 confirms bullish momentum, below 50 confirms bearish momentum, avoiding trades without trend. 3. EMA trend filtering: Using 200-period EMA to determine main trend, only trading in trend direction. Long above EMA, short below EMA.

Trade confirmation requires: - Breakout conditions maintained for two consecutive candles - Volume above 20-period average - Dynamic stop-loss calculated based on ATR - Profit target set at 1.5 times risk-reward ratio

Strategy Advantages

- Multiple technical indicators synergize to significantly improve signal quality

- Dynamic position management mechanism adapts to market volatility

- Strict trade confirmation mechanism effectively reduces false signals

- Complete risk control system including dynamic stop-loss and fixed risk-reward ratio

- Flexible parameter optimization space adaptable to different market environments

Strategy Risks

- Excessive parameter optimization may lead to overfitting

- Volatile markets may trigger frequent stop-losses

- Oscillating markets may produce consecutive losses

- Signals lag at trend turning points

- Technical indicators may produce contradictory signals

Risk control suggestions: - Strictly execute stop-loss discipline - Control single trade risk - Regular backtest parameter validity - Integrate fundamental analysis - Avoid overtrading

Strategy Optimization Directions

- Introduce more technical indicators for cross-validation

- Develop adaptive parameter optimization mechanism

- Add market sentiment indicators

- Optimize trade confirmation mechanism

- Develop more flexible position management system

Main optimization approaches: - Dynamically adjust parameters based on different market cycles - Add trading filters - Optimize risk-reward ratio settings - Improve stop-loss mechanism - Develop smarter signal confirmation system

Summary

This strategy constructs a complete trading system through organic combination of Bollinger Bands, RSI and EMA technical indicators. While ensuring trading quality, the system demonstrates strong practical value through strict risk control and flexible parameter optimization space. Traders are advised to carefully validate parameters in live trading, strictly execute trading discipline, and continuously optimize strategy performance.

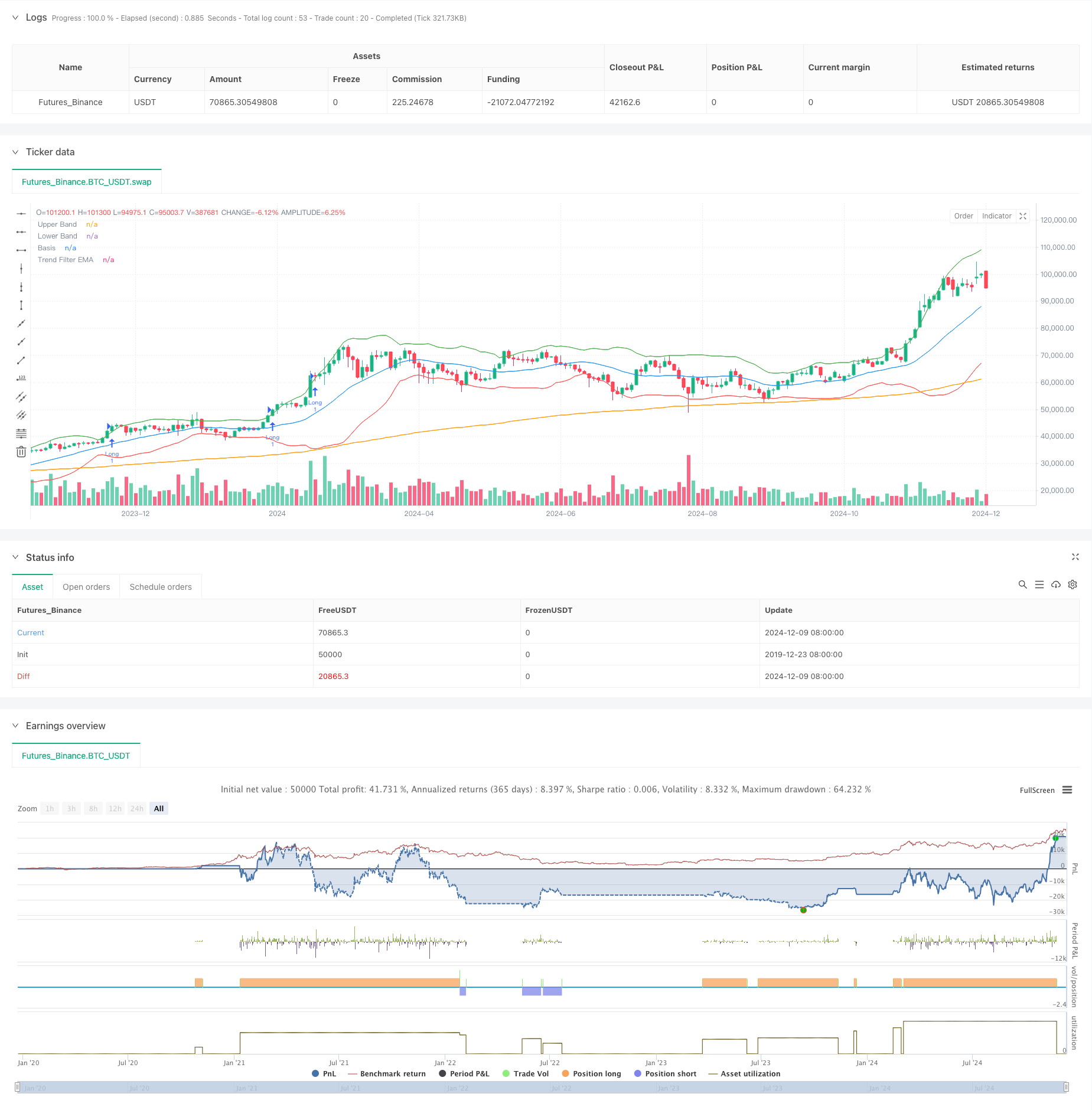

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Bollinger Breakout with Trend Filtering", overlay=true)

