Tendance dynamique multi-indicateur suivant une stratégie basée sur les EMA et SMA

Auteur:ChaoZhang est là., Date: 2024-12-27 14:12:50 Je vous en prie.Les étiquettes:Le taux d'intérêtSMAATRPPtendance supérieure

Vue d'ensemble de la stratégie

Cette stratégie est un système dynamique de suivi des tendances qui combine plusieurs indicateurs techniques. Elle intègre des points pivots, un indicateur SuperTrend et des signaux croisés de moyenne mobile pour identifier les tendances du marché et les opportunités de trading.

Principes de stratégie

La stratégie fonctionne sur la base des mécanismes de base suivants:

- Utilise pour l'analyse des données relatives aux prix dans des délais fixes, en évitant les interférences de différents délais

- Calcule les SMA basées sur les EMA à 8 périodes et à 21 périodes pour former une tendance suivant la base

- Combine ATR et points pivots pour calculer l'indicateur SuperTrend pour la confirmation de la direction de la tendance

- Considère que les signaux croisés SMA ne sont valables que s'ils se produisent dans les 3 périodes d'un point pivot

- Calcule et suit dynamiquement les niveaux de support/résistance pour la référence de négociation

Les avantages de la stratégie

- La validation croisée à plusieurs indicateurs améliore la fiabilité du signal

- L'analyse des délais fixes réduit les interférences de faux signaux

- La validation des points pivots garantit que les transactions ont lieu aux niveaux de prix clés

- Suivi dynamique du support/résistance aide à déterminer les niveaux de stop-loss et de take profit

- L'indicateur SuperTrend fournit une confirmation supplémentaire de la direction de la tendance

- Des paramètres flexibles permettent de les adapter aux différentes conditions du marché

Risques stratégiques

- Plusieurs indicateurs peuvent entraîner un décalage du signal

- Peut générer des signaux erronés excessifs sur différents marchés

- L'analyse à cadres horaires fixes peut manquer des signaux importants dans d'autres cadres horaires

- La validation des points pivots peut entraîner la perte de certaines opportunités commerciales importantes

- L'optimisation des paramètres peut entraîner un surajustement

Directions d'optimisation de la stratégie

- Introduction d'un mécanisme de filtrage de la volatilité pour réduire la fréquence des transactions pendant les périodes de faible volatilité

- Ajouter des indicateurs de confirmation de la force de la tendance tels que l'ADX ou le MACD

- Développer un système de paramètres adaptatif qui s'ajuste dynamiquement en fonction des conditions du marché

- Incorporer une analyse du volume pour améliorer la fiabilité du signal

- Mettre en œuvre un mécanisme de stop-loss dynamique qui s'ajuste en fonction de la volatilité du marché

Résumé

Cette stratégie établit une tendance relativement complète suivant le système de négociation grâce à la combinaison de plusieurs indicateurs techniques. Son principal avantage réside dans l'amélioration de la fiabilité du signal grâce à l'analyse à temps fixe et à la validation des points pivots. Bien qu'il existe certains risques de retard, ceux-ci peuvent être efficacement contrôlés grâce à l'optimisation des paramètres et aux mesures de gestion des risques. Les traders sont invités à effectuer un backtesting approfondi avant la mise en œuvre et à ajuster les paramètres en fonction des caractéristiques spécifiques du marché.

