Tendencia dinámica de múltiples indicadores siguiendo una estrategia basada en EMA y SMA

El autor:¿ Qué pasa?, Fecha: 2024-12-27 14:12:50Las etiquetas:El EMALa SMAEl ATREl PPsuper tendencia

Resumen de la estrategia

Esta estrategia es un sistema dinámico de seguimiento de tendencias que combina múltiples indicadores técnicos. Integra Puntos de Pivot, indicador de SuperTendencia y señales de cruce de promedio móvil para identificar tendencias de mercado y oportunidades comerciales.

Principios de estrategia

La estrategia se basa en los siguientes mecanismos fundamentales:

- Utiliza datos de precios fijos para el análisis, evitando interferencias de diferentes marcos de tiempo

- Calcula las SMA basadas en las EMA de 8 y 21 períodos para formar una tendencia después de la base

- Combina ATR y puntos de pivote para calcular el indicador SuperTrend para la confirmación de la dirección de la tendencia

- Solo se consideran válidas las señales de cruce SMA si se producen dentro de 3 períodos de un punto de pivote

- Calcula y rastrea dinámicamente los niveles de soporte/resistencia para la referencia de negociación

Ventajas estratégicas

- La validación cruzada de múltiples indicadores mejora la fiabilidad de la señal

- El análisis de tiempo fijo reduce las interferencias de la señal falsa

- La validación del punto de pivote garantiza que las operaciones se realicen a los niveles clave de precios

- El seguimiento dinámico de soporte/resistencia ayuda a determinar los niveles de stop-loss y take profit

- El indicador SuperTrend proporciona una confirmación adicional de la dirección de la tendencia

- Los parámetros flexibles permiten ajustarlos a las diferentes condiciones del mercado

Riesgos estratégicos

- Los indicadores múltiples pueden provocar un retraso de la señal

- Puede generar señales falsas excesivas en mercados variados

- El análisis de marcos de tiempo fijos puede perder señales importantes en otros marcos de tiempo

- La validación del punto de pivote puede hacer que se pierdan algunas oportunidades comerciales importantes

- Optimización de parámetros puede conducir a sobreajuste

Direcciones para la optimización de la estrategia

- Introducir un mecanismo de filtrado de volatilidad para reducir la frecuencia de las operaciones durante los períodos de baja volatilidad

- Añadir indicadores de confirmación de la fuerza de la tendencia como ADX o MACD

- Desarrollar un sistema de parámetros adaptativos que se ajuste dinámicamente en función de las condiciones del mercado

- Incorporar análisis de volumen para mejorar la fiabilidad de la señal

- Implementar un mecanismo dinámico de stop-loss que se ajuste en función de la volatilidad del mercado

Resumen de las actividades

Esta estrategia establece una tendencia relativamente completa siguiendo el sistema de negociación a través de la combinación de múltiples indicadores técnicos. Su principal ventaja radica en mejorar la confiabilidad de la señal a través del análisis de marcos de tiempo fijos y la validación de puntos pivot. Si bien hay ciertos riesgos de retraso, estos pueden controlarse eficazmente a través de la optimización de parámetros y medidas de gestión de riesgos. Se aconseja a los operadores que realicen pruebas posteriores exhaustivas antes de la implementación en vivo y ajusten los parámetros de acuerdo con las características específicas del mercado.

