Strategi perdagangan stop trailing multi-indikator dinamis

Penulis:ChaoZhang, Tanggal: 2025-01-06 11:51:53Tag:CPREMARSIATRR2R

Gambaran umum

Strategi ini adalah sistem perdagangan yang komprehensif yang menggabungkan Central Pivot Range (CPR), Exponential Moving Average (EMA), Relative Strength Index (RSI), dan logika breakout. Strategi ini menggunakan mekanisme stop-loss trailing dinamis berbasis ATR, memanfaatkan beberapa indikator teknis untuk mengidentifikasi tren pasar dan peluang perdagangan sambil menerapkan manajemen risiko dinamis.

Prinsip Strategi

Strategi ini didasarkan pada beberapa komponen inti:

- Indikator CPR untuk menentukan level support dan resistance utama, menghitung titik pivot harian, level atas dan bawah.

- Sistem EMA ganda (9 hari dan 21 hari) untuk identifikasi arah tren melalui crossover.

- Indikator RSI (14-hari) untuk mengkonfirmasi kondisi overbought/oversold dan penyaringan sinyal.

- Logika breakout yang menggabungkan price break dari titik pivot untuk konfirmasi sinyal.

- Indikator ATR untuk stop-loss trailing dinamis, menyesuaikan jarak stop secara adaptif berdasarkan volatilitas pasar.

Keuntungan Strategi

- Integrasi beberapa indikator teknis meningkatkan keandalan sinyal.

- Mekanisme stop-loss trailing yang dinamis secara efektif mengunci keuntungan dan mengendalikan risiko.

- Indikator CPR menyediakan titik referensi harga penting untuk posisi struktur pasar yang akurat.

- Strategi menunjukkan kemampuan beradaptasi yang baik dengan parameter yang dapat disesuaikan dengan kondisi pasar yang berbeda.

- Filter RSI dan konfirmasi breakout meningkatkan kualitas sinyal perdagangan.

Risiko Strategi

- Berbagai indikator dapat menghasilkan sinyal yang tertinggal dan palsu di pasar yang bergolak.

- Trailing stops dapat dipicu prematur selama periode volatilitas tinggi.

- Optimasi parameter membutuhkan pertimbangan karakteristik pasar; pengaturan yang tidak tepat dapat mempengaruhi kinerja strategi.

- Konflik sinyal dapat mempengaruhi akurasi keputusan.

Arah Optimasi Strategi

- Masukkan indikator volume untuk mengkonfirmasi validitas price breakout.

- Tambahkan filter kekuatan tren untuk meningkatkan akurasi tren berikut.

- Mengoptimalkan mekanisme penyesuaian dinamis untuk parameter stop-loss untuk meningkatkan perlindungan.

- Menerapkan mekanisme adaptasi volatilitas pasar untuk penyesuaian parameter dinamis.

- Pertimbangkan untuk menambahkan indikator sentimen untuk meningkatkan waktu pasar.

Ringkasan

Strategi ini membangun sistem perdagangan yang komprehensif melalui efek sinergis dari beberapa indikator teknis. Mekanisme stop-loss dinamis dan konfirmasi sinyal multi-dimensi memberikan karakteristik risiko-pahala yang menguntungkan. Potensi optimasi strategi terutama terletak pada peningkatan kualitas sinyal dan penyempurnaan manajemen risiko. Melalui optimasi dan penyesuaian terus-menerus, strategi menunjukkan janji dalam mempertahankan kinerja yang stabil di berbagai kondisi pasar.

