Strategi Dagangan Berbilang Penunjuk yang Difilterkan dengan Bollinger Bands dan Woodies CCI

Penulis:ChaoZhang, Tarikh: 2024-12-27 15:32:30Tag:BBCCIMAOBVATRSMATPSL

Ringkasan

Strategi ini adalah sistem perdagangan pelbagai penunjuk yang menggabungkan Bollinger Bands, Woodies CCI (Commodity Channel Index), Moving Averages (MA), dan On-Balance Volume (OBV). Ia menggunakan Bollinger Bands untuk menyediakan julat turun naik pasaran, penunjuk CCI untuk penapisan isyarat, dan menggabungkan sistem MA dengan pengesahan jumlah untuk melaksanakan dagangan apabila trend pasaran jelas. Di samping itu, ia menggunakan ATR untuk penempatan stop-loss dinamik dan mengambil keuntungan untuk mengawal risiko dengan berkesan.

Prinsip Strategi

Logik teras adalah berdasarkan elemen utama berikut:

- Menggunakan dua Band Bollinger deviasi standard (1x dan 2x) untuk membina saluran turun naik harga

- Menggunakan penunjuk CCI 6 tempoh dan 14 tempoh sebagai penapis isyarat, memerlukan pengesahan dari kedua-dua tempoh

- Menggabungkan purata bergerak 50 tempoh dan 200 tempoh untuk menentukan trend pasaran

- Mengukuhkan trend jumlah melalui OBV 10 tempoh yang halus

- Menggunakan ATR 14 tempoh untuk paras stop-loss dan mengambil keuntungan dinamik

Kelebihan Strategi

- Penyelarasan silang pelbagai penunjuk mengurangkan isyarat palsu dengan ketara

- Gabungan Bollinger Bands dan CCI memberikan penilaian volatiliti pasaran yang tepat

- Sistem MA jangka panjang dan jangka pendek berkesan menangkap trend utama

- OBV mengesahkan sokongan jumlah, meningkatkan kebolehpercayaan isyarat

- Tetapan stop-loss dan mengambil keuntungan dinamik disesuaikan dengan keadaan pasaran yang berbeza

- Isyarat dagangan yang jelas dengan pelaksanaan standard, sesuai untuk pelaksanaan kuantitatif

Risiko Strategi

- Pelbagai penunjuk boleh menyebabkan isyarat tertunda

- Stop-loss yang kerap di pasaran pelbagai

- Risiko penyesuaian parameter yang berlebihan

- Stop-loss mungkin tidak mencetuskan dengan cepat dalam tempoh yang tidak menentu Langkah-langkah pengurangan:

- Sesuaikan parameter penunjuk secara dinamik untuk kitaran pasaran yang berbeza

- Memantau penarikan untuk kawalan kedudukan

- Pengesahan parameter biasa

- Tetapkan had kerugian maksimum

Arahan pengoptimuman

- Memperkenalkan penunjuk turun naik untuk menyesuaikan kedudukan dalam tempoh turun naik yang tinggi

- Tambah penapisan kekuatan trend untuk mengelakkan perdagangan pasaran yang berbeza

- Mengoptimumkan pemilihan tempoh CCI untuk meningkatkan kepekaan isyarat

- Meningkatkan pengurusan keuntungan/kerugian dengan mengambil keuntungan separa

- Melaksanakan sistem amaran anomali jumlah

Ringkasan

Ini adalah sistem perdagangan lengkap berdasarkan kombinasi penunjuk teknikal yang meningkatkan ketepatan perdagangan melalui pengesahan isyarat berbilang. Reka bentuk strategi adalah munasabah dengan kawalan risiko yang betul dan mempunyai nilai aplikasi praktikal yang baik.

