E9 Shark-32 Pattern Strategi Penembusan Harga Kuantitatif

Penulis:ChaoZhang, Tarikh: 2024-11-12 14:51:17Tag:

Ringkasan

Strategi ini adalah sistem perdagangan kuantitatif berdasarkan pengenalan corak, memberi tumpuan kepada mengenal pasti dan berdagang corak lilin

Prinsip Strategi

Prinsip terasnya terletak pada mengenal pasti corak

Kelebihan Strategi

- Pengiktirafan corak yang tepat: Menggunakan definisi matematik yang ketat untuk mengenal pasti corak, mengelakkan penghakiman subjektif

- Pengurusan risiko yang komprehensif: Termasuk tetapan sasaran stop-loss dan keuntungan yang jelas

- Maklumat maklum balas visual yang jelas: Menggunakan garis dan latar belakang berwarna yang berbeza untuk menandakan corak dan isyarat perdagangan

- Isyarat berulang yang ditapis: Hanya membenarkan satu dagangan setiap corak, mengelakkan overtrading

- Penentuan sasaran rasional: Menetapkan sasaran keuntungan berdasarkan amplitud corak, menyediakan nisbah risiko-balasan yang baik

Risiko Strategi

- Risiko pasaran yang bergelora: Boleh menghasilkan isyarat pecah palsu yang kerap di pasaran yang berbeza

- Risiko tergelincir: Mungkin menghadapi tergelincir yang ketara di pasaran yang bergerak pantas

- Kebergantungan satu corak: Kebergantungan berlebihan pada satu corak boleh kehilangan peluang perdagangan lain

- Sensitiviti parameter: Prestasi strategi sangat bergantung kepada tetapan parameter sasaran stop-loss dan keuntungan

Arahan Pengoptimuman Strategi

- Tambah pengesahan jumlah: Masukkan perubahan jumlah untuk mengesahkan kesahihan pecah

- Melaksanakan penapis persekitaran pasaran: Tambah penunjuk kekuatan trend untuk menapis keadaan pasaran yang tidak baik

- Mengoptimumkan kaedah stop-loss: Pertimbangkan stop-loss dinamik untuk meningkatkan kesesuaian strategi

- Tambah penapis masa: Masukkan penapis sesi dagangan untuk mengelakkan tempoh tidak menentu tertentu

- Meningkatkan pengurusan wang: Tambah modul saiz kedudukan untuk mengoptimumkan kecekapan modal

Ringkasan

E9 Shark-32 Pattern Quantitative Price Breakout Strategy adalah sistem dagangan yang berstruktur dengan logika yang jelas. Ia membina strategi dagangan yang boleh diukur melalui definisi corak yang ketat dan peraturan dagangan yang jelas. Strategi ini mempunyai sistem pengurusan risiko yang komprehensif dan maklum balas visual yang jelas, menjadikannya mudah difahami dan dilaksanakan oleh peniaga. Melalui arahan pengoptimuman yang dicadangkan, terdapat ruang untuk peningkatan lanjut. Strategi ini sesuai untuk pelabur yang mencari pendekatan perdagangan sistematik, tetapi perhatian mesti diberikan kepada kebolehsesuaian persekitaran pasaran dan pengoptimuman parameter.

