Estrategia del canal de Keltner de soporte dinámico multicanal

El autor:¿ Qué pasa?, Fecha: 2025-01-17 15:17:59Las etiquetas:KCEl EMAEl ATRLa SMALa WMAEl PPEl número de personas

Resumen general

Esta estrategia es un sistema de negociación integral basado en los canales de Keltner y niveles dinámicos de soporte / resistencia. Analiza múltiples marcos de tiempo, combinando promedios móviles e indicadores de volatilidad para formar un marco completo de decisión comercial. El enfoque central es identificar oportunidades de ruptura de precios considerando las tendencias del mercado y la volatilidad para capturar oportunidades comerciales de alta probabilidad.

Principios de estrategia

La estrategia emplea un sistema de indicadores técnicos de varias capas: 1. Utiliza los canales de Keltner de 21 períodos como la principal herramienta de identificación de tendencias, con el ancho del canal determinado por ATR Calcula los niveles de soporte/resistencia clave utilizando 21 barras del lado izquierdo y 8 del lado derecho 3. Incorpora medias móviles de mayor plazo como filtros de tendencia 4. Combina las medias móviles a corto plazo (5 períodos) y a largo plazo (30 períodos) para el calendario de entrada 5. Utiliza ATR para el ajuste dinámico de stop-loss

Ventajas estratégicas

- Los indicadores técnicos multidimensionales proporcionan una verificación mutua, reduciendo las falsas señales

- Actualización dinámica de los niveles de soporte/resistencia en tiempo real, adaptándose a los cambios del mercado

- El análisis de marcos de tiempo más largos filtra los movimientos del mercado secundario

- Parámetros flexibles de stop-loss basados en diferentes plazos

- Gestión de posiciones basada en el porcentaje para un control eficaz del riesgo

Riesgos estratégicos

- Puede generar señales comerciales frecuentes en mercados variados

- La verificación de múltiples indicadores podría perder algunas oportunidades comerciales

- La optimización de parámetros plantea riesgos de sobreajuste

- Los niveles de stop-loss pueden ser demasiado amplios en entornos de alta volatilidad

- Los niveles de soporte/resistencia pueden fallar durante cambios rápidos del mercado

Direcciones de optimización

- Incorporar indicadores de volumen para validar las rupturas

- Añadir módulo de análisis de volatilidad del mercado para el ajuste de parámetros dinámicos

- Mejorar los métodos de cálculo de soporte/resistencia para una mayor precisión

- Añadir una evaluación de la fuerza de la tendencia para refinar las condiciones de entrada

- Mejorar el sistema de gestión de posiciones para un control de riesgos más preciso

Resumen de las actividades

Esta es una estrategia de trading cuantitativa bien estructurada y lógicamente rigurosa. A través del uso coordinado de múltiples indicadores técnicos, garantiza señales comerciales confiables y un control eficaz del riesgo. La gran extensibilidad de la estrategia permite una optimización y mejora continuas, manteniendo potencialmente un rendimiento estable en diferentes entornos de mercado.

