EMA/SMA sigue la tendencia con la estrategia de negociación oscilante combinada con el filtro de volumen y el sistema de toma de ganancias/detención de pérdidas por porcentaje

El autor:¿ Qué pasa?, Fecha: 2024-12-11 15:12:35Las etiquetas:El EMALa SMA

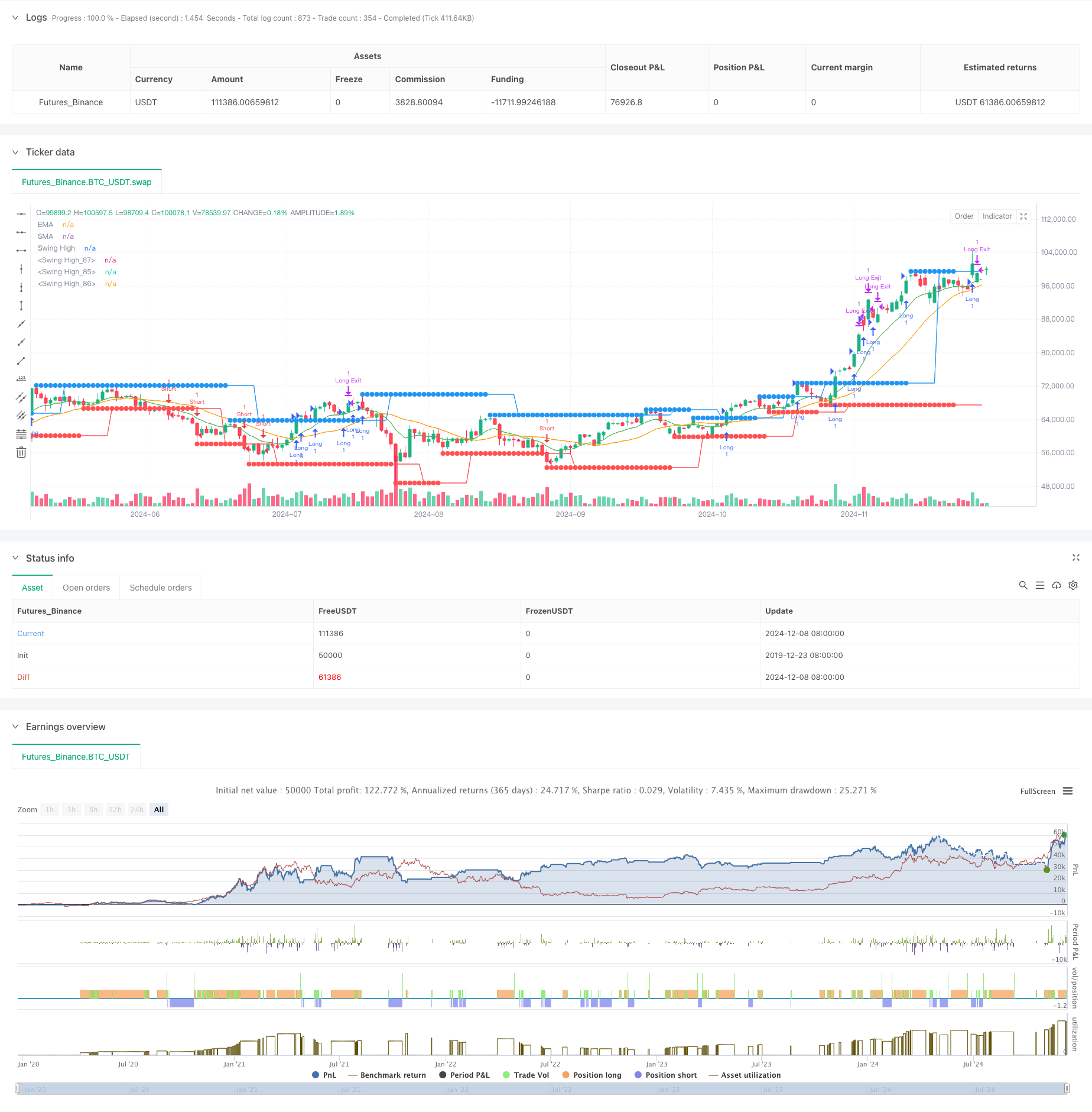

Resumen general

Esta estrategia es un sistema de negociación integral que combina el seguimiento de tendencias con métodos de negociación swing, utilizando cruces EMA y SMA, identificación swing high/low, filtrado de volumen y mecanismos de take-profit y trailing stop-loss basados en porcentajes.

Principios de estrategia

La estrategia emplea un mecanismo de filtrado de señales de múltiples capas, comenzando con cruces de EMA (10) y SMA (21) para la determinación básica de la tendencia, luego utilizando breakouts de puntos de pivote izquierdo / derecho de 6 bares para el tiempo de entrada, mientras que requiere un volumen por encima del promedio móvil de 200 períodos para garantizar una liquidez suficiente.

