Trend Dinamis Multi-Indikator Mengikuti Strategi Berdasarkan EMA dan SMA

Penulis:ChaoZhang, Tanggal: 2024-12-27 14:12:50Tag:EMASMAATRPPsupertrend

Tinjauan Strategi

Strategi ini adalah sistem trend berikut yang dinamis yang menggabungkan beberapa indikator teknis. Ini mengintegrasikan Pivot Points, indikator SuperTrend, dan sinyal crossover rata-rata bergerak untuk mengidentifikasi tren pasar dan peluang perdagangan. Fitur utama strategi ini adalah pendekatan analisis jangka waktu tetap, memastikan konsistensi sinyal sambil memvalidasi sinyal melalui titik pivot.

Prinsip Strategi

Strategi ini beroperasi berdasarkan mekanisme inti berikut:

- Menggunakan data harga jangka waktu tetap untuk analisis, menghindari gangguan dari jangka waktu yang berbeda

- Menghitung SMA berdasarkan EMA 8 periode dan 21 periode untuk membentuk tren setelah dasar

- Menggabungkan titik ATR dan pivot untuk menghitung indikator SuperTrend untuk konfirmasi arah tren

- Hanya menganggap sinyal crossover SMA yang valid jika terjadi dalam 3 periode dari titik pivot

- Menghitung dan melacak secara dinamis level support/resistance untuk referensi trading

Keuntungan Strategi

- Multi-indicator cross-validation meningkatkan keandalan sinyal

- Analisis jangka waktu tetap mengurangi gangguan sinyal palsu

- Validasi titik pivot memastikan perdagangan terjadi pada tingkat harga kunci

- Pelacakan dinamis support/resistance membantu menentukan level stop loss dan take profit

- Indikator SuperTrend memberikan konfirmasi arah tren tambahan

- Pengaturan parameter yang fleksibel memungkinkan penyesuaian untuk kondisi pasar yang berbeda

Risiko Strategi

- Beberapa indikator dapat menyebabkan keterlambatan sinyal

- Dapat menghasilkan sinyal palsu yang berlebihan di berbagai pasar

- Analisis jangka waktu tetap mungkin kehilangan sinyal penting dalam jangka waktu lain

- Validasi titik pivot dapat menyebabkan kehilangan beberapa peluang perdagangan penting

- Optimasi parameter dapat menyebabkan overfitting

Arah Optimasi Strategi

- Memperkenalkan mekanisme penyaringan volatilitas untuk mengurangi frekuensi perdagangan selama periode volatilitas rendah

- Tambahkan indikator konfirmasi kekuatan tren seperti ADX atau MACD

- Mengembangkan sistem parameter adaptif yang menyesuaikan secara dinamis berdasarkan kondisi pasar

- Masukkan analisis volume untuk meningkatkan keandalan sinyal

- Mengimplementasikan mekanisme stop-loss dinamis yang disesuaikan berdasarkan volatilitas pasar

Ringkasan

Strategi ini menetapkan tren yang relatif lengkap mengikuti sistem perdagangan melalui kombinasi beberapa indikator teknis. Keuntungannya utama terletak pada peningkatan keandalan sinyal melalui analisis jangka waktu tetap dan validasi titik pivot. Meskipun ada risiko lag tertentu, ini dapat dikendalikan secara efektif melalui optimasi parameter dan langkah-langkah manajemen risiko. Pedagang disarankan untuk melakukan backtesting menyeluruh sebelum implementasi langsung dan menyesuaikan parameter sesuai dengan karakteristik pasar tertentu.

