概要

この戦略は、複数の平滑移動平均に基づくトレンド追跡システムであり、トリプル平滑化を使用して市場ノイズを除去しながら、RSI モメンタム インジケーター、ATR ボラティリティ インジケーター、および 200 期間 EMA トレンド フィルターを組み合わせて取引シグナルを確認します。この戦略では 1 時間の期間を使用します。これは、機関投資家の取引行動と一致しながら、取引頻度とトレンドの信頼性のバランスを効果的に取る時間枠です。

戦略原則

この戦略の核心は、価格を 3 回平滑化してメイントレンドラインを構築し、より短い期間のシグナルラインを使用してそれを横切って取引シグナルを生成することです。取引シグナルは、以下の条件が同時に満たされた場合にのみ実行されます。

- 価格ポジションと200EMAの関係は、主なトレンドの方向を裏付けています。

- RSIインジケーターの位置が勢いを裏付ける

- ATR指標は十分なボラティリティを確認

- シグナルラインと3倍平滑移動平均のクロスオーバーは、特定のエントリーポイントを確認します。 ストップロスはATRに基づく動的ストップロスを採用し、テイクプロフィットはATRの2倍に設定され、良好なリスクリターン比を確保します。

戦略的優位性

- トリプルスムージングにより、誤ったシグナルが大幅に減少し、トレンド判断の信頼性が向上します。

- 複数の確認メカニズムにより、取引の方向が主なトレンドと一致していることが保証されます。

- さまざまな市場変動に適応するための動的なストップロスとテイクプロフィットの設定

- この戦略は 1 時間サイクルで実行されるため、より短い時間サイクルでのショックを効果的に回避できます。

- 再描画なし機能により、バックテスト結果の信頼性が保証されます。

戦略リスク

- 横ばい市場では、継続的に小さな損失が発生する可能性がある

- 複数の確認メカニズムにより、取引機会を逃す可能性がある

- シグナルラグはエントリーポイントの最適化に影響を与える可能性がある

- 有効なシグナルを生成するには十分なボラティリティが必要である

- 極端な市場状況では、ダイナミックストップロスは十分なタイミングで行われない可能性がある

戦略最適化の方向性

- 補助的な確認としてボリュームインジケーターを追加できます

- 適応型パラメータ最適化メカニズムの導入を検討する

- トレンドの強さの定量的な判断力を高めることができる

- ストップロスとテイクプロフィットの複数の設定を最適化する

- 横ばい市場のパフォーマンスを最適化するためにオシレーターの追加を検討する

要約する

これは、完全な構造と厳密なロジックを備えたトレンド追跡戦略です。複数の平滑化プロセスと複数の確認メカニズムを通じて、取引シグナルの信頼性が効果的に向上します。動的なリスク管理メカニズムにより、高い適応性が実現します。ある程度の遅れはあるものの、パラメータの最適化や補助指標の追加などにより、戦略を改善する余地はまだ多くあります。