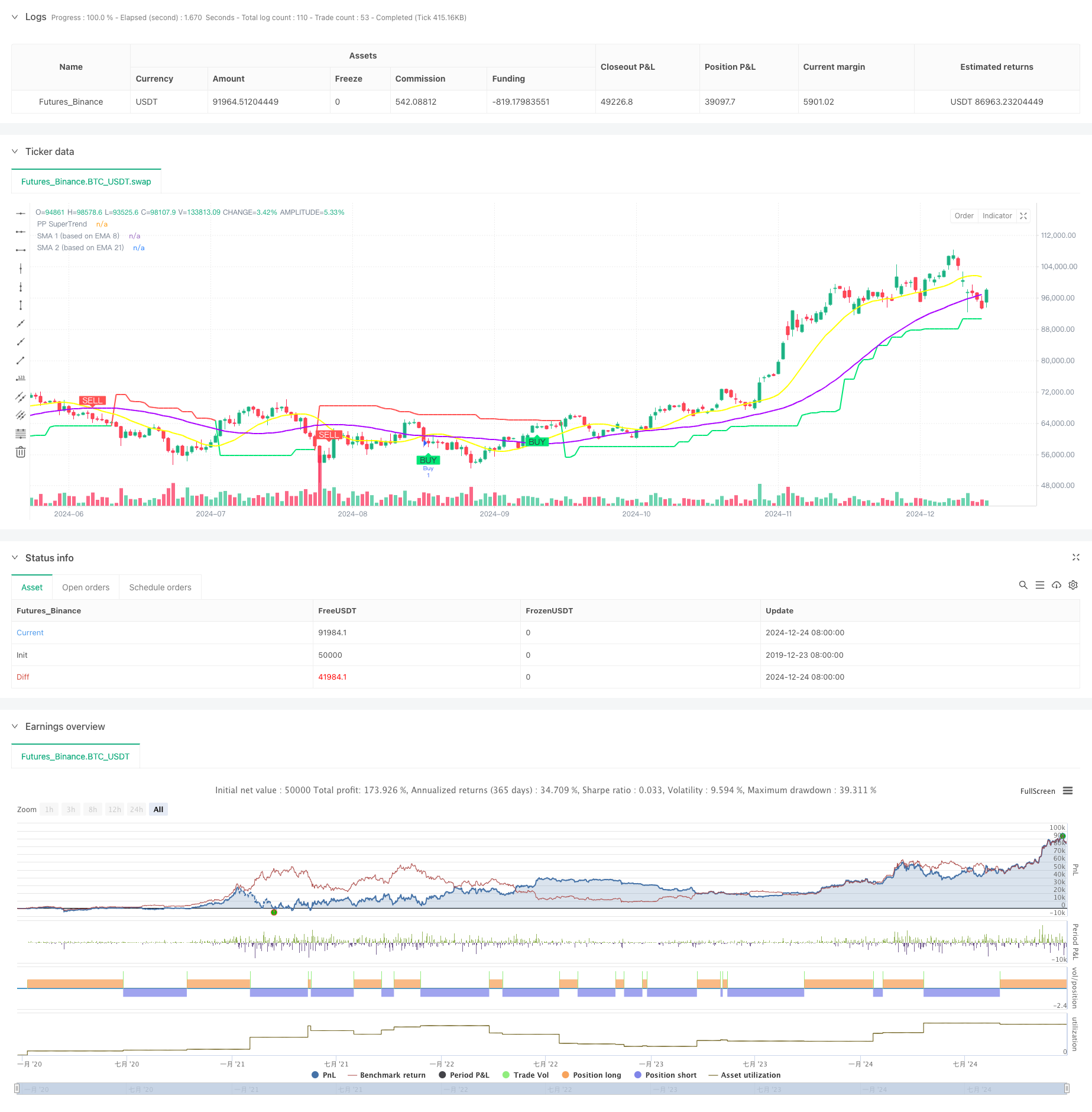

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Buy Sell Pivot Point", overlay=true)

// Input Parameters

prd = input.int(defval=2, title="Periodo Pivot Point", minval=1, maxval=50)

Factor = input.float(defval=3, title="Fator ATR", minval=1, step=0.1)

Pd = input.int(defval=10, title="Periodo ATR", minval=1)

showpivot = input.bool(defval=false, title="Mostrar Pivot Points")

showlabel = input.bool(defval=true, title="Mostrar Buy/Sell Labels")

showcl = input.bool(defval=false, title="Mostrar PP Center Line")

showsr = input.bool(defval=false, title="Mostrar Support/Resistance")

sma1_length = input.int(defval=8, title="SMA 1")

sma2_length = input.int(defval=21, title="SMA 2")

timeframe_fix = input.timeframe("D", title="Timeframe Fixo")

