EMA/SMA Trend Following dengan Swing Trading Strategy Combined Volume Filter and Percentage Take-Profit/Stop-Loss System

Penulis:ChaoZhang, Tanggal: 2024-12-11 15:12:35Tag:EMASMA

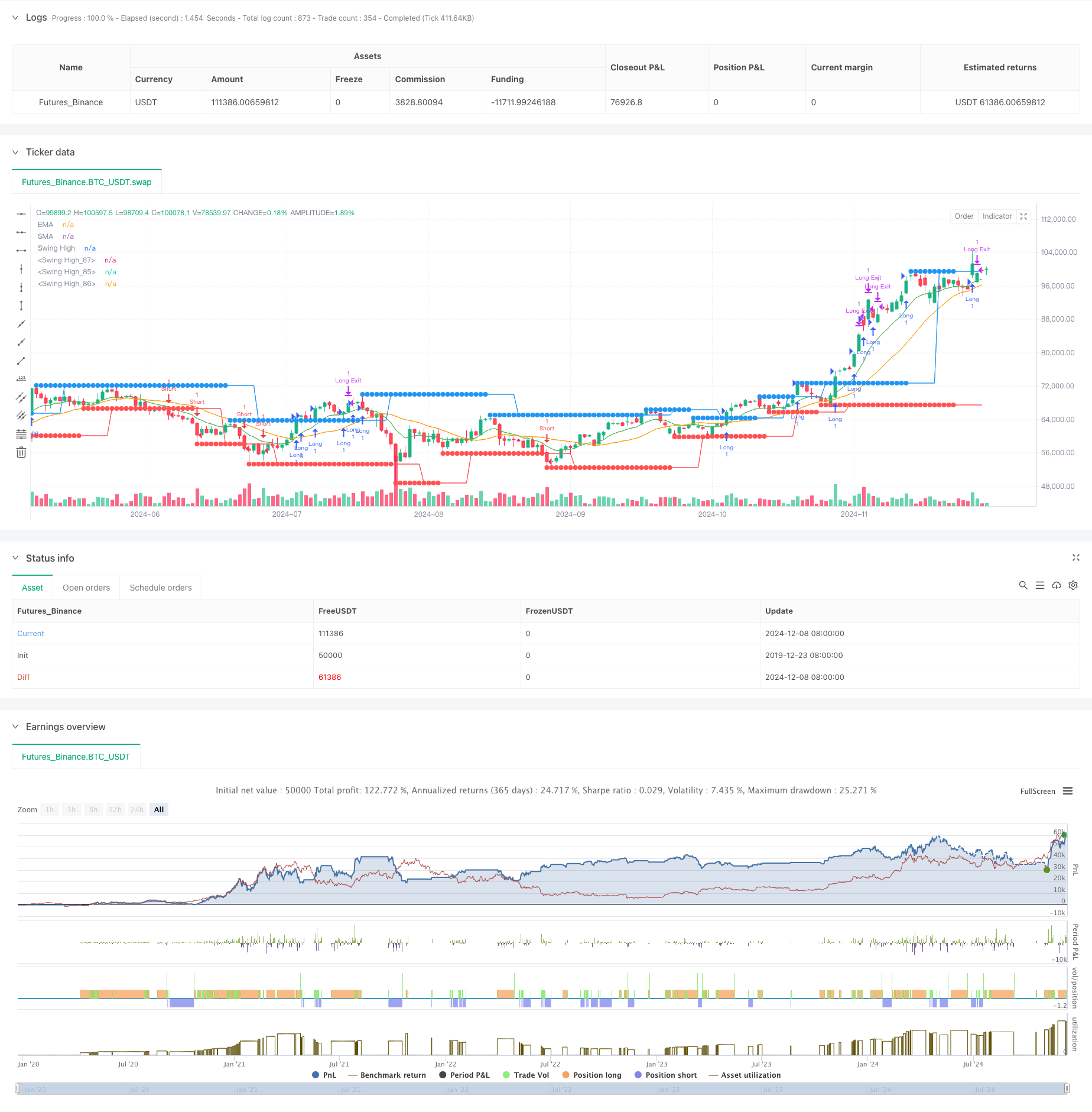

Gambaran umum

Strategi ini adalah sistem perdagangan yang komprehensif yang menggabungkan mengikuti tren dengan metode perdagangan swing, memanfaatkan crossover EMA dan SMA, identifikasi swing high/low, penyaringan volume, dan mekanisme take-profit dan trailing stop-loss berbasis persentase.

Prinsip Strategi

Strategi ini menggunakan mekanisme penyaringan sinyal berlapis-lapis, dimulai dengan EMA ((10) dan SMA ((21) crossover untuk penentuan tren dasar, kemudian menggunakan 6-bar titik pivot kiri/kanan untuk waktu masuk, sementara membutuhkan volume di atas rata-rata bergerak 200 periode untuk memastikan likuiditas yang cukup. Sistem ini menggunakan 2% take profit dan 1% trailing stop-loss untuk manajemen risiko. Posisi panjang dimulai ketika harga melanggar di atas swing high dengan konfirmasi volume; posisi pendek diambil ketika harga melanggar di bawah swing low dengan konfirmasi volume.

