Multi-Channel Dynamic Support Resistance Keltner Channel Strategy

Author: ChaoZhang, Date: 2025-01-17 15:17:59Tags: KCEMAATRSMAWMAPPSR

Overview

This strategy is a comprehensive trading system based on Keltner Channels and dynamic support/resistance levels. It analyzes multiple timeframes, combining moving averages and volatility indicators to form a complete trading decision framework. The core approach is to identify price breakout opportunities while considering market trends and volatility to capture high-probability trading opportunities.

Strategy Principles

The strategy employs a multi-layer technical indicator system: 1. Uses 21-period Keltner Channels as the primary trend identification tool, with channel width determined by ATR 2. Calculates key support/resistance levels using 21 left-side and 8 right-side bars 3. Incorporates higher timeframe moving averages as trend filters 4. Combines short-term (5-period) and long-term (30-period) moving averages for entry timing 5. Uses ATR for dynamic stop-loss adjustment

Strategy Advantages

- Multi-dimensional technical indicators provide mutual verification, reducing false signals

- Dynamic support/resistance levels update in real-time, adapting to market changes

- Higher timeframe analysis filters out secondary market movements

- Flexible stop-loss parameters based on different timeframes

- Percentage-based position management for effective risk control

Strategy Risks

- May generate frequent trading signals in ranging markets

- Multiple indicator verification might miss some trading opportunities

- Parameter optimization poses overfitting risks

- Stop-loss levels may be too wide in high-volatility environments

- Support/resistance levels may fail during rapid market changes

Optimization Directions

- Incorporate volume indicators to validate breakouts

- Add market volatility analysis module for dynamic parameter adjustment

- Improve support/resistance calculation methods for better accuracy

- Add trend strength assessment to refine entry conditions

- Enhance position management system for more precise risk control

Summary

This is a well-structured and logically rigorous quantitative trading strategy. Through the coordinated use of multiple technical indicators, it ensures both reliable trading signals and effective risk control. The strategy’s strong extensibility allows for continuous optimization and improvement, potentially maintaining stable performance across different market environments.

