Dynamic Trend Following SuperTrend Triple Enhancement Strategy

Author: ChaoZhang, Date: 2025-01-17 14:37:39Tags: ATREMAsupertrendSLTS

Overview

This is a trend following strategy based on SuperTrend indicator, Exponential Moving Average (EMA) and Average True Range (ATR). The strategy achieves dynamic trend tracking and risk control through the combination of multiple technical indicators, initial stop loss and trailing stop loss. The core of the strategy lies in capturing trend direction changes using the SuperTrend indicator, while using EMA for trend confirmation and setting up dual stop loss mechanisms to protect profits.

Strategy Principles

The strategy operates based on the following core components: 1. SuperTrend indicator for identifying trend direction changes, calculated with ATR period of 16 and factor of 3.02 2. 49-period EMA as trend filter for confirming trend direction 3. Initial stop loss set at 50 points providing basic protection for each trade 4. Trailing stop loss activates after 70 points profit, dynamically tracking price changes

The system generates long signals when SuperTrend direction turns downward and closing price is above EMA, provided there’s no existing position. Conversely, short signals are generated when SuperTrend direction turns upward and closing price is below EMA.

Strategy Advantages

- Multiple confirmation mechanism: Reduces false signals through combined use of SuperTrend and EMA

- Comprehensive risk control: Employs dual stop loss mechanism with both fixed and dynamic trailing stops

- Flexible position management: Strategy defaults to 15% of equity as position size, adjustable as needed

- Strong trend adaptability: Can self-adjust in different market environments, especially suitable for volatile markets

- Parameter optimization potential: All major parameters can be optimized for different market characteristics

Strategy Risks

- Choppy market risk: May result in frequent trades and consecutive stops in sideways markets

- Slippage risk: Stop loss execution prices may significantly deviate from expected in fast markets

- Parameter sensitivity: Strategy effectiveness is sensitive to parameter settings, may need adjustment in different market environments

- Trend reversal risk: May experience significant drawdowns before stops are triggered at trend reversal points

- Money management risk: Fixed proportion position sizing may bring substantial risks during extreme volatility

Strategy Optimization Directions

- Dynamic parameter adjustment: Automatically adjust SuperTrend and EMA parameters based on market volatility

- Market environment filtering: Add market environment assessment mechanism to stop trading in unsuitable conditions

- Stop loss optimization: Introduce ATR-based dynamic stop loss settings to better adapt to market volatility

- Position management optimization: Develop volatility-based dynamic position sizing system

- Add profit targets: Set dynamic profit targets based on market volatility

Summary

This is a complete trading strategy combining multiple technical indicators and risk control mechanisms. It achieves a favorable risk-reward ratio through trend capture with SuperTrend indicator, direction confirmation with EMA, coupled with dual stop loss mechanisms. The strategy’s optimization potential mainly lies in dynamic parameter adjustment, market environment assessment, and risk management system enhancement. In practical application, it is recommended to conduct thorough historical data backtesting and adjust parameters according to specific trading instrument characteristics.

