Strategi Kuantitatif Bollinger Breakout yang Dipertingkatkan dengan Sistem Integrasi Penapis Momentum

Penulis:ChaoZhang, Tarikh: 2024-12-12 14:55:37Tag:BBRSIEMAATRRR

Ringkasan

Strategi ini adalah sistem perdagangan kuantitatif yang maju yang menggabungkan Bollinger Bands, penunjuk RSI, dan penapis trend EMA 200-periode. Melalui sinergi pelbagai penunjuk teknikal, ia menangkap peluang pecah yang berkemungkinan tinggi ke arah trend sambil menapis isyarat palsu secara berkesan di pasaran berayun. Sistem ini menggunakan sasaran stop-loss dan keuntungan dinamik berdasarkan nisbah risiko-balasan untuk mencapai prestasi perdagangan yang kukuh.

Prinsip Strategi

Logik teras adalah berdasarkan tiga peringkat: 1. Isyarat pecah Bollinger Bands: Menggunakan Bollinger Bands sebagai saluran turun naik, harga pecah di atas entri panjang isyarat band atas, pecah di bawah entri pendek isyarat band bawah. 2. Pengesahan momentum RSI: RSI di atas 50 mengesahkan momentum bullish, di bawah 50 mengesahkan momentum bearish, mengelakkan perdagangan tanpa trend. 3. Penapisan trend EMA: Menggunakan EMA 200 tempoh untuk menentukan trend utama, hanya berdagang dalam arah trend.

Pengesahan perdagangan memerlukan: - Keadaan pecah dikekalkan untuk dua lilin berturut-turut - Volume di atas purata 20 tempoh - Stop-loss dinamik yang dikira berdasarkan ATR - Sasaran keuntungan ditetapkan pada nisbah risiko-balasan 1.5 kali

Kelebihan Strategi

- Pelbagai penunjuk teknikal bekerjasama untuk meningkatkan kualiti isyarat dengan ketara

- Mekanisme pengurusan kedudukan dinamik menyesuaikan diri dengan turun naik pasaran

- Mekanisme pengesahan perdagangan yang ketat secara berkesan mengurangkan isyarat palsu

- Sistem kawalan risiko lengkap termasuk stop-loss dinamik dan nisbah risiko-balasan tetap

- Ruang pengoptimuman parameter yang fleksibel yang dapat disesuaikan dengan persekitaran pasaran yang berbeza

Risiko Strategi

- Pengoptimuman parameter yang berlebihan boleh membawa kepada pemasangan berlebihan

- Pasaran yang tidak menentu boleh mencetuskan stop-loss yang kerap

- Pasaran berayun boleh menghasilkan kerugian berturut-turut

- Isyarat kelewatan pada titik perubahan trend

- Indikator teknikal boleh menghasilkan isyarat yang bertentangan

Cadangan kawalan risiko: - Melaksanakan disiplin stop-loss yang ketat - Kawalan risiko perdagangan tunggal - Validiti parameter backtest biasa - Mengintegrasikan analisis asas - Elakkan overtrading

Arahan Pengoptimuman Strategi

- Memperkenalkan lebih banyak penunjuk teknikal untuk pengesahan silang

- Membangunkan mekanisme pengoptimuman parameter adaptif

- Tambah penunjuk sentimen pasaran

- Mengoptimumkan mekanisme pengesahan perdagangan

- Membangunkan sistem pengurusan kedudukan yang lebih fleksibel

Pendekatan pengoptimuman utama: - Sesuaikan parameter secara dinamik berdasarkan kitaran pasaran yang berbeza - Tambah penapis perdagangan - Mengoptimumkan tetapan nisbah risiko-balasan - Meningkatkan mekanisme stop-loss - Membangunkan sistem pengesahan isyarat yang lebih pintar

Ringkasan

Strategi ini membina sistem perdagangan yang lengkap melalui gabungan organik Bollinger Bands, RSI dan penunjuk teknikal EMA. Semasa memastikan kualiti perdagangan, sistem menunjukkan nilai praktikal yang kuat melalui kawalan risiko yang ketat dan ruang pengoptimuman parameter yang fleksibel.

