モメントフィルター統合システムで強化されたボリンジャーブレイク量的な戦略

作者: リン・ハーンチャオチャン開催日:2024年12月12日 14:55:37タグ:BBRSIエイマATRRR

概要

この戦略は,ボリンジャーバンド,RSI指標,および200期EMAトレンドフィルターを組み合わせた高度な定量取引システムである.複数の技術指標のシネージを通じて,トレンド方向に高い確率のブレイクアウト機会を捉え,振動する市場で誤った信号を効果的にフィルタリングする.システムは,強力な取引パフォーマンスを達成するために,リスク・リターン比に基づいて動的なストップ・ロストと利益目標を採用する.

戦略原則

基本的な論理は3つのレベルに基づいています 1. ボリンジャーバンドのブレイクシグナル:ボリンジャーバンドを波動性チャネルとして使用し,上帯の信号の長エントリー上の価格ブレイク,下帯の信号の短エントリー下のブレイク. 2. RSIの勢力の確認: RSI 50を超える場合は上昇勢力を確認し,50未満では下落勢力を確認し,トレンドのない取引を避ける. EMAトレンドフィルタリング: 200期 EMA を用いてメイントレンドを決定し,トレンド方向での取引のみを行う. EMA を長引く,EMA を短引く.

取引の確認には, - 2つの連続したキャンドルで保持されたブレイク条件 - 20 期間の平均以上 - ATRに基づいて計算されたダイナミックストップ損失 - 利得目標は,リスク・リターン比の1.5倍

戦略 の 利点

- 複数の技術指標が連携して信号の質を大幅に向上させる

- 動的ポジション管理メカニズムは市場の変動に適応する

- 厳格な取引確認メカニズムは誤った信号を効果的に減少させる

- ダイナミックストップ・ロースと固定リスク・リターン比を含む完全なリスク管理システム

- 柔軟なパラメータ最適化空間 異なる市場環境に適応可能

戦略リスク

- 過剰なパラメータ最適化によりオーバーフィッティングが発生する

- 変動する市場は,頻繁にストップ・ロスを引き起こす可能性があります.

- 変動する市場は 連続した損失を生む可能性があります

- 傾向の転換点でシグナルが遅れている

- テクニカルインジケーターは矛盾する信号を生む可能性があります

リスク管理の提案: - ストップ・ロスの規律を厳格に行う - 単一貿易リスクの管理 - 通常のバックテストパラメータの有効性 - 基礎分析を統合する - 過剰取引を避ける

戦略の最適化方向

- クロスバリダーションのためのより多くの技術指標を導入する

- 適応性パラメータ最適化メカニズムを開発

- 市場情勢指標を追加する

- 貿易確認メカニズムを最適化

- より柔軟なポジション管理システムを開発

主な最適化アプローチ: - 異なる市場サイクルに基づいてパラメータを動的に調整 - トレーディングフィルターを追加 - リスク・報酬比の設定を最適化 - ストップ・ロスのメカニズムを改良 - よりスマートな信号確認システムを開発

概要

この戦略は,ボリンジャーバンド,RSIおよびEMAの技術指標の有機的な組み合わせを通じて完全な取引システムを構築する.取引の品質を確保しながら,システムは厳格なリスク管理と柔軟なパラメータ最適化スペースを通じて強力な実用的な価値を示している.トレーダーはライブ取引でパラメータを慎重に検証し,厳格に取引の規律を実行し,戦略のパフォーマンスを継続的に最適化することをお勧めする.