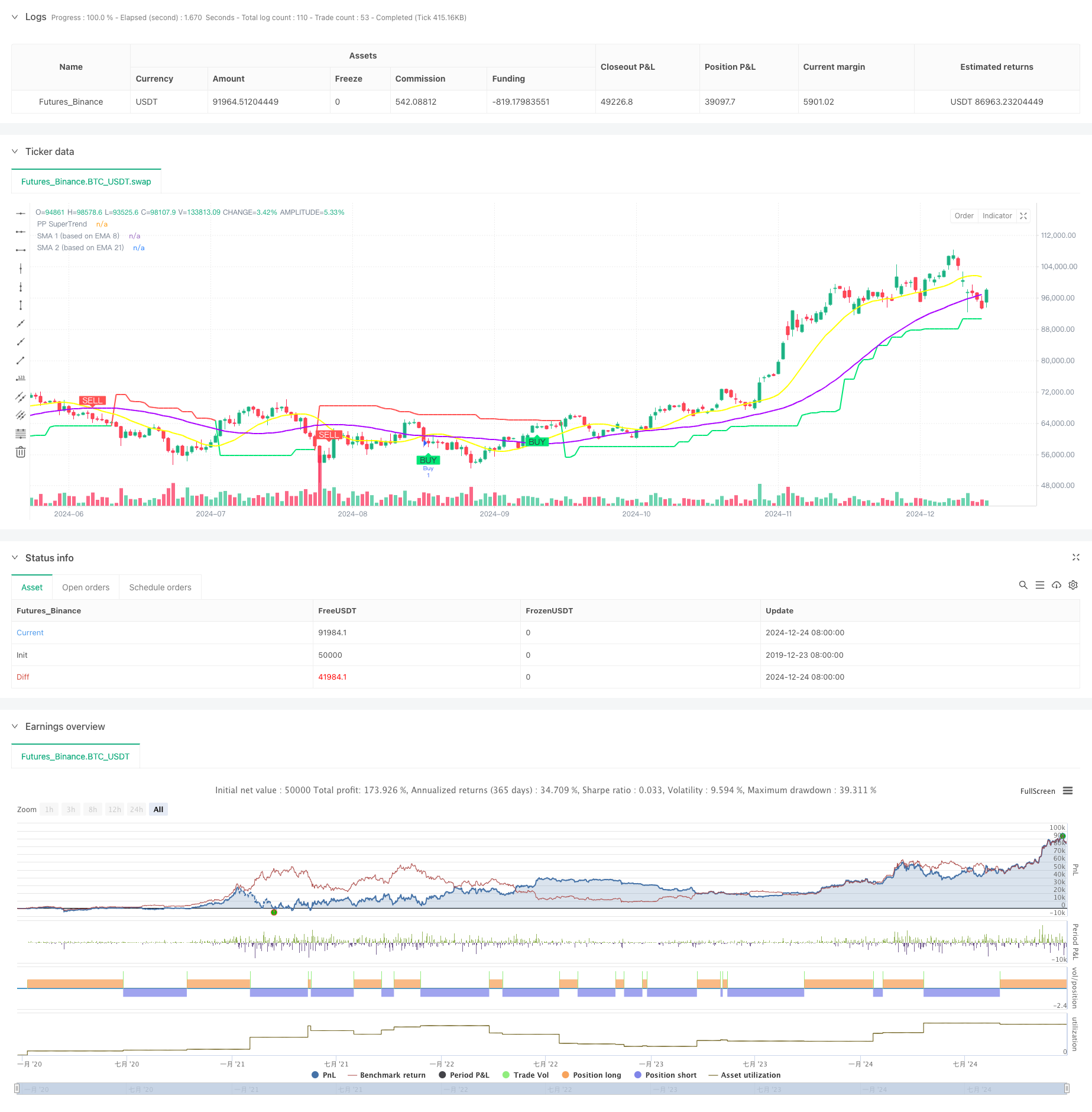

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Buy Sell Pivot Point", overlay=true)

// Input Parameters

prd = input.int(defval=2, title="Periodo Pivot Point", minval=1, maxval=50)

Factor = input.float(defval=3, title="Fator ATR", minval=1, step=0.1)

Pd = input.int(defval=10, title="Periodo ATR", minval=1)

showpivot = input.bool(defval=false, title="Mostrar Pivot Points")

showlabel = input.bool(defval=true, title="Mostrar Buy/Sell Labels")

showcl = input.bool(defval=false, title="Mostrar PP Center Line")

showsr = input.bool(defval=false, title="Mostrar Support/Resistance")

sma1_length = input.int(defval=8, title="SMA 1")

sma2_length = input.int(defval=21, title="SMA 2")

timeframe_fix = input.timeframe("D", title="Timeframe Fixo")

