Dynamic Trend Following ATR Multi-Period Trading Strategy

Author: ChaoZhang, Date: 2024-12-12 16:00:56Tags: ATREMAMA

Overview

This strategy is a dynamic trend following system based on the ATR (Average True Range) indicator, combining multi-period analysis and portfolio management capabilities. The strategy tracks the relative position between price and ATR channel to capture trend changes across different timeframes while dynamically managing positions according to user-defined trading quantities. The strategy design balances trend following stability with trading timing flexibility.

Strategy Principle

The core logic of the strategy is based on the following key elements: 1. Uses ATR indicator to establish dynamic stop-loss channel, with channel width determined by ATR period and sensitivity parameters 2. Determines buy/sell signals through crossovers between EMA and ATR channel 3. Supports operation across multiple timeframes from 5 minutes to 2 hours 4. Incorporates portfolio tracking mechanism to dynamically adjust buy/sell quantities based on current positions 5. Optional use of Heikin Ashi candles to reduce false signals

Strategy Advantages

- High Adaptability - Dynamically adjusts channel width through ATR to adapt to different market conditions

- Controlled Risk - Built-in stop-loss mechanism provides dynamic stop-loss levels through ATR channel

- Operational Flexibility - Supports multi-period analysis, allowing selection of appropriate timeframes for different instruments

- Position Management - Achieves dynamic position management through portfolio tracking

- Signal Stability - Optional smoothed candles to reduce noise and improve signal quality

Strategy Risks

- Trend Dependency - May generate frequent trades in ranging markets

- Lag - Use of moving averages and ATR introduces some signal delay

- Parameter Sensitivity - Strategy performance heavily influenced by choice of ATR period and sensitivity parameters

- Money Management - Requires appropriate setting of trade quantities to avoid over-position

- Market Adaptability - Performance may vary across different market conditions

Strategy Optimization Directions

- Signal Filtering

- Add trend strength confirmation indicators

- Introduce volume analysis

- Consider adding volatility filters

- Position Management

- Dynamically adjust position size based on volatility

- Implement scaled entry and exit

- Add maximum drawdown control

- Stop Loss Optimization

- Incorporate support/resistance levels for stop placement

- Implement trailing stops

- Optimize stop distance calculation method

Summary

This strategy is a complete trading system combining technical analysis and portfolio management. It provides stable trend following capabilities through ATR dynamic channels and multi-period analysis while considering position management needs in actual trading. Strategy optimization should focus on improving signal quality and enhancing risk control. Further practicality can be achieved through parameter optimization and feature expansion.

