Visão geral

A estratégia é um sistema de negociação quantitativa que combina Bollinger Bands, Indicadores de Força Relativa (RSI) e Média de Custo Dinâmico (DCA). A estratégia executa automaticamente operações de construção de posição em lotes em meio a flutuações do mercado, através da definição de regras de gerenciamento de fundos, ao mesmo tempo em que combina indicadores técnicos para julgar sinais de compra e venda e executar transações com risco controlado. O sistema também inclui lógica de parada e rastreamento de lucros acumulados, que permitem monitorar e gerenciar efetivamente o desempenho das negociações.

Princípio da estratégia

A estratégia baseia-se principalmente nos seguintes componentes principais:

- O indicador de correia de Brin é usado para avaliar oscilações de preços, considerando a compra quando o preço toca a baixa e a venda quando toca a alta

- O indicador RSI é usado para confirmar o estado de sobrecompra e sobrevenda no mercado, confirmando o excesso de venda quando o RSI é inferior a 25 e confirmando o excesso de venda quando é superior a 75

- O módulo DCA calcula o valor de cada posição em função da dinâmica dos direitos e interesses da conta, permitindo a gestão adaptativa dos fundos

- Módulo de stop loss estabelece um objetivo de lucro de 5% para atingir o objetivo de proteção de lucro automática

- O módulo de monitoramento do estado do mercado calcula a amplitude de variação do mercado em 90 dias, ajudando a determinar a tendência geral

- O módulo de rastreamento de lucros acumulados registra os lucros e perdas de cada transação para avaliar o desempenho da estratégia

Vantagens estratégicas

- Aumento da fiabilidade do sinal, combinado com a verificação cruzada de vários indicadores técnicos

- Adotar gestão de posições dinâmicas para evitar riscos de posições fixas

- Estabelecer condições razoáveis de suspensão e bloquear lucros em tempo hábil

- Com a função de monitoramento de tendências de mercado, é mais fácil entender o cenário geral

- Sistema de rastreamento de lucro para análise de desempenho estratégico

- Alerta em tempo real para oportunidades de negociação

Risco estratégico

- Mercado em turbulência pode desencadear sinais frequentes de aumento de custos de transação

- O RSI pode ficar para trás no mercado de tendência

- A paralisação de percentual fixo pode ser uma saída prematura de um mercado em forte tendência

- A estratégia da DCA pode causar um retorno maior em um mercado de queda unilateral As seguintes medidas são recomendadas para gerenciar riscos:

- Configurar um limite máximo de posição

- Parâmetros de ajuste dinâmico à volatilidade do mercado

- Adicionar filtro de tendência

- Implementar estratégias de suspensão por etapas

Direção de otimização da estratégia

- Otimização dinâmica de parâmetros:

- Os parâmetros da faixa de Bryn podem ser ajustados de acordo com a taxa de flutuação

- Os limites do RSI podem variar com o ciclo do mercado

- A proporção de fundos DCA pode ser ajustada com o tamanho da conta

- Sistema de sinalização reforçado:

- Aumentar a confirmação do volume

- Adição de análise de linha de tendência

- Combinado com mais indicadores técnicos de verificação cruzada

- O risco é controlado:

- Realização de stop loss dinâmico

- Adição de controle de retração máxima

- Configurar um limite de perda diária

Resumir

A estratégia, por meio da aplicação integrada de métodos de análise técnica e de gestão de fundos, constrói um sistema de negociação mais completo. A vantagem da estratégia reside na identificação de múltiplos sinais e na gestão de riscos perfeita, mas ainda precisa de ser plenamente testada e otimizada no mercado real. A estratégia deve ter um desempenho estável em negociações reais, através da melhoria contínua da configuração de parâmetros e do aumento de indicadores auxiliares.