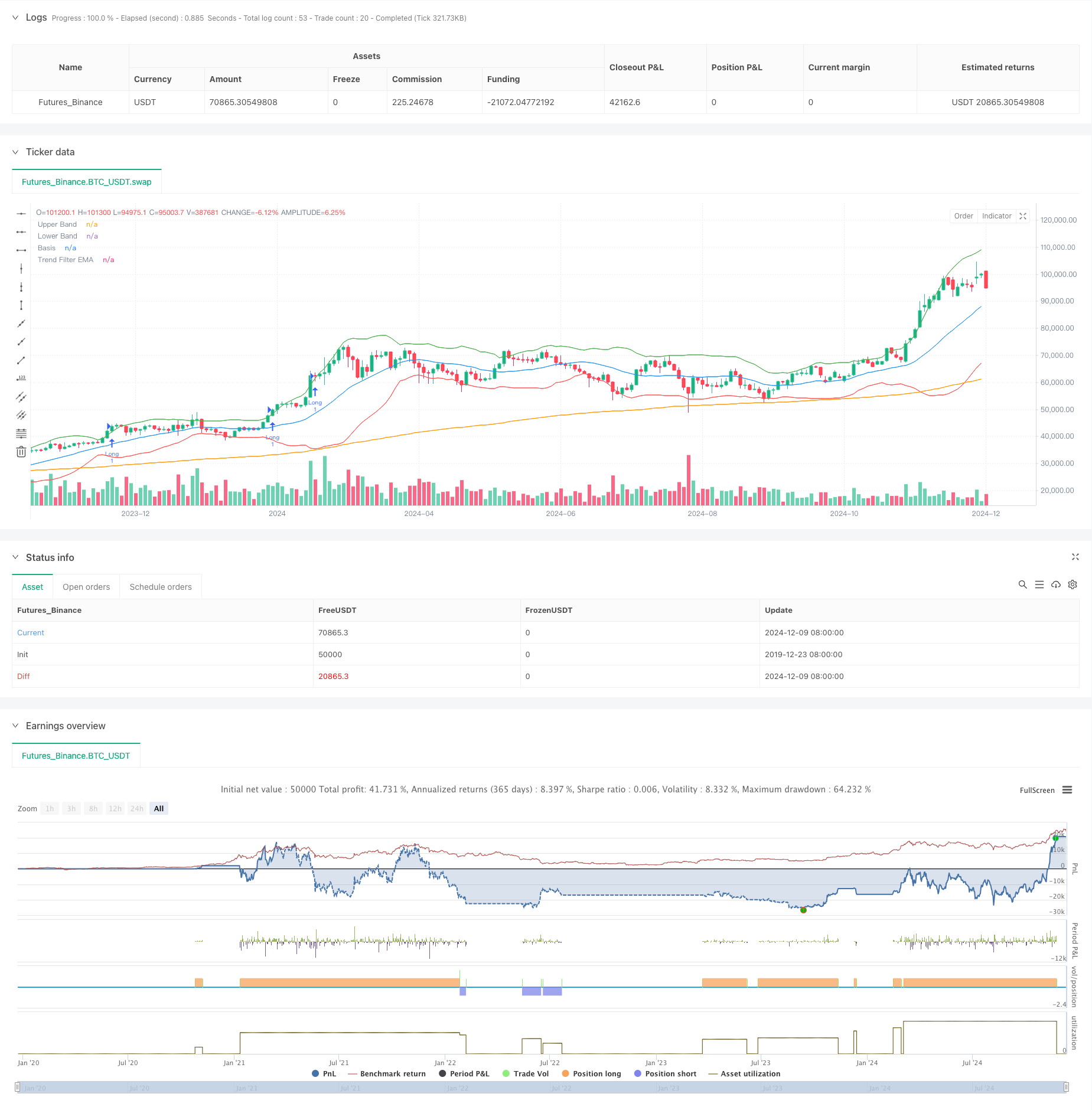

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Bollinger Breakout with Trend Filtering", overlay=true)

// === Inputs ===

length = input(20, title="Bollinger Bands Length", tooltip="The number of candles used to calculate the Bollinger Bands. Higher values smooth the bands, lower values make them more reactive.")

mult = input(2.0, title="Bollinger Bands Multiplier", tooltip="Controls the width of the Bollinger Bands. Higher values widen the bands, capturing more price movement.")

rsi_length = input(14, title="RSI Length", tooltip="The number of candles used to calculate the RSI. Shorter lengths make it more sensitive to recent price movements.")

rsi_midline = input(50, title="RSI Midline", tooltip="Defines the midline for RSI to confirm momentum. Higher values make it stricter for bullish conditions.")

risk_reward_ratio = input(1.5, title="Risk/Reward Ratio", tooltip="Determines the take-profit level relative to the stop-loss.")

atr_multiplier = input(1.5, title="ATR Multiplier for Stop-Loss", tooltip="Defines the distance of the stop-loss based on ATR. Higher values set wider stop-losses.")

volume_filter = input(true, title="Enable Volume Filter", tooltip="If enabled, trades will only execute when volume exceeds the 20-period average.")

trend_filter_length = input(200, title="Trend Filter EMA Length", tooltip="The EMA length used to filter trades based on the market trend.")