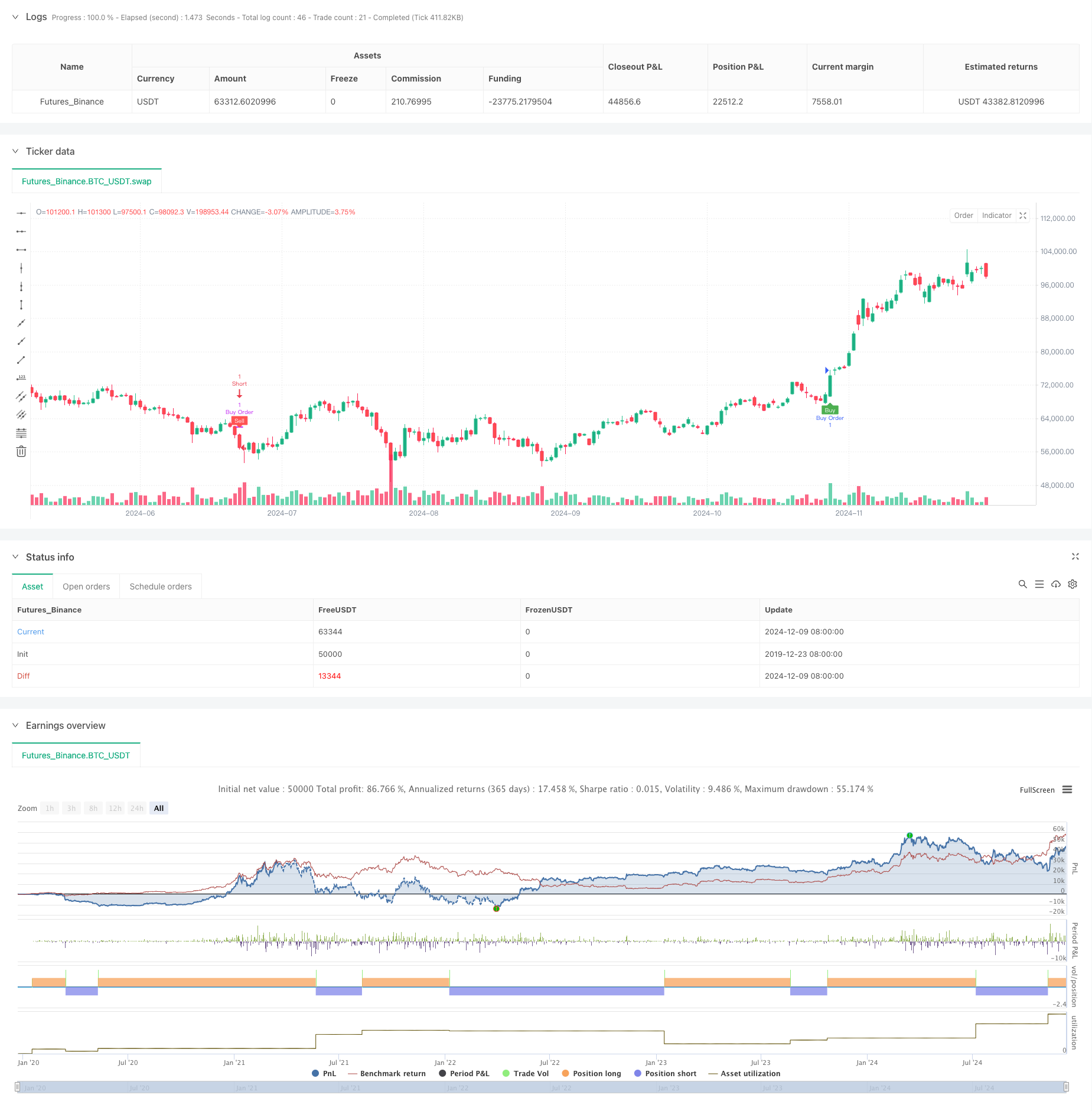

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='ADET GİRMELİ Trend İz Süren Stop Strategy', overlay=true, overlay=true,default_qty_type = strategy.fixed, default_qty_value = 1)

// Inputs

a = input(9, title='Key Value. "This changes the sensitivity"')

c = input(3, title='ATR Period')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

// Alım ve Satım Sinyalleri

buySignal = src > xATRTrailingStop and above

sellSignal = src < xATRTrailingStop and below

// Kullanıcı girişi

sell_quantity = input.int(1, title="Sell Quantity", minval=1)

buy_quantity = input.int(1, title="Buy Quantity", minval=1)

// Portföy miktarı (örnek simülasyon verisi)

var portfolio_quantity = 0

// Sinyal üretimi (örnek sinyal, gerçek stratejinizle değiştirin)

indicator_signal = (src > xATRTrailingStop and above) ? "buy" :

(src < xATRTrailingStop and below) ? "sell" : "hold"

// Şartlara göre al/sat

if indicator_signal == "buy" and portfolio_quantity < buy_quantity

strategy.entry("Buy Order", strategy.long, qty=buy_quantity)

portfolio_quantity := portfolio_quantity + buy_quantity

if indicator_signal == "sell" and portfolio_quantity >= sell_quantity

strategy.close("Buy Order", qty=sell_quantity)

portfolio_quantity := portfolio_quantity - sell_quantity

// Plot buy and sell signals

plotshape(buy, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(sell, title='Sell', text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// Bar coloring

barcolor(barbuy ? color.rgb(6, 250, 14) : na)

barcolor(barsell ? color.red : na)

// Alerts

alertcondition(buy, 'UT Long', 'UT Long')

alertcondition(sell, 'UT Short', 'UT Short')

// Strategy Entry and Exit

if buy

strategy.entry('Long', strategy.long)

if sell

strategy.entry('Short', strategy.short)

// Optional Exit Conditions

if sell

strategy.close('Long')

if buy

strategy.close('Short')

// ///TARAMA///

// gurupSec = input.string(defval='1', options=['1', '2', '3', '4', '5','6','7'], group='Taraması yapılacak 40\'arlı gruplardan birini seçin', title='Grup seç')

// per = input.timeframe(defval='', title='PERİYOT',group = "Tarama yapmak istediğiniz periyotu seçin")

// loc = input.int(defval=20, title='Konum Ayarı', minval = -100,maxval = 200 , step = 5, group='Tablonun konumunu belirleyin')

// func() =>

// //ÖRNEK BİR FONKSİYON AŞAĞIDA YAZILMIŞTIR. SİZ DE İSTEDİĞİNİZ KOŞULLAR İÇİN TARAMA YAZABİLİRSİNİZ.