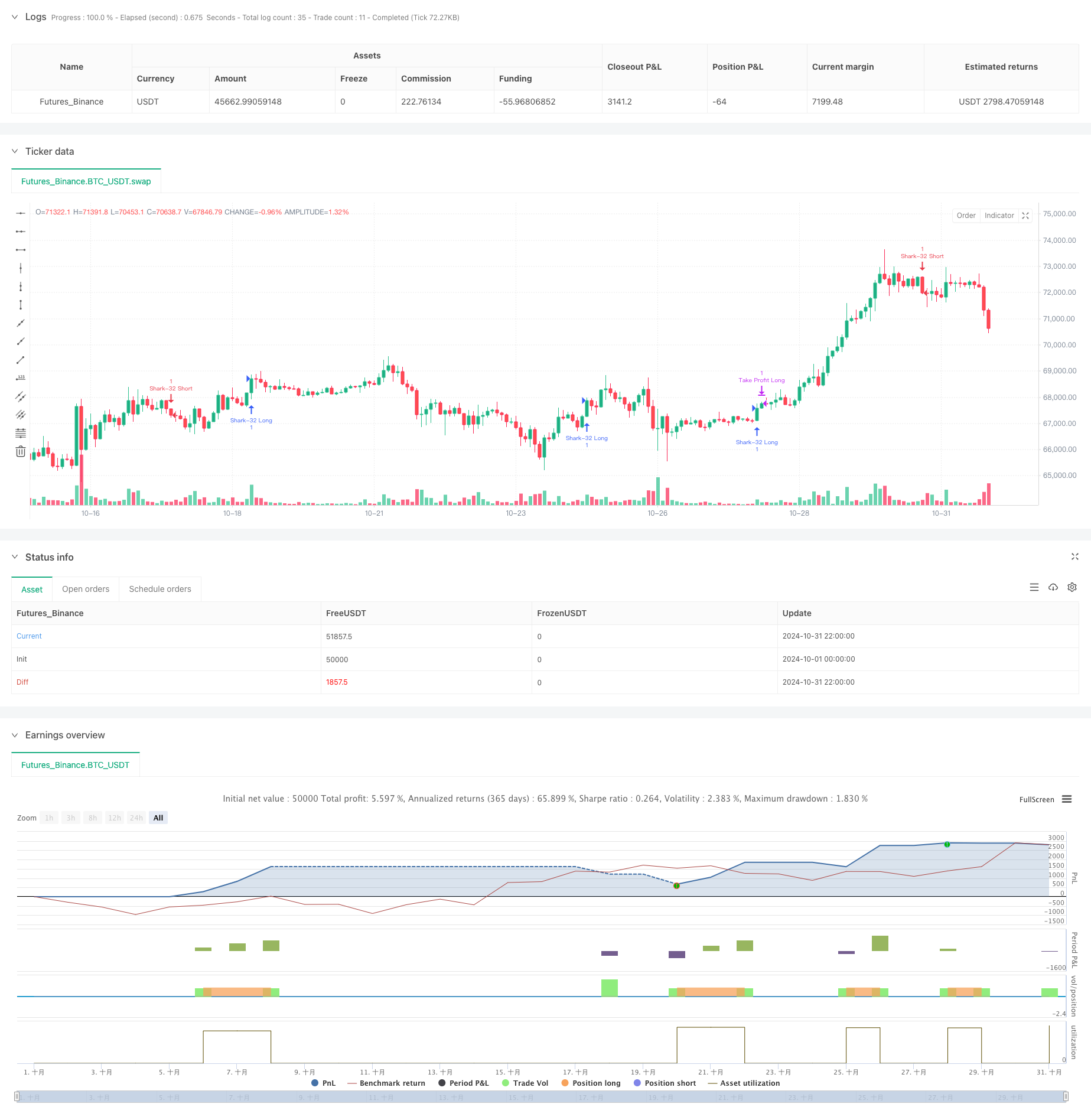

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//╔═════════════════════════════════════════════════════════════════════════════════════════════════════════════╗

//║ ║

//║ ░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓██████▓▒░░▒▓███████▓▒░░▒▓████████▓▒░▒▓███████▓▒░ ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓██████▓▒░ ░▒▓███████▓▒░. ░▒▓██████▓▒░ ░▒▓███████▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒. ░▒▓█▓▒░ ░▒▓█▓▒░ ║

//║ ░▒▓█▓▒░ ░▒▓█▓▒░░▒▓█▓▒░▒▓█▓▒░░▒▓█▓▒░▒▓███████▓▒░░▒▓████████▓▒░▒▓█▓▒░░▒▓█▓▒. ░▒▓████████▓▒░▒▓██████▓▒░ ║