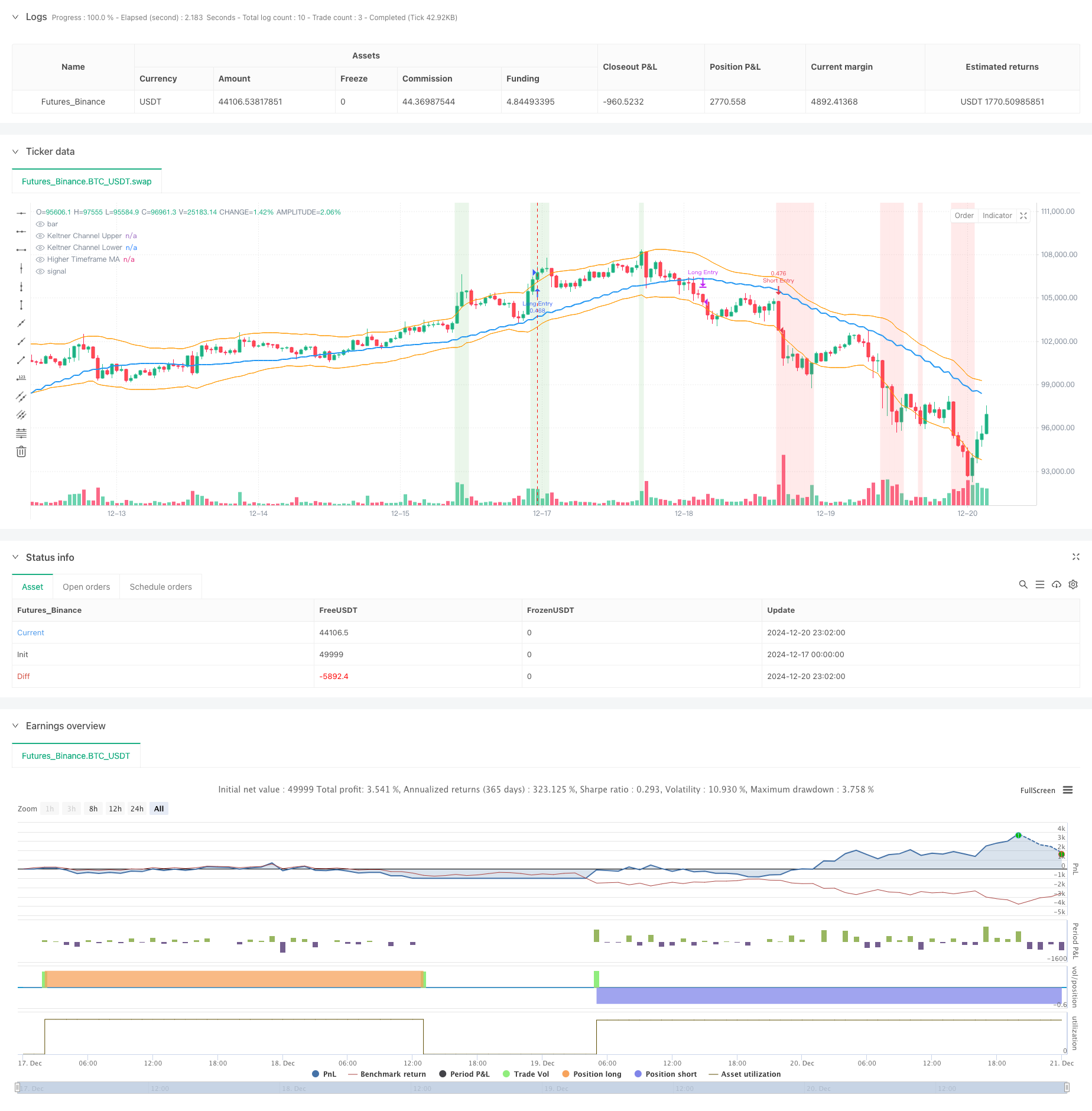

/*backtest

start: 2024-12-17 00:00:00

end: 2024-12-21 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sathcm

//@version=5

strategy("KMS", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.05, slippage=3)

// Inputs for Keltner Channels

kcLength = input.int(21, title="Keltner Channel Length", minval=1) // Length for Keltner Channel calculation

kcMultiplier = input.float(2.0, title="Keltner Channel Multiplier", minval=0.1) // Multiplier for Keltner Channel width

// Calculate Keltner Channels using best practices

kcBasis = ta.ema(close, kcLength) // Use EMA for a smoother basis line

atrValue = ta.atr(kcLength) // Use ATR for channel width calculation

kcUpper = kcBasis + kcMultiplier * atrValue // Upper Keltner Channel

kcLower = kcBasis - kcMultiplier * atrValue // Lower Keltner Channel

// Inputs for Pivot Point Calculation

leftBars = input.int(21, title="Left Bars", minval=1) // Number of bars to the left for pivot calculation

rightBars = input.int(8, title="Right Bars", minval=1, tooltip="Number of bars to the right for pivot calculation") // Number of bars to the right for pivot calculation