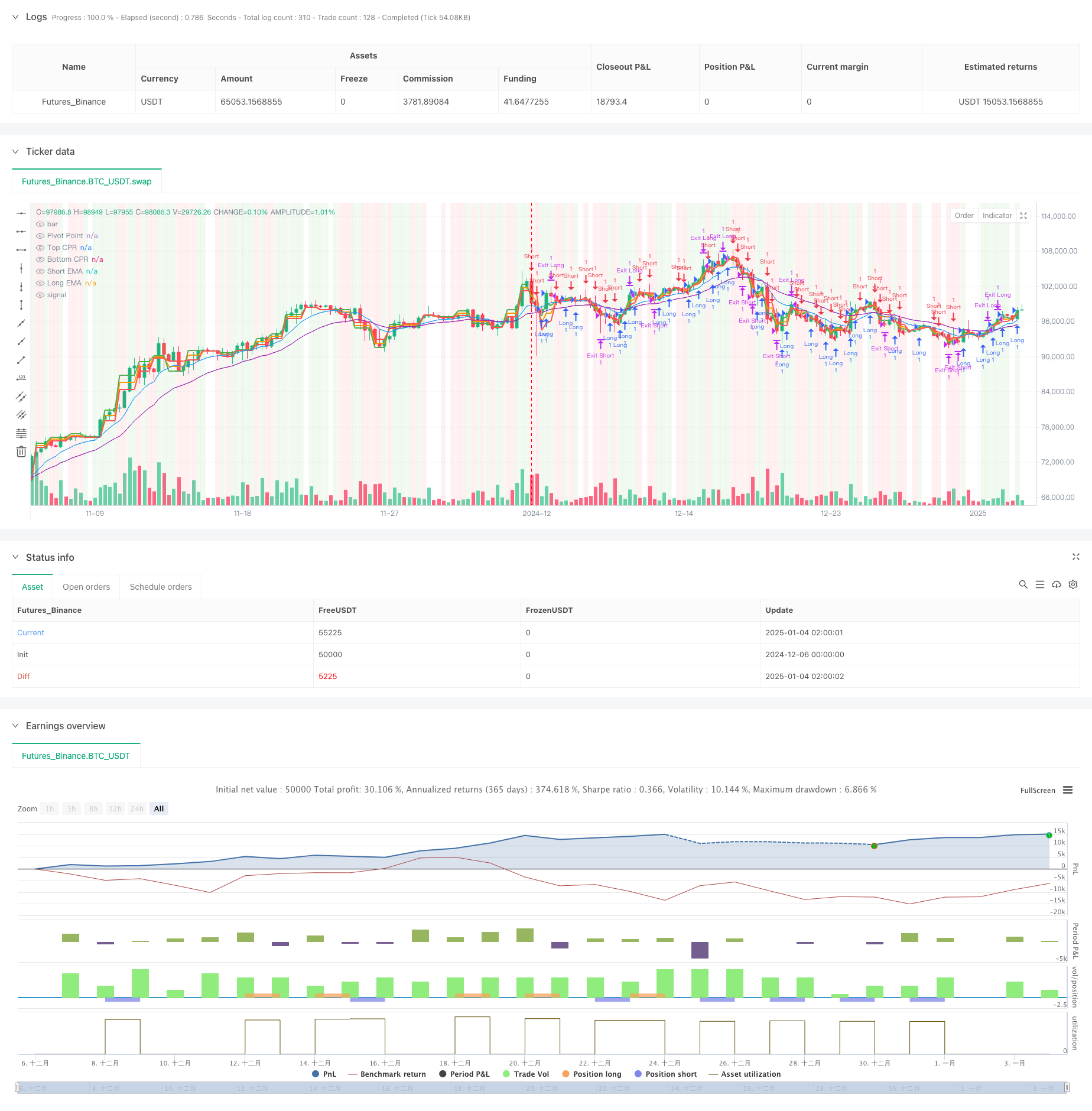

/*backtest

start: 2024-12-06 00:00:00

end: 2025-01-04 08:00:00

period: 7h

basePeriod: 7h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Enhanced CPR + EMA + RSI + Breakout Strategy", overlay=true)

// Inputs

ema_short = input(9, title="Short EMA Period")

ema_long = input(21, title="Long EMA Period")

cpr_lookback = input.timeframe("D", title="CPR Timeframe")

atr_multiplier = input.float(1.5, title="ATR Multiplier")

rsi_period = input(14, title="RSI Period")

rsi_overbought = input(70, title="RSI Overbought Level")

rsi_oversold = input(30, title="RSI Oversold Level")

breakout_buffer = input.float(0.001, title="Breakout Buffer (in %)")

// Calculate EMAs

short_ema = ta.ema(close, ema_short)

long_ema = ta.ema(close, ema_long)

// Request Daily Data for CPR Calculation

high_cpr = request.security(syminfo.tickerid, cpr_lookback, high)

low_cpr = request.security(syminfo.tickerid, cpr_lookback, low)

close_cpr = request.security(syminfo.tickerid, cpr_lookback, close)

// CPR Levels

pivot = (high_cpr + low_cpr + close_cpr) / 3

bc = (high_cpr + low_cpr) / 2

tc = pivot + (pivot - bc)

// ATR for Stop-Loss and Take-Profit

atr = ta.atr(14)