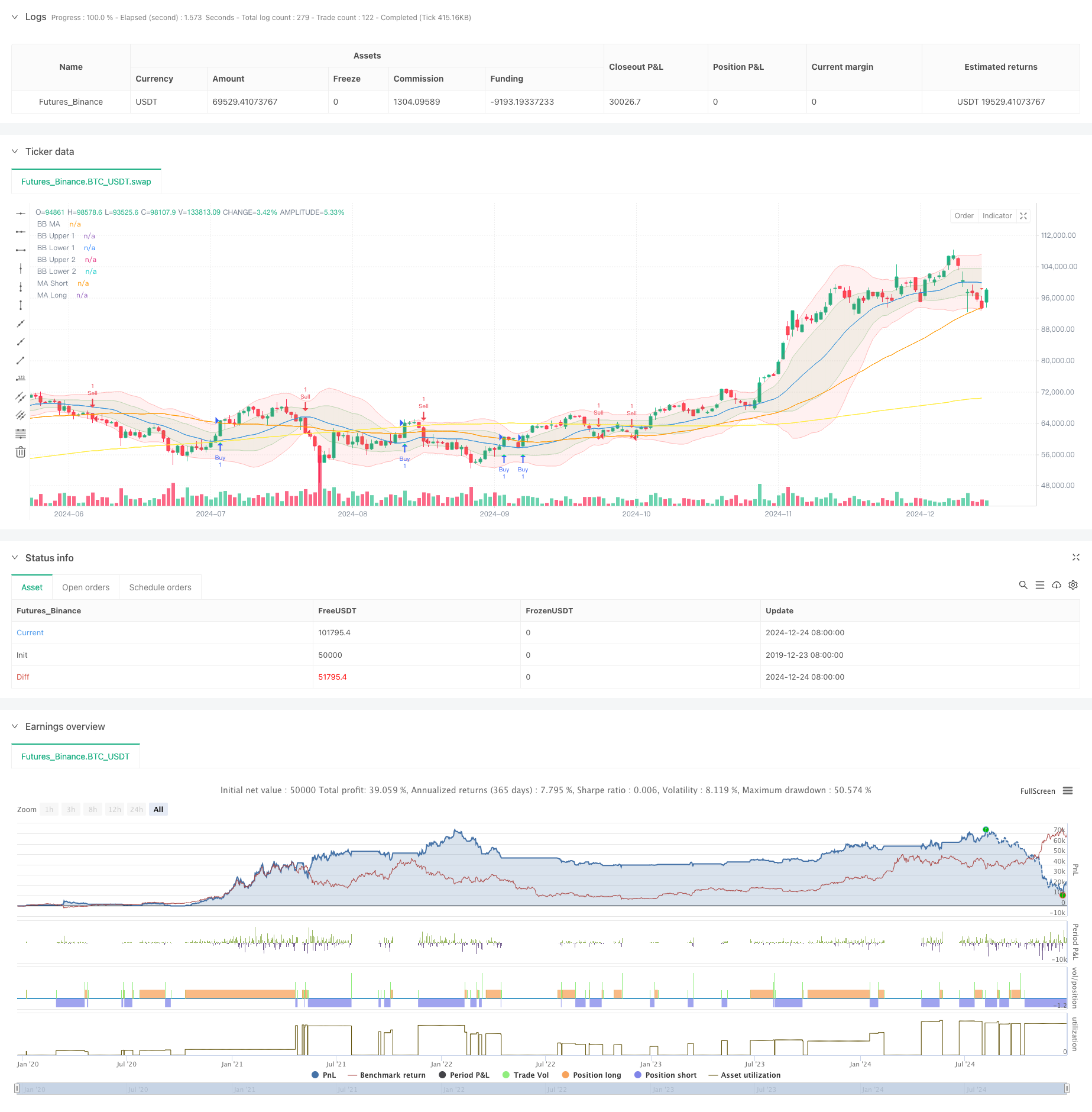

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(shorttitle="BB Debug + Woodies CCI Filter", title="Debug Buy/Sell Signals with Woodies CCI Filter", overlay=true)

// Input Parameters

length = input.int(20, minval=1, title="BB MA Length")

src = input.source(close, title="BB Source")

mult1 = input.float(1.0, minval=0.001, maxval=50, title="BB Multiplier 1 (Std Dev 1)")

mult2 = input.float(2.0, minval=0.001, maxval=50, title="BB Multiplier 2 (Std Dev 2)")

ma_length = input.int(50, minval=1, title="MA Length")

ma_long_length = input.int(200, minval=1, title="Long MA Length")

obv_smoothing = input.int(10, minval=1, title="OBV Smoothing Length")

atr_length = input.int(14, minval=1, title="ATR Length") // ATR Length for TP/SL

// Bollinger Bands

basis = ta.sma(src, length)

dev1 = mult1 * ta.stdev(src, length)

dev2 = mult2 * ta.stdev(src, length)

upper_1 = basis + dev1

lower_1 = basis - dev1

upper_2 = basis + dev2

lower_2 = basis - dev2

plot(basis, color=color.blue, title="BB MA")

p1 = plot(upper_1, color=color.new(color.green, 80), title="BB Upper 1")

p2 = plot(lower_1, color=color.new(color.green, 80), title="BB Lower 1")

p3 = plot(upper_2, color=color.new(color.red, 80), title="BB Upper 2")

p4 = plot(lower_2, color=color.new(color.red, 80), title="BB Lower 2")

fill(p1, p2, color=color.new(color.green, 90))

fill(p3, p4, color=color.new(color.red, 90))

// Moving Averages

ma_short = ta.sma(close, ma_length)

ma_long = ta.sma(close, ma_long_length)

plot(ma_short, color=color.orange, title="MA Short")

plot(ma_long, color=color.yellow, title="MA Long")

// OBV and Smoothing

obv = ta.cum(ta.change(close) > 0 ? volume : ta.change(close) < 0 ? -volume : 0)

obv_smooth = ta.sma(obv, obv_smoothing)

// Debugging: Buy/Sell Signals

debugBuy = ta.crossover(close, ma_short)

debugSell = ta.crossunder(close, ma_short)

// Woodies CCI

cciTurboLength = 6

cci14Length = 14

cciTurbo = ta.cci(src, cciTurboLength)

cci14 = ta.cci(src, cci14Length)

