Stratégie quantitative améliorée de rupture de Bollinger avec système d'intégration de filtre de dynamique

Auteur:ChaoZhang est là., Date: 2024-12-12 14:55:37 Je suis désoléLes étiquettes:BBIndice de résistanceLe taux d'intérêtATRRR

Résumé

Cette stratégie est un système de trading quantitatif avancé combinant les bandes de Bollinger, l'indicateur RSI et le filtre de tendance EMA de 200 périodes.

Principe de stratégie

La logique de base est basée sur trois niveaux: 1. signaux de rupture des bandes de Bollinger: en utilisant les bandes de Bollinger comme canaux de volatilité, les ruptures de prix au-dessus des entrées longues du signal supérieur de la bande, les ruptures au-dessous des entrées courtes du signal inférieur de la bande. 2. Confirmation de l'élan du SRI: un SRI supérieur à 50 confirme une dynamique haussière, inférieur à 50 confirme une dynamique baissière, évitant les transactions sans tendance. Filtrage des tendances de l'EMA: Utilisation de l'EMA de 200 périodes pour déterminer la tendance principale, uniquement négocié dans la direction de la tendance.

La confirmation des échanges exige: - conditions de rupture maintenues pendant deux bougies consécutives - Volume supérieur à la moyenne de 20 périodes - Stop-loss dynamique calculé sur la base de l'ATR - Objectif de bénéfice fixé à 1,5 fois le ratio risque/rendement

Les avantages de la stratégie

- Plusieurs indicateurs techniques synergent pour améliorer considérablement la qualité du signal

- Le mécanisme de gestion dynamique des positions s'adapte à la volatilité du marché

- Un mécanisme strict de confirmation des échanges réduit efficacement les faux signaux

- Système complet de contrôle des risques comprenant un stop-loss dynamique et un ratio risque/rendement fixe

- Espace d'optimisation des paramètres flexible et adaptable à différents environnements de marché

Risques stratégiques

- L'optimisation excessive des paramètres peut entraîner un surajustement

- Les marchés volatils peuvent déclencher des stop-loss fréquents

- Les marchés oscillants peuvent entraîner des pertes consécutives

- Les signaux sont en retard à des points de basculement

- Les indicateurs techniques peuvent produire des signaux contradictoires

Suggestions de contrôle des risques: - Exécuter strictement la discipline de stop-loss - Contrôle du risque du commerce unique - Validité du paramètre de backtest régulier - Intégrer l'analyse fondamentale - Évitez de trop négocier.

Directions d'optimisation de la stratégie

- Mettre en place davantage d'indicateurs techniques pour la validation croisée

- Développer un mécanisme d'optimisation adaptatif des paramètres

- Ajouter des indicateurs du sentiment du marché

- Optimiser le mécanisme de confirmation des échanges

- Développer un système de gestion des positions plus souple

Principales approches d'optimisation: - Ajustez dynamiquement les paramètres en fonction des différents cycles du marché - Ajoutez des filtres de négociation - Optimiser les paramètres du rapport risque/rendement - Améliorer le mécanisme de stop-loss - Développer un système de confirmation de signal plus intelligent

Résumé

Cette stratégie construit un système de trading complet grâce à une combinaison organique d'indicateurs techniques Bollinger Bands, RSI et EMA. Tout en assurant la qualité du trading, le système démontre une forte valeur pratique grâce à un contrôle strict des risques et un espace d'optimisation flexible des paramètres.