// //rsi = ta.rsi(close,14)

// //cond = rsi <= 30

// //[close,cond]

// ////value = ta.cci(close,length23)

// cond = buySignal or sellSignal

// [close,cond]

// c1 = input.symbol(title='1', defval='BIST:BRYAT',group = "1. Grup Hisseleri")

// c2 = input.symbol(title='2', defval='BIST:TARKM')

// c3 = input.symbol(title='3', defval='BIST:TNZTP')

// c4 = input.symbol(title='4', defval='BIST:ERBOS')

// c5 = input.symbol(title='5', defval='BIST:BFREN')

// c6 = input.symbol(title='6', defval='BIST:ALARK')

// c7 = input.symbol(title='7', defval='BIST:ISMEN')

// c8 = input.symbol(title='8', defval='BIST:CVKMD')

// c9 = input.symbol(title='9', defval='BIST:TTRAK')

// c10 = input.symbol(title='10', defval='BIST:ASELS')

// c11 = input.symbol(title='11', defval='BIST:ATAKP')

// c12 = input.symbol(title='12', defval='BIST:MGROS')

// c13 = input.symbol(title='13', defval='BIST:BRSAN')

// c14 = input.symbol(title='14', defval='BIST:ALFAS')

// c15 = input.symbol(title='15', defval='BIST:CWENE')

// c16 = input.symbol(title='16', defval='BIST:THYAO')

// c17 = input.symbol(title='17', defval='BIST:EREGL')

// c18 = input.symbol(title='18', defval='BIST:TUPRS')

// c19 = input.symbol(title='19', defval='BIST:YYLGD')

// c20 = input.symbol(title='20', defval='BIST:KLSER')

// c21 = input.symbol(title='21', defval='BIST:MIATK')

// c22 = input.symbol(title='22', defval='BIST:ASTOR')

// c23 = input.symbol(title='23', defval='BIST:DOAS')

// c24 = input.symbol(title='24', defval='BIST:ERCB')

// c25 = input.symbol(title='25', defval='BIST:REEDR')

// c26 = input.symbol(title='26', defval='BIST:DNISI')

// c27 = input.symbol(title='27', defval='BIST:ARZUM')

// c28 = input.symbol(title='28', defval='BIST:EBEBK')

// c29 = input.symbol(title='29', defval='BIST:KLKIM')

// c30 = input.symbol(title='30', defval='BIST:ONCSM')

// c31 = input.symbol(title='31', defval='BIST:SOKE')

// c32 = input.symbol(title='32', defval='BIST:GUBRF')

// c33 = input.symbol(title='33', defval='BIST:KONTR')

// c34 = input.symbol(title='34', defval='BIST:DAPGM')

// c35 = input.symbol(title='35', defval='BIST:BVSAN')

// c36 = input.symbol(title='36', defval='BIST:ODAS')

// c37 = input.symbol(title='37', defval='BIST:OYAKC')

// c38 = input.symbol(title='38', defval='BIST:KRPLS')

// c39 = input.symbol(title='39', defval='BIST:BOBET')

// [v1,s1] = request.security(c1, per, func())

// [v2,s2] = request.security(c2, per, func())

// [v3,s3] = request.security(c3, per, func())

// [v4,s4] = request.security(c4, per, func())

// [v5,s5] = request.security(c5, per, func())

// [v6,s6] = request.security(c6, per, func())

// [v7,s7] = request.security(c7, per, func())

// [v8,s8] = request.security(c8, per, func())

// [v9,s9] = request.security(c9, per, func())

// [v10,s10] = request.security(c10, per, func())

// [v11,s11] = request.security(c11, per, func())

// [v12,s12] = request.security(c12, per, func())

// [v13,s13] = request.security(c13, per, func())

// [v14,s14] = request.security(c14, per, func())

// [v15,s15] = request.security(c15, per, func())

// [v16,s16] = request.security(c16, per, func())

// [v17,s17] = request.security(c17, per, func())

// [v18,s18] = request.security(c18, per, func())

// [v19,s19] = request.security(c19, per, func())

// [v20,s20] = request.security(c20, per, func())

// [v21,s21] = request.security(c21, per, func())

// [v22,s22] = request.security(c22, per, func())

// [v23,s23] = request.security(c23, per, func())

// [v24,s24] = request.security(c24, per, func())

// [v25,s25] = request.security(c25, per, func())

// [v26,s26] = request.security(c26, per, func())

// [v27,s27] = request.security(c27, per, func())

// [v28,s28] = request.security(c28, per, func())

// [v29,s29] = request.security(c29, per, func())

// [v30,s30] = request.security(c30, per, func())

// [v31,s31] = request.security(c31, per, func())

// [v32,s32] = request.security(c32, per, func())