Keuntungan Strategi

- Konfirmasi sinyal ganda mengurangi sinyal palsu melalui verifikasi tren, harga, dan ekspansi volume

- Pengelolaan laba/rugi yang fleksibel dengan menggunakan persentase berbasis take-profit dengan stop-loss trailing

- Sistem visualisasi yang komprehensif untuk pemantauan perdagangan dan sinyal

- Kemampuan penyesuaian yang tinggi dengan parameter kunci yang dapat disesuaikan

- Manajemen risiko sistematis melalui tingkat stop loss dan take profit yang ditetapkan sebelumnya

Risiko Strategi

- Potensi kegagalan palsu di pasar yang berbeda-beda

- Filter volume mungkin melewatkan beberapa sinyal yang valid

- Persentase tetap mengambil keuntungan mungkin keluar terlalu awal dalam tren yang kuat

- Sistem rata-rata bergerak memiliki keterlambatan yang melekat dalam pembalikan cepat

- Kebutuhan untuk mempertimbangkan dampak biaya perdagangan pada laba strategi

Arahan Optimasi

- Memperkenalkan penyesuaian volatilitas untuk penyesuaian dinamis take-profit/stop-loss

- Tambahkan penyaringan kekuatan tren untuk menghindari perdagangan dalam tren yang lemah

- Mengoptimalkan algoritma penyaringan volume dengan mempertimbangkan perubahan volume relatif

- Mengimplementasikan filter berbasis waktu untuk menghindari periode perdagangan yang tidak menguntungkan

- Pertimbangkan klasifikasi sistem pasar untuk adaptasi parameter

Ringkasan

Strategi ini membangun sistem perdagangan lengkap melalui moving average, price breakout, dan verifikasi volume, yang cocok untuk mengikuti tren jangka menengah hingga panjang. Kekuatannya terletak pada konfirmasi beberapa sinyal dan manajemen risiko yang komprehensif, meskipun kinerja di berbagai pasar membutuhkan perhatian. Melalui optimasi yang disarankan, terutama dalam kemampuan beradaptasi, strategi ini memiliki ruang untuk peningkatan stabilitas dan kinerja.

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Strategy combining EMA/SMA Crossover, Swing High/Low, Volume Filtering, and Percentage TP & Trailing Stop

strategy("Swing High/Low Strategy with Volume, EMA/SMA Crossovers, Percentage TP and Trailing Stop", overlay=true)

// --- Inputs ---

source = close

TITLE = input(false, title='Enable Alerts & Background Color for EMA/SMA Crossovers')

turnonAlerts = input(true, title='Turn on Alerts?')

colorbars = input(true, title="Color Bars?")

turnonEMASMA = input(true, title='Turn on EMA1 & SMA2?')

backgroundcolor = input(false, title='Enable Background Color?')

// EMA/SMA Lengths

emaLength = input.int(10, minval=1, title='EMA Length')

smaLength = input.int(21, minval=1, title='SMA Length')

ema1 = ta.ema(source, emaLength)

sma2 = ta.sma(source, smaLength)

// Swing High/Low Lengths

leftBars = input.int(6, title="Left Bars for Swing High/Low", minval=1)

rightBars = input.int(6, title="Right Bars for Swing High/Low", minval=1)

// Volume MA Length

volMaLength = input.int(200, title="Volume Moving Average Length")

// Percentage Take Profit with hundredth place adjustment

takeProfitPercent = input.float(2.00, title="Take Profit Percentage (%)", minval=0.01, step=0.01) / 100

// Trailing Stop Loss Option

useTrailingStop = input.bool(true, title="Enable Trailing Stop Loss?")

trailingStopPercent = input.float(1.00, title="Trailing Stop Loss Percentage (%)", minval=0.01, step=0.01) / 100

// --- Swing High/Low Logic ---

pivotHigh(_leftBars, _rightBars) =>

ta.pivothigh(_leftBars, _rightBars)

pivotLow(_leftBars, _rightBars) =>

ta.pivotlow(_leftBars, _rightBars)

ph = fixnan(pivotHigh(leftBars, rightBars))

pl = fixnan(pivotLow(leftBars, rightBars))

// --- Volume Condition ---

volMa = ta.sma(volume, volMaLength)

// Declare exit conditions as 'var' so they are initialized

var bool longExitCondition = na

var bool shortExitCondition = na

// --- Long Entry Condition: Close above Swing High & Volume >= 200 MA ---

longCondition = (close > ph and volume >= volMa)

if (longCondition)

strategy.entry("Long", strategy.long)

// --- Short Entry Condition: Close below Swing Low & Volume >= 200 MA ---

shortCondition = (close < pl and volume >= volMa)

if (shortCondition)

strategy.entry("Short", strategy.short)