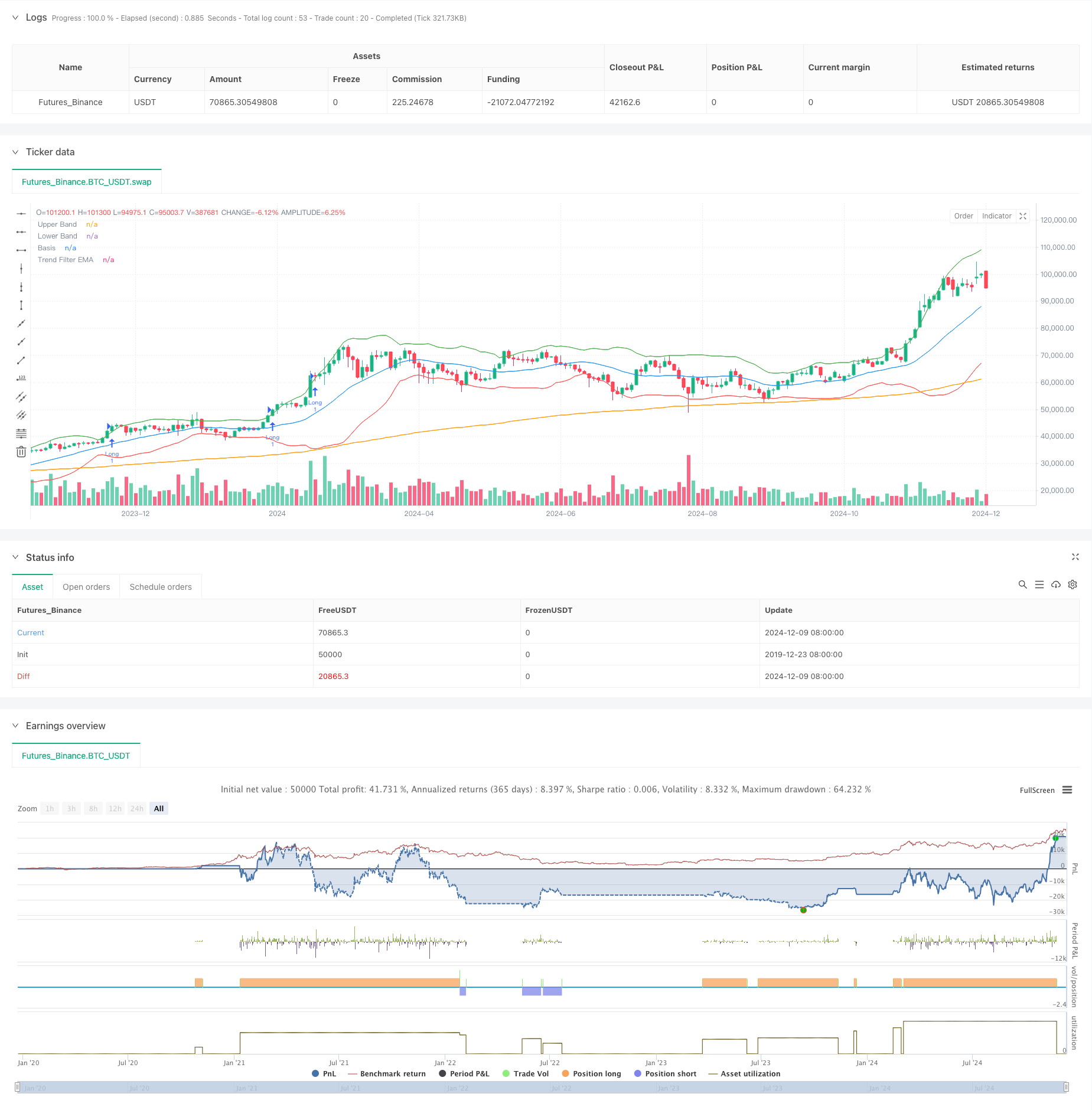

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Bollinger Breakout with Trend Filtering", overlay=true)

// === Inputs ===

length = input(20, title="Bollinger Bands Length", tooltip="The number of candles used to calculate the Bollinger Bands. Higher values smooth the bands, lower values make them more reactive.")

mult = input(2.0, title="Bollinger Bands Multiplier", tooltip="Controls the width of the Bollinger Bands. Higher values widen the bands, capturing more price movement.")

rsi_length = input(14, title="RSI Length", tooltip="The number of candles used to calculate the RSI. Shorter lengths make it more sensitive to recent price movements.")

rsi_midline = input(50, title="RSI Midline", tooltip="Defines the midline for RSI to confirm momentum. Higher values make it stricter for bullish conditions.")

risk_reward_ratio = input(1.5, title="Risk/Reward Ratio", tooltip="Determines the take-profit level relative to the stop-loss.")

atr_multiplier = input(1.5, title="ATR Multiplier for Stop-Loss", tooltip="Defines the distance of the stop-loss based on ATR. Higher values set wider stop-losses.")

volume_filter = input(true, title="Enable Volume Filter", tooltip="If enabled, trades will only execute when volume exceeds the 20-period average.")

trend_filter_length = input(200, title="Trend Filter EMA Length", tooltip="The EMA length used to filter trades based on the market trend.")

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"], tooltip="Choose whether to trade only Long, only Short, or Both directions.")

confirm_candles = input(2, title="Number of Confirming Candles", tooltip="The number of consecutive candles that must meet the conditions before entering a trade.")