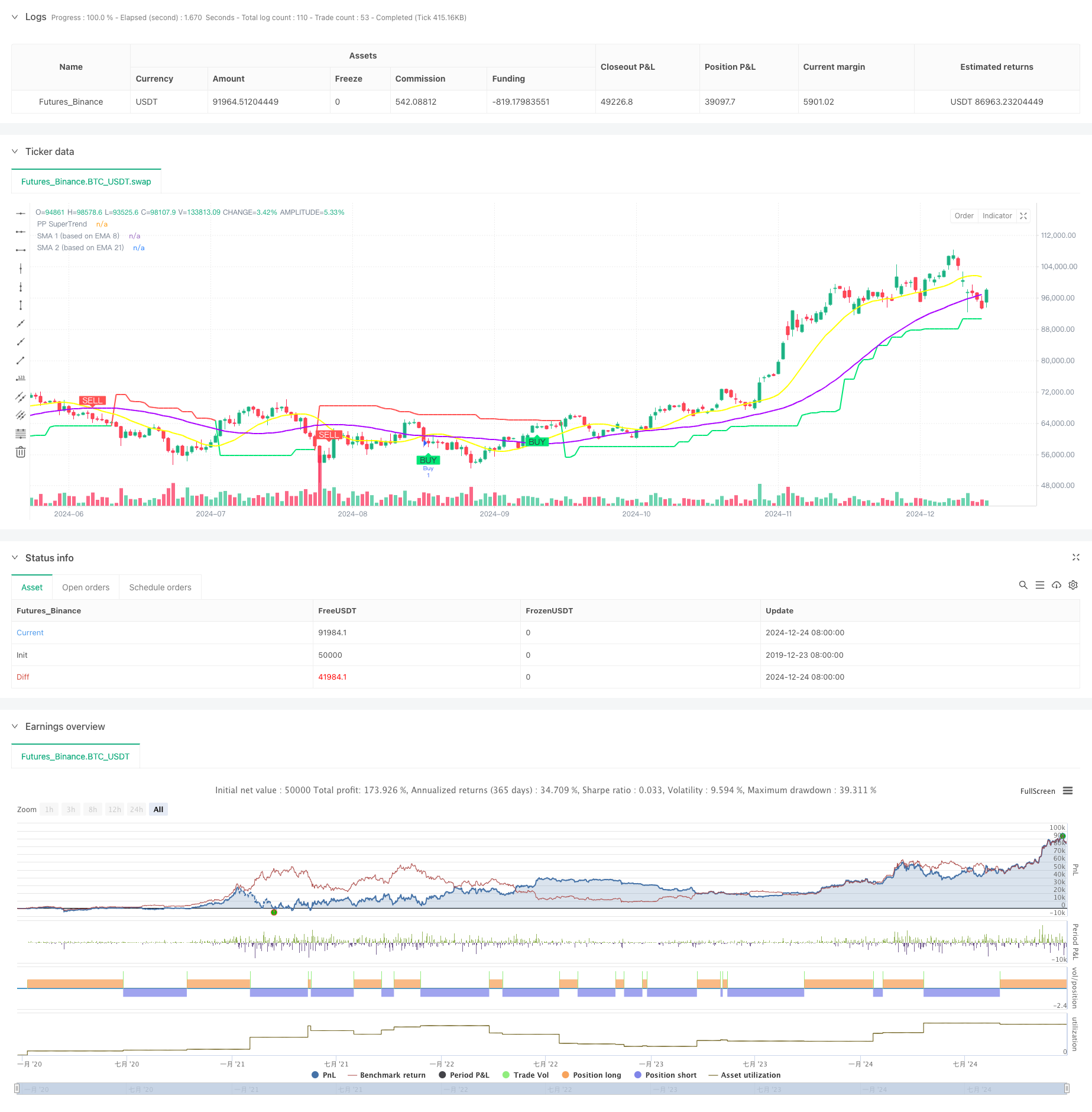

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Buy Sell Pivot Point", overlay=true)

// Input Parameters

prd = input.int(defval=2, title="Periodo Pivot Point", minval=1, maxval=50)

Factor = input.float(defval=3, title="Fator ATR", minval=1, step=0.1)

Pd = input.int(defval=10, title="Periodo ATR", minval=1)

showpivot = input.bool(defval=false, title="Mostrar Pivot Points")

showlabel = input.bool(defval=true, title="Mostrar Buy/Sell Labels")

showcl = input.bool(defval=false, title="Mostrar PP Center Line")

showsr = input.bool(defval=false, title="Mostrar Support/Resistance")

sma1_length = input.int(defval=8, title="SMA 1")

sma2_length = input.int(defval=21, title="SMA 2")

timeframe_fix = input.timeframe("D", title="Timeframe Fixo")