Ventajas estratégicas

- La confirmación de múltiples señales reduce las falsas señales a través de la tendencia, la ruptura de precios y la verificación de la expansión del volumen.

- Gestión flexible de pérdidas y ganancias mediante un porcentaje basado en la obtención de ganancias con un stop-loss posterior

- Sistema de visualización integral para el seguimiento de operaciones y señales

- Alta personalizabilidad con parámetros clave ajustables

- Gestión sistemática del riesgo mediante niveles de stop-loss y take profit preestablecidos

Riesgos estratégicos

- Posibilidad de false breakouts en mercados variados

- El filtro de volumen puede no tener algunas señales válidas

- El porcentaje fijo de ganancia podría salir demasiado pronto en tendencias fuertes

- El sistema de media móvil tiene un retraso inherente en las inversiones rápidas

- Necesidad de considerar el impacto de los costes de negociación en los rendimientos de la estrategia

Direcciones de optimización

- Introducir un ajuste de volatilidad para el ajuste dinámico de las operaciones de toma de ganancias/dejan de perder

- Añadir filtro de fuerza de tendencia para evitar la negociación en tendencias débiles

- Optimizar el algoritmo de filtración de volumen teniendo en cuenta los cambios de volumen relativo

- Implementar filtros basados en el tiempo para evitar períodos comerciales desfavorables

- Considerar la clasificación del régimen de mercado para la adaptación de parámetros

Resumen de las actividades

La estrategia construye un sistema de negociación completo a través de promedios móviles, breakouts de precios y verificación de volumen, adecuado para seguir tendencias a medio y largo plazo. Sus fortalezas se encuentran en la confirmación de múltiples señales y la gestión de riesgos integral, aunque el rendimiento en mercados variados necesita atención. A través de las optimizaciones sugeridas, particularmente en adaptabilidad, la estrategia tiene margen para mejorar la estabilidad y el rendimiento.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Strategy combining EMA/SMA Crossover, Swing High/Low, Volume Filtering, and Percentage TP & Trailing Stop

strategy("Swing High/Low Strategy with Volume, EMA/SMA Crossovers, Percentage TP and Trailing Stop", overlay=true)

// --- Inputs ---

source = close

TITLE = input(false, title='Enable Alerts & Background Color for EMA/SMA Crossovers')

turnonAlerts = input(true, title='Turn on Alerts?')

colorbars = input(true, title="Color Bars?")

turnonEMASMA = input(true, title='Turn on EMA1 & SMA2?')

backgroundcolor = input(false, title='Enable Background Color?')

// EMA/SMA Lengths

emaLength = input.int(10, minval=1, title='EMA Length')

smaLength = input.int(21, minval=1, title='SMA Length')

ema1 = ta.ema(source, emaLength)

sma2 = ta.sma(source, smaLength)

// Swing High/Low Lengths

leftBars = input.int(6, title="Left Bars for Swing High/Low", minval=1)

rightBars = input.int(6, title="Right Bars for Swing High/Low", minval=1)

// Volume MA Length

volMaLength = input.int(200, title="Volume Moving Average Length")

// Percentage Take Profit with hundredth place adjustment

takeProfitPercent = input.float(2.00, title="Take Profit Percentage (%)", minval=0.01, step=0.01) / 100

// Trailing Stop Loss Option

useTrailingStop = input.bool(true, title="Enable Trailing Stop Loss?")

trailingStopPercent = input.float(1.00, title="Trailing Stop Loss Percentage (%)", minval=0.01, step=0.01) / 100

// --- Swing High/Low Logic ---

pivotHigh(_leftBars, _rightBars) =>

ta.pivothigh(_leftBars, _rightBars)

pivotLow(_leftBars, _rightBars) =>

ta.pivotlow(_leftBars, _rightBars)

ph = fixnan(pivotHigh(leftBars, rightBars))

pl = fixnan(pivotLow(leftBars, rightBars))

// --- Volume Condition ---

volMa = ta.sma(volume, volMaLength)

// Declare exit conditions as 'var' so they are initialized

var bool longExitCondition = na

var bool shortExitCondition = na

// --- Long Entry Condition: Close above Swing High & Volume >= 200 MA ---

longCondition = (close > ph and volume >= volMa)

if (longCondition)

strategy.entry("Long", strategy.long)

// --- Short Entry Condition: Close below Swing Low & Volume >= 200 MA ---

shortCondition = (close < pl and volume >= volMa)

if (shortCondition)

strategy.entry("Short", strategy.short)

// --- Take Profit and Trailing Stop Logic ---

// For long position: Set take profit at the entry price + takeProfitPercent

longTakeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercent)

shortTakeProfitLevel = strategy.position_avg_price * (1 - takeProfitPercent)