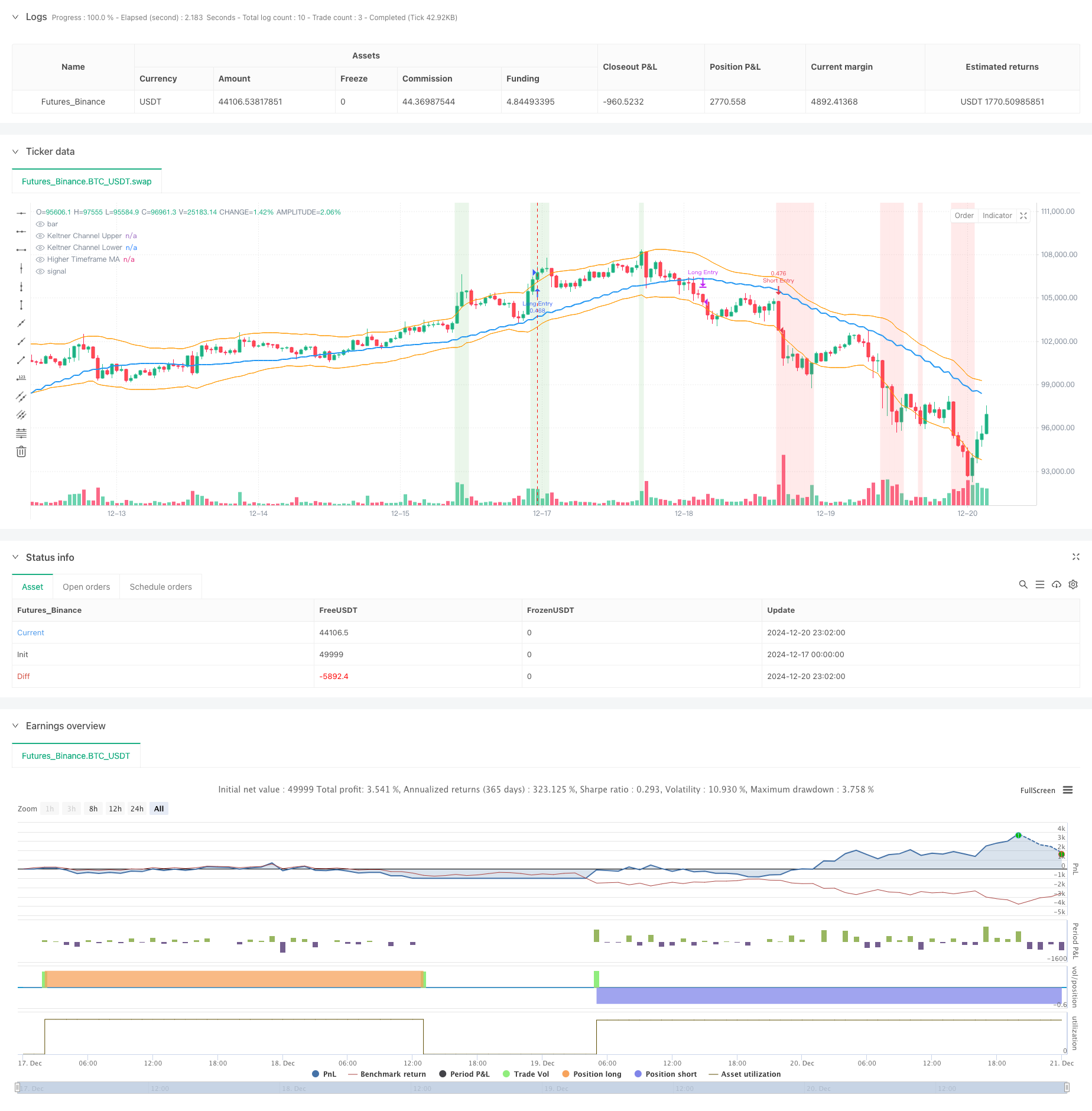

/*backtest

start: 2024-12-17 00:00:00

end: 2024-12-21 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sathcm

//@version=5

strategy("KMS", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.05, slippage=3)

// Inputs for Keltner Channels

kcLength = input.int(21, title="Keltner Channel Length", minval=1) // Length for Keltner Channel calculation

kcMultiplier = input.float(2.0, title="Keltner Channel Multiplier", minval=0.1) // Multiplier for Keltner Channel width

// Calculate Keltner Channels using best practices

kcBasis = ta.ema(close, kcLength) // Use EMA for a smoother basis line

atrValue = ta.atr(kcLength) // Use ATR for channel width calculation

kcUpper = kcBasis + kcMultiplier * atrValue // Upper Keltner Channel

kcLower = kcBasis - kcMultiplier * atrValue // Lower Keltner Channel

// Inputs for Pivot Point Calculation

leftBars = input.int(21, title="Left Bars", minval=1) // Number of bars to the left for pivot calculation

rightBars = input.int(8, title="Right Bars", minval=1, tooltip="Number of bars to the right for pivot calculation") // Number of bars to the right for pivot calculation

// Calculate Smoothed Pivot Highs and Lows using Weighted Moving Average

pivotHigh = ta.pivothigh(high, leftBars, rightBars) // Apply WMA for smoothing

pivotLow = ta.pivotlow(low, leftBars, rightBars) // Apply WMA for smoothing

// Convert Pivot Highs and Lows to Boolean Conditions

isPivotHigh = not na(pivotHigh) // True when a pivot high exists

isPivotLow = not na(pivotLow) // True when a pivot low exists

// Get Recent Support and Resistance Levels

recentResistance = ta.valuewhen(isPivotHigh, high, 0) // Most recent resistance level

recentSupport = ta.valuewhen(isPivotLow, low, 0) // Most recent support level

// Plot Smoothed Support and Resistance Levels

//plot(recentResistance, color=color.red, title="Recent Resistance", linewidth=2, style=plot.style_line)

//plot(recentSupport, color=color.green, title="Recent Support", linewidth=2, style=plot.style_line)

// Store Entry Price into a Variable

var float entryPrice = na // Declare a variable to store the entry price

// Input for Higher Timeframe

higherTimeframeInput = input.timeframe('W', title="Higher Timeframe for MA Calculation")

if (timeframe.period == "240") or (timeframe.period == "120")

higherTimeframeInput := "D"

if (timeframe.period == "60") or (timeframe.period == "30") or (timeframe.period == "15")

higherTimeframeInput := "120"

if (timeframe.period == "10") or (timeframe.period == "5")

higherTimeframeInput := "30"

if (timeframe.period == "1")

higherTimeframeInput := "10"

prd = input.int(defval=10, title='Pivot Period', minval=4, maxval=30, group='Settings 🔨', tooltip='Used while calculating Pivot Points, checks left&right bars')

ppsrc = input.string(defval='High/Low', title='Source', options=['High/Low', 'Close/Open'], group='Settings 🔨', tooltip='Source for Pivot Points')