// [v33,s33] = request.security(c33, per, func())

// [v34,s34] = request.security(c34, per, func())

// [v35,s35] = request.security(c35, per, func())

// [v36,s36] = request.security(c36, per, func())

// [v37,s37] = request.security(c37, per, func())

// [v38,s38] = request.security(c38, per, func())

// [v39,s39] = request.security(c39, per, func())

// roundn(x, n) =>

// mult = 1

// if n != 0

// for i = 1 to math.abs(n) by 1

// mult *= 10

// mult

// n >= 0 ? math.round(x * mult) / mult : math.round(x / mult) * mult

// scr_label = 'A/G İZSÜREN\n'

// scr_label := s1 ? scr_label + syminfo.ticker(c1) + ' ' + str.tostring(roundn(v1, 2)) + '\n' : scr_label

// scr_label := s2 ? scr_label + syminfo.ticker(c2) + ' ' + str.tostring(roundn(v2, 2)) + '\n' : scr_label

// scr_label := s3 ? scr_label + syminfo.ticker(c3) + ' ' + str.tostring(roundn(v3, 2)) + '\n' : scr_label

// scr_label := s4 ? scr_label + syminfo.ticker(c4) + ' ' + str.tostring(roundn(v4, 2)) + '\n' : scr_label

// scr_label := s5 ? scr_label + syminfo.ticker(c5) + ' ' + str.tostring(roundn(v5, 2)) + '\n' : scr_label

// scr_label := s6 ? scr_label + syminfo.ticker(c6) + ' ' + str.tostring(roundn(v6, 2)) + '\n' : scr_label

// scr_label := s7 ? scr_label + syminfo.ticker(c7) + ' ' + str.tostring(roundn(v7, 2)) + '\n' : scr_label

// scr_label := s8 ? scr_label + syminfo.ticker(c8) + ' ' + str.tostring(roundn(v8, 2)) + '\n' : scr_label

// scr_label := s9 ? scr_label + syminfo.ticker(c9) + ' ' + str.tostring(roundn(v9, 2)) + '\n' : scr_label

// scr_label := s10 ? scr_label + syminfo.ticker(c10) + ' ' + str.tostring(roundn(v10, 2)) + '\n' : scr_label

// scr_label := s11 ? scr_label + syminfo.ticker(c11) + ' ' + str.tostring(roundn(v11, 2)) + '\n' : scr_label

// scr_label := s12 ? scr_label + syminfo.ticker(c12) + ' ' + str.tostring(roundn(v12, 2)) + '\n' : scr_label

// scr_label := s13 ? scr_label + syminfo.ticker(c13) + ' ' + str.tostring(roundn(v13, 2)) + '\n' : scr_label

// scr_label := s14 ? scr_label + syminfo.ticker(c14) + ' ' + str.tostring(roundn(v14, 2)) + '\n' : scr_label

// scr_label := s15 ? scr_label + syminfo.ticker(c15) + ' ' + str.tostring(roundn(v15, 2)) + '\n' : scr_label

// scr_label := s16 ? scr_label + syminfo.ticker(c16) + ' ' + str.tostring(roundn(v16, 2)) + '\n' : scr_label

// scr_label := s17 ? scr_label + syminfo.ticker(c17) + ' ' + str.tostring(roundn(v17, 2)) + '\n' : scr_label

// scr_label := s18 ? scr_label + syminfo.ticker(c18) + ' ' + str.tostring(roundn(v18, 2)) + '\n' : scr_label

// scr_label := s19 ? scr_label + syminfo.ticker(c19) + ' ' + str.tostring(roundn(v19, 2)) + '\n' : scr_label

// scr_label := s20 ? scr_label + syminfo.ticker(c20) + ' ' + str.tostring(roundn(v20, 2)) + '\n' : scr_label

// scr_label := s21 ? scr_label + syminfo.ticker(c21) + ' ' + str.tostring(roundn(v21, 2)) + '\n' : scr_label

// scr_label := s22 ? scr_label + syminfo.ticker(c22) + ' ' + str.tostring(roundn(v22, 2)) + '\n' : scr_label

// scr_label := s23 ? scr_label + syminfo.ticker(c23) + ' ' + str.tostring(roundn(v23, 2)) + '\n' : scr_label

// scr_label := s24 ? scr_label + syminfo.ticker(c24) + ' ' + str.tostring(roundn(v24, 2)) + '\n' : scr_label

// scr_label := s25 ? scr_label + syminfo.ticker(c25) + ' ' + str.tostring(roundn(v25, 2)) + '\n' : scr_label

