EMAとSMAに基づく戦略をフォローする多指標動的傾向

作者: リン・ハーンチャオチャン開催日:2024年12月27日 14:12:50タグ:エイマSMAATRPPスーパートレンド

戦略の概要

この戦略は,複数の技術指標を組み合わせた動的なトレンドフォローシステムである.市場動向と取引機会を特定するために,ピボットポイント,スーパートレンド指標,移動平均クロスオーバー信号を統合する.この戦略の主要な特徴は,固定タイムフレーム分析アプローチであり,ピボットポイントを通じて信号を検証しながら信号の一貫性を確保する.

戦略の原則

この戦略は,次の基本的メカニズムに基づいて機能します.

- 分析のために固定時間枠の価格データを利用し,異なる時間枠からの干渉を避ける.

- 基礎を踏まえてトレンドを形成する 8 期間の EMA と 21 期間の EMA に基づいて SMA を計算する.

- トレンド方向確認のためのスーパートレンド指標を計算するためにATRとピボットポイントを組み合わせます.

- SMAのクロスオーバー信号は,ピボットポイントの3つの期間に発生する場合にのみ有効とみなす.

- 取引基準のサポート/レジスタンスレベルを動的に計算し,追跡する

戦略 の 利点

- 複数の指標のクロスバリデーションにより信号の信頼性が向上する

- 固定タイムフレーム分析は 偽信号の干渉を減らす

- ピボットポイントの検証は,取引がキー価格レベルで行われることを保証します.

- サポート/レジスタンスをダイナミックに追跡することで,ストップ・ロストとテイク・プロフィートのレベルが決定されます.

- スーパートレンド指標は,トレンド方向の追加的な確認を提供します.

- 柔軟なパラメータ設定により,異なる市場条件に調整できます

戦略リスク

- 複数の指標が信号遅延を引き起こす可能性があります

- 市場の範囲で過剰な誤った信号を生む可能性があります.

- 固定タイムフレーム分析は,他のタイムフレームで重要な信号を見逃す可能性があります.

- ピボットポイントの検証は重要な取引機会を逃す可能性があります.

- パラメータの最適化によりオーバーフィッティングが発生する

戦略の最適化方向

- 低波動期間の取引頻度を減らすため,波動性フィルタリングメカニズムを導入する

- ADX や MACD などのトレンド強度確認指標を追加します.

- 市場状況に基づいて動的に調整する適応性パラメータシステムを開発する

- 信号の信頼性を向上させるため,音量分析を組み込む

- 市場変動に応じて調整する動的ストップ・ロスのメカニズムを導入する

概要

この戦略は,複数の技術指標の組み合わせを通じて,比較的完全なトレンドを追跡する取引システムを確立する.その主な利点は,固定タイムフレーム分析とピボットポイント検証を通じて信号の信頼性を向上させることにある.一定の遅れリスクがあるものの,パラメータ最適化およびリスク管理措置を通じて効果的に制御することができる.トレーダーは,ライブ実装の前に徹底的なバックテストを行い,特定の市場特性に合わせてパラメータを調整することをお勧めする.