// RSI Calculation

rsi = ta.rsi(close, rsi_period)

// Entry Conditions with RSI Filter and Breakout Logic

long_condition = ((close > tc) and (ta.crossover(short_ema, long_ema)) and (rsi > 50 and rsi < rsi_overbought)) or (rsi > 80) or (close > (pivot + pivot * breakout_buffer))

short_condition = ((close < bc) and (ta.crossunder(short_ema, long_ema)) and (rsi < 50 and rsi > rsi_oversold)) or (rsi < 20) or (close < (pivot - pivot * breakout_buffer))

// Dynamic Exit Logic

long_exit = short_condition

short_exit = long_condition

// Trailing Stop-Loss Implementation

if long_condition

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", from_entry="Long",

trail_points=atr * atr_multiplier,

trail_offset=atr * atr_multiplier / 2)

if short_condition

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", from_entry="Short",

trail_points=atr * atr_multiplier,

trail_offset=atr * atr_multiplier / 2)

// Plot CPR Levels and EMAs

plot(pivot, title="Pivot Point", color=color.orange, linewidth=2)

plot(tc, title="Top CPR", color=color.green, linewidth=2)

plot(bc, title="Bottom CPR", color=color.red, linewidth=2)

plot(short_ema, title="Short EMA", color=color.blue, linewidth=1)

plot(long_ema, title="Long EMA", color=color.purple, linewidth=1)

// Highlight Buy and Sell Signals

bgcolor(long_condition ? color.new(color.green, 90) : na, title="Buy Signal Highlight")

bgcolor(short_condition ? color.new(color.red, 90) : na, title="Sell Signal Highlight")

- Strategi perdagangan kuantitatif multi-frame berdasarkan EMA-Smoothed RSI dan ATR Dynamic Stop-Loss/Take-Profit

- RSI50_EMA Strategi Hanya Berjangka

- Strategi Momentum Pembalikan Saluran Tren Emas

- 4-jam timeframe mengangkut pola strategi perdagangan dengan dinamis mengambil keuntungan dan stop loss optimasi

- Tren RSI Multi-Periode Stop-Loss Dinamis Mengikuti Strategi

- Sistem perdagangan ATR-RSI Enhanced Trend Following

- EMA RSI Crossover Strategi

- Han Yue - Tren Mengikuti Strategi Trading Berdasarkan Multiple EMA, ATR dan RSI

- Strategi Piramida Cerdas Berbagai Indikator

- Strategi Perdagangan AlphaTradingBot

- Strategi Perdagangan Crossover Momentum Rata-rata Bergerak Eksponensial Ganda

- RSI dan Bollinger Bands Synergistic Swing Trading Strategy

- Tren Momentum Ichimoku Cloud Trading Strategi

- Multi-Moving Average Supertrend dengan Bollinger Breakout Trading Strategy

- Strategi Kuantitatif Crossover Rata-rata Bergerak Dinamis Multi-Indikator

- Rata-rata Bergerak Dua Periode dengan Momentum RSI dan Tren Volume Mengikuti Strategi

- RSI Trend Breakthrough dan Momentum Enhancement Strategi Perdagangan

- Tren Dinamis Dual EMA Crossover Mengikuti Strategi Perdagangan Kuantitatif

- Adaptive Trend Flow Multiple Filter Strategi Perdagangan

- Indikator Teknis Dual Dinamis Strategi Perdagangan Konfirmasi Terlalu Terjual-Terlalu Dibeli

- Sistem osilator stokastik EMA ganda: Model perdagangan kuantitatif yang menggabungkan trend berikut dan momentum

- Strategi Perdagangan Volatilitas Dinamis Multi-Indikator

- Teori Perdagangan Dinamis: Eksponensial Moving Average dan Cumulative Volume Periode Crossover Strategy

- Strategi Crossover EMA Dinamis dengan Sistem Penyaringan Kekuatan Tren ADX

- Strategi Perdagangan Kuantitatif

- Adaptive Channel Breakout Strategy dengan Dynamic Support and Resistance Trading System

- Filter Dinamis EMA Cross Strategy untuk Analisis Tren Harian

- Multi-EMA Crossover dengan Camarilla Support/Resistance Trend Trading System

- Strategi Perdagangan Dinamis Trend Multi-Signal yang Ditingkatkan

- Adaptive Momentum Martingale Trading System (Sistem Perdagangan Momentum Martingale yang Adaptif)