Rata-rata bergerak multi-level dengan sistem perdagangan pengakuan pola candlestick

Penulis:ChaoZhang, Tanggal: 2024-11-12 16:39:22Tag:EMASMAMA50MA200

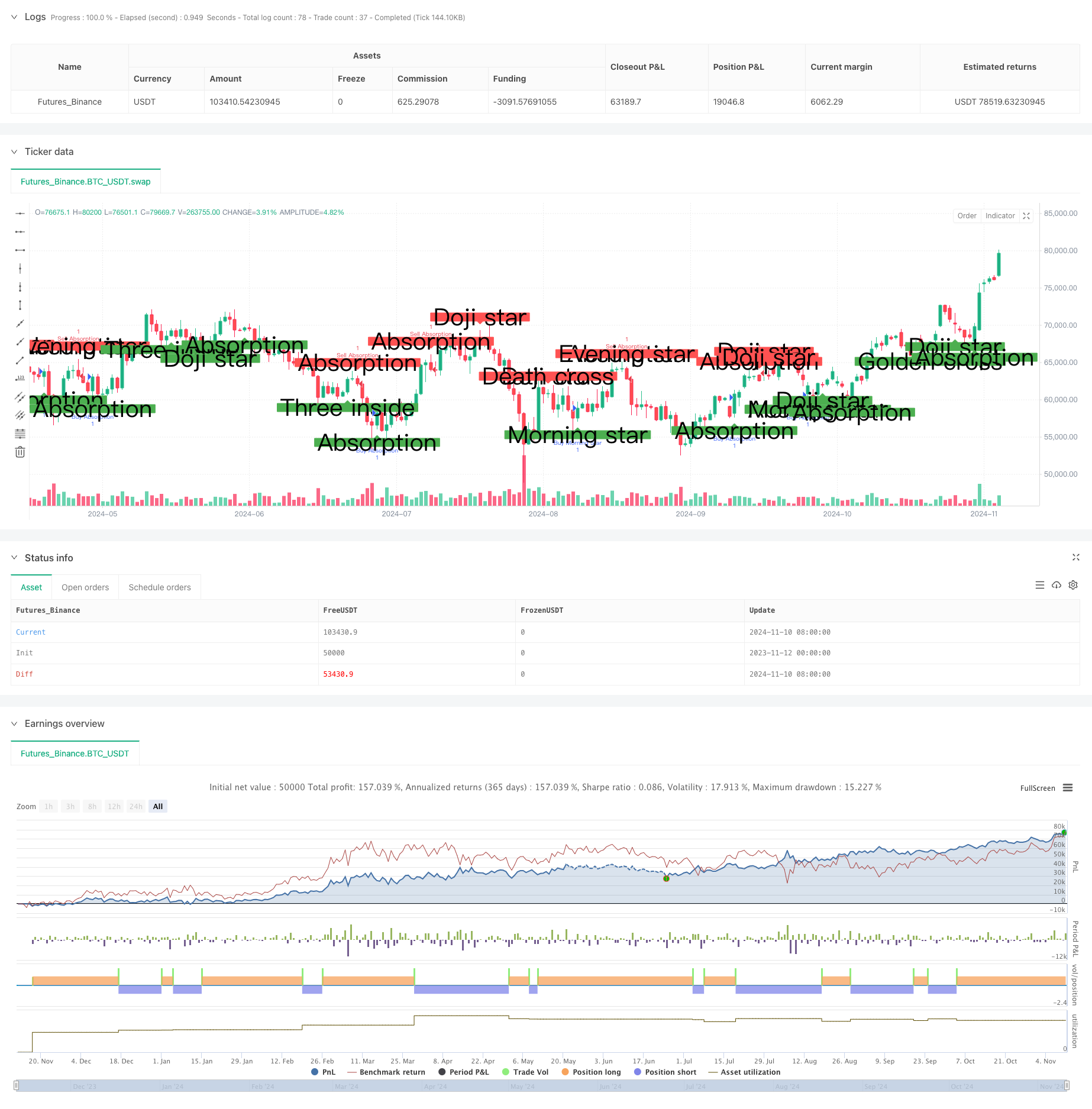

Gambaran umum

Strategi ini adalah sistem perdagangan analisis teknis yang komprehensif yang menggabungkan pengenalan pola lilin klasik dengan analisis tren. Sistem ini terutama mengandalkan identifikasi beberapa pola lilin klasik, termasuk lebih dari sepuluh formasi yang berbeda, sambil menggabungkan rata-rata bergerak jangka pendek dan jangka panjang untuk mengkonfirmasi tren pasar dan menghasilkan sinyal beli / jual. Strategi ini dapat disesuaikan dengan kerangka waktu yang berbeda dan cocok untuk perdagangan jangka pendek dan kepemilikan posisi jangka menengah hingga panjang.