// Calculate Smoothed Pivot Highs and Lows using Weighted Moving Average

pivotHigh = ta.pivothigh(high, leftBars, rightBars) // Apply WMA for smoothing

pivotLow = ta.pivotlow(low, leftBars, rightBars) // Apply WMA for smoothing

// Convert Pivot Highs and Lows to Boolean Conditions

isPivotHigh = not na(pivotHigh) // True when a pivot high exists

isPivotLow = not na(pivotLow) // True when a pivot low exists

// Get Recent Support and Resistance Levels

recentResistance = ta.valuewhen(isPivotHigh, high, 0) // Most recent resistance level

recentSupport = ta.valuewhen(isPivotLow, low, 0) // Most recent support level

// Plot Smoothed Support and Resistance Levels

//plot(recentResistance, color=color.red, title="Recent Resistance", linewidth=2, style=plot.style_line)

//plot(recentSupport, color=color.green, title="Recent Support", linewidth=2, style=plot.style_line)

// Store Entry Price into a Variable

var float entryPrice = na // Declare a variable to store the entry price

// Input for Higher Timeframe

higherTimeframeInput = input.timeframe('W', title="Higher Timeframe for MA Calculation")

if (timeframe.period == "240") or (timeframe.period == "120")

higherTimeframeInput := "D"

if (timeframe.period == "60") or (timeframe.period == "30") or (timeframe.period == "15")

higherTimeframeInput := "120"

if (timeframe.period == "10") or (timeframe.period == "5")

higherTimeframeInput := "30"

if (timeframe.period == "1")

higherTimeframeInput := "10"

prd = input.int(defval=10, title='Pivot Period', minval=4, maxval=30, group='Settings 🔨', tooltip='Used while calculating Pivot Points, checks left&right bars')

ppsrc = input.string(defval='High/Low', title='Source', options=['High/Low', 'Close/Open'], group='Settings 🔨', tooltip='Source for Pivot Points')

ChannelW = input.int(defval=5, title='Maximum Channel Width %', minval=1, maxval=8, group='Settings 🔨', tooltip='Calculated using Highest/Lowest levels in 300 bars')

minstrength = input.int(defval=1, title='Minimum Strength', minval=1, group='Settings 🔨', tooltip='Channel must contain at least 2 Pivot Points')

maxnumsr = input.int(defval=4, title='Maximum Number of S/R', minval=1, maxval=10, group='Settings 🔨', tooltip='Maximum number of Support/Resistance Channels to Show') - 1

loopback = input.int(defval=150, title='Loopback Period', minval=100, maxval=400, group='Settings 🔨', tooltip='While calculating S/R levels it checks Pivots in Loopback Period')

res_col = input.color(defval=color.new(color.red, 75), title='Resistance Color', group='Colors 🟡🟢🟣')

sup_col = input.color(defval=color.new(color.lime, 75), title='Support Color', group='Colors 🟡🟢🟣')

inch_col = input.color(defval=color.new(color.gray, 75), title='Color When Price in Channel', group='Colors 🟡🟢🟣')

// Get Pivot High/Low

src1 = ppsrc == 'High/Low' ? high : math.max(close, open)

src2 = ppsrc == 'High/Low' ? low : math.min(close, open)

ph = ta.pivothigh(src1, prd, prd)

pl = ta.pivotlow(src2, prd, prd)