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"], tooltip="Choose whether to trade only Long, only Short, or Both directions.")

confirm_candles = input(2, title="Number of Confirming Candles", tooltip="The number of consecutive candles that must meet the conditions before entering a trade.")

// === Indicator Calculations ===

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

rsi_val = ta.rsi(close, rsi_length)

atr_val = ta.atr(14)

vol_filter = volume > ta.sma(volume, 20)

ema_trend = ta.ema(close, trend_filter_length)

// === Helper Function for Confirmation ===

confirm_condition(cond, lookback) =>

count = 0

for i = 0 to lookback - 1

count += cond[i] ? 1 : 0

count == lookback

// === Trend Filter ===

trend_is_bullish = close > ema_trend

trend_is_bearish = close < ema_trend

// === Long and Short Conditions with Confirmation ===

long_raw_condition = close > upper_band * 1.01 and rsi_val > rsi_midline and (not volume_filter or vol_filter) and trend_is_bullish

short_raw_condition = close < lower_band * 0.99 and rsi_val < rsi_midline and (not volume_filter or vol_filter) and trend_is_bearish

long_condition = confirm_condition(long_raw_condition, confirm_candles)

short_condition = confirm_condition(short_raw_condition, confirm_candles)

// === Trade Entry and Exit Logic ===

if long_condition and (trade_direction == "Long" or trade_direction == "Both")

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - (atr_multiplier * atr_val), limit=close + (atr_multiplier * risk_reward_ratio * atr_val))

if short_condition and (trade_direction == "Short" or trade_direction == "Both")

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + (atr_multiplier * atr_val), limit=close - (atr_multiplier * risk_reward_ratio * atr_val))

// === Plotting ===

plot(upper_band, color=color.green, title="Upper Band")

plot(lower_band, color=color.red, title="Lower Band")

plot(basis, color=color.blue, title="Basis")

plot(ema_trend, color=color.orange, title="Trend Filter EMA")

- リスク・リターン最適化によるマルチタイムフレーム指数関数移動平均クロスオーバー戦略

- ATRベースのダイナミックなポジションマネジメントを備えたオープン後のブレイクアウト取引戦略

- 多トレンドモメンタムクロスオーバー戦略と波動性最適化システム

- 高勝率トレンドは逆転トレード戦略を意味する

- 上方ウィック・ブイッシュ・キャンドル・ブレークアウト戦略なし

- 多指標動的ストップ・ロスの動向トレンド・トレード戦略

- 戦略をフォローする多指標複合動向

- 多指標トレンド・モメンタム・トレーディング・戦略:ボリンジャー・バンド,フィボナッチ,ATRをベースとした最適化された定量取引システム

- RSI・ボリンジャー・バンド統合戦略: ダイナミック・セルフアダプティブ・マルチインジケータ・トレーディング・システム

- EMAのクロスオーバーとボリンジャー帯のダブルエントリー戦略:トレンドフォローとボラティリティブレイクを組み合わせた定量取引システム

- 動的チャネルと移動平均取引システムによる多指標トレンドフォロー戦略

- SMMAの確認による多EMAトレンドフォロー戦略

- 動向分析戦略を持つ多指標トレンド取引システム

- トレンドをフォローするクラウド・モメンタム・ディバージェンスの戦略

- 複数の指標のトレンドフォローと波動性ブレイク戦略

- 多市場適応型多指標傾向 戦略をフォローする

- 動的タイミングと波動性に基づくポジション管理戦略

- トレンド・スカルピングのためのEMA-MACD複合戦略

- 多技術指標に基づく動向追跡と動力戦略

- 高周波定量セッション取引戦略: ブレイクシグナルに基づく適応動的ポジション管理システム

- マルチEMAクロスオーバーモメントトレンド 戦略をフォローする

- 多ターゲットのインテリジェント・ボリューム・モメント・トレード・戦略

- 多期ボリンガー帯 触動トレンド逆転 定量取引戦略

- 高周波ブレイク取引戦略

- 先進的なダイナミックフィボナッチリトレースメント トレンド 定量的な取引戦略

- 動的指数 動的平均 多階層利益傾向 戦略に従った

- モメントとボリュームの確認を持つマルチ移動平均取引システム

- アダプティブ トレイリング・ドラウド バランスのとれた取引戦略

- 強化されたトレンドフォローシステム:ADXとパラボリックSARに基づく動的トレンド識別

- 2つのタイムフレームストーカスティックモメンタム取引戦略