Prinsip Strategi

Strategi ini menggunakan mekanisme konfirmasi sinyal berlapis-lapis:

- Menggunakan 6 periode eksponensial Moving Average (EMA) sebagai indikator tren jangka pendek

- Menggunakan 50 dan 200-periode Simple Moving Averages (SMA) untuk penilaian tren jangka panjang

- Mengidentifikasi beberapa pola candlestick:

- Keluarga Doji (Doji biasa, Gravestone Doji, Dragonfly Doji)

- Pola palu (Palu, Hanging Man, Inverted Hammer, Shooting Star)

- Pola penyerapan

- Pola interior

- Pola Bintang Pagi/Bintang Malam

- Pola Tiga Prajurit/Tiga Burung Tikus

- Menghasilkan sinyal perdagangan dengan menggabungkan analisis tren dan pola

Keuntungan Strategi

- Konfirmasi multi-dimensi: Meningkatkan keandalan sinyal melalui konfirmasi ganda rata-rata bergerak dan pola candlestick

- Kemampuan beradaptasi yang tinggi: Sesuai dengan lingkungan pasar yang berbeda, menangkap tren dan pembalikan

- Pengendalian risiko yang komprehensif: Mengurangi sinyal palsu melalui kriteria pengenalan pola yang ketat

- Logika operasi yang jelas: Setiap sinyal perdagangan memiliki kondisi masuk tertentu

- Skalabilitas tinggi: Kerangka strategi dengan mudah mengakomodasi modul pengenalan pola baru

Risiko Strategi

- Penundaan pengenalan pola: Beberapa lilin yang diperlukan untuk konfirmasi mungkin melewatkan titik masuk optimal

- Sinyal tumpang tindih: Pola serentak dapat menyebabkan sinyal yang bertentangan

- Kebisingan pasar: Dapat menghasilkan sinyal palsu yang berlebihan di pasar yang bergolak

- Sensitivitas parameter: Pemilihan periode rata-rata bergerak berdampak signifikan pada kinerja strategi

- Kompleksitas komputasi: Perhitungan real-time dari beberapa pola dapat mempengaruhi efisiensi pelaksanaan

Arah Optimasi Strategi

- Sistem bobot sinyal:

- Mengimplementasikan bobot disesuaikan untuk pola yang berbeda

- Mengatur bobot secara dinamis berdasarkan kondisi pasar

- Pengakuan lingkungan pasar:

- Menambahkan indikator volatilitas untuk mengidentifikasi kondisi pasar

- Sesuaikan parameter strategi berdasarkan kondisi pasar

- Optimasi stop-loss:

- Desain stop-loss dinamis berdasarkan karakteristik pola

- Tambahkan mekanisme trailing stop

- Penyaringan sinyal:

- Mengintegrasikan mekanisme konfirmasi volume

- Tambahkan filter kekuatan tren

- Optimasi efisiensi komputasi:

- Sederhanakan algoritma pengenalan pola

- Mengoptimalkan struktur data

Ringkasan

Strategi ini mengintegrasikan beberapa alat analisis teknis untuk membangun sistem perdagangan yang lengkap. Kekuatannya utama terletak pada mekanisme konfirmasi sinyal multidimensi, meskipun menghadapi tantangan penundaan sinyal dan overfit potensial. Kinerja strategi dapat ditingkatkan dengan menambahkan pengenalan lingkungan pasar dan mekanisme penyesuaian parameter dinamis. Dalam aplikasi praktis, disarankan untuk mengoptimalkan parameter melalui backtesting dan menerapkannya bersama dengan sistem manajemen risiko.