//║ ║

//╚═════════════════════════════════════════════════════════════════════════════════════════════════════════════╝

//@version=5

strategy("E9 Shark-32 Pattern Strategy with Target Lines", shorttitle="E9 Shark-32 Strategy", overlay=true)

// Inputs for background color settings

bgcolorEnabled = input(true, title="Enable Background Color")

bgcolorColor = input.color(color.new(color.blue, 90), title="Background Color")

// Inputs for bar color settings

barcolorEnabled = input(true, title="Enable Bar Color")

barcolorColor = input.color(color.rgb(240, 241, 154), title="Bar Color")

// Inputs for target lines settings

targetLinesEnabled = input(true, title="Enable Target Lines")

targetLineColor = input.color(color.white, title="Target Line Color")

targetLineThickness = input.int(1, title="Target Line Thickness", minval=1, maxval=5)

// Define Shark-32 Pattern

shark32 = low[2] < low[1] and low[1] < low and high[2] > high[1] and high[1] > high

// Initialize color variables for bars

var color barColorCurrent = na

var color barColor1 = na

var color barColor2 = na

// Update color variables based on Shark-32 pattern

barColorCurrent := barcolorEnabled and (shark32 or shark32[1] or shark32[2]) ? barcolorColor : na

barColor1 := barcolorEnabled and (shark32[1] or shark32[2]) ? barcolorColor : na

barColor2 := barcolorEnabled and shark32[2] ? barcolorColor : na

// Apply the bar colors to the chart

barcolor(barColorCurrent, offset=-2, title="Shark-32 Confirmed Current")

barcolor(barColor1, offset=-3, title="Shark-32 Confirmed Previous Bar 1")

barcolor(barColor2, offset=-4, title="Shark-32 Confirmed Previous Bar 2")

// Variables for locking the high and low of confirmed Shark-32

var float patternHigh = na

var float patternLow = na

var float upperTarget = na

var float lowerTarget = na

// Once Shark-32 pattern is confirmed, lock the patternHigh, patternLow, and target lines

if shark32

patternHigh := high[2] // The high of the first bar in Shark-32 pattern

patternLow := low[2] // The low of the first bar in Shark-32 pattern

// Calculate the upper and lower white target lines

upperTarget := patternHigh + (patternHigh - patternLow) // Dotted white line above

lowerTarget := patternLow - (patternHigh - patternLow) // Dotted white line below

// Initialize variables for the lines

var line greenLine = na

var line redLine = na

var line upperTargetLine = na

var line lowerTargetLine = na

// Draw the lines based on the locked patternHigh, patternLow, and target lines

// if shark32

// future_bar_index_lines = bar_index + 10

// // Draw lines based on locked patternHigh and patternLow

// greenLine := line.new(x1=bar_index[2], y1=patternHigh, x2=future_bar_index_lines, y2=patternHigh, color=color.green, width=2, extend=extend.none)

// redLine := line.new(x1=bar_index[2], y1=patternLow, x2=future_bar_index_lines, y2=patternLow, color=color.red, width=2, extend=extend.none)

// // Draw dotted white lines if targetLinesEnabled is true

// if targetLinesEnabled

// upperTargetLine := line.new(x1=bar_index[2], y1=upperTarget, x2=future_bar_index_lines, y2=upperTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// lowerTargetLine := line.new(x1=bar_index[2], y1=lowerTarget, x2=future_bar_index_lines, y2=lowerTarget, color=targetLineColor, width=targetLineThickness, style=line.style_dotted, extend=extend.none)

// // Create a box to fill the background between the red and green lines

// if bgcolorEnabled

// box.new(left=bar_index[2], top=patternHigh, right=future_bar_index_lines, bottom=patternLow, bgcolor=bgcolorColor)

