Estratégias de combinação entre RSI e MA

Autora:ChaoZhang, Data: 2024-05-28 17:34:11Tags:RSIMAEMASMAHMAWMASTOCHRSI

Resumo

A estratégia combina o indicador RSI com a média móvel (MA) para gerar sinais de negociação. O RSI é usado para determinar se o mercado está sobrevendendo ou sobrevendendo, e o MA é usado para determinar a tendência do preço. O RSI produz um sinal de compra quando o RSI está sobrevendido e o preço está acima do MA. O RSI produz um sinal de venda quando o RSI está sobrevendido ou o MA produz um forco morto.

Princípios estratégicos

- Calcula o valor do indicador RSI para determinar se o mercado está sobrevendendo ou sobrevendendo.

- Calcula os MA de ciclos personalizados, incluindo os quatro tipos de EMA, SMA, HMA e WMA, e decide se eles são exibidos no gráfico, dependendo da configuração dos parâmetros.

- O sinal de compra é gerado quando o RSI é muito comprado e o preço de fechamento é superior ao MA; o sinal de venda é gerado quando o RSI é muito vendido ou o MA é morto.

- A introdução do StochRSI como um julgamento auxiliar, quando o StochRSI é sobrecomprado (<70) ou sobrevendido (<30), marca-se uma sugestão no gráfico, mas não produz um sinal de negociação real.

Vantagens estratégicas

- A combinação orgânica dos dois indicadores clássicos, RSI e MA, permite uma melhor captura do mercado de tendências e do momento em que o supercomprador vende.

- O tipo e os parâmetros da MA são facilmente configuráveis, com uma grande flexibilidade e podem ser ajustados de acordo com diferentes características do mercado.

- Introdução do StochRSI como um juízo auxiliar para fornecer mais referências para decisões de negociação.

- A lógica do código é clara, legível, fácil de entender e de desenvolvimento secundário.

Risco estratégico

- O RSI e o MA são ambos indicadores atrasados e podem gerar mais sinais enganosos no início da reversão da tendência.

- A configuração incorreta dos parâmetros pode causar um sinal prematuro ou atrasado, afetando o rendimento geral.

- A falta de gestão de stop loss e posições pode assumir um risco maior quando o mercado está em forte volatilidade.

Estratégias de otimização

- A introdução de mais indicadores prévios, como a taxa de flutuação, para determinar a mudança de tendência com antecedência.

- Os sinais de venda são filtrados, como exigir que o RSI e o MA atendam simultaneamente a certas condições para gerar sinais, para aumentar a precisão do sinal.

- Incorporar módulos de gestão de stop loss e posições na estratégia para controlar o risco de transações individuais e o risco geral.

- Otimizar os parâmetros da estratégia para encontrar a melhor combinação de parâmetros.

- Considere a inclusão de diferentes ciclos ou de várias variedades, aproveitando ao máximo as relações inter-relacionadas entre cada variedade ou ciclo.

Resumo

A estratégia é capaz de capturar os mercados de tendência e os momentos de sobrevenda, combinando os dois indicadores clássicos do RSI e do MA, e introduzindo o StochRSI como um julgamento auxiliar. O pensamento geral é simples e claro. Mas a estratégia também possui algumas deficiências, como a falta de medidas de controle de risco, a precisão do sinal a ser melhorada, etc. No futuro, a estratégia pode ser aperfeiçoada através da introdução de mais indicadores, regras de sinalização otimizadas, a inclusão de módulos de controle de risco, etc., com a esperança de obter ganhos mais sólidos.