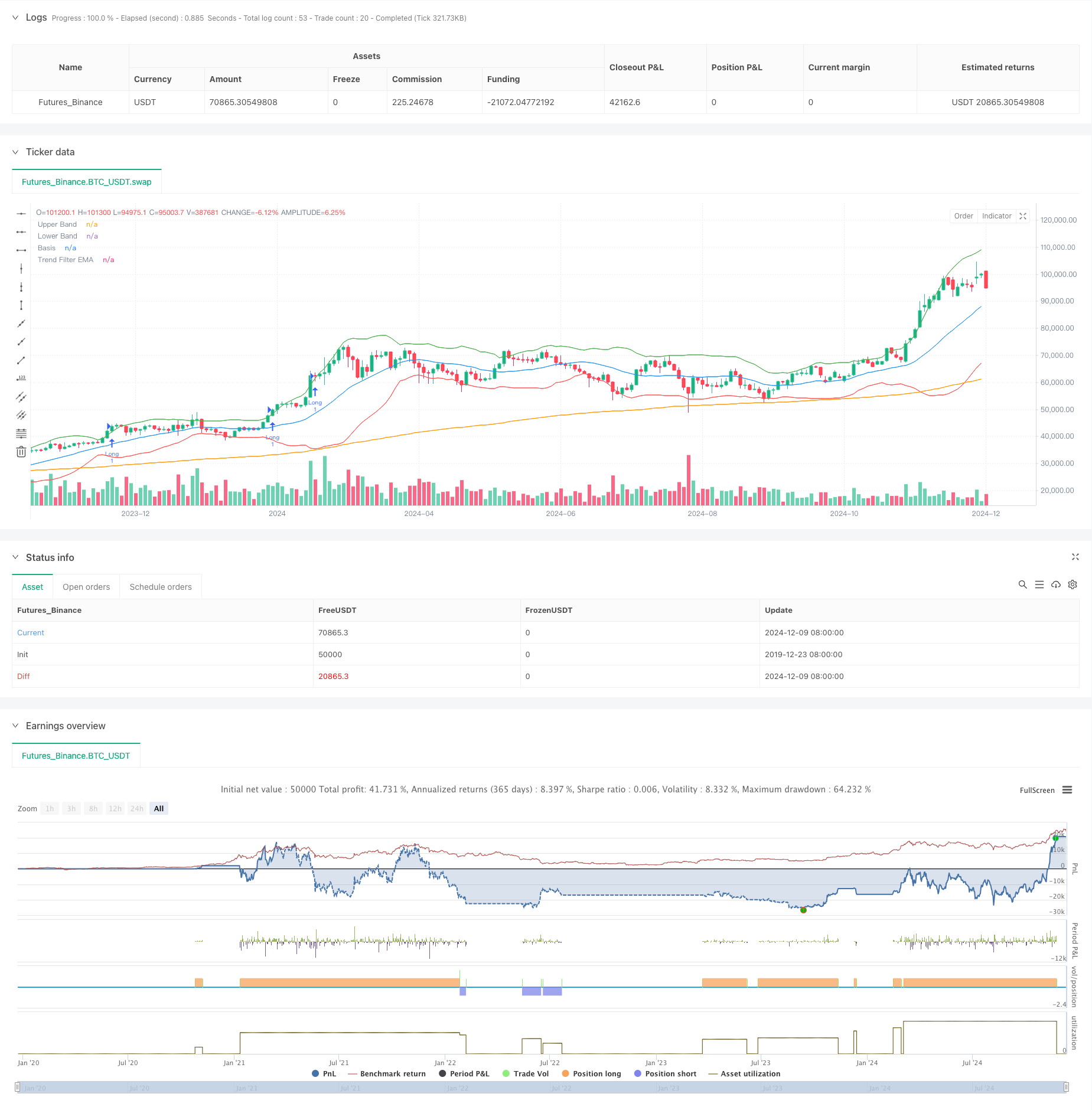

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Bollinger Breakout with Trend Filtering", overlay=true)

// === Inputs ===

length = input(20, title="Bollinger Bands Length", tooltip="The number of candles used to calculate the Bollinger Bands. Higher values smooth the bands, lower values make them more reactive.")

mult = input(2.0, title="Bollinger Bands Multiplier", tooltip="Controls the width of the Bollinger Bands. Higher values widen the bands, capturing more price movement.")

rsi_length = input(14, title="RSI Length", tooltip="The number of candles used to calculate the RSI. Shorter lengths make it more sensitive to recent price movements.")

rsi_midline = input(50, title="RSI Midline", tooltip="Defines the midline for RSI to confirm momentum. Higher values make it stricter for bullish conditions.")

risk_reward_ratio = input(1.5, title="Risk/Reward Ratio", tooltip="Determines the take-profit level relative to the stop-loss.")

atr_multiplier = input(1.5, title="ATR Multiplier for Stop-Loss", tooltip="Defines the distance of the stop-loss based on ATR. Higher values set wider stop-losses.")

volume_filter = input(true, title="Enable Volume Filter", tooltip="If enabled, trades will only execute when volume exceeds the 20-period average.")

trend_filter_length = input(200, title="Trend Filter EMA Length", tooltip="The EMA length used to filter trades based on the market trend.")

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"], tooltip="Choose whether to trade only Long, only Short, or Both directions.")

confirm_candles = input(2, title="Number of Confirming Candles", tooltip="The number of consecutive candles that must meet the conditions before entering a trade.")