// scr_label := s26 ? scr_label + syminfo.ticker(c26) + ' ' + str.tostring(roundn(v26, 2)) + '\n' : scr_label

// scr_label := s27 ? scr_label + syminfo.ticker(c27) + ' ' + str.tostring(roundn(v27, 2)) + '\n' : scr_label

// scr_label := s28 ? scr_label + syminfo.ticker(c28) + ' ' + str.tostring(roundn(v28, 2)) + '\n' : scr_label

// scr_label := s29 ? scr_label + syminfo.ticker(c29) + ' ' + str.tostring(roundn(v29, 2)) + '\n' : scr_label

// scr_label := s30 ? scr_label + syminfo.ticker(c30) + ' ' + str.tostring(roundn(v30, 2)) + '\n' : scr_label

// scr_label := s31 ? scr_label + syminfo.ticker(c31) + ' ' + str.tostring(roundn(v31, 2)) + '\n' : scr_label

// scr_label := s32 ? scr_label + syminfo.ticker(c32) + ' ' + str.tostring(roundn(v32, 2)) + '\n' : scr_label

// scr_label := s33 ? scr_label + syminfo.ticker(c33) + ' ' + str.tostring(roundn(v33, 2)) + '\n' : scr_label

// scr_label := s34 ? scr_label + syminfo.ticker(c34) + ' ' + str.tostring(roundn(v34, 2)) + '\n' : scr_label

// scr_label := s35 ? scr_label + syminfo.ticker(c35) + ' ' + str.tostring(roundn(v35, 2)) + '\n' : scr_label

// scr_label := s36 ? scr_label + syminfo.ticker(c36) + ' ' + str.tostring(roundn(v36, 2)) + '\n' : scr_label

// scr_label := s37 ? scr_label + syminfo.ticker(c37) + ' ' + str.tostring(roundn(v37, 2)) + '\n' : scr_label

// scr_label := s38 ? scr_label + syminfo.ticker(c38) + ' ' + str.tostring(roundn(v38, 2)) + '\n' : scr_label

// scr_label := s39 ? scr_label + syminfo.ticker(c39) + ' ' + str.tostring(roundn(v39, 2)) + '\n' : scr_label

// var panel = table.new(position = position.top_right,columns = 10,rows = 10,bgcolor = color.green,frame_color = color.white,border_color = color.red)

// if barstate.islast

// table.cell(panel,0,0,text = str.tostring(scr_label))

// //------------------------------------------------------

- Magic Channel Price Action Trading Strategy

- Advanced Dual EMA Strategy with ATR Volatility Filter System

- AlphaTradingBot Trading Strategy

- Triple Bottom Rebound Momentum Breakthrough Strategy

- Dual EMA Pullback Trading System with ATR-Based Dynamic Stop-Loss Optimization

- Dynamic Moving Average Crossover Trend Following Strategy with ATR Risk Management System

- Enhanced Price-Volume Trend Momentum Strategy

- Dual EMA Trend Momentum Trading Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- MACD-V and Fibonacci Multi-Timeframe Dynamic Take Profit Strategy

- Adaptive Trend Following and Reversal Detection Strategy: A Quantitative Trading System Based on ZigZag and Aroon Indicators

- Multi-Indicator Synergistic Trading Strategy with Bollinger Bands, Fibonacci, MACD and RSI

- Mean Reversion Bollinger Band Dollar-Cost Averaging Investment Strategy

- Multi-dimensional Gold Friday Anomaly Strategy Analysis System

- Multi-Timeframe Trend Dynamic ATR Tracking Strategy

- Moving Average Crossover with RSI Trend Momentum Tracking Strategy

- Dynamic ATR-based Trailing Stop Trading Strategy

- Momentum Trend Following MACD-RSI Dual Confirmation Trading Strategy

- Dynamic Pivot Points with Golden Cross Optimization System

- Multi-Indicator Trend Following Strategy with Bollinger Bands and ATR Dynamic Stop Loss

- Multi-Indicator Trend Following Strategy with Dynamic Channel and Moving Average Trading System

- Multi-EMA Trend Following Strategy with SMMA Confirmation

- Multi-Indicator Trend Trading System with Momentum Analysis Strategy

- Trend-Following Cloud Momentum Divergence Strategy

- Multi-Indicator Trend Following and Volatility Breakout Strategy

- Multi-Market Adaptive Multi-Indicator Trend Following Strategy

- Dynamic Timing and Position Management Strategy Based on Volatility

- EMA-MACD Composite Strategy for Trend Scalping

- Multi-Technical Indicator Based Trend Following and Momentum Strategy

- High-Frequency Quantitative Session Trading Strategy: Adaptive Dynamic Position Management System Based on Breakout Signals