// Filter: Only allow trades when CCI confirms the signal

cciBuyFilter = cciTurbo > 0 and cci14 > 0

cciSellFilter = cciTurbo < 0 and cci14 < 0

finalBuySignal = debugBuy and cciBuyFilter

finalSellSignal = debugSell and cciSellFilter

// Plot Debug Buy/Sell Signals

plotshape(finalBuySignal, title="Filtered Buy", location=location.belowbar, color=color.lime, style=shape.triangleup, size=size.normal)

plotshape(finalSellSignal, title="Filtered Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.normal)

// Change candle color based on filtered signals

barcolor(finalBuySignal ? color.lime : finalSellSignal ? color.red : na)

// ATR for Stop Loss and Take Profit

atr = ta.atr(atr_length)

tp_long = close + 2 * atr // Take Profit for Long = 2x ATR

sl_long = close - 1 * atr // Stop Loss for Long = 1x ATR

tp_short = close - 2 * atr // Take Profit for Short = 2x ATR

sl_short = close + 1 * atr // Stop Loss for Short = 1x ATR

// Strategy Execution

if (finalBuySignal)

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit/Stop Loss", "Buy", limit=tp_long, stop=sl_long)

if (finalSellSignal)

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit/Stop Loss", "Sell", limit=tp_short, stop=sl_short)

// Check for BTC/USDT pair

isBTCUSDT = syminfo.ticker == "BTCUSDT"

// Add alerts only for BTC/USDT

alertcondition(isBTCUSDT and finalBuySignal, title="BTCUSDT Buy Signal", message="Buy signal detected for BTCUSDT!")

alertcondition(isBTCUSDT and finalSellSignal, title="BTCUSDT Sell Signal", message="Sell signal detected for BTCUSDT!")

- Pergerakan purata dinamik dan Bollinger Bands strategi silang dengan model optimum stop-loss tetap

- Strategi crossover purata bergerak berganda dengan pengurusan risiko dinamik

- Adaptive Moving Average Crossover dengan strategi Stop-Loss yang mengikut

- Trend Kadar Menang Tinggi Bermakna Strategi Perdagangan Pembalikan

- Strategi Dagangan ATR Berbilang Langkah dengan Mengambil Keuntungan Dinamik

- Strategi pembalikan purata yang ditingkatkan dengan pelaksanaan MACD-ATR

- Dinamis Trailing Stop Dual Sasaran Moving Purata strategi crossover

- Sistem Dagangan Trend Breakout dengan Purata Bergerak (Strategi TBMA)

- Strategi Dagangan Kuantitatif Beradaptasi dengan Crossover Purata Bergerak Berganda dan Ambil Keuntungan / Hentikan Kerugian

- Trend silang purata bergerak dinamik mengikut strategi dengan pengurusan risiko yang beradaptasi

- Triple Supertrend dan Trend Purata Bergerak Eksponensial Berikutan Strategi Dagangan Kuantitatif

- Bollinger Bands Berasaskan Awan Strategi Trend Kuantitatif Purata Bergerak Ganda

- Strategi Dagangan Kuantitatif Berbilang Tahap Berdasarkan Trend Divergence Bollinger Bands

- Strategi Dagangan Kuantitatif Berdasarkan Fibonacci 0.7 Level Trend Breakthrough

- Strategi Perdagangan Beradaptasi Blok Perintah Pecahan Berbilang Tempoh

- Strategi Rasio Risiko-Balas yang Dioptimumkan Berdasarkan Rintasan Purata Bergerak

- Strategi Dagangan Pengiktirafan Trend Dinamik

- Strategi Dagangan Kuantitatif Julat Dinamik Rentas Sempadan Berdasarkan Bollinger Bands

- Strategi Ramalan SMI Crossover Signal Berasaskan Momentum

- Strategi Dagangan Peningkatan Sinyal Crossover Purata Bergerak Berganda

- Trend Purata Bergerak Dinamik Mengikuti dengan RSI Strategi Perdagangan Pengesahan

- Strategi Salib Purata Bergerak Eksponensial Multi-Period Dinamis dengan Sistem Pengoptimuman Pullback

- Trend silang purata bergerak dinamik mengikut strategi dengan pengurusan risiko yang beradaptasi

- Strategi Dagangan Adaptif Berdasarkan RSI Stochastic Dual-Line Crossover

- Strategi kuantitatif aliran pesanan institusi berbilang peringkat dengan sistem skala kedudukan dinamik

- Strategi Dagangan Kuantitatif Mengambil Trend Dinamik Multi-EMA

- Pergerakan purata dinamik dan Bollinger Bands strategi silang dengan model optimum stop-loss tetap

- RSI Strategi Dagangan Pembalikan Trend dengan ATR Stop Loss dan Kawalan Zon Dagangan

- Multi-EMA Cross dengan Osilator dan Strategi Perdagangan Sokongan/Rintangan Dinamik

- Trend gabungan Multi-SMA dan Stochastic Berikutan Strategi Dagangan