// Request data from the fixed timeframe

fix_close = request.security(syminfo.tickerid, timeframe_fix, close)

fix_high = request.security(syminfo.tickerid, timeframe_fix, high)

fix_low = request.security(syminfo.tickerid, timeframe_fix, low)

fix_ph = request.security(syminfo.tickerid, timeframe_fix, ta.pivothigh(prd, prd))

fix_pl = request.security(syminfo.tickerid, timeframe_fix, ta.pivotlow(prd, prd))

fix_atr = request.security(syminfo.tickerid, timeframe_fix, ta.atr(Pd))

// Convert Pivot High/Low to valid boolean for conditions

ph_cond = not na(fix_ph)

pl_cond = not na(fix_pl)

// Draw Pivot Points

plotshape(ph_cond and showpivot, title="Pivot High", text="H", style=shape.labeldown, color=color.red, textcolor=color.red, location=location.abovebar, offset=-prd)

plotshape(pl_cond and showpivot, title="Pivot Low", text="L", style=shape.labelup, color=color.lime, textcolor=color.lime, location=location.belowbar, offset=-prd)

// Calculate the Center line using pivot points

var float center = na

lastpp = ph_cond ? fix_ph : pl_cond ? fix_pl : na

if not na(lastpp)

center := na(center) ? lastpp : (center * 2 + lastpp) / 3

// Upper/Lower bands calculation

Up = center - (Factor * fix_atr)

Dn = center + (Factor * fix_atr)

// Get the trend

var float TUp = na

var float TDown = na

var int Trend = 0

TUp := na(TUp[1]) ? Up : fix_close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := na(TDown[1]) ? Dn : fix_close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := fix_close > TDown[1] ? 1 : fix_close < TUp[1] ? -1 : nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// Plot the trend

linecolor = Trend == 1 ? color.lime : Trend == -1 ? color.red : na

plot(Trailingsl, color=linecolor, linewidth=2, title="PP SuperTrend")

// Plot Center Line

plot(showcl ? center : na, color=showcl ? (center < fix_close ? color.blue : color.red) : na, title="Center Line")

// Calculate Base EMAs

ema_8 = ta.ema(fix_close, 8)

ema_21 = ta.ema(fix_close, 21)

// Calculate SMAs based on EMAs

sma1 = ta.sma(ema_8, sma1_length)

sma2 = ta.sma(ema_21, sma2_length)

// Plot SMAs

plot(sma1, color=#ffff00, linewidth=2, title="SMA 1 (based on EMA 8)")

plot(sma2, color=#aa00ff, linewidth=2, title="SMA 2 (based on EMA 21)")

// Initialize variables to track pivot points

var float last_pivot_time = na

// Update the pivot time when a new pivot is detected

if (ph_cond)

last_pivot_time := bar_index

if (pl_cond)

last_pivot_time := bar_index

// Calculate the crossover/crossunder signals

buy_signal = ta.crossover(sma1, sma2) // SMA 8 crossing SMA 21 upwards

sell_signal = ta.crossunder(sma1, sma2) // SMA 8 crossing SMA 21 downwards

// Ensure signal is only valid if it happens within 3 candles of a pivot point

valid_buy_signal = buy_signal and (bar_index - last_pivot_time <= 3)

valid_sell_signal = sell_signal and (bar_index - last_pivot_time <= 3)

// Plot Buy/Sell Signals

plotshape(valid_buy_signal and showlabel, title="Buy Signal", text="BUY", style=shape.labelup, color=color.lime, textcolor=color.black, location=location.belowbar)

plotshape(valid_sell_signal and showlabel, title="Sell Signal", text="SELL", style=shape.labeldown, color=color.red, textcolor=color.white, location=location.abovebar)