// Request data from the fixed timeframe

fix_close = request.security(syminfo.tickerid, timeframe_fix, close)

fix_high = request.security(syminfo.tickerid, timeframe_fix, high)

fix_low = request.security(syminfo.tickerid, timeframe_fix, low)

fix_ph = request.security(syminfo.tickerid, timeframe_fix, ta.pivothigh(prd, prd))

fix_pl = request.security(syminfo.tickerid, timeframe_fix, ta.pivotlow(prd, prd))

fix_atr = request.security(syminfo.tickerid, timeframe_fix, ta.atr(Pd))

// Convert Pivot High/Low to valid boolean for conditions

ph_cond = not na(fix_ph)

pl_cond = not na(fix_pl)

// Draw Pivot Points

plotshape(ph_cond and showpivot, title="Pivot High", text="H", style=shape.labeldown, color=color.red, textcolor=color.red, location=location.abovebar, offset=-prd)

plotshape(pl_cond and showpivot, title="Pivot Low", text="L", style=shape.labelup, color=color.lime, textcolor=color.lime, location=location.belowbar, offset=-prd)

// Calculate the Center line using pivot points

var float center = na

lastpp = ph_cond ? fix_ph : pl_cond ? fix_pl : na

if not na(lastpp)

center := na(center) ? lastpp : (center * 2 + lastpp) / 3

// Upper/Lower bands calculation

Up = center - (Factor * fix_atr)

Dn = center + (Factor * fix_atr)

// Get the trend

var float TUp = na

var float TDown = na

var int Trend = 0

TUp := na(TUp[1]) ? Up : fix_close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := na(TDown[1]) ? Dn : fix_close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := fix_close > TDown[1] ? 1 : fix_close < TUp[1] ? -1 : nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// Plot the trend

linecolor = Trend == 1 ? color.lime : Trend == -1 ? color.red : na

plot(Trailingsl, color=linecolor, linewidth=2, title="PP SuperTrend")

// Plot Center Line

plot(showcl ? center : na, color=showcl ? (center < fix_close ? color.blue : color.red) : na, title="Center Line")

// Calculate Base EMAs

ema_8 = ta.ema(fix_close, 8)

ema_21 = ta.ema(fix_close, 21)

// Calculate SMAs based on EMAs

sma1 = ta.sma(ema_8, sma1_length)

sma2 = ta.sma(ema_21, sma2_length)

// Plot SMAs

plot(sma1, color=#ffff00, linewidth=2, title="SMA 1 (based on EMA 8)")

plot(sma2, color=#aa00ff, linewidth=2, title="SMA 2 (based on EMA 21)")

// Initialize variables to track pivot points

var float last_pivot_time = na

// Update the pivot time when a new pivot is detected

if (ph_cond)

last_pivot_time := bar_index

if (pl_cond)

last_pivot_time := bar_index

// Calculate the crossover/crossunder signals

buy_signal = ta.crossover(sma1, sma2) // SMA 8 crossing SMA 21 upwards

sell_signal = ta.crossunder(sma1, sma2) // SMA 8 crossing SMA 21 downwards

// Ensure signal is only valid if it happens within 3 candles of a pivot point

valid_buy_signal = buy_signal and (bar_index - last_pivot_time <= 3)

valid_sell_signal = sell_signal and (bar_index - last_pivot_time <= 3)

// Plot Buy/Sell Signals

plotshape(valid_buy_signal and showlabel, title="Buy Signal", text="BUY", style=shape.labelup, color=color.lime, textcolor=color.black, location=location.belowbar)

plotshape(valid_sell_signal and showlabel, title="Sell Signal", text="SELL", style=shape.labeldown, color=color.red, textcolor=color.white, location=location.abovebar)