ChannelW = input.int(defval=5, title='Maximum Channel Width %', minval=1, maxval=8, group='Settings 🔨', tooltip='Calculated using Highest/Lowest levels in 300 bars')

minstrength = input.int(defval=1, title='Minimum Strength', minval=1, group='Settings 🔨', tooltip='Channel must contain at least 2 Pivot Points')

maxnumsr = input.int(defval=4, title='Maximum Number of S/R', minval=1, maxval=10, group='Settings 🔨', tooltip='Maximum number of Support/Resistance Channels to Show') - 1

loopback = input.int(defval=150, title='Loopback Period', minval=100, maxval=400, group='Settings 🔨', tooltip='While calculating S/R levels it checks Pivots in Loopback Period')

res_col = input.color(defval=color.new(color.red, 75), title='Resistance Color', group='Colors 🟡🟢🟣')

sup_col = input.color(defval=color.new(color.lime, 75), title='Support Color', group='Colors 🟡🟢🟣')

inch_col = input.color(defval=color.new(color.gray, 75), title='Color When Price in Channel', group='Colors 🟡🟢🟣')

// Get Pivot High/Low

src1 = ppsrc == 'High/Low' ? high : math.max(close, open)

src2 = ppsrc == 'High/Low' ? low : math.min(close, open)

ph = ta.pivothigh(src1, prd, prd)

pl = ta.pivotlow(src2, prd, prd)

// Calculate maximum S/R channel width

prdhighest = ta.highest(300)

prdlowest = ta.lowest(300)

cwidth = (prdhighest - prdlowest) * ChannelW / 100

// Get/keep Pivot levels

var pivotvals = array.new_float(0)

var pivotlocs = array.new_float(0)

if ph or pl

array.unshift(pivotvals, ph ? ph : pl)

array.unshift(pivotlocs, bar_index)

for x = array.size(pivotvals) - 1 to 0 by 1

if bar_index - array.get(pivotlocs, x) > loopback // remove old pivot points

array.pop(pivotvals)

array.pop(pivotlocs)

continue

break

// Find/create SR channel of a pivot point

get_sr_vals(ind) =>

float lo = array.get(pivotvals, ind)

float hi = lo

int numpp = 0

for y = 0 to array.size(pivotvals) - 1 by 1

float cpp = array.get(pivotvals, y)

float wdth = cpp <= hi ? hi - cpp : cpp - lo

if wdth <= cwidth // fits the max channel width?

if cpp <= hi

lo := math.min(lo, cpp)

else

hi := math.max(hi, cpp)

numpp += 20 // each pivot point added as 20

[hi, lo, numpp]

// Keep old SR channels and calculate/sort new channels if we met new pivot point

var suportresistance = array.new_float(20, 0) // min/max levels

changeit(x, y) =>

tmp = array.get(suportresistance, y * 2)

array.set(suportresistance, y * 2, array.get(suportresistance, x * 2))

array.set(suportresistance, x * 2, tmp)

tmp := array.get(suportresistance, y * 2 + 1)

array.set(suportresistance, y * 2 + 1, array.get(suportresistance, x * 2 + 1))

array.set(suportresistance, x * 2 + 1, tmp)

if ph or pl

supres = array.new_float(0) // number of pivot, strength, min/max levels

stren = array.new_float(10, 0)

// Get levels and strengths

for x = 0 to array.size(pivotvals) - 1 by 1

[hi, lo, strength] = get_sr_vals(x)

array.push(supres, strength)

array.push(supres, hi)

array.push(supres, lo)

// Add each HL to strength

for x = 0 to array.size(pivotvals) - 1 by 1

h = array.get(supres, x * 3 + 1)

l = array.get(supres, x * 3 + 2)

s = 0

for y = 0 to loopback by 1

if high[y] <= h and high[y] >= l or low[y] <= h and low[y] >= l

s += 1

array.set(supres, x * 3, array.get(supres, x * 3) + s)