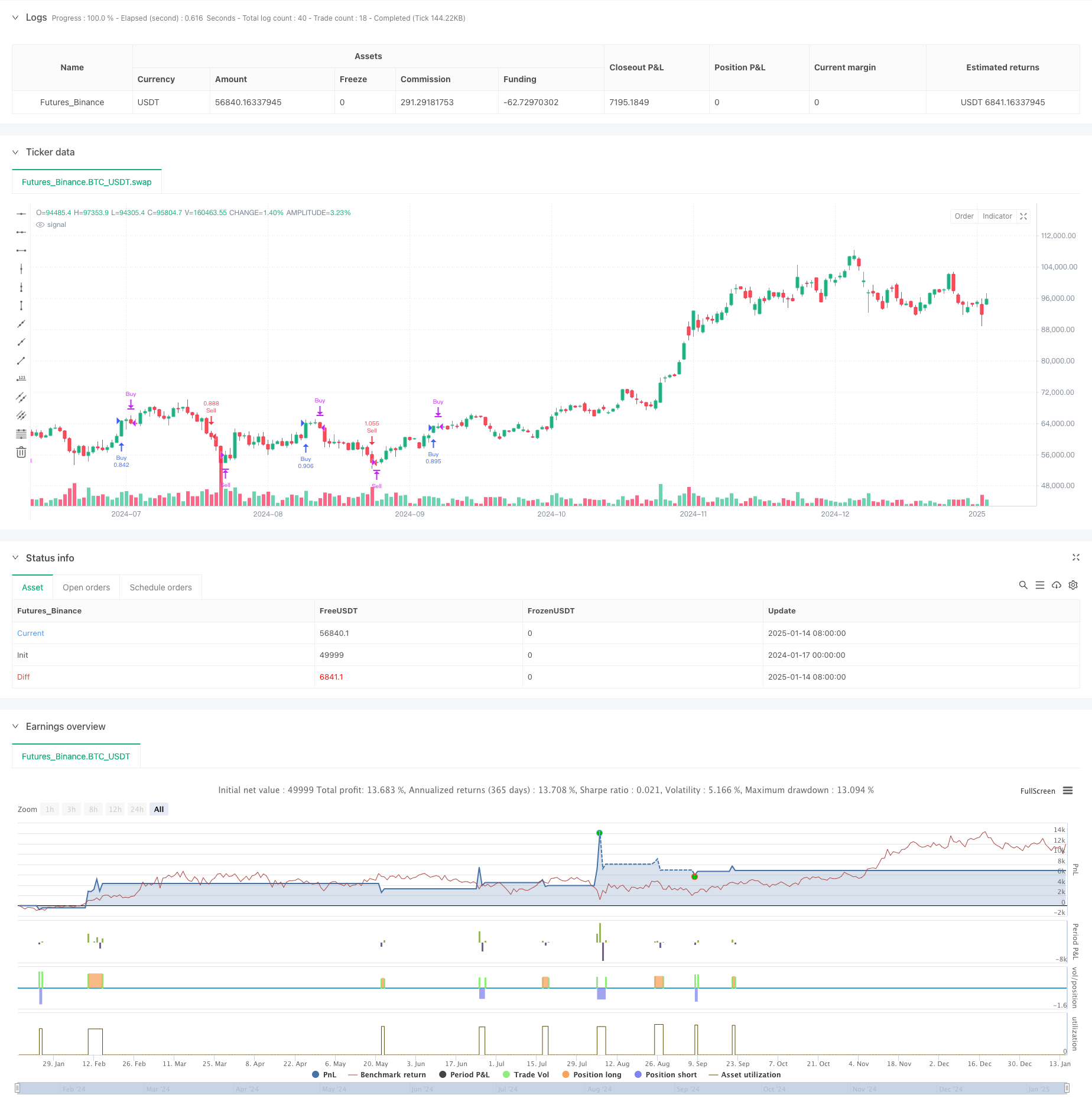

/*backtest

start: 2024-01-17 00:00:00

end: 2025-01-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy(" nifty supertrend triton", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Input parameters

atrPeriod = input.int(16, "ATR Length", step=1)

factor = input.float(3.02, "Factor", step=0.01)

maPeriod = input.int(49, "Moving Average Period", step=1)

trailPoints = input.int(70, "Trailing Points", step=1) // Points after which trailing stop activates

initialStopLossPoints = input.int(50, "Initial Stop Loss Points", step=1) // Initial stop loss of 50 points

// Calculate Supertrend

[_, direction] = ta.supertrend(factor, atrPeriod)

// Calculate EMA

ema = ta.ema(close, maPeriod)