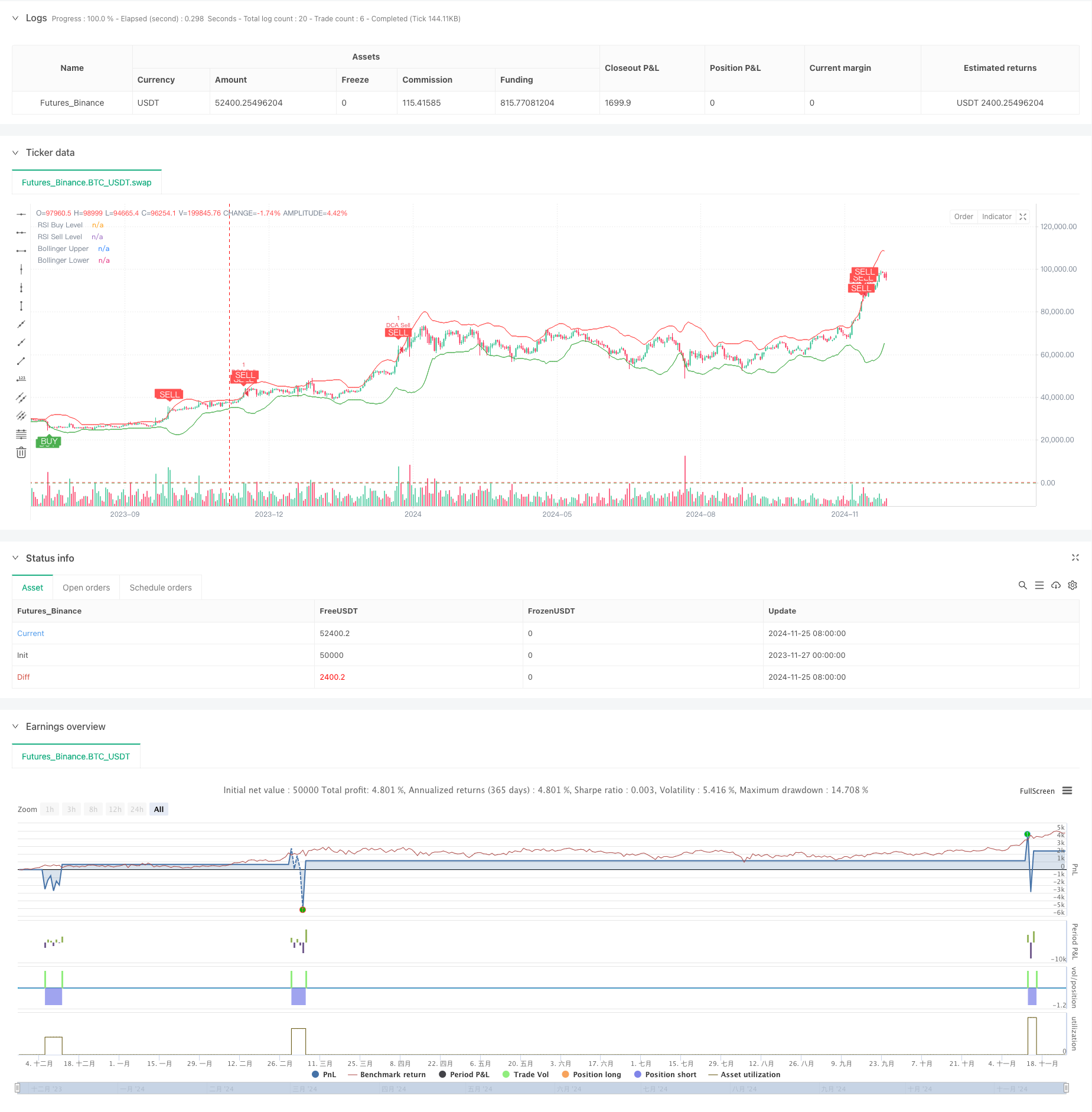

/*backtest

start: 2023-11-27 00:00:00

end: 2024-11-26 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined BB RSI with Cumulative Profit, Market Change, and Futures Strategy (DCA)", shorttitle="BB RSI Combined DCA Strategy", overlay=true)