/*backtest

start: 2023-11-12 00:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("hazed candles", shorttitle="hazed candles", overlay=true)

// Inputs

ema_input = input.int(6, title="EMA value to detect trend")

show_doji = input.bool(true, title="Doji star")

show_doji_grave = input.bool(true, title="Doji grave")

show_doji_dragonfly = input.bool(true, title="Doji dragonfly")

show_hammer = input.bool(true, title="Hammer")

show_hanginman = input.bool(true, title="Hanging man")

show_rhammer = input.bool(true, title="Reversed hammer")

show_falling_star = input.bool(true, title="Falling star")

show_absorption = input.bool(true, title="Absorptions")

show_tweezers = input.bool(true, title="Tweezers")

show_triple_inside = input.bool(true, title="Triple inside")

show_three_soldiers = input.bool(true, title="Three soldiers")

show_three_crows = input.bool(true, title="Three crows")

show_morning_evening_stars = input.bool(true, title="Morning / evening stars")

show_golden_death_cross = input.bool(true, title="Golden / Death cross")

// EMA calculation

prev_p_1 = ta.ema(close, ema_input)

// Variables

lowhigh_long_prop = 10

body_prop_size = 9

bar_size_h = high - close

bar_size_l = math.max(open, close) - math.min(close, open)

body_size_h = high - low

low_body_prop = close - low

high_body_prop = high - close

low_half_eq = (low_body_prop > body_size_h / 2.5 and low_body_prop < body_size_h / 1.65)

high_half_eq = (high_body_prop > body_size_h / 2.5 and high_body_prop < body_size_h / 1.65)

open_close_eq = (bar_size_l < body_size_h / body_prop_size)

///////////////// Doji star ///////////////

doji_star_up = show_doji and close <= prev_p_1 and open_close_eq and high_body_prop and low_half_eq

doji_star_down = show_doji and close > prev_p_1 and open_close_eq and high_body_prop and low_half_eq

plotshape(doji_star_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji star")

plotshape(doji_star_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji star")

// Strategy entries for Doji star

if (doji_star_up)

strategy.entry("Buy Doji Star", strategy.long)

if (doji_star_down)

strategy.entry("Sell Doji Star", strategy.short)

///////////////// Doji grave ///////////////

long_high_body = (high_body_prop > bar_size_l * lowhigh_long_prop)

open_low_eq = ((close - low) < body_size_h / body_prop_size)

doji_grave = show_doji_grave and close > prev_p_1 and open_close_eq and open_low_eq and long_high_body

plotshape(doji_grave, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Doji grave")

// Strategy entries for Doji grave

if (doji_grave)

strategy.entry("Sell Doji Grave", strategy.short)

///////////////// Doji dragonfly ///////////////

long_low_body = (low_body_prop > bar_size_l * lowhigh_long_prop)

open_high_eq = ((high - close) < body_size_h / body_prop_size)

doji_dragonfly = show_doji_dragonfly and close <= prev_p_1 and open_close_eq and open_high_eq and long_low_body

plotshape(doji_dragonfly, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Doji dragonfly")

// Strategy entries for Doji dragonfly

if (doji_dragonfly)

strategy.entry("Buy Doji Dragonfly", strategy.long)

///////////////// Hammer ///////////////

bottom_low = close - bar_size_h * 15

bottom_high = close - bar_size_h * 1.5

top_low = open + bar_size_l * 1.5

top_high = open + bar_size_l * 15

h_down = show_hammer and prev_p_1 > close and open == high and low > bottom_low and low < bottom_high

plotshape(h_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Hammer")

// Strategy entries for Hammer

if (h_down)

strategy.entry("Buy Hammer", strategy.long)

///////////////// Hanging man ///////////////

hm_down = show_hanginman and prev_p_1 < close and open == high and low > bottom_low and low < bottom_high

plotshape(hm_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Hanging man")

// Strategy entries for Hanging man

if (hm_down)

strategy.entry("Sell Hanging Man", strategy.short)

///////////////// Reversed hammer ///////////////

rh_down = show_rhammer and prev_p_1 > open and low == close and high > top_low and high < top_high

plotshape(rh_down, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Reversed hammer")

// Strategy entries for Reversed hammer

if (rh_down)

strategy.entry("Buy Reversed Hammer", strategy.long)

///////////////// Fallling star ///////////////

fs_down = show_falling_star and prev_p_1 < close and low == close and high > top_low and high < top_high

plotshape(fs_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Falling star")

// Strategy entries for Falling star

if (fs_down)

strategy.entry("Sell Falling Star", strategy.short)