// Variables to track stop loss levels

var float trailStop = na

var float entryPrice = na

var float initialStopLoss = na // To track the initial stop loss

// Generate buy and sell signals

if ta.change(direction) < 0 and close > ema

if strategy.position_size == 0 // Only open a new long position if no current position

strategy.entry("Buy", strategy.long)

entryPrice := close // Record the entry price for the long position

initialStopLoss := entryPrice - initialStopLossPoints // Set initial stop loss for long position

trailStop := na // Reset trailing stop for long

if ta.change(direction) > 0 and close < ema

if strategy.position_size == 0 // Only open a new short position if no current position

strategy.entry("Sell", strategy.short)

entryPrice := close // Record the entry price for the short position

initialStopLoss := entryPrice + initialStopLossPoints // Set initial stop loss for short position

trailStop := na // Reset trailing stop for short

// Apply initial stop loss for long positions

if (strategy.position_size > 0) // Check if in a long position

if close <= initialStopLoss // If the price drops to or below the initial stop loss

strategy.close("Buy", "Initial Stop Loss Hit") // Exit the long position

// Apply trailing stop logic for long positions

if (strategy.position_size > 0) // Check if in a long position

if (close - entryPrice >= trailPoints) // If the price has moved up by the threshold

trailStop := na(trailStop) ? close - trailPoints : math.max(trailStop, close - trailPoints) // Adjust trailing stop upwards

if not na(trailStop) and close < trailStop // If the price drops below the trailing stop

strategy.close("Buy", "Trailing Stop Hit") // Exit the long position

// Apply initial stop loss for short positions

if (strategy.position_size < 0) // Check if in a short position

if close >= initialStopLoss // If the price rises to or above the initial stop loss

strategy.close("Sell", "Initial Stop Loss Hit") // Exit the short position

// Apply trailing stop logic for short positions

if (strategy.position_size < 0) // Check if in a short position

if (entryPrice - close >= trailPoints) // If the price has moved down by the threshold

trailStop := na(trailStop) ? close + trailPoints : math.min(trailStop, close + trailPoints) // Adjust trailing stop downwards

if not na(trailStop) and close > trailStop // If the price rises above the trailing stop

strategy.close("Sell", "Trailing Stop Hit") // Exit the short position

- Advanced Dynamic Stop-Loss Strategy Based on Large Candles and RSI Divergence

- Multi-Indicator Trend Following Strategy: Integrating SuperTrend, EMA, and Risk Management

- Advanced Trend Following Strategy with Adaptive Trailing Stop

- Dynamic ATR-based Trailing Stop Trading Strategy

- Dynamic EMA Crossover Strategy with ADX Trend Strength Filtering System

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- Dual EMA Pullback Trading System with ATR-Based Dynamic Stop-Loss Optimization

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- Dynamic WaveTrend and Fibonacci Integrated Quantitative Trading Strategy

- Volatility Stop Based EMA Trend Following Trading Strategy

- Multi-EMA Trend Following Strategy with Dynamic Volatility Filter

- Triple EMA Trend Following Multi-Indicator Quantitative Trading Strategy

- Year-end Trend Following Momentum Trading Strategy(60-day MA Breakout)

- Multi-Indicator Trend Following with RSI Overbought/Oversold Quantitative Trading Strategy

- Efficient Price Channel Trading Strategy Based on 15-Minute Breakout

- Multi-timeframe Fair Value Gap Breakout Strategy with Historical Backtest

- Dynamic QQE Trend Following with Risk Management Quantitative Trading Strategy

- Dual Trend Confirmation Trading Strategy Based on Moving Averages and Outside Bar Pattern

- RSI Dynamic Breakout Retracement Trading Strategy

- Optimized Dual T3 Trend Tracking Strategy

- Multi-Condition Donchian Channel Momentum Breakout Strategy

- Multi-Period Technical Indicator Dynamic Trading System Strategy

- Dynamic Support Resistance & Bollinger Bands Multi-Indicator Cross Strategy

- Multi-Dimensional Ichimoku Cloud Price Breakthrough Trend Confirmation Trading Strategy

- Dynamic Neural RSI Trend-Following Trading Strategy

- Multi-EMA Crossover Trend Following Quantitative Trading Strategy

- Multi-level Indicator Overlapping RSI Trading Strategy

- Bollinger Bands and Fibonacci Intraday Trend Following Strategy