// -------------------------------------------------------------------------

// Strategy Entry and Exit Parameters

// -------------------------------------------------------------------------

// Input parameters for stop loss

longStopLoss = input.float(1.0, title="Long Stop Loss (%)", minval=0.1) // Percentage-based stop loss for long

shortStopLoss = input.float(1.0, title="Short Stop Loss (%)", minval=0.1) // Percentage-based stop loss for short

// Variable to track if a trade has been taken

var bool tradeTaken = false

// Reset the flag when a new Shark-32 pattern is confirmed

if shark32

tradeTaken := false

// Entry conditions only trigger after the Shark-32 is confirmed

longCondition = ta.crossover(close, patternHigh) and not tradeTaken // Long entry when close crosses above locked patternHigh

shortCondition = ta.crossunder(close, patternLow) and not tradeTaken // Short entry when close crosses below locked patternLow

// Trigger long and short trades based on the crossover conditions

if (longCondition)

label.new(bar_index, high, "Long Trigger", style=label.style_label_down, color=color.green, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Long", strategy.long)

tradeTaken := true // Set the flag to true after a trade is taken

if (shortCondition)

label.new(bar_index, low, "Short Trigger", style=label.style_label_up, color=color.red, textcolor=color.white, size=size.small)

strategy.entry("Shark-32 Short", strategy.short)

tradeTaken := true // Set the flag to true after a trade is taken

// Exit long trade based on the upper target line (upper white dotted line) as take profit

if strategy.position_size > 0

strategy.exit("Take Profit Long", "Shark-32 Long", limit=upperTarget, stop=close * (1 - longStopLoss / 100))

// Exit short trade based on the lower target line (lower white dotted line) as take profit

if strategy.position_size < 0

strategy.exit("Take Profit Short", "Shark-32 Short", limit=lowerTarget, stop=close * (1 + shortStopLoss / 100))

- Sistem Strategi Dinamik Crossover Multi-Indikator: Model Dagangan Kuantitatif Berdasarkan EMA, RVI dan Isyarat Dagangan

- Strategi Kuantitatif Pembalikan Julat Dinamik RSI dengan Model Optimasi Volatiliti

- Trend Momentum Bollinger Bands Berikutan Strategi Kuantitatif

- Analisis Teknikal Pelbagai Tempoh dan Strategi Perdagangan Sentimen Pasaran

- Strategi tempoh pegangan dinamik berdasarkan corak pembalikan 123 mata

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Analisis Integrasi Berdasarkan EMA, RSI dan ADX

- Strategi Perdagangan Perbezaan SAR Parabolik

- Strategi silang Momentum SMA yang digabungkan dengan Sentimen Pasaran dan Sistem Pengoptimuman Tahap Rintangan

- RSI Multi-Periode Momentum dan Tren EMA Tiga Berikutan Strategi Komposit

- Trend Momentum Purata Multi-Moving Mengikut Strategi

- Eksposur Pasaran Terbuka Penyesuaian Posisi Dinamik Strategi Dagangan Kuantitatif

- Trend Kadar Menang Tinggi Bermakna Strategi Perdagangan Pembalikan

- Strategi Momentum Trend RSI Purata Bergerak Berganda

- Trend pembalikan purata penggabungan pelbagai penunjuk mengikut strategi

- Strategi Dagangan Pasca-Terbuka Breakout dengan Pengurusan Posisi Berasaskan ATR Dinamis

- Integrasi Multi-Indikator dan Kawalan Risiko Cerdas Sistem Dagangan Kuantitatif

- Pengukuran Posisi Adaptif Dinamik Multi-Indikator dengan Strategi Volatiliti ATR

- RSI Strategi Perdagangan Pintar Stop-Loss Dinamik

- Pembaharuan purata RSI yang disahkan tiga kali dengan strategi penapis purata bergerak

- Strategi Dagangan Trend Osilasi Beradaptasi dengan Bollinger Bands dan Integrasi RSI