Adaptive Fibonacci Bollinger Bands Analisis Strategi

Penulis:ChaoZhang, Tanggal: 2025-01-06 16:41:48Tag:ATRBBSMAFIB

Gambaran umum

Strategi ini adalah sistem perdagangan inovatif yang menggabungkan urutan Fibonacci dan Bollinger Bands. Ini menggantikan perkali standar deviasi Bollinger Bands tradisional dengan rasio Fibonacci (1.618, 2.618, 4.236), menciptakan sistem penilaian volatilitas harga yang unik. Strategi ini mencakup fitur manajemen perdagangan yang komprehensif, termasuk pengaturan stop-loss / take-profit dan filter jendela waktu perdagangan, menjadikannya sangat praktis dan fleksibel.

Prinsip Strategi

Logika inti didasarkan pada interaksi harga dengan Fibonacci Bollinger Bands. Pertama menghitung Simple Moving Average (SMA) sebagai band tengah, kemudian menggunakan ATR dikalikan dengan rasio Fibonacci yang berbeda untuk membentuk band atas dan bawah. Sinyal perdagangan dihasilkan ketika harga pecah melalui band Fibonacci yang dipilih pengguna. Secara khusus, sinyal panjang dipicu ketika harga rendah di bawah dan harga tinggi di atas band beli target; sinyal pendek dipicu ketika harga rendah di bawah dan harga tinggi di atas band jual target.

Keuntungan Strategi

- Adaptabilitas yang kuat: Mengatur lebar pita secara dinamis melalui ATR, lebih beradaptasi dengan kondisi pasar yang berbeda

- Fleksibilitas tinggi: Pengguna dapat memilih berbagai pita Fibonacci sebagai sinyal perdagangan berdasarkan gaya trading mereka

- Manajemen Risiko yang Komprehensif: Fungsi take profit/stop-loss dan penyaringan waktu yang dibangun secara efektif mengendalikan risiko

- Visual Intuitif: Tingkat transparansi yang berbeda dari area pita membantu pedagang memahami struktur pasar

- Logika Perhitungan yang Jelas: Menggunakan kombinasi indikator teknis klasik, mudah dimengerti dan dipelihara

Risiko Strategi

- Risiko Pemecahan Palsu: Harga dapat segera kembali setelah pemecahan, menghasilkan sinyal palsu

- Sensitivitas Parameter: Pilihan rasio Fibonacci yang berbeda secara signifikan mempengaruhi kinerja strategi

- Time Dependency: Ketika jendela perdagangan diaktifkan, mungkin kehilangan peluang perdagangan penting

- Kecenderungan lingkungan pasar: Dapat menghasilkan sinyal yang berlebihan di berbagai pasar

Arah Optimasi Strategi

- Mekanisme Konfirmasi Sinyal: Saran untuk menambahkan indikator volume atau momentum untuk konfirmasi breakout

- Optimasi Parameter Dinamis: Sesuaikan rasio Fibonacci secara otomatis berdasarkan volatilitas pasar

- Penyaringan Lingkungan Pasar: Tambahkan fungsi identifikasi tren, gunakan parameter yang berbeda dalam kondisi pasar yang berbeda

- Sistem Penimbangan Sinyal: Membuat analisis multi-frame waktu untuk meningkatkan keandalan sinyal

- Optimasi Manajemen Posisi: Sesuaikan ukuran posisi secara dinamis berdasarkan volatilitas pasar dan kekuatan sinyal

Ringkasan

Strategi ini secara inovatif menggabungkan alat analisis teknis klasik dengan mengoptimalkan Bollinger Bands tradisional dengan urutan Fibonacci. Keuntungannya utama terletak pada kemampuan beradaptasi dan fleksibilitas, tetapi perhatian harus diberikan pada pemilihan parameter dan kompatibilitas lingkungan pasar. Strategi ini memiliki potensi peningkatan yang signifikan melalui penambahan indikator konfirmasi tambahan dan mengoptimalkan mekanisme generasi sinyal.

