概要

この戦略は,ブリン帯 ((Bollinger Bands),相対的に強い指標 ((RSI) と動的コスト平均 ((DCA) を組み合わせた量的な取引システムである.戦略は,資金管理のルールを設定し,市場の波動で自動的にバッチアップポーズ操作を実行し,同時に,技術指標と組み合わせて,買入シグナル判断を行い,リスクを制御できる取引実行を実現する.システムには,ストップストップロジックと累積利益の追跡機能が含まれ,取引のパフォーマンスを効果的に監視および管理することができます.

戦略原則

この戦略は主に以下のコアコンポーネントに基づいています。

- ブリン帯の指標は,価格の波動区間を判断するために使用され,価格が下線に触れたときに購入を検討し,上線に触れたときに販売を検討します.

- RSI指標は,市場がオーバーバイオーバーセール状態を確認するために使用されます.RSIが25を下回るとオーバーセールが確認され,75を超えるとオーバーセールが確認されます.

- DCAモジュールは,口座権益の動向に基づいて,各ポジションの金額を計算し,資金の自在管理を実現する.

- ストップモジュールで5%の利益目標設定,目標を達成 自動平仓保護利益

- 市場状況モニタリングモジュールは,90日間の市場変動の幅を計算し,全体的なトレンドを判断するのに役立ちます.

- 累積利益トラッキングモジュールは,戦略のパフォーマンスを評価するために,各取引の利益と損失を記録します.

戦略的優位性

- 複数の技術指標のクロス検証と組み合わせた信号信頼性の向上

- 固定ポジションのリスクを回避するために,ダイナミックポジション管理を採用

- 合理的な停止条件を設定し,利益を間に合うようにロックする

- 市場動向を監視する機能で,全体像を把握する

- 戦略のパフォーマンスを分析するための優れた利益追跡システム

- 取引機会をリアルタイムで警告する 警告機能の配置

戦略リスク

- 市場の揺れが頻繁にシグナルを誘発し,取引コストが上昇する可能性があります.

- RSIはトレンドマーケットで遅れをとる可能性がある

- 固定比率のストップは,強いトレンドの市場から早めに撤退する可能性がある.

- DCAの戦略は,市場が一方的に下落すると,大きな後退を引き起こす可能性がある. リスクを管理するために、次の対策が推奨されます。

- ポジションの最大限を設定する

- 市場変動による動的調整パラメータ

- トレンドフィルターを追加

- 段階的停止策を導入する

戦略最適化の方向性

- パラメータの動的最適化:

- ブリン帯のパラメータは波動率に応じて自律的に調整できる

- RSIの値は市場周期によって変化します.

- DCAの資金比率は,口座のサイズに合わせて調整できます.

- 信号システム強化:

- 音量を上げる確認

- トレンドライン分析

- 複数の技術指標のクロス検証

- リスクの管理は完璧です.

- ダイナミック・ストローを実現する

- 追加最大撤回コントロール

- 1日の損失制限を設定します.

要約する

この戦略は,総合的な技術分析と資金管理方法の適用によって,比較的完全な取引システムを構築している.この戦略の優点は,複数の信号の確認と優れたリスク管理にあるが,まだ実盤で十分なテストと最適化が必要である.パラメータ設定の継続的な改善と補助指標の追加により,この戦略は,実際の取引で安定したパフォーマンスを期待されている.