// Calculate maximum S/R channel width

prdhighest = ta.highest(300)

prdlowest = ta.lowest(300)

cwidth = (prdhighest - prdlowest) * ChannelW / 100

// Get/keep Pivot levels

var pivotvals = array.new_float(0)

var pivotlocs = array.new_float(0)

if ph or pl

array.unshift(pivotvals, ph ? ph : pl)

array.unshift(pivotlocs, bar_index)

for x = array.size(pivotvals) - 1 to 0 by 1

if bar_index - array.get(pivotlocs, x) > loopback // remove old pivot points

array.pop(pivotvals)

array.pop(pivotlocs)

continue

break

// Find/create SR channel of a pivot point

get_sr_vals(ind) =>

float lo = array.get(pivotvals, ind)

float hi = lo

int numpp = 0

for y = 0 to array.size(pivotvals) - 1 by 1

float cpp = array.get(pivotvals, y)

float wdth = cpp <= hi ? hi - cpp : cpp - lo

if wdth <= cwidth // fits the max channel width?

if cpp <= hi

lo := math.min(lo, cpp)

else

hi := math.max(hi, cpp)

numpp += 20 // each pivot point added as 20

[hi, lo, numpp]

// Keep old SR channels and calculate/sort new channels if we met new pivot point

var suportresistance = array.new_float(20, 0) // min/max levels

changeit(x, y) =>

tmp = array.get(suportresistance, y * 2)

array.set(suportresistance, y * 2, array.get(suportresistance, x * 2))

array.set(suportresistance, x * 2, tmp)

tmp := array.get(suportresistance, y * 2 + 1)

array.set(suportresistance, y * 2 + 1, array.get(suportresistance, x * 2 + 1))

array.set(suportresistance, x * 2 + 1, tmp)

if ph or pl

supres = array.new_float(0) // number of pivot, strength, min/max levels

stren = array.new_float(10, 0)

// Get levels and strengths

for x = 0 to array.size(pivotvals) - 1 by 1

[hi, lo, strength] = get_sr_vals(x)

array.push(supres, strength)

array.push(supres, hi)

array.push(supres, lo)

// Add each HL to strength

for x = 0 to array.size(pivotvals) - 1 by 1

h = array.get(supres, x * 3 + 1)

l = array.get(supres, x * 3 + 2)

s = 0

for y = 0 to loopback by 1

if high[y] <= h and high[y] >= l or low[y] <= h and low[y] >= l

s += 1

array.set(supres, x * 3, array.get(supres, x * 3) + s)

// Reset SR levels

array.fill(suportresistance, 0)

// Get strongest SRs

src = 0

for x = 0 to array.size(pivotvals) - 1 by 1

stv = -1. // value

stl = -1 // location

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3) > stv and array.get(supres, y * 3) >= minstrength * 20

stv := array.get(supres, y * 3)

stl := y

if stl >= 0

// Get SR level

hh = array.get(supres, stl * 3 + 1)

ll = array.get(supres, stl * 3 + 2)

array.set(suportresistance, src * 2, hh)

array.set(suportresistance, src * 2 + 1, ll)

array.set(stren, src, array.get(supres, stl * 3))

// Make included pivot points' strength zero

for y = 0 to array.size(pivotvals) - 1 by 1

if array.get(supres, y * 3 + 1) <= hh and array.get(supres, y * 3 + 1) >= ll or array.get(supres, y * 3 + 2) <= hh and array.get(supres, y * 3 + 2) >= ll

array.set(supres, y * 3, -1)

src += 1

if src >= 10

break

for x = 0 to 8 by 1

for y = x + 1 to 9 by 1

if array.get(stren, y) > array.get(stren, x)

tmp = array.get(stren, y)

array.set(stren, y, array.get(stren, x))

changeit(x, y)

get_level(ind) =>

float ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind)

ret

get_color(ind) =>

color ret = na

if ind < array.size(suportresistance)

if array.get(suportresistance, ind) != 0

ret := array.get(suportresistance, ind) > close and array.get(suportresistance, ind + 1) > close ? res_col : array.get(suportresistance, ind) < close and array.get(suportresistance, ind + 1) < close ? sup_col : inch_col

ret

// var srchannels = array.new_box(10)