// Request data from the fixed timeframe

fix_close = request.security(syminfo.tickerid, timeframe_fix, close)

fix_high = request.security(syminfo.tickerid, timeframe_fix, high)

fix_low = request.security(syminfo.tickerid, timeframe_fix, low)

fix_ph = request.security(syminfo.tickerid, timeframe_fix, ta.pivothigh(prd, prd))

fix_pl = request.security(syminfo.tickerid, timeframe_fix, ta.pivotlow(prd, prd))

fix_atr = request.security(syminfo.tickerid, timeframe_fix, ta.atr(Pd))

// Convert Pivot High/Low to valid boolean for conditions

ph_cond = not na(fix_ph)

pl_cond = not na(fix_pl)

// Draw Pivot Points

plotshape(ph_cond and showpivot, title="Pivot High", text="H", style=shape.labeldown, color=color.red, textcolor=color.red, location=location.abovebar, offset=-prd)

plotshape(pl_cond and showpivot, title="Pivot Low", text="L", style=shape.labelup, color=color.lime, textcolor=color.lime, location=location.belowbar, offset=-prd)

// Calculate the Center line using pivot points

var float center = na

lastpp = ph_cond ? fix_ph : pl_cond ? fix_pl : na

if not na(lastpp)

center := na(center) ? lastpp : (center * 2 + lastpp) / 3

// Upper/Lower bands calculation

Up = center - (Factor * fix_atr)

Dn = center + (Factor * fix_atr)

// Get the trend

var float TUp = na

var float TDown = na

var int Trend = 0

TUp := na(TUp[1]) ? Up : fix_close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := na(TDown[1]) ? Dn : fix_close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := fix_close > TDown[1] ? 1 : fix_close < TUp[1] ? -1 : nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// Plot the trend

linecolor = Trend == 1 ? color.lime : Trend == -1 ? color.red : na

plot(Trailingsl, color=linecolor, linewidth=2, title="PP SuperTrend")

// Plot Center Line

plot(showcl ? center : na, color=showcl ? (center < fix_close ? color.blue : color.red) : na, title="Center Line")

// Calculate Base EMAs

ema_8 = ta.ema(fix_close, 8)

ema_21 = ta.ema(fix_close, 21)

// Calculate SMAs based on EMAs

sma1 = ta.sma(ema_8, sma1_length)

sma2 = ta.sma(ema_21, sma2_length)

// Plot SMAs

plot(sma1, color=#ffff00, linewidth=2, title="SMA 1 (based on EMA 8)")

plot(sma2, color=#aa00ff, linewidth=2, title="SMA 2 (based on EMA 21)")

// Initialize variables to track pivot points

var float last_pivot_time = na

// Update the pivot time when a new pivot is detected

if (ph_cond)

last_pivot_time := bar_index

if (pl_cond)

last_pivot_time := bar_index

// Calculate the crossover/crossunder signals

buy_signal = ta.crossover(sma1, sma2) // SMA 8 crossing SMA 21 upwards

sell_signal = ta.crossunder(sma1, sma2) // SMA 8 crossing SMA 21 downwards

// Ensure signal is only valid if it happens within 3 candles of a pivot point

valid_buy_signal = buy_signal and (bar_index - last_pivot_time <= 3)

valid_sell_signal = sell_signal and (bar_index - last_pivot_time <= 3)

// Plot Buy/Sell Signals

plotshape(valid_buy_signal and showlabel, title="Buy Signal", text="BUY", style=shape.labelup, color=color.lime, textcolor=color.black, location=location.belowbar)

plotshape(valid_sell_signal and showlabel, title="Sell Signal", text="SELL", style=shape.labeldown, color=color.red, textcolor=color.white, location=location.abovebar)