// --- Take Profit and Trailing Stop Logic ---

// For long position: Set take profit at the entry price + takeProfitPercent

longTakeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercent)

shortTakeProfitLevel = strategy.position_avg_price * (1 - takeProfitPercent)

// --- Long Exit Logic ---

if (useTrailingStop)

// Trailing Stop for Long

strategy.exit("Long Exit", "Long", stop=na, trail_offset=strategy.position_avg_price * trailingStopPercent, limit=longTakeProfitLevel)

else

// Exit Long on Take Profit only

strategy.exit("Long Exit", "Long", limit=longTakeProfitLevel)

// --- Short Exit Logic ---

if (useTrailingStop)

// Trailing Stop for Short

strategy.exit("Short Exit", "Short", stop=na, trail_offset=strategy.position_avg_price * trailingStopPercent, limit=shortTakeProfitLevel)

else

// Exit Short on Take Profit only

strategy.exit("Short Exit", "Short", limit=shortTakeProfitLevel)

// --- Plot Swing High/Low ---

plot(ph, style=plot.style_circles, linewidth=1, color=color.blue, offset=-rightBars, title="Swing High")

plot(ph, style=plot.style_line, linewidth=1, color=color.blue, offset=0, title="Swing High")

plot(pl, style=plot.style_circles, linewidth=1, color=color.red, offset=-rightBars, title="Swing High")

plot(pl, style=plot.style_line, linewidth=1, color=color.red, offset=0, title="Swing High")

// --- Plot EMA/SMA ---

plot(turnonEMASMA ? ema1 : na, color=color.green, title="EMA")

plot(turnonEMASMA ? sma2 : na, color=color.orange, title="SMA")

// --- Alerts ---

alertcondition(longCondition, title="Long Entry", message="Price closed above Swing High with Volume >= 200 MA")

alertcondition(shortCondition, title="Short Entry", message="Price closed below Swing Low with Volume >= 200 MA")

// --- Bar Colors for Visualization ---

barcolor(longCondition ? color.green : na, title="Long Entry Color")

barcolor(shortCondition ? color.red : na, title="Short Entry Color")

bgcolor(backgroundcolor ? (ema1 > sma2 ? color.new(color.green, 50) : color.new(color.red, 50)) : na)

- EMA, SMA, Moving Average Crossover, Indikator Momentum

- Strategi Crossover EMA Dual Dinamis dengan Kontrol Keuntungan/Hilang yang Adaptif

- Saluran SSL

- EMA5 dan EMA13 Strategi Crossover

- Indikator: WaveTrend Oscillator

- Strategi Crossover SMA Dual Moving Average

- Dual EMA Volume Trend Confirmation Strategy untuk Perdagangan Kuantitatif

- Strategi perdagangan Take Profit dan Stop Loss yang dinamis berdasarkan tiga lilin bearish berturut-turut dan moving average

- Strategi Crossover Super Moving Average dan Upperband

- EMA Crossover Momentum Scalping Strategi

- Strategi Momentum Crossover Multi-EMA

- MACD-Supertrend Tren Konfirmasi Ganda Mengikuti Strategi Perdagangan

- Strategi Perdagangan Dinamis SuperTrend Multi-Periode

- Multi-Timeframe EMA dengan Fibonacci Retracement dan Pivot Points Trading Strategy

- Strategi perdagangan EMA-Squeeze Stop-Loss Dinamis Multi-Timeframe

- MACD dan Strategi Perdagangan Cerdas Sinyal Ganda Regresi Linear

- Tren Multi-EMA Mengikuti Strategi Perdagangan

- Tren Heikin Ashi yang Diatasi Berbagai Jangka Waktu Mengikuti Sistem Perdagangan Kuantitatif

- Osilator RSI Dinamis Indikator Kecocokan Polinomial Tren Strategi Perdagangan Kuantitatif

- Strategi Perdagangan Satu Arah Penembusan Jangkauan Harian

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- VWAP Standar Deviasi Rata-rata Reversi Strategi Perdagangan

- Strategi Perdagangan Breakout Zona Harga Dinamis Berdasarkan Sistem Kuantitatif Dukungan dan Resistensi

- Strategi Kuantitatif Crossover Trend Momentum Multi-Indikator

- Perhentian Trailing Dinamis Lanjutan dengan Strategi Penargetan Risiko-Penghargaan

- Strategi Breakout Trendline Dinamis Lang-Only Advanced

- Strategi Stop Trailing Dynamic Multi-Level yang cerdas berdasarkan Bollinger Bands dan ATR

- Strategi Crossover EMA Dual Dinamis dengan Kontrol Keuntungan/Hilang yang Adaptif

- Bollinger Bands dan RSI Combined Dynamic Trading Strategy

- RSI-ATR Momentum Volatilitas Strategi Perdagangan Gabungan

- Dual EMA Trend-Following Strategy dengan Limit Buy Entry