// === Indicator Calculations ===

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

rsi_val = ta.rsi(close, rsi_length)

atr_val = ta.atr(14)

vol_filter = volume > ta.sma(volume, 20)

ema_trend = ta.ema(close, trend_filter_length)

// === Helper Function for Confirmation ===

confirm_condition(cond, lookback) =>

count = 0

for i = 0 to lookback - 1

count += cond[i] ? 1 : 0

count == lookback

// === Trend Filter ===

trend_is_bullish = close > ema_trend

trend_is_bearish = close < ema_trend

// === Long and Short Conditions with Confirmation ===

long_raw_condition = close > upper_band * 1.01 and rsi_val > rsi_midline and (not volume_filter or vol_filter) and trend_is_bullish

short_raw_condition = close < lower_band * 0.99 and rsi_val < rsi_midline and (not volume_filter or vol_filter) and trend_is_bearish

long_condition = confirm_condition(long_raw_condition, confirm_candles)

short_condition = confirm_condition(short_raw_condition, confirm_candles)

// === Trade Entry and Exit Logic ===

if long_condition and (trade_direction == "Long" or trade_direction == "Both")

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - (atr_multiplier * atr_val), limit=close + (atr_multiplier * risk_reward_ratio * atr_val))

if short_condition and (trade_direction == "Short" or trade_direction == "Both")

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + (atr_multiplier * atr_val), limit=close - (atr_multiplier * risk_reward_ratio * atr_val))

// === Plotting ===

plot(upper_band, color=color.green, title="Upper Band")

plot(lower_band, color=color.red, title="Lower Band")

plot(basis, color=color.blue, title="Basis")

plot(ema_trend, color=color.orange, title="Trend Filter EMA")

- Strategi Crossover Purata Bergerak Eksponensial Berbilang Jangka Masa dengan Pengoptimuman Risiko-Hadiah

- Strategi Dagangan Pasca-Terbuka Breakout dengan Pengurusan Posisi Berasaskan ATR Dinamis

- Multi-Trend Momentum Crossover Strategy dengan Sistem Pengoptimuman Volatiliti

- Trend Kadar Menang Tinggi Bermakna Strategi Perdagangan Pembalikan

- Tiada Upper Wick Bullish Candle Breakout Strategi

- Strategi Dagangan Trend Trend Stop-Loss Dinamik Berbilang Penunjuk

- Strategi Dagangan Momentum Trend Multi-Indikator: Sistem Dagangan Kuantitatif yang Dioptimumkan Berdasarkan Bollinger Bands, Fibonacci dan ATR

- Strategi Integrasi RSI-Bollinger Bands: Sistem Dagangan Multi-Indikator yang Dinamis dan Sesuai Sendiri

- EMA Crossover dengan Bollinger Bands Double Entry Strategy: Sistem Dagangan Kuantitatif yang menggabungkan trend berikut dan volatility breakout

- Trend Multi-Indikator Mengikuti Strategi dengan Saluran Dinamik dan Sistem Dagangan Purata Bergerak

- Multi-EMA Trend Mengikut Strategi dengan Pengesahan SMMA

- Sistem Dagangan Trend Multi-Indikator dengan Strategi Analisis Momentum

- Strategi Divergensi Momentum Awan Mengikut Trend

- Mengikut Trend Multi-Indikator dan Strategi Penembusan Volatiliti

- Trend Multi-Pasar Beradaptasi Multi-Indikator Mengikut Strategi

- Strategi Masa Dinamik dan Pengurusan Posisi Berdasarkan Volatiliti

- Strategi Komposit EMA-MACD untuk Trend Scalping

- Mengikuti trend dan strategi momentum berdasarkan penunjuk pelbagai teknikal

- Strategi Dagangan Sesi Kuantitatif Frekuensi Tinggi: Sistem Pengurusan Posisi Dinamik Beradaptasi Berdasarkan Isyarat Penembusan

- Trend Momentum Crossover Multi-EMA Berikutan Strategi

- Strategi Perdagangan Volume Momentum Berbilang Sasaran Pintar

- Bollinger Bands Multi-Period Touch Trend Reversal Strategi Dagangan Kuantitatif

- Strategi Perdagangan Breakout Frekuensi Tinggi Berdasarkan Arahan Dekat Candlestick

- Trend Retracement Fibonacci Dinamik Lanjutan Strategi Dagangan Kuantitatif

- Indeks Berubah Purata Dinamik Trend Keuntungan Berbilang Tahap Mengikut Strategi

- Sistem Dagangan Purata Bergerak Berbilang dengan Pengesahan Momentum dan Volume Strategi Trend Kuantitatif

- Strategi Dagangan Seimbang Dengan Amalan Keuntungan dan Hentikan Kerugian

- Sistem Pengikut Trend yang Dipertingkatkan: Identifikasi Trend Dinamik Berdasarkan ADX dan SAR Parabolik

- Strategi Dagangan Momentum Stochastic Dual Timeframe