// === Inputs ===

length = input(20, title="Bollinger Bands Length", tooltip="The number of candles used to calculate the Bollinger Bands. Higher values smooth the bands, lower values make them more reactive.")

mult = input(2.0, title="Bollinger Bands Multiplier", tooltip="Controls the width of the Bollinger Bands. Higher values widen the bands, capturing more price movement.")

rsi_length = input(14, title="RSI Length", tooltip="The number of candles used to calculate the RSI. Shorter lengths make it more sensitive to recent price movements.")

rsi_midline = input(50, title="RSI Midline", tooltip="Defines the midline for RSI to confirm momentum. Higher values make it stricter for bullish conditions.")

risk_reward_ratio = input(1.5, title="Risk/Reward Ratio", tooltip="Determines the take-profit level relative to the stop-loss.")

atr_multiplier = input(1.5, title="ATR Multiplier for Stop-Loss", tooltip="Defines the distance of the stop-loss based on ATR. Higher values set wider stop-losses.")

volume_filter = input(true, title="Enable Volume Filter", tooltip="If enabled, trades will only execute when volume exceeds the 20-period average.")

trend_filter_length = input(200, title="Trend Filter EMA Length", tooltip="The EMA length used to filter trades based on the market trend.")

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"], tooltip="Choose whether to trade only Long, only Short, or Both directions.")

confirm_candles = input(2, title="Number of Confirming Candles", tooltip="The number of consecutive candles that must meet the conditions before entering a trade.")

// === Indicator Calculations ===

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

rsi_val = ta.rsi(close, rsi_length)

atr_val = ta.atr(14)

vol_filter = volume > ta.sma(volume, 20)

ema_trend = ta.ema(close, trend_filter_length)

// === Helper Function for Confirmation ===

confirm_condition(cond, lookback) =>

count = 0

for i = 0 to lookback - 1

count += cond[i] ? 1 : 0

count == lookback

// === Trend Filter ===

trend_is_bullish = close > ema_trend

trend_is_bearish = close < ema_trend

// === Long and Short Conditions with Confirmation ===

long_raw_condition = close > upper_band * 1.01 and rsi_val > rsi_midline and (not volume_filter or vol_filter) and trend_is_bullish

short_raw_condition = close < lower_band * 0.99 and rsi_val < rsi_midline and (not volume_filter or vol_filter) and trend_is_bearish

long_condition = confirm_condition(long_raw_condition, confirm_candles)

short_condition = confirm_condition(short_raw_condition, confirm_candles)

// === Trade Entry and Exit Logic ===

if long_condition and (trade_direction == "Long" or trade_direction == "Both")

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - (atr_multiplier * atr_val), limit=close + (atr_multiplier * risk_reward_ratio * atr_val))

if short_condition and (trade_direction == "Short" or trade_direction == "Both")

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + (atr_multiplier * atr_val), limit=close - (atr_multiplier * risk_reward_ratio * atr_val))

// === Plotting ===

plot(upper_band, color=color.green, title="Upper Band")

plot(lower_band, color=color.red, title="Lower Band")

plot(basis, color=color.blue, title="Basis")

plot(ema_trend, color=color.orange, title="Trend Filter EMA")

- Multi-Timeframe Exponential Moving Average Crossover Strategy with Risk-Reward Optimization

- Post-Open Breakout Trading Strategy with Dynamic ATR-Based Position Management

- Multi-Trend Momentum Crossover Strategy with Volatility Optimization System

- High Win Rate Trend Mean Reversion Trading Strategy

- No Upper Wick Bullish Candle Breakout Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Indicator Composite Trend Following Strategy

- Multi-Indicator Trend Momentum Trading Strategy: An Optimized Quantitative Trading System Based on Bollinger Bands, Fibonacci and ATR

- RSI-Bollinger Bands Integration Strategy: A Dynamic Self-Adaptive Multi-Indicator Trading System

- EMA Crossover with Bollinger Bands Double Entry Strategy: A Quantitative Trading System Combining Trend Following and Volatility Breakout

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Multi-EMA Trend Following Strategy with SMMA Confirmation

- Multi-Indicator Trend Trading System with Momentum Analysis Strategy

- Trend-Following Cloud Momentum Divergence Strategy

- Multi-Indicator Trend Following and Volatility Breakout Strategy

- Multi-Market Adaptive Multi-Indicator Trend Following Strategy

- Dynamic Timing and Position Management Strategy Based on Volatility

- EMA-MACD Composite Strategy for Trend Scalping

- Multi-Technical Indicator Based Trend Following and Momentum Strategy

- High-Frequency Quantitative Session Trading Strategy: Adaptive Dynamic Position Management System Based on Breakout Signals

- Multi-EMA Crossover Momentum Trend Following Strategy

- Multi-Target Intelligent Volume Momentum Trading Strategy

- Multi-Period Bollinger Bands Touch Trend Reversal Quantitative Trading Strategy

- High-Frequency Breakout Trading Strategy Based on Candlestick Close Direction

- Advanced Dynamic Fibonacci Retracement Trend Quantitative Trading Strategy

- Variable Index Dynamic Average Multi-Tier Profit Trend Following Strategy

- Multi Moving Average Trading System with Momentum and Volume Confirmation Quantitative Trend Strategy

- Adaptive Trailing Drawdown Balanced Trading Strategy with Take-Profit and Stop-Loss

- Enhanced Trend Following System: Dynamic Trend Identification Based on ADX and Parabolic SAR

- Dual Timeframe Stochastic Momentum Trading Strategy