///////////////// Absorption ///////////////

open_1 = open[1]

close_1 = close[1]

high_1 = high[1]

low_1 = low[1]

open_2 = open[2]

close_2 = close[2]

high_2 = high[2]

low_2 = low[2]

open_3 = open[3]

close_3 = close[3]

high_3 = high[3]

low_3 = low[3]

bar_1 = math.max(open_1, close_1) - math.min(open_1, close_1)

bar_2 = math.max(open_2, close_2) - math.min(open_2, close_2)

bar_3 = math.max(open_3, close_3) - math.min(open_3, close_3)

bar_h = math.max(open, close) - math.min(open, close)

bar_size_min = bar_1 * 1.2

bar_size_f = (bar_h > bar_size_min)

absorption_up = show_absorption and bar_size_f and open_1 > close_1 and open_1 != open and open_3 > open_2 and open_2 > open_1 and open_1 > open and close > open

absorption_down = show_absorption and bar_size_f and open_1 < close_1 and open_1 != open and open_3 < open_2 and open_2 < open_1 and open_1 < open and close < open

plotshape(absorption_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Absorption")

plotshape(absorption_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Absorption")

// Strategy entries for Absorption

if (absorption_up)

strategy.entry("Buy Absorption", strategy.long)

if (absorption_down)

strategy.entry("Sell Absorption", strategy.short)

///////////////// Tweezer ///////////////

match_lows = (low_1 == low or (low_2 == low and open_2 == open_1))

sprici_up = show_tweezers and prev_p_1 > open and match_lows and open_3 > open_2 and open_2 > open_1 and open_1 > open and low != open and close_1 != low_1

plotshape(sprici_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Tweezer")

match_highs = (high_1 == high or (high_2 == high and open_2 == open_1))

sprici_down = show_tweezers and prev_p_1 <= open and match_highs and open_3 < open_2 and open_2 < open_1 and open_1 < open and high != open and close_1 != high_1

plotshape(sprici_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Tweezer")

// Strategy entries for Tweezer

if (sprici_up)

strategy.entry("Buy Tweezer", strategy.long)

if (sprici_down)

strategy.entry("Sell Tweezer", strategy.short)

///////////////// Triple inside up/down ///////////////

open_close_min = math.min(close, open)

open_close_max = math.max(close, open)

bar = open_close_max - open_close_min

open_close_min_1 = math.min(close[1], open[1])

open_close_max_1 = math.max(close[1], open[1])

open_close_min_2 = math.min(close[2], open[2])

open_close_max_2 = math.max(close[2], open[2])

body_top_1 = math.max(close[1], open[1])

body_low_1 = math.min(close[1], open[1])

triple_inside_up = show_triple_inside and open_close_min_2 == open_close_min_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close > open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three inside")

triple_inside_down = show_triple_inside and open_close_max_2 == open_close_max_1 and bar_1 > bar_2 * 0.4 and bar_1 < bar_2 * 0.6 and close < open_2 and bar > bar_1 and bar + bar_1 < bar_2 * 2

plotshape(triple_inside_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three inside")

// Strategy entries for Triple inside

if (triple_inside_up)

strategy.entry("Buy Triple Inside", strategy.long)

if (triple_inside_down)

strategy.entry("Sell Triple Inside", strategy.short)

///////////////// Triple soldiers / crows ///////////////

triple_solders = show_three_soldiers and prev_p_1 > open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close > close_1 and close_1 > close_2 and open_2 < close_2 and open_1 < close_1

plotshape(triple_solders, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Three soldiers")

triple_crows = show_three_crows and prev_p_1 < open_2 and bar > bar_1 * 0.8 and bar < bar_1 * 1.2 and bar > bar_2 * 0.8 and bar < bar_2 * 1.2 and close < close_1 and close_1 < close_2 and open_2 > close_2 and open_1 > close_1

plotshape(triple_crows, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Three crows")

// Strategy entries for Three soldiers and Three crows

if (triple_solders)

strategy.entry("Buy Three Soldiers", strategy.long)

if (triple_crows)

strategy.entry("Sell Three Crows", strategy.short)