// Reset SR levels

array.fill(suportresistance, 0)

// Get strongest SRs

src = 0

for x = 0 to array.size(pivotvals) - 1 by 1

stv = -1. // value

stl = -1 // location

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3) > stv and array.get(supres, y * 3) >= minstrength * 20

stv := array.get(supres, y * 3)

stl := y

if stl >= 0

// Get SR level

hh = array.get(supres, stl * 3 + 1)

ll = array.get(supres, stl * 3 + 2)

array.set(suportresistance, src * 2, hh)

array.set(suportresistance, src * 2 + 1, ll)

array.set(stren, src, array.get(supres, stl * 3))

// Make included pivot points' strength zero

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3 + 1) <= hh and array.get(supres, y * 3 + 1) >= ll or array.get(supres, y * 3 + 2) <= hh and array.get(supres, y * 3 + 2) >= ll

array.set(supres, y * 3, -1)

src += 1

if src >= 10

break

for x = 0 to 8 by 1

for y = x + 1 to 9 by 1

if array.get(stren, y) > array.get(stren, x)

tmp = array.get(stren, y)

array.set(stren, y, array.get(stren, x))

changeit(x, y)

get_level(ind) =>

float ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind)

ret

get_color(ind) =>

color ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind) > close and array.get(suportresistance, ind + 1) > close ? res_col : array.get(suportresistance, ind) < close and array.get(suportresistance, ind + 1) < close ? sup_col : inch_col

ret

// var srchannels = array.new_box(10)

// for x = 0 to math.min(9, maxnumsr) by 1

// box.delete(array.get(srchannels, x))

// srcol = get_color(x * 2)

// if not na(srcol)

// array.set(srchannels, x, box.new(left=bar_index, top=get_level(x * 2), right=bar_index + 1, bottom=get_level(x * 2 + 1), border_color=srcol, border_width=1, extend=extend.both, bgcolor=srcol))

// Improved dynamic support detection

float recentSupport1 = na

float previousSupport = na

float currentsupport = na

if na(previousSupport) or currentsupport != previousSupport

if array.size(suportresistance) > 1

for i = 0 to math.floor(array.size(suportresistance) / 2) - 1 // Iterate through support levels

currentsupport := array.get(suportresistance, i * 2 + 1) // Support is stored at odd indices

if currentsupport < close and (na(recentSupport1) or math.abs(close - currentsupport) < math.abs(close - recentSupport1))

previousSupport := currentsupport // Store the newly detected support

// Set the most recent support to the new support

recentSupport1 := na(recentSupport1) ? ta.lowest(low, 10) : currentsupport

// Moving averages for entry and exit

maShort = ta.sma(close, 5)

maLong = ta.sma(close, 30) + ta.atr(14)

// Track entry price

entryPrice1 = strategy.position_avg_price // Get the price of the currently open position

currentTimeFrame = timeframe.period

exitPrice = entryPrice1 * 0.99

if currentTimeFrame == "1H" or currentTimeFrame == "30" or currentTimeFrame == "15" or currentTimeFrame == "5"

exitPrice := entryPrice1 * 0.99 // Set the exit price at 99% of the entry price

if currentTimeFrame == "120" or currentTimeFrame == "180" or currentTimeFrame == "240" or currentTimeFrame == "D"

exitPrice := entryPrice1 * 0.98 // Set the exit price at 95% of the entry price

// Calculate Moving Average based on higher timeframe for length of 20 bars

higherTimeframeMA = request.security(syminfo.tickerid, higherTimeframeInput, ta.sma(close, 20), barmerge.gaps_off, barmerge.lookahead_on) // Calculate MA with adjusted timeframe

// Entry and Exit Conditions for Long

entryLong = (close > kcUpper) and (close > recentResistance) and (close > higherTimeframeMA) // Long entry when price breaks above KC upper, recent resistance, and higher timeframe MA

exitLong = (close < recentResistance - 1.5*atrValue) // Long exit when price falls below recent resistance with cushion of one ATR