// for x = 0 to math.min(9, maxnumsr) by 1

// box.delete(array.get(srchannels, x))

// srcol = get_color(x * 2)

// if not na(srcol)

// array.set(srchannels, x, box.new(left=bar_index, top=get_level(x * 2), right=bar_index + 1, bottom=get_level(x * 2 + 1), border_color=srcol, border_width=1, extend=extend.both, bgcolor=srcol))

// Improved dynamic support detection

float recentSupport1 = na

float previousSupport = na

float currentsupport = na

if na(previousSupport) or currentsupport != previousSupport

if array.size(suportresistance) > 1

for i = 0 to math.floor(array.size(suportresistance) / 2) - 1 // Iterate through support levels

currentsupport := array.get(suportresistance, i * 2 + 1) // Support is stored at odd indices

if currentsupport < close and (na(recentSupport1) or math.abs(close - currentsupport) < math.abs(close - recentSupport1))

previousSupport := currentsupport // Store the newly detected support

// Set the most recent support to the new support

recentSupport1 := na(recentSupport1) ? ta.lowest(low, 10) : currentsupport

// Moving averages for entry and exit

maShort = ta.sma(close, 5)

maLong = ta.sma(close, 30) + ta.atr(14)

// Track entry price

entryPrice1 = strategy.position_avg_price // Get the price of the currently open position

currentTimeFrame = timeframe.period

exitPrice = entryPrice1 * 0.99

if currentTimeFrame == "1H" or currentTimeFrame == "30" or currentTimeFrame == "15" or currentTimeFrame == "5"

exitPrice := entryPrice1 * 0.99 // Set the exit price at 99% of the entry price

if currentTimeFrame == "120" or currentTimeFrame == "180" or currentTimeFrame == "240" or currentTimeFrame == "D"

exitPrice := entryPrice1 * 0.98 // Set the exit price at 95% of the entry price

// Calculate Moving Average based on higher timeframe for length of 20 bars

higherTimeframeMA = request.security(syminfo.tickerid, higherTimeframeInput, ta.sma(close, 20), barmerge.gaps_off, barmerge.lookahead_on) // Calculate MA with adjusted timeframe

// Entry and Exit Conditions for Long

entryLong = (close > kcUpper) and (close > recentResistance) and (close > higherTimeframeMA) // Long entry when price breaks above KC upper, recent resistance, and higher timeframe MA

exitLong = (close < recentResistance - 1.5*atrValue) // Long exit when price falls below recent resistance with cushion of one ATR

// Entry and Exit Conditions for Short

entryShort = (close < kcLower) and (close < recentSupport) and (close < higherTimeframeMA+atrValue) // Add RSI filter to reduce false signals by confirming momentum // Short entry when price breaks below KC lower, recent support, and higher timeframe MA

exitShort = (close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR(close > recentSupport + atrValue) // Short exit when price rises above recent support with cushion of one ATR

// Strategy Execution for Long

if not na(recentSupport1) and (close <= recentSupport1 +(close*0.01) or close >= recentSupport1 - (close*0.0075)) and (maShort > maLong) and entryLong

strategy.entry("Long Entry", strategy.long)

//entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if ((maShort < maLong + 3*ta.atr(14)) or close < exitPrice) and exitLong

strategy.close("Long Entry")

// Strategy Execution for Short

if entryShort

strategy.entry("Short Entry", strategy.short)

entryPrice := strategy.position_avg_price // Store the entry price when a position is opened

if exitShort

strategy.close("Short Entry")

// Plot Keltner Channels

plot(kcUpper, color=color.orange, title="Keltner Channel Upper", linewidth=1)

plot(kcLower, color=color.orange, title="Keltner Channel Lower", linewidth=1)