// --- Long Exit Logic ---

if (useTrailingStop)

// Trailing Stop for Long

strategy.exit("Long Exit", "Long", stop=na, trail_offset=strategy.position_avg_price * trailingStopPercent, limit=longTakeProfitLevel)

else

// Exit Long on Take Profit only

strategy.exit("Long Exit", "Long", limit=longTakeProfitLevel)

// --- Short Exit Logic ---

if (useTrailingStop)

// Trailing Stop for Short

strategy.exit("Short Exit", "Short", stop=na, trail_offset=strategy.position_avg_price * trailingStopPercent, limit=shortTakeProfitLevel)

else

// Exit Short on Take Profit only

strategy.exit("Short Exit", "Short", limit=shortTakeProfitLevel)

// --- Plot Swing High/Low ---

plot(ph, style=plot.style_circles, linewidth=1, color=color.blue, offset=-rightBars, title="Swing High")

plot(ph, style=plot.style_line, linewidth=1, color=color.blue, offset=0, title="Swing High")

plot(pl, style=plot.style_circles, linewidth=1, color=color.red, offset=-rightBars, title="Swing High")

plot(pl, style=plot.style_line, linewidth=1, color=color.red, offset=0, title="Swing High")

// --- Plot EMA/SMA ---

plot(turnonEMASMA ? ema1 : na, color=color.green, title="EMA")

plot(turnonEMASMA ? sma2 : na, color=color.orange, title="SMA")

// --- Alerts ---

alertcondition(longCondition, title="Long Entry", message="Price closed above Swing High with Volume >= 200 MA")

alertcondition(shortCondition, title="Short Entry", message="Price closed below Swing Low with Volume >= 200 MA")

// --- Bar Colors for Visualization ---

barcolor(longCondition ? color.green : na, title="Long Entry Color")

barcolor(shortCondition ? color.red : na, title="Short Entry Color")

bgcolor(backgroundcolor ? (ema1 > sma2 ? color.new(color.green, 50) : color.new(color.red, 50)) : na)

- El valor de las variaciones de la media móvil se calculará en función de las variaciones de la media móvil de la media móvil.

- Las operaciones de inversión en el mercado de divisas se clasifican en el grupo de operaciones de inversión.

- Canal SSL

- Estrategia de cruce de la EMA5 y la EMA13

- Indicador: Oscilador de tendencia de onda

- Estrategia de cruce de la media móvil doble de SMA

- Estrategia de confirmación de tendencias de volumen de la EMA para operaciones cuantitativas

- Estrategia de negociación dinámica de toma de ganancias y parada de pérdidas basada en tres velas bajistas consecutivas y promedios móviles

- Estrategia de cruce de la media móvil súper y la banda superior

- Estrategia de scalping de impulso cruzado de la EMA

- Estrategia de impulso cruzado multi-EMA

- Tendencia de confirmación doble de MACD-Supertrend siguiendo la estrategia de negociación

- Estrategia de negociación dinámica de supertendencia de varios períodos

- EMA de margen de tiempo múltiple con retroceso de Fibonacci y estrategia de negociación de puntos pivot

- Estrategia de negociación de reducción de pérdidas de la EMA

- MACD y estrategia de negociación inteligente de doble señal de regresión lineal

- Tendencia multi-EMA después de la estrategia de negociación

- Tendencia de Heikin Ashi suavizada de varios plazos siguiendo el sistema de negociación cuantitativa

- Indicador de inclinación polinomial del oscilador dinámico del RSI Tendencia Estrategia de negociación cuantitativa

- Estrategia de negociación en un solo sentido de ruptura diaria del rango

- Las operaciones de negociación de órdenes de límite dinámicas con múltiples indicadores de SMA-RSI-MACD

- Estrategia de negociación de reversión de la media de desviación estándar de VWAP

- Estrategia de negociación de ruptura de la zona de precios dinámica basada en el sistema cuantitativo de soporte y resistencia

- Estrategia cuantitativa cruzada de tendencia de impulso de múltiples indicadores

- Detención de seguimiento dinámico avanzado con estrategia de orientación riesgo-recompensa

- Estrategia avanzada de ruptura de la línea de tendencia dinámica de longitud única

- Las entidades que no cumplen los requisitos establecidos en el artículo 4, apartado 1, letra b), del Reglamento (UE) no 575/2013 deberán tener en cuenta los siguientes elementos:

- Las operaciones de inversión en el mercado de divisas se clasifican en el grupo de operaciones de inversión.

- Las bandas de Bollinger y la estrategia de negociación dinámica combinada del RSI

- Estrategia de negociación combinada de volatilidad de impulso RSI-ATR

- Estrategia de doble seguimiento de tendencias de la EMA con entrada de compra limitada