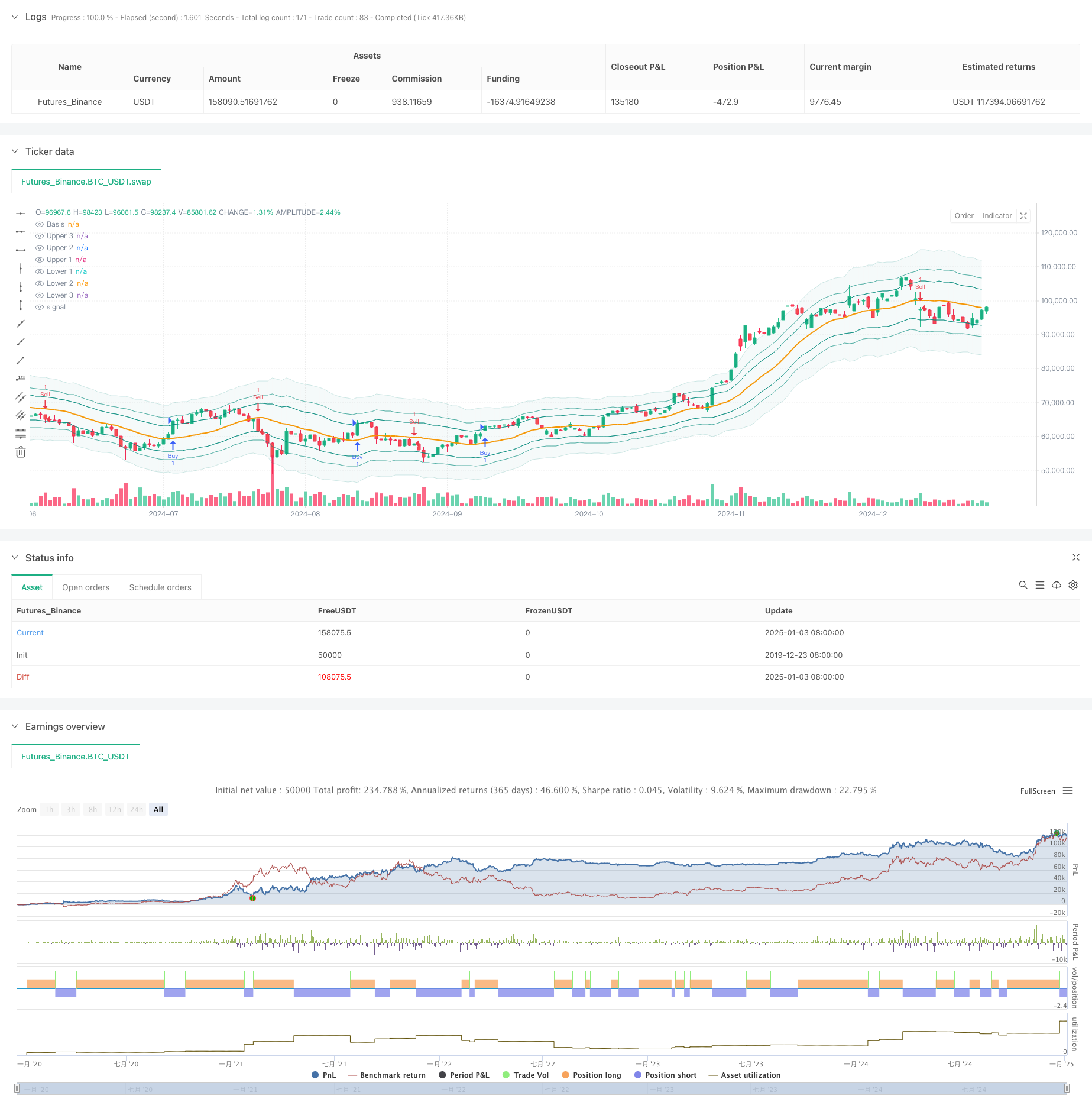

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// © sapphire_edge

// # ========================================================================= #

// #

// # _____ __ _ ______ __

// # / ___/____ _____ ____ / /_ (_)_______ / ____/___/ /___ ____

// # \__ \/ __ `/ __ \/ __ \/ __ \/ / ___/ _ \ / __/ / __ / __ `/ _ \

// # ___/ / /_/ / /_/ / /_/ / / / / / / / __/ / /___/ /_/ / /_/ / __/

// # /____/\__,_/ .___/ .___/_/ /_/_/_/ \___/ /_____/\__,_/\__, /\___/

// # /_/ /_/ /____/

// #

// # ========================================================================= #

strategy(shorttitle="⟡Sapphire⟡ FiboBands Strategy", title="[Sapphire] Fibonacci Bollinger Bands Strategy", initial_capital= 50000, currency= currency.USD,default_qty_value = 1,commission_type= strategy.commission.cash_per_contract,overlay= true )