// Get S/R levels using Pivot Points

var float resistance = na

var float support = na

support := pl_cond ? fix_pl : support[1]

resistance := ph_cond ? fix_ph : resistance[1]

// Plot S/R levels

plot(showsr and not na(support) ? support : na, color=showsr ? color.lime : na, style=plot.style_circles, offset=-prd)

plot(showsr and not na(resistance) ? resistance : na, color=showsr ? color.red : na, style=plot.style_circles, offset=-prd)

// Execute trades based on valid signals

if valid_buy_signal

strategy.entry("Buy", strategy.long)

if valid_sell_signal

strategy.entry("Sell", strategy.short)

// Alerts

alertcondition(valid_buy_signal, title="Buy Signal", message="Buy Signal Detected")

alertcondition(valid_sell_signal, title="Sell Signal", message="Sell Signal Detected")

alertcondition(Trend != Trend[1], title="Trend Changed", message="Trend Changed")

- Estrategia de negociación de impulso adaptativo con SMA Crossover y SuperTrend

- Estrategia de seguimiento de la volatilidad del Cisne Negro y del momento cruzado de la media móvil

- Modelo de alertas de ML

- Estrategia avanzada de negociación en la nube Ichimoku con análisis multidimensional dinámico

- Estrategia RSI-EMA-ATR de negociación de volatilidad con varios indicadores

- SSL híbrido

- EMA, SMA, CCI, ATR, Orden perfecta Estrategia de promedio móvil con el indicador de tendencia mágica Sistema de negociación automática

- El valor de las posiciones de los instrumentos de inversión se calculará en función de la posición de los activos de inversión.

- Estrategia cuantitativa cruzada de tendencia de impulso de múltiples indicadores

- Tendencia dinámica MACD-ATR-EMA de múltiples indicadores siguiendo la estrategia

- Estrategia de negociación de reversión de la tendencia del RSI con ATR Stop Loss y control de la zona de negociación

- Las posiciones en el mercado de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas de divisas

- Tendencia combinada multi-SMA y estocástica siguiendo una estrategia de negociación

- Estrategia de negociación dinámica adaptativa basada en rendimientos logarítmicos normalizados

- Estrategia de negociación de seguimiento de tendencias transversales de múltiples indicadores: Análisis cuantitativo basado en el RSI estocástico y el sistema de promedios móviles

- Estrategia de cruce de tendencia de múltiples indicadores: Sistema de negociación de banda de apoyo al mercado alcista

- Tendencia MACD dinámica de varios niveles siguiendo la estrategia con sistema de análisis de extensión alta/baja de 52 semanas

- Sistema de negociación de inversión de tendencia de impulso de doble EMA RSI - Una estrategia de avance de impulso basada en el cruce de EMA y RSI

- Estrategia de negociación de rango de alta frecuencia de múltiples indicadores

- Estrategia de negociación de reversión de la línea de tendencia dinámica

- Estrategia mejorada de seguimiento de tendencias de Fibonacci y gestión de riesgos

- Estrategia de impulso EMA-RSI adaptativa de varios estados con sistema de filtro de índice de choppiness

- Sistema de optimización de estrategias de negociación de promedio móvil exponencial inteligente

- Sistema de precios de volatilidad basado en IA Estrategia de negociación de divergencia

- Estrategia de negociación oscilante de seguimiento de tendencias multi-EMA con gestión del riesgo basada en ATR

- Estrategia mejorada de inversión media con bandas de Bollinger e integración del RSI

- Divergencia del RSI de varios períodos con estrategia de negociación cuantitativa de soporte/resistencia

- Tendencia adaptativa de seguimiento de la estrategia con sistema de control de extracción dinámico

- Estrategia de cruz de oro multi-EMA con rentabilidad por niveles

- Estrategia de seguimiento de tendencias cruzadas de indicadores técnicos múltiples: RSI y sistema de negociación de sinergia de RSI estocástico