ストラテジーソースコード

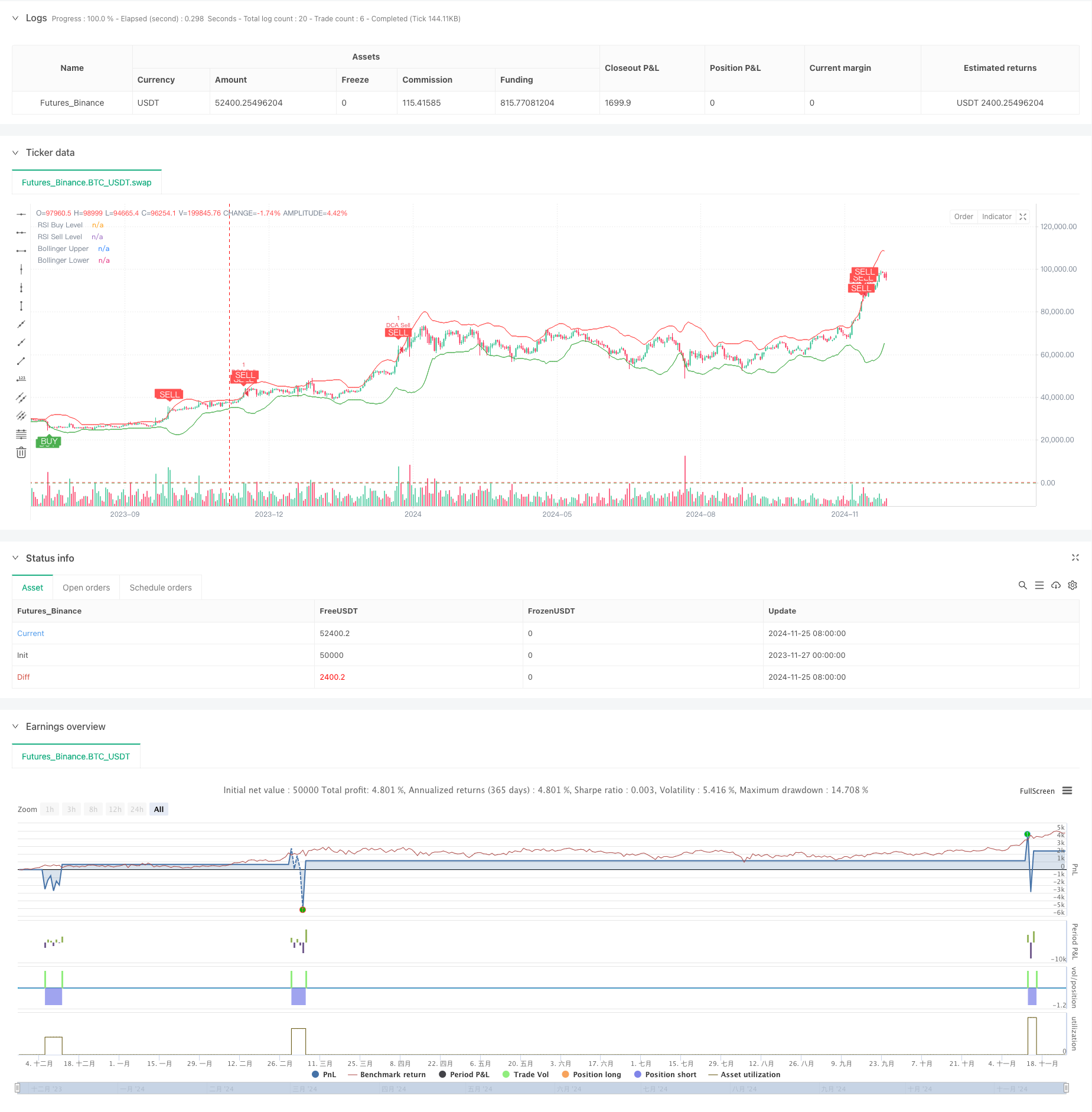

/*backtest

start: 2023-11-27 00:00:00

end: 2024-11-26 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined BB RSI with Cumulative Profit, Market Change, and Futures Strategy (DCA)", shorttitle="BB RSI Combined DCA Strategy", overlay=true)

// Input Parameters

length = input.int(20, title="BB Length") // Adjusted BB length

mult = input.float(2.5, title="BB Multiplier") // Adjusted BB multiplier

rsiLength = input.int(14, title="RSI Length") // Adjusted RSI length

rsiBuyLevel = input.int(25, title="RSI Buy Level") // Adjusted RSI Buy Level

rsiSellLevel = input.int(75, title="RSI Sell Level") // Adjusted RSI Sell Level

dcaPositionSizePercent = input.float(1, title="DCA Position Size (%)", tooltip="Percentage of equity to use in each DCA step")

takeProfitPercentage = input.float(5, title="Take Profit (%)", tooltip="Take profit percentage for DCA strategy")