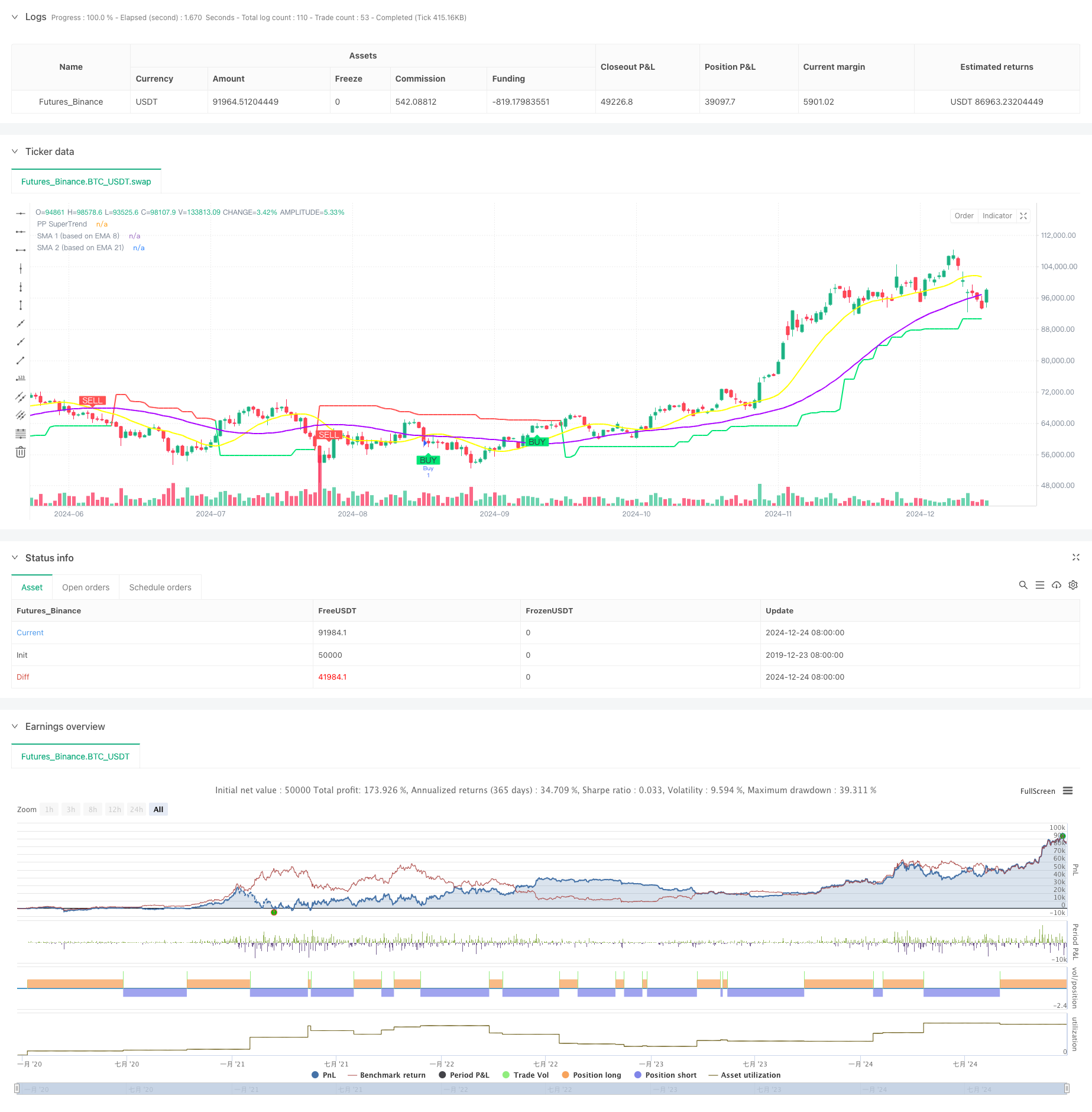

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Buy Sell Pivot Point", overlay=true)

// Input Parameters

prd = input.int(defval=2, title="Periodo Pivot Point", minval=1, maxval=50)

Factor = input.float(defval=3, title="Fator ATR", minval=1, step=0.1)

Pd = input.int(defval=10, title="Periodo ATR", minval=1)

showpivot = input.bool(defval=false, title="Mostrar Pivot Points")

showlabel = input.bool(defval=true, title="Mostrar Buy/Sell Labels")

showcl = input.bool(defval=false, title="Mostrar PP Center Line")

showsr = input.bool(defval=false, title="Mostrar Support/Resistance")

sma1_length = input.int(defval=8, title="SMA 1")

sma2_length = input.int(defval=21, title="SMA 2")

timeframe_fix = input.timeframe("D", title="Timeframe Fixo")

// Request data from the fixed timeframe

fix_close = request.security(syminfo.tickerid, timeframe_fix, close)

fix_high = request.security(syminfo.tickerid, timeframe_fix, high)

fix_low = request.security(syminfo.tickerid, timeframe_fix, low)

fix_ph = request.security(syminfo.tickerid, timeframe_fix, ta.pivothigh(prd, prd))

fix_pl = request.security(syminfo.tickerid, timeframe_fix, ta.pivotlow(prd, prd))

fix_atr = request.security(syminfo.tickerid, timeframe_fix, ta.atr(Pd))

// Convert Pivot High/Low to valid boolean for conditions

ph_cond = not na(fix_ph)

pl_cond = not na(fix_pl)

// Draw Pivot Points

plotshape(ph_cond and showpivot, title="Pivot High", text="H", style=shape.labeldown, color=color.red, textcolor=color.red, location=location.abovebar, offset=-prd)

plotshape(pl_cond and showpivot, title="Pivot Low", text="L", style=shape.labelup, color=color.lime, textcolor=color.lime, location=location.belowbar, offset=-prd)

// Calculate the Center line using pivot points

var float center = na

lastpp = ph_cond ? fix_ph : pl_cond ? fix_pl : na

if not na(lastpp)

center := na(center) ? lastpp : (center * 2 + lastpp) / 3

// Upper/Lower bands calculation

Up = center - (Factor * fix_atr)

Dn = center + (Factor * fix_atr)

// Get the trend

var float TUp = na

var float TDown = na

var int Trend = 0

TUp := na(TUp[1]) ? Up : fix_close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := na(TDown[1]) ? Dn : fix_close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := fix_close > TDown[1] ? 1 : fix_close < TUp[1] ? -1 : nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// Plot the trend

linecolor = Trend == 1 ? color.lime : Trend == -1 ? color.red : na

plot(Trailingsl, color=linecolor, linewidth=2, title="PP SuperTrend")

// Plot Center Line

plot(showcl ? center : na, color=showcl ? (center < fix_close ? color.blue : color.red) : na, title="Center Line")

// Calculate Base EMAs

ema_8 = ta.ema(fix_close, 8)

ema_21 = ta.ema(fix_close, 21)