// Plot Moving Averages

plot(higherTimeframeMA, color=color.blue, title="Higher Timeframe MA", linewidth=2)

//plot(recentSupport1, color=#04313f, title="Recent Support1")

//plot(recentResistance, color=color.purple, title="Recent Resistance")

//plot(entryPrice1, color=color.lime, title="Entry Price 1")

//plot(exitPrice, color=color.maroon, title="Exit Price")

//plot(maShort, color=color.green, title="MA Short")

//plot(maLong, color=color.blue, title="MA Long Plus ATR")

// Highlight Entry Zones

bgcolor(entryLong ? color.new(color.green, 85) : na, title="Long Entry Zone")

bgcolor(entryShort ? color.new(color.red, 85) : na, title="Short Entry Zone")

// Alerts

alertcondition(entryLong, title="Long Entry", message="Price broke above the Keltner Channel and recent resistance for Long Entry")

alertcondition(exitLong, title="Long Exit", message="Price fell below recent resistance with cushion of one ATR - Long Exit")

alertcondition(entryShort, title="Short Entry", message="Price broke below the Keltner Channel and recent support for Short Entry")

alertcondition(exitShort, title="Short Exit", message="Price rose above recent support with cushion of one ATR - Short Exit")

- Estrategia de negociación de tendencia de impulso de la EMA en varios marcos de tiempo

- Super Salto Volver hacia atrás Banda de Bollinger

- La AEVM

- El Super Scalper

- Tendencia dinámica de múltiples indicadores siguiendo una estrategia basada en EMA y SMA

- Super Scalper - 5 Min 15 Min

- Promedios móviles con tendencia superior

- Estrategia de negociación de banda de volatilidad de múltiples capas

- Maximizador de ganancias PMax

- Estrategia de negociación cuantitativa de inversión de tendencia sinérgica de múltiples indicadores

- Tendencia doble de cruce de la siguiente estrategia: EMA y MACD Sistema de negociación sinérgico

- Estrategia de parada de seguimiento inteligente basada en SMA con reconocimiento de patrones intradiarios

- Sistema de conmutación dinámica adaptativo de múltiples estrategias: una estrategia de negociación cuantitativa que combina el seguimiento de tendencias y la oscilación de rango

- Estrategia cuantitativa avanzada de tendencias multidimensionales de múltiples indicadores

- Sistema de negociación cuantitativa de regresión multifactorial y franja de precios dinámica

- Estrategia de negociación de detección de tendencias dinámicas y gestión de riesgos de múltiples indicadores

- Tendencia de cruce dinámico de media móvil multiglazada siguiendo una estrategia con múltiples confirmaciones

- Estrategia de stop-loss dinámica avanzada basada en velas grandes y divergencia del RSI

- Estrategia de cruce de la media móvil de impulso ponderada por liquidez

- Estrategia de negociación cuantitativa de inversión de tendencia sinérgica de múltiples indicadores

- Aprendizaje automático estrategia de trading cuantitativa

- Tendencia de onda dinámica y estrategia de negociación cuantitativa integrada de Fibonacci

- Tendencia de la EMA basada en la detención de la volatilidad siguiendo la estrategia de negociación

- Se trata de una estrategia de seguimiento de tendencias multi-EMA con filtro dinámico de volatilidad.

- Tendencia a la triple EMA tras una estrategia de negociación cuantitativa de múltiples indicadores

- Tendencia de fin de año siguiendo la estrategia de negociación de impulso ((Breakout de MA de 60 días)

- Tendencia de múltiples indicadores con RSI Estrategia de negociación cuantitativa sobrecomprada/sobrevendida

- Estrategia de negociación de canal de precios eficiente basada en una ruptura de 15 minutos

- Estrategia de ruptura de la brecha de valor razonable de varios plazos con retroceso histórico

- Tendencia dinámica de QQE seguido de la estrategia de negociación cuantitativa de gestión de riesgos