// Input Parameters

length = input.int(20, title="BB Length") // Adjusted BB length

mult = input.float(2.5, title="BB Multiplier") // Adjusted BB multiplier

rsiLength = input.int(14, title="RSI Length") // Adjusted RSI length

rsiBuyLevel = input.int(25, title="RSI Buy Level") // Adjusted RSI Buy Level

rsiSellLevel = input.int(75, title="RSI Sell Level") // Adjusted RSI Sell Level

dcaPositionSizePercent = input.float(1, title="DCA Position Size (%)", tooltip="Percentage of equity to use in each DCA step")

takeProfitPercentage = input.float(5, title="Take Profit (%)", tooltip="Take profit percentage for DCA strategy")

// Calculate DCA position size

equity = strategy.equity // Account equity

dcaPositionSize = (equity * dcaPositionSizePercent) / 100 // DCA position size as percentage of equity

// Bollinger Bands Calculation

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// Plotting Bollinger Bands and RSI levels

plot(upper, color=color.red, title="Bollinger Upper")

plot(lower, color=color.green, title="Bollinger Lower")

hline(rsiBuyLevel, "RSI Buy Level", color=color.green)

hline(rsiSellLevel, "RSI Sell Level", color=color.red)

// Buy and Sell Signals

buySignal = (rsi < rsiBuyLevel and close <= lower)

sellSignal = (rsi > rsiSellLevel and close >= upper)

// DCA Strategy: Enter Long or Short based on signals with calculated position size

if (buySignal)

strategy.entry("DCA Buy", strategy.long)

if (sellSignal)

strategy.entry("DCA Sell", strategy.short)

// Take Profit Logic

if (strategy.position_size > 0) // If long

strategy.exit("Take Profit Long", from_entry="DCA Buy", limit=close * (1 + takeProfitPercentage / 100))

if (strategy.position_size < 0) // If short

strategy.exit("Take Profit Short", from_entry="DCA Sell", limit=close * (1 - takeProfitPercentage / 100))

// Plot Buy/Sell Signals on the chart

plotshape(buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY", textcolor=color.white)

plotshape(sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", textcolor=color.white)

// Alerts for Buy/Sell Signals

alertcondition(buySignal, title="Buy Alert", message="Buy Signal Detected")

alertcondition(sellSignal, title="Sell Alert", message="Sell Signal Detected")

// Cumulative Profit Calculation

var float buyPrice = na

var float profit = na

var float cumulativeProfit = 0.0 // Cumulative profit tracker

if (buySignal)

buyPrice := close

if (sellSignal and not na(buyPrice))

profit := (close - buyPrice) / buyPrice * 100

cumulativeProfit := cumulativeProfit + profit // Update cumulative profit

label.new(bar_index, high, text="P: " + str.tostring(profit, "#.##") + "%", color=color.blue, style=label.style_label_down)

buyPrice := na // Reset buyPrice after sell

// Plot cumulative profit on the chart

var label cumulativeLabel = na

if (not na(cumulativeProfit))

if not na(cumulativeLabel)

label.delete(cumulativeLabel)

cumulativeLabel := label.new(bar_index, high + 10, text="Cumulative Profit: " + str.tostring(cumulativeProfit, "#.##") + "%", color=color.purple, style=label.style_label_up)

// Market Change over 3 months Calculation

threeMonthsBars = 3 * 30 * 24 // Approximation of 3 months in bars (assuming 1 hour per bar)

priceThreeMonthsAgo = request.security(syminfo.tickerid, "D", close[threeMonthsBars])

marketChange = (close - priceThreeMonthsAgo) / priceThreeMonthsAgo * 100

// Plot market change over 3 months

var label marketChangeLabel = na

if (not na(marketChange))

if not na(marketChangeLabel)

label.delete(marketChangeLabel)

marketChangeLabel := label.new(bar_index, high + 20, text="Market Change (3 months): " + str.tostring(marketChange, "#.##") + "%", color=color.orange, style=label.style_label_up)

// Both labels (cumulative profit and market change) are displayed simultaneously

var label infoLabel = na

if (not na(cumulativeProfit) and not na(marketChange))

if not na(infoLabel)

label.delete(infoLabel)

infoLabel := label.new(bar_index, high + 30, text="Cumulative Profit: " + str.tostring(cumulativeProfit, "#.##") + "% | Market Change (3 months): " + str.tostring(marketChange, "#.##") + "%", color=color.purple, style=label.style_label_upper_right)