// Get S/R levels using Pivot Points

var float resistance = na

var float support = na

support := pl_cond ? fix_pl : support[1]

resistance := ph_cond ? fix_ph : resistance[1]

// Plot S/R levels

plot(showsr and not na(support) ? support : na, color=showsr ? color.lime : na, style=plot.style_circles, offset=-prd)

plot(showsr and not na(resistance) ? resistance : na, color=showsr ? color.red : na, style=plot.style_circles, offset=-prd)

// Execute trades based on valid signals

if valid_buy_signal

strategy.entry("Buy", strategy.long)

if valid_sell_signal

strategy.entry("Sell", strategy.short)

// Alerts

alertcondition(valid_buy_signal, title="Buy Signal", message="Buy Signal Detected")

alertcondition(valid_sell_signal, title="Sell Signal", message="Sell Signal Detected")

alertcondition(Trend != Trend[1], title="Trend Changed", message="Trend Changed")

- Adaptive Momentum Trading Strategy dengan SMA Crossover dan SuperTrend

- Black Swan Volatility dan Moving Average Crossover Momentum Tracking Strategi

- Cithakan Alerts ML

- Advanced Multi-Timeframe Ichimoku Cloud Trading Strategy dengan Analisis Multidimensional Dinamis

- Strategi Trading Volatilitas Multi-Indikator RSI-EMA-ATR

- SSL hibrida

- EMA, SMA, CCI, ATR, Perfect Order Moving Average Strategi dengan Sistem Perdagangan Otomatis Indikator Trend Magic

- Multi-Indicator Dynamic Adaptive Position Sizing dengan Strategi Volatilitas ATR

- Strategi Kuantitatif Crossover Trend Momentum Multi-Indikator

- MACD-ATR-EMA Multi-Indikator Tren Dinamis Mengikuti Strategi

- RSI Trend Reversal Trading Strategy dengan ATR Stop Loss dan Kontrol Zona Trading

- Multi-EMA Cross dengan Oscillator dan Strategi Perdagangan Dukungan/Resistansi Dinamis

- Multi-SMA dan Stochastic Combined Trend Mengikuti Strategi Trading

- Adaptive Dynamic Trading Strategy Berdasarkan Standardized Logarithmic Returns

- Multi-Indikator Cross-Trend Mengikuti Strategi Trading: Analisis Kuantitatif Berdasarkan Stochastic RSI dan Sistem Moving Average

- Multi-Indicator Trend Crossing Strategy: Bull Market Support Band Trading System (Sistem Perdagangan Band Dukungan Bursa)

- Multi-Level Dynamic MACD Trend Following Strategy dengan Sistem Analisis Ekstensi Tinggi/Rendah 52-Minggu

- Sistem Perdagangan Pembalikan Tren Momentum RSI Dual EMA - Strategi Terobosan Momentum Berdasarkan EMA dan RSI Crossover

- Strategi perdagangan rentang frekuensi tinggi multi-indikator

- Strategi Trading Reversal Trendline Breakout yang Dinamis

- Peningkatan Fibonacci Trend Following dan Strategi Manajemen Risiko

- Adaptive Multi-State EMA-RSI Momentum Strategy dengan Sistem Filter Indeks Choppiness

- Sistem Optimasi Strategi Perdagangan Rata-rata Bergerak Eksponensial Cerdas

- Strategi Perdagangan Divergensi Sistem Harga Volatilitas Berbasis AI

- Multi-EMA Trend-Following Swing Trading Strategy dengan manajemen risiko berbasis ATR

- Strategi pembalikan rata-rata yang ditingkatkan dengan Bollinger Bands dan Integrasi RSI

- Divergensi RSI Multi-Periode dengan Strategi Perdagangan Kuantitatif Dukungan/Resistensi

- Adaptive Trend Following Strategy dengan Sistem Pengendalian Penarikan Dinamis

- Strategi Golden Cross Multi-EMA dengan tingkat Take-Profit

- Multi-Technical Indicator Cross-Trend Tracking Strategy: RSI dan Stochastic RSI Synergy Trading System