// Calculate SMAs based on EMAs

sma1 = ta.sma(ema_8, sma1_length)

sma2 = ta.sma(ema_21, sma2_length)

// Plot SMAs

plot(sma1, color=#ffff00, linewidth=2, title="SMA 1 (based on EMA 8)")

plot(sma2, color=#aa00ff, linewidth=2, title="SMA 2 (based on EMA 21)")

// Initialize variables to track pivot points

var float last_pivot_time = na

// Update the pivot time when a new pivot is detected

if (ph_cond)

last_pivot_time := bar_index

if (pl_cond)

last_pivot_time := bar_index

// Calculate the crossover/crossunder signals

buy_signal = ta.crossover(sma1, sma2) // SMA 8 crossing SMA 21 upwards

sell_signal = ta.crossunder(sma1, sma2) // SMA 8 crossing SMA 21 downwards

// Ensure signal is only valid if it happens within 3 candles of a pivot point

valid_buy_signal = buy_signal and (bar_index - last_pivot_time <= 3)

valid_sell_signal = sell_signal and (bar_index - last_pivot_time <= 3)

// Plot Buy/Sell Signals

plotshape(valid_buy_signal and showlabel, title="Buy Signal", text="BUY", style=shape.labelup, color=color.lime, textcolor=color.black, location=location.belowbar)

plotshape(valid_sell_signal and showlabel, title="Sell Signal", text="SELL", style=shape.labeldown, color=color.red, textcolor=color.white, location=location.abovebar)

// Get S/R levels using Pivot Points

var float resistance = na

var float support = na

support := pl_cond ? fix_pl : support[1]

resistance := ph_cond ? fix_ph : resistance[1]

// Plot S/R levels

plot(showsr and not na(support) ? support : na, color=showsr ? color.lime : na, style=plot.style_circles, offset=-prd)

plot(showsr and not na(resistance) ? resistance : na, color=showsr ? color.red : na, style=plot.style_circles, offset=-prd)

// Execute trades based on valid signals

if valid_buy_signal

strategy.entry("Buy", strategy.long)

if valid_sell_signal

strategy.entry("Sell", strategy.short)

// Alerts

alertcondition(valid_buy_signal, title="Buy Signal", message="Buy Signal Detected")

alertcondition(valid_sell_signal, title="Sell Signal", message="Sell Signal Detected")

alertcondition(Trend != Trend[1], title="Trend Changed", message="Trend Changed")

関連性

- SMAクロスオーバーとスーパートレンドによる適応モメンタム取引戦略

- ブラック・スワン・ボラティリティと移動平均のクロスオーバー・モメント・トラッキング戦略

- ML 警告 テンプレート

- ダイナミック・マルチディメンショナル・アナリティスによる高度なマルチタイムフレーム・イチモク・クラウド・トレーディング・戦略

- 複数の指標による変動取引のRSI-EMA-ATR戦略

- SSL ハイブリッド

- EMA,SMA,CCI,ATR,トレンドマジックインジケーター自動取引システムを持つ完璧な順序移動平均戦略

- ATR波動性戦略を用いた多指標動的適応位置サイズ化

- 多指標トレンド・モメント・クロスオーバー量的な戦略

- MACD-ATR-EMA マルチインジケーター 戦略をフォローする動的トレンド

もっと

- RSIトレンド逆転取引戦略 ATRストップ損失と取引エリア制御

- オシレーターとダイナミックサポート/レジスタンスの取引戦略を持つマルチEMAクロス

- 複数のSMAとストーカスティックの組み合わせたトレンド

- 標準化されたロガリズムリターンに基づく適応動的取引戦略

- ストカスティックRSIと移動平均システムに基づく定量分析

- 多指標トレンドクロシング戦略: ブール市場サポートバンド取引システム

- マルチレベルダイナミックMACDトレンドフォロー戦略 52週間の高低延長分析システム

- 双 EMA RSI モメンタム トレンド 逆転 トレーディング システム - EMA と RSI クロスオーバー をベースにしたモメンタム 突破戦略

- 多指標高周波範囲取引戦略

- 動的トレンドライン ブレイク逆転取引戦略

- 強化されたフィボナッチトレンドフォローとリスク管理戦略

- 適性多態EMA-RSIモメントストラテジーは,ショッピネスインデックスフィルターシステム

- インテリジェント指数関数移動平均取引戦略最適化システム

- AI駆動波動性価格システム ダイバージェンス・トレーディング戦略

- ATR ベースのリスク管理による多EMA 傾向を追求するスウィング・トレーディング戦略

- Bollinger Bands と RSI 統合による強化された平均逆転戦略

- サポート/レジスタンスの量的な取引戦略による多期RSI差異

- ダイナミック・ドラウダウン・コントロール・システムによる 適応傾向の戦略

- 複数のEMAのゴールデンクロス戦略

- マルチテクニカル指標クロストレンド追跡戦略:RSIとストカスティックRSIシネージ取引システム