// === Indicator Calculations ===

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

rsi_val = ta.rsi(close, rsi_length)

atr_val = ta.atr(14)

vol_filter = volume > ta.sma(volume, 20)

ema_trend = ta.ema(close, trend_filter_length)

// === Helper Function for Confirmation ===

confirm_condition(cond, lookback) =>

count = 0

for i = 0 to lookback - 1

count += cond[i] ? 1 : 0

count == lookback

// === Trend Filter ===

trend_is_bullish = close > ema_trend

trend_is_bearish = close < ema_trend

// === Long and Short Conditions with Confirmation ===

long_raw_condition = close > upper_band * 1.01 and rsi_val > rsi_midline and (not volume_filter or vol_filter) and trend_is_bullish

short_raw_condition = close < lower_band * 0.99 and rsi_val < rsi_midline and (not volume_filter or vol_filter) and trend_is_bearish

long_condition = confirm_condition(long_raw_condition, confirm_candles)

short_condition = confirm_condition(short_raw_condition, confirm_candles)

// === Trade Entry and Exit Logic ===

if long_condition and (trade_direction == "Long" or trade_direction == "Both")

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - (atr_multiplier * atr_val), limit=close + (atr_multiplier * risk_reward_ratio * atr_val))

if short_condition and (trade_direction == "Short" or trade_direction == "Both")

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + (atr_multiplier * atr_val), limit=close - (atr_multiplier * risk_reward_ratio * atr_val))

// === Plotting ===

plot(upper_band, color=color.green, title="Upper Band")

plot(lower_band, color=color.red, title="Lower Band")

plot(basis, color=color.blue, title="Basis")

plot(ema_trend, color=color.orange, title="Trend Filter EMA")

- Stratégie de croisement des moyennes mobiles exponentielles sur plusieurs périodes avec optimisation risque-rendement

- Stratégie de négociation après rupture ouverte avec gestion dynamique des positions basée sur ATR

- Stratégie de croisement de dynamique multi-tendance avec système d'optimisation de la volatilité

- La tendance à un taux de gain élevé signifie une stratégie de négociation de renversement

- Aucune stratégie de rupture de bougie haussière

- Stratégie de négociation de tendance dynamique multi-indicateur

- Tendance composite à plusieurs indicateurs suivant une stratégie

- Stratégie de négociation de l'élan de tendance multi-indicateur: un système de négociation quantitatif optimisé basé sur les bandes de Bollinger, Fibonacci et ATR

- Stratégie d'intégration des bandes RSI-Bollinger: un système de négociation dynamique et auto-adaptatif à multiples indicateurs

- Crossover de l' EMA avec la stratégie de double entrée des bandes de Bollinger: un système de négociation quantitatif combinant suivi de tendance et rupture de volatilité

- Tendance multi-indicateur suivant une stratégie avec canal dynamique et système de négociation de moyenne mobile

- Suivre la stratégie de tendance multi-EMA avec confirmation SMMA

- Système de négociation de tendance multi-indicateur avec stratégie d'analyse de l'élan

- Stratégie de divergence de l'élan du cloud suivant la tendance

- Suivi de tendance multi-indicateurs et stratégie de rupture de la volatilité

- Tendance multi-indicateur adaptative au marché suivant la stratégie

- Stratégie dynamique de planification et de gestion des positions basée sur la volatilité

- Stratégie composite EMA-MACD pour le scalping de tendance

- Suivi de tendance et stratégie de dynamique basée sur des indicateurs techniques multiples

- Stratégie de négociation de session quantitative à haute fréquence: système de gestion dynamique adaptatif des positions basé sur des signaux de rupture

- Tendance de l'élan croisé multi-EMA à la suite de la stratégie

- Stratégie de négociation de volume et de dynamique multi-cibles intelligente

- Stratégie de négociation quantitative d' inversion de tendance des bandes de Bollinger à plusieurs périodes

- Stratégie de négociation de rupture à haute fréquence basée sur la direction de rapprochement du chandelier

- Stratégie de négociation quantitative de la tendance de rétraction dynamique de Fibonacci

- Indice variable Dynamique Moyenne Tendance des bénéfices à plusieurs niveaux Suivant la stratégie

- Système de négociation de moyennes mobiles multiples avec confirmation de l'élan et du volume Stratégie de tendance quantitative

- Stratégie de négociation équilibrée avec prise de bénéfices et stop-loss

- Système amélioré de suivi des tendances: Identification dynamique des tendances basée sur ADX et SAR parabolique

- Stratégie de négociation à dynamique stochastique à deux délais