ストラテジーソースコード

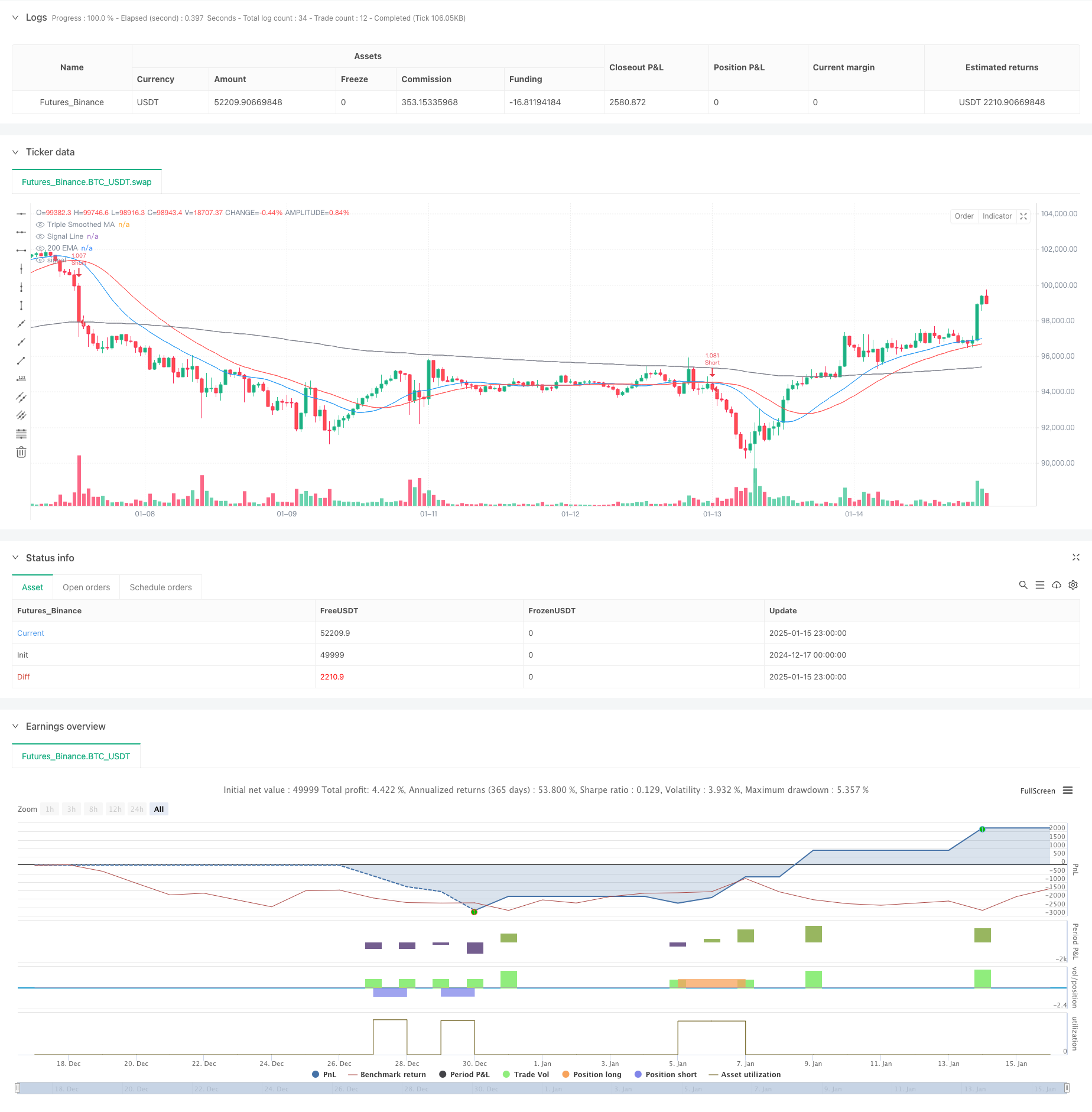

/*backtest

start: 2024-12-17 00:00:00

end: 2025-01-16 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("Optimized Triple Smoothed MA Crossover Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// === Input Settings ===

slength = input.int(7, "Main Smoothing Length", group="Moving Average Settings")

siglen = input.int(12, "Signal Length", group="Moving Average Settings")

src = input.source(close, "Data Source", group="Moving Average Settings")

mat = input.string("EMA", "Triple Smoothed MA Type", ["EMA", "SMA", "RMA", "WMA"], group="Moving Average Settings")

mat1 = input.string("EMA", "Signal Type", ["EMA", "SMA", "RMA", "WMA"], group="Moving Average Settings")

// === Trend Confirmation (Higher Timeframe Filter) ===

useTrendFilter = input.bool(true, "Enable Trend Filter (200 EMA)", group="Trend Confirmation")

trendMA = ta.ema(close, 200)

// === Momentum Filter (RSI Confirmation) ===

useRSIFilter = input.bool(true, "Enable RSI Confirmation", group="Momentum Confirmation")

rsi = ta.rsi(close, 14)

rsiThreshold = input.int(50, "RSI Threshold", group="Momentum Confirmation")

// === Volatility Filter (ATR) ===

useATRFilter = input.bool(true, "Enable ATR Filter", group="Volatility Filtering")

atr = ta.atr(14)

atrMa = ta.sma(atr, 14)

// === Risk Management (ATR-Based Stop Loss) ===

useAdaptiveSL = input.bool(true, "Use ATR-Based Stop Loss", group="Risk Management")

atrMultiplier = input.float(1.5, "ATR Multiplier for SL", minval=0.5, maxval=5, group="Risk Management")

takeProfitMultiplier = input.float(2, "Take Profit Multiplier", group="Risk Management")

// === Moving Average Function ===

ma(source, length, MAtype) =>

switch MAtype

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"RMA" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

// === Triple Smoothed Calculation ===

tripleSmoothedMA = ma(ma(ma(src, slength, mat), slength, mat), slength, mat)

signalLine = ma(tripleSmoothedMA, siglen, mat1)

// === Crossovers (Entry Signals) ===

bullishCrossover = ta.crossunder(signalLine, tripleSmoothedMA)

bearishCrossover = ta.crossover(signalLine, tripleSmoothedMA)

// === Additional Confirmation Conditions ===

trendLongCondition = not useTrendFilter or (close > trendMA) // Only long if price is above 200 EMA

trendShortCondition = not useTrendFilter or (close < trendMA) // Only short if price is below 200 EMA

rsiLongCondition = not useRSIFilter or (rsi > rsiThreshold) // RSI above 50 for longs

rsiShortCondition = not useRSIFilter or (rsi < rsiThreshold) // RSI below 50 for shorts

atrCondition = not useATRFilter or (atr > atrMa) // ATR must be above its MA for volatility confirmation

// === Final Trade Entry Conditions ===

longCondition = bullishCrossover and trendLongCondition and rsiLongCondition and atrCondition

shortCondition = bearishCrossover and trendShortCondition and rsiShortCondition and atrCondition

// === ATR-Based Stop Loss & Take Profit ===

longSL = close - (atr * atrMultiplier)

longTP = close + (atr * takeProfitMultiplier)

shortSL = close + (atr * atrMultiplier)

shortTP = close - (atr * takeProfitMultiplier)

// === Strategy Execution ===

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longSL, limit=longTP)

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortSL, limit=shortTP)

// === Plots ===

plot(tripleSmoothedMA, title="Triple Smoothed MA", color=color.blue)

plot(signalLine, title="Signal Line", color=color.red)

plot(trendMA, title="200 EMA", color=color.gray)

// === Alerts ===

alertcondition(longCondition, title="Bullish Signal", message="Triple Smoothed MA Bullish Crossover Confirmed")

alertcondition(shortCondition, title="Bearish Signal", message="Triple Smoothed MA Bearish Crossover Confirmed")