// Calculate DCA position size

equity = strategy.equity // Account equity

dcaPositionSize = (equity * dcaPositionSizePercent) / 100 // DCA position size as percentage of equity

// Bollinger Bands Calculation

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// Plotting Bollinger Bands and RSI levels

plot(upper, color=color.red, title="Bollinger Upper")

plot(lower, color=color.green, title="Bollinger Lower")

hline(rsiBuyLevel, "RSI Buy Level", color=color.green)

hline(rsiSellLevel, "RSI Sell Level", color=color.red)

// Buy and Sell Signals

buySignal = (rsi < rsiBuyLevel and close <= lower)

sellSignal = (rsi > rsiSellLevel and close >= upper)

// DCA Strategy: Enter Long or Short based on signals with calculated position size

if (buySignal)

strategy.entry("DCA Buy", strategy.long)

if (sellSignal)

strategy.entry("DCA Sell", strategy.short)

// Take Profit Logic

if (strategy.position_size > 0) // If long

strategy.exit("Take Profit Long", from_entry="DCA Buy", limit=close * (1 + takeProfitPercentage / 100))

if (strategy.position_size < 0) // If short

strategy.exit("Take Profit Short", from_entry="DCA Sell", limit=close * (1 - takeProfitPercentage / 100))

// Plot Buy/Sell Signals on the chart

plotshape(buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", textcolor=color.white)

plotshape(sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", textcolor=color.white)

// Alerts for Buy/Sell Signals

alertcondition(buySignal, title="Buy Alert", message="Buy Signal Detected")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal Detected")

// Cumulative Profit Calculation

var float buyPrice = na

var float profit = na

var float cumulativeProfit = 0.0 // Cumulative profit tracker

if (buySignal)

buyPrice := close

if (sellSignal and not na(buyPrice))

profit := (close - buyPrice) / buyPrice * 100

cumulativeProfit := cumulativeProfit + profit // Update cumulative profit

label.new(bar_index, high, text="P: " + str.tostring(profit, "#.##") + "%", color=color.blue, style=label.style_label_down)

buyPrice := na // Reset buyPrice after sell

// Plot cumulative profit on the chart

var label cumulativeLabel = na

if (not na(cumulativeProfit))

if not na(cumulativeLabel)

label.delete(cumulativeLabel)

cumulativeLabel := label.new(bar_index, high + 10, text="Cumulative Profit: " + str.tostring(cumulativeProfit, "#.##") + "%", color=color.purple, style=label.style_label_up)

// Market Change over 3 months Calculation

threeMonthsBars = 3 * 30 * 24 // Approximation of 3 months in bars (assuming 1 hour per bar)

priceThreeMonthsAgo = request.security(syminfo.tickerid, "D", close[threeMonthsBars])

marketChange = (close - priceThreeMonthsAgo) / priceThreeMonthsAgo * 100

// Plot market change over 3 months

var label marketChangeLabel = na

if (not na(marketChange))

if not na(marketChangeLabel)

label.delete(marketChangeLabel)

marketChangeLabel := label.new(bar_index, high + 20, text="Market Change (3 months): " + str.tostring(marketChange, "#.##") + "%", color=color.orange, style=label.style_label_up)

// Both labels (cumulative profit and market change) are displayed simultaneously

var label infoLabel = na

if (not na(cumulativeProfit) and not na(marketChange))

if not na(infoLabel)

label.delete(infoLabel)

infoLabel := label.new(bar_index, high + 30, text="Cumulative Profit: " + str.tostring(cumulativeProfit, "#.##") + "% | Market Change (3 months): " + str.tostring(marketChange, "#.##") + "%", color=color.purple, style=label.style_label_upper_right)