///////////////// Golden death cross ///////////////

ma_50 = ta.sma(close, 50)

ma_200 = ta.sma(close, 200)

ma_50_200_cross = ta.crossover(ma_50, ma_200) or ta.crossunder(ma_50, ma_200)

golden_cross_up = show_golden_death_cross and ma_50_200_cross and ma_50 > ma_200

plotshape(golden_cross_up, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Golden cross")

death_cross_down = show_golden_death_cross and ma_50_200_cross and ma_50 < ma_200

plotshape(death_cross_down, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Death cross")

// Strategy entries for Golden cross and Death cross

if (golden_cross_up)

strategy.entry("Buy Golden Cross", strategy.long)

if (death_cross_down)

strategy.entry("Sell Death Cross", strategy.short)

///////////////// Morning evening stars ///////////////

morning_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_min_2 > open_close_min_1 and open_close_min > open_close_min_1 and prev_p_1 > close_2 and prev_p_1 > close_1 and close > close_1 and close_3 > close_2 and close_2 > close_1 and close > body_top_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(morning_star, style=shape.labelup, color=color.green, location=location.belowbar, size=size.large, text="Morning star")

evening_star = show_morning_evening_stars and bar > bar_1 and bar_2 > bar_1 and bar > (bar_2 * 0.5) and open_close_max_2 < open_close_max_1 and open_close_max < open_close_max_1 and prev_p_1 < close_2 and prev_p_1 < close_1 and close < close_1 and close_3 < close_2 and close_2 < close_1 and close < body_low_1 and close_2 != close_1 and open != close and open_2 != close_2

plotshape(evening_star, style=shape.labeldown, color=color.red, location=location.abovebar, size=size.large, text="Evening star")

// Strategy entries for Morning star and Evening star

if (morning_star)

strategy.entry("Buy Morning Star", strategy.long)

if (evening_star)

strategy.entry("Sell Evening Star", strategy.short)

- Strategi Crossover Rata-rata Bergerak Ganda

- Strategi Crossover Multi-EMA dengan Konfirmasi Tren

- Strategi Crossover EMA Dual Dinamis dengan Kontrol Keuntungan/Hilang yang Adaptif

- Saluran SSL

- BMSB Breakout Strategi

- Indikator: WaveTrend Oscillator

- Strategi Beli/Jual Berdasarkan Volume & Pola Lilin

- Strategi MOST dan Dual Moving Average Crossover

- Strategi Crossover EMA yang Mengikuti Tren yang Dinamis

- EMA/SMA Trend Following dengan Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

- Strategi perdagangan dua arah dengan volatilitas besar: Sistem entri ambang berbasis titik

- Strategi Kuantitatif Reversi Rata-rata Bollinger yang Ditingkatkan

- Dynamic Darvas Box Breakout dengan Moving Average Trend Confirmation Trading System

- Strategi Perdagangan Kuantitatif EMA Crossover Dinamis Take-Profit Stop-Loss

- Tren Crossover Multi-EMA Mengikuti Strategi dengan Optimasi Stop-Loss dan Take-Profit yang Dinamis

- Strategi crossover rata-rata bergerak ganda dengan manajemen risiko dinamis

- Strategi perimbangan hedging dua platform

- Pertukaran rata-rata bergerak ganda dengan strategi manajemen risiko dinamis

- Multi-MA Trend Strength Capture dengan Momentum Profit-Taking Strategy

- Multi-Strategy Adaptive Trend Following dan Breakout Trading System

- Strategi perdagangan EMA Trend Momentum Multi-Timeframe

- Strategi perdagangan yang seimbang berbasis waktu dengan rotasi jangka panjang dan jangka pendek

- Strategi Perdagangan Kuantitatif Tren Dinamis MACD Lanjutan

- Sistem Trading Trend Breakout dengan Moving Average (Strategi TBMA)

- Strategi Multi-Trend Following berbasis ATR dengan Sistem Optimasi Take-Profit dan Stop-Loss

- Sistem Perdagangan Smart Adaptif berbasis Momentum RSI dengan Manajemen Risiko Multi-level

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization (Strategi Perdagangan Dinamis RSI yang Adaptif dengan Optimasi Ambang)

- RSI dan AO Synergistic Trend Setelah Strategi Perdagangan Kuantitatif

- Adaptive Trend Momentum RSI Strategy dengan Sistem Filter Moving Average

- Dual Moving Average Cross RSI Momentum Strategy dengan Sistem Optimasi Risiko-Reward