// Entry and Exit Conditions for Short

entryShort = (close < kcLower) and (close < recentSupport) and (close < higherTimeframeMA+atrValue) // Add RSI filter to reduce false signals by confirming momentum // Short entry when price breaks below KC lower, recent support, and higher timeframe MA

exitShort = (close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR

// Strategy Execution for Long

if not na(recentSupport1) and (close <= recentSupport1 +(close*0.01) or close >= recentSupport1 - (close*0.0075)) and (maShort > maLong) and entryLong

strategy.entry("Long Entry", strategy.long)

//entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if ((maShort < maLong + 3*ta.atr(14)) or close < exitPrice) and exitLong

strategy.close("Long Entry")

// Strategy Execution for Short

if entryShort

strategy.entry("Short Entry", strategy.short)

entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if exitShort

strategy.close("Short Entry")

// Plot Keltner Channels

plot(kcUpper, color=color.orange, title="Keltner Channel Upper", linewidth=1)

plot(kcLower, color=color.orange, title="Keltner Channel Lower", linewidth=1)

// Plot Moving Averages

plot(higherTimeframeMA, color=color.blue, title="Higher Timeframe MA", linewidth=2)

//plot(recentSupport1, color=#04313f, title="Recent Support1")

//plot(recentResistance, color=color.purple, title="Recent Resistance")

//plot(entryPrice1, color=color.lime, title="Entry Price 1")

//plot(exitPrice, color=color.maroon, title="Exit Price")

//plot(maShort, color=color.green, title="MA Short")

//plot(maLong, color=color.blue, title="MA Long Plus ATR")

// Highlight Entry Zones

bgcolor(entryLong ? color.new(color.green, 85) : na, title="Long Entry Zone")

bgcolor(entryShort ? color.new(color.red, 85) : na, title="Short Entry Zone")

// Alerts

alertcondition(entryLong, title="Long Entry", message="Price broke above the Keltner Channel and recent resistance for Long Entry")

alertcondition(exitLong, title="Long Exit", message="Price fell below recent resistance with cushion of one ATR - Long Exit")

alertcondition(entryShort, title="Short Entry", message="Price broke below the Keltner Channel and recent support for Short Entry")

alertcondition(exitShort, title="Short Exit", message="Price rose above recent support with cushion of one ATR - Short Exit")

- Multi-Timeframe EMA Trend Momentum Trading Strategy

- SuperJump Turn Back Bollinger Band

- ESSMA

- Super Scalper

- Multi-Indicator Dynamic Trend Following Strategy Based on EMA and SMA

- Super Scalper - 5 Min 15 Min

- SuperTrended Moving Averages

- Multi-Layer Volatility Band Trading Strategy

- Profit Maximizer PMax

- Multi-Indicator Synergistic Trend Reversal Quantitative Trading Strategy

- Dual Crossover Trend Following Strategy: EMA and MACD Synergistic Trading System

- SMA-Based Intelligent Trailing Stop Strategy with Intraday Pattern Recognition

- Adaptive Multi-Strategy Dynamic Switching System: A Quantitative Trading Strategy Combining Trend Following and Range Oscillation

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

- Multi-Factor Regression and Dynamic Price Band Quantitative Trading System

- Multi-Indicator Dynamic Trend Detection and Risk Management Trading Strategy

- Multi-Smoothed Moving Average Dynamic Crossover Trend Following Strategy with Multiple Confirmations

- Advanced Dynamic Stop-Loss Strategy Based on Large Candles and RSI Divergence

- Liquidity-Weighted Moving Average Momentum Crossover Strategy

- Multi-Indicator Synergistic Trend Reversal Quantitative Trading Strategy

- Machine Learning Adaptive SuperTrend Quantitative Trading Strategy

- Dynamic WaveTrend and Fibonacci Integrated Quantitative Trading Strategy

- Volatility Stop Based EMA Trend Following Trading Strategy

- Multi-EMA Trend Following Strategy with Dynamic Volatility Filter

- Triple EMA Trend Following Multi-Indicator Quantitative Trading Strategy

- Year-end Trend Following Momentum Trading Strategy(60-day MA Breakout)

- Multi-Indicator Trend Following with RSI Overbought/Oversold Quantitative Trading Strategy

- Efficient Price Channel Trading Strategy Based on 15-Minute Breakout

- Multi-timeframe Fair Value Gap Breakout Strategy with Historical Backtest

- Dynamic QQE Trend Following with Risk Management Quantitative Trading Strategy