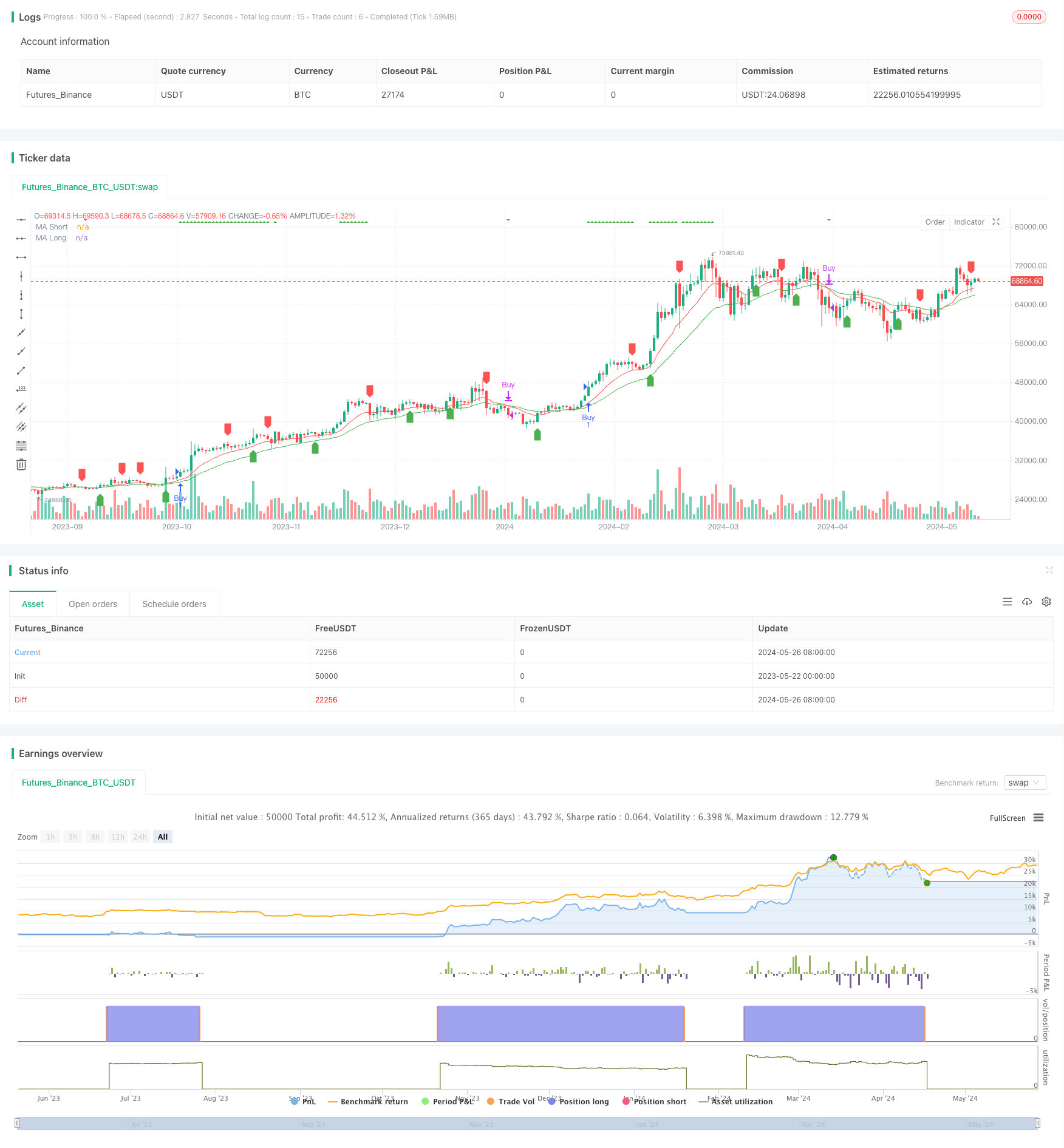

/*backtest

start: 2023-05-22 00:00:00

end: 2024-05-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI Strategy with Customizable MA and StochRSI Alert", overlay=true)

// กำหนดค่า RSI สำหรับการเปิดสัญญาณซื้อและขาย

rsiOverbought = input(70, title="RSI Overbought Level")

rsiOversold = input(30, title="RSI Oversold Level")

// เลือกชนิดของเส้นค่าเฉลี่ยเคลื่อนที่

maType = input.string("EMA", title="MA Type", options=["EMA", "SMA", "HMA", "WMA"])

// กำหนดค่าเส้นค่าเฉลี่ยเคลื่อนที่

maShortLength = input(12, title="MA Short Length")

maLongLength = input(26, title="MA Long Length")

// เลือกการแสดงผลของเส้นค่าเฉลี่ยเคลื่อนที่

showShortMA = input(true, title="Show Short Moving Average")

showLongMA = input(true, title="Show Long Moving Average")

// ฟังก์ชันสำหรับเลือกชนิดของเส้นค่าเฉลี่ยเคลื่อนที่

f_ma(src, length, type) =>

switch type

"SMA" => ta.sma(src, length)

"EMA" => ta.ema(src, length)

"HMA" => ta.hma(src, length)

"WMA" => ta.wma(src, length)

// คำนวณค่าเส้นค่าเฉลี่ยเคลื่อนที่

maShort = showShortMA ? f_ma(close, maShortLength, maType) : na

maLong = showLongMA ? f_ma(close, maLongLength, maType) : na

// คำนวณค่า RSI

rsiValue = ta.rsi(close, 14)