// # ========================================================================= #

// # // Settings Menu //

// # ========================================================================= #

// -------------------- Main Settings -------------------- //

groupFiboBands = "FiboBands"

length = input.int(20, minval = 1, title = 'Length', group=groupFiboBands)

src = input(close, title = 'Source', group=groupFiboBands)

offset = input.int(0, 'Offset', minval = -500, maxval = 500, group=groupFiboBands)

fibo1 = input(defval = 1.618, title = 'Fibonacci Ratio 1', group=groupFiboBands)

fibo2 = input(defval = 2.618, title = 'Fibonacci Ratio 2', group=groupFiboBands)

fibo3 = input(defval = 4.236, title = 'Fibonacci Ratio 3', group=groupFiboBands)

fiboBuy = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Buy', group=groupFiboBands)

fiboSell = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Sell', group=groupFiboBands)

showSignals = input.bool(true, title="Show Signals", group=groupFiboBands)

signalOffset = input.int(5, title="Signal Vertical Offset", group=groupFiboBands)

// -------------------- Trade Management Inputs -------------------- //

groupTradeManagement = "Trade Management"

useProfitPerc = input.bool(false, title="Enable Profit Target", group=groupTradeManagement)

takeProfitPerc = input.float(1.0, title="Take Profit (%)", step=0.1, group=groupTradeManagement)

useStopLossPerc = input.bool(false, title="Enable Stop Loss", group=groupTradeManagement)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", step=0.1, group=groupTradeManagement)

// -------------------- Time Filter Inputs -------------------- //

groupTimeOfDayFilter = "Time of Day Filter"

useTimeFilter1 = input.bool(false, title="Enable Time Filter 1", group=groupTimeOfDayFilter)

startHour1 = input.int(0, title="Start Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

startMinute1 = input.int(0, title="Start Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

endHour1 = input.int(23, title="End Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

endMinute1 = input.int(45, title="End Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

closeAtEndTimeWindow = input.bool(false, title="Close Trades at End of Time Window", group=groupTimeOfDayFilter)

// -------------------- Trading Window -------------------- //

isWithinTradingWindow(startHour, startMinute, endHour, endMinute) =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

startInMinutes = startHour * 60 + startMinute

endInMinutes = endHour * 60 + endMinute

timeInMinutes >= startInMinutes and timeInMinutes <= endInMinutes

timeCondition = (useTimeFilter1 ? isWithinTradingWindow(startHour1, startMinute1, endHour1, endMinute1) : true)

// Check if the current bar is the last one within the specified time window

isEndOfTimeWindow() =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

endInMinutes = endHour1 * 60 + endMinute1

timeInMinutes == endInMinutes

// Logic to close trades if the time window ends

if timeCondition and closeAtEndTimeWindow and isEndOfTimeWindow()

strategy.close_all(comment="Closing trades at end of time window")

// # ========================================================================= #

// # // Calculations //

// # ========================================================================= #

sma = ta.sma(src, length)

atr = ta.atr(length)

ratio1 = atr * fibo1

ratio2 = atr * fibo2

ratio3 = atr * fibo3

upper3 = sma + ratio3

upper2 = sma + ratio2

upper1 = sma + ratio1

lower1 = sma - ratio1

lower2 = sma - ratio2

lower3 = sma - ratio3

// # ========================================================================= #

// # // Signal Logic //

// # ========================================================================= #

// -------------------- Entry Logic -------------------- //

targetBuy = fiboBuy == 'Fibo 1' ? upper1 : fiboBuy == 'Fibo 2' ? upper2 : upper3

buy = low < targetBuy and high > targetBuy

// -------------------- User-Defined Exit Logic -------------------- //

targetSell = fiboSell == 'Fibo 1' ? lower1 : fiboSell == 'Fibo 2' ? lower2 : lower3

sell = low < targetSell and high > targetSell

// # ========================================================================= #

// # // Strategy Management //

// # ========================================================================= #

// -------------------- Trade Execution Flags -------------------- //

var bool buyExecuted = false

var bool sellExecuted = false

float labelOffset = ta.atr(14) * signalOffset

// -------------------- Buy Logic -------------------- //

if buy and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Buy", strategy.long, stop=(useStopLossPerc ? close * (1 - stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 + takeProfitPerc / 100) : na))

else

strategy.entry("Buy", strategy.long)

if showSignals and not buyExecuted

buyExecuted := true

sellExecuted := false

label.new(bar_index, high - labelOffset, "◭", style=label.style_label_up, color = color.rgb(119, 0, 255, 20), textcolor=color.white)