// Get S/R levels using Pivot Points

var float resistance = na

var float support = na

support := pl_cond ? fix_pl : support[1]

resistance := ph_cond ? fix_ph : resistance[1]

// Plot S/R levels

plot(showsr and not na(support) ? support : na, color=showsr ? color.lime : na, style=plot.style_circles, offset=-prd)

plot(showsr and not na(resistance) ? resistance : na, color=showsr ? color.red : na, style=plot.style_circles, offset=-prd)

// Execute trades based on valid signals

if valid_buy_signal

strategy.entry("Buy", strategy.long)

if valid_sell_signal

strategy.entry("Sell", strategy.short)

// Alerts

alertcondition(valid_buy_signal, title="Buy Signal", message="Buy Signal Detected")

alertcondition(valid_sell_signal, title="Sell Signal", message="Sell Signal Detected")

alertcondition(Trend != Trend[1], title="Trend Changed", message="Trend Changed")

- Stratégie de négociation de dynamique adaptative avec SMA Crossover et SuperTrend

- Stratégie de suivi de la volatilité du cygne noir et de la dynamique croisée de la moyenne mobile

- Modèle d'alerte ML

- Stratégie de négociation avancée dans le cloud Ichimoku avec analyse multidimensionnelle dynamique

- La stratégie RSI-EMA-ATR de négociation de la volatilité sur plusieurs indicateurs

- SSL hybride

- EMA, SMA, CCI, ATR, Stratégie de moyenne mobile d'ordre parfait avec indicateur de tendance magique Système de trading automatique

- La mise en place d'une stratégie de volatilité ATR pour la position dynamique adaptative multi-indicateur

- Stratégie quantitative croisée de tendance à multiples indicateurs

- Le taux de change de l'indicateur MACD-ATR-EMA est supérieur au taux de change de l'indicateur

- Stratégie de négociation d'inversion de tendance des indices de risque avec ATR Stop Loss et contrôle de la zone de négociation

- La stratégie de négociation multi-EMA croisée avec oscillateur et support/résistance dynamique

- Tendance combinée multi-SMA et stochastique suivant une stratégie de négociation

- Stratégie de négociation dynamique adaptative basée sur des rendements logarithmiques standardisés

- Stratégie de négociation à tendance croisée multi-indicateurs: analyse quantitative basée sur le RSI stochastique et le système de moyenne mobile

- Stratégie de croisement de tendance multi-indicateurs: système de négociation de bandes de soutien au marché haussier

- Système d'analyse de l'extension haute/basse de 52 semaines

- Système de négociation de renversement de tendance du momentum de la double EMA RSI - Stratégie de percée du momentum basée sur le croisement de l'EMA et du RSI

- Stratégie de négociation à haute fréquence multi-indicateur

- Stratégie de négociation dynamique de rupture de tendance

- Stratégie améliorée de suivi des tendances de Fibonacci et de gestion des risques

- Stratégie de dynamisme EMA-RSI adaptative à plusieurs états avec système de filtrage de l'indice de bonheur

- Système d'optimisation de la stratégie de négociation de moyenne mobile exponentielle intelligente

- Stratégie de négociation de divergence du système de prix de volatilité basé sur l'IA

- Stratégie de négociation d'évolution de tendance multi-EMA avec gestion des risques basée sur ATR

- Stratégie améliorée d'inversion de la moyenne avec bandes de Bollinger et intégration de l'indicateur RSI

- La stratégie de négociation quantitative de l'indice de résistance à la hausse à plusieurs périodes

- Stratégie de suivi de la tendance adaptative avec système de contrôle dynamique de la consommation

- Stratégie multi-EMA "croix d'or" avec prise de bénéfices à plusieurs niveaux

- Stratégie de suivi croisé des tendances d'indicateurs techniques multiples: RSI et système de négociation de synergie stochastique RSI