// สร้างสัญญาณซื้อและขาย

buySignal = (rsiValue > rsiOverbought and ((showShortMA and showLongMA and close > maShort and maShort > maLong) or (showShortMA and not showLongMA and close > maShort) or (showLongMA and not showShortMA and close > maLong)))

sellSignal = (showShortMA and showLongMA and ta.crossover(maLong, maShort)) or (showShortMA and not showLongMA and ta.crossover(maShort, close)) or (showLongMA and not showShortMA and ta.crossover(maLong, close))

// แสดงค่าเส้นค่าเฉลี่ยเคลื่อนที่บนกราฟ

plot(maShort, color=color.red, title="MA Short")

plot(maLong, color=color.green, title="MA Long")

// คำนวณค่า Stochastic RSI

smoothK = 3

smoothD = 3

RSIlen = 14

STOlen = 14

SRsrc = close

OSlevel = 30

OBlevel = 70

rsi1 = ta.rsi(SRsrc, RSIlen)

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, STOlen), smoothK)

d = ta.sma(k, smoothD)

stochRSIOverbought = OBlevel

stochRSIOversold = OSlevel

stochRSIBuyAlert = ta.crossover(k, stochRSIOversold)

stochRSISellAlert = ta.crossunder(k, stochRSIOverbought)

// สร้างคำสั่งซื้อและขายเมื่อมีสัญญาณจาก RSI และ MA เท่านั้น

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Buy")

// แสดงสัญญาณเตือนจาก Stochastic RSI บนกราฟ

plotshape(series=stochRSIBuyAlert, location=location.belowbar, color=color.green, style=shape.labelup, title="StochRSI Buy Alert")

plotshape(series=stochRSISellAlert, location=location.abovebar, color=color.red, style=shape.labeldown, title="StochRSI Sell Alert")

// แสดงสัญญาณซื้อและขายจาก RSI และ MA บนกราฟ

plotshape(series=buySignal, location=location.top, color=color.green, style=shape.triangleup, title="RSI>70")

plotshape(series=sellSignal, location=location.top, color=color.red, style=shape.triangledown, title="MA crossoverDown")

- Flexível multi-ciclo estratégia de cruzamento linear superior

- Estratégias de negociação quantitativas de parâmetros dinâmicos RSI auxiliados por cruzamento multilinear

- Estratégias de negociação quantitativas de alta RSI que se afastam do portfólio médio

- Estratégias de quantificação de cruzamento de médias móveis dinâmicas com múltiplos indicadores

- Múltiplas estratégias de negociação quantitativas de rastreamento de tendências de cruzamento dinâmico e de confirmação múltipla

- Sistema de otimização de estratégias de cruzamento e retrocesso de média móvel de índices dinâmicos multicíclicos

- Estratégias de otimização de indicadores dinâmicos duplos

- Múltiplas tendências de cruzamento de linha de diagonal seguem estratégias de flutuação do RSI

- Múltiplas estratégias de rastreamento de tendências de indicadores tecnológicos combinadas com sistemas de ruptura e stop-loss no mapa das nuvens

- Barras de Momento RedK

- Ichimoku Kumo estratégia de negociação

- Dinâmica ATR paragem paragem paragem estratégia de cruzamento de linha uniforme móvel

- Mudanças de tendência da EMA

- Estratégias de detecção de tendências do G-Channel

- Estratégias de bloqueio e bloqueio de movimentação transversal uniforme

- EMA estratégia de negociação de parâmetros de parâmetros cruzados

- Estratégias de rastreamento de tendências da faixa de Boling e da EMA

- A tendência de flutuação dos indicadores de convulsão desvia-se da estratégia, e a tendência de flutuação dos indicadores desvia-se da estratégia.

- Estratégias de otimização de mecanismos de mercado multiespaço baseados em volatilidade e linha de retorno

- Estratégias de quantificação de pontuação Z de estado binário misto

- Estratégia de negociação de volume da EMA

- Estratégia de negociação de curto prazo da FVG

- Estratégias de adaptação de prejuízo baseadas em ATR e EMA dinâmicas

- Estratégias de rastreamento de tendências baseadas em rupturas e filtragem de frequência.

- A estratégia de ruptura do ouro e do alumínio de Fibonacci

- Estratégias de identificação de estado de mercado dinâmico baseadas em gradientes de regressão linear

- Estratégias de negociação de reversão de tendência baseadas no desvio do RSI

- A estratégia de dinâmica do RSI bi-equilíneo baseada em brechas da EMA e da linha de tendência

- Gestão de posições dinâmicas estratégias de negociação diárias

- Estratégias de negociação técnicas baseadas em gráficos de 15 minutos do BTC