// -------------------- Sell Logic -------------------- //

if sell and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Sell", strategy.short, stop=(useStopLossPerc ? close * (1 + stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 - takeProfitPerc / 100) : na))

else

strategy.entry("Sell", strategy.short)

if showSignals and not sellExecuted

sellExecuted := true

buyExecuted := false

label.new(bar_index, low + labelOffset, "⧩", style=label.style_label_down, color = color.rgb(255, 85, 0, 20), textcolor=color.white)

// # ========================================================================= #

// # // Plots and Charts //

// # ========================================================================= #

plot(sma, style = plot.style_line, title = 'Basis', color = color.new(color.orange, 0), linewidth = 2, offset = offset)

upp3 = plot(upper3, title = 'Upper 3', color = color.new(color.teal, 90), offset = offset)

upp2 = plot(upper2, title = 'Upper 2', color = color.new(color.teal, 60), offset = offset)

upp1 = plot(upper1, title = 'Upper 1', color = color.new(color.teal, 30), offset = offset)

low1 = plot(lower1, title = 'Lower 1', color = color.new(color.teal, 30), offset = offset)

low2 = plot(lower2, title = 'Lower 2', color = color.new(color.teal, 60), offset = offset)

low3 = plot(lower3, title = 'Lower 3', color = color.new(color.teal, 90), offset = offset)

fill(upp3, low3, title = 'Background', color = color.new(color.teal, 95))

- Bollinger Band ATR Trend Mengikuti Strategi

- Multi-Periode Bollinger Bands Touch Trend Reversal Strategi Perdagangan Kuantitatif

- Bollinger Bands Momentum Optimization Strategi

- Strategi RSI dan Bollinger Bands Breakout dengan presisi tinggi dengan rasio risiko-imbalan yang dioptimalkan

- Strategi perdagangan yang seimbang berbasis waktu dengan rotasi jangka panjang dan jangka pendek

- Strategi Pemecahan Momentum dengan Standar Penyimpangan Ganda Bollinger Bands

- Strategi Kuantitatif Reversi Rata-rata Bollinger yang Ditingkatkan

- Strategi lintas rata-rata bergerak dinamis dan Bollinger Bands dengan model optimasi stop-loss tetap

- Triple Supertrend dan Bollinger Bands Multi-Indicator Trend Mengikuti Strategi

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Strategi Perdagangan Piramida Dinamis Supertrend Multi-Periode

- Strategi kuantitatif lintas SMA tren jangka panjang

- Trend Fusi Indikator Multi-Teknis Mengikuti Strategi Perdagangan Kuantitatif

- Indikator Multi-Teknis Momentum-MA Trend Mengikuti Strategi

- Sistem Perdagangan Crossover EMA Tiga dengan Smart R2R berbasis Stop Loss Management

- Strategi kuantitatif EMA lintas frekuensi tinggi yang didorong oleh volatilitas dinamis

- Strategi perdagangan pembalikan momentum indikator teknis ganda dengan sistem manajemen risiko

- Strategi perdagangan kuantitatif multi-frame berdasarkan EMA-Smoothed RSI dan ATR Dynamic Stop-Loss/Take-Profit

- Strategi perdagangan pola candlestick multi-frame

- Algoritma Perdagangan Tren Dinamis Supertrend Multi-Timeframe

- Strategi Trading Crossover MACD Lanjutan dengan Manajemen Risiko Adaptif

- Strategi Penangkapan Tren Kuantitatif Berdasarkan Analisis Panjang Wick Candle

- Strategi Perdagangan Breakout VWAP dengan Penyimpangan Standar Ganda

- Strategi Jaringan Panjang Berdasarkan Penarikan dan Target Keuntungan

- Trend crossover rata-rata bergerak dinamis mengikuti strategi dengan sistem manajemen risiko ATR

- Multi-Indikator Optimized KDJ Trend Crossover Strategy Berdasarkan Sistem Perdagangan Pola Stochastic Dinamis

- Multi-Timeframe Heikin-Ashi Moving Average Trend Mengikuti Sistem Perdagangan

- Tren Dinamis yang Disesuaikan dengan Volatilitas Mengikuti Strategi Berdasarkan Indikator DI dengan Manajemen Stop ATR