Стратегия представляет собой количественную торговую систему, основанную на динамическом колебателе RSI. Для захвата рыночной динамики используется многомерное сопоставление и временной анализ RSI, чтобы рассчитать скорость изменения RSI. Стратегия использует высокотехнологичные математические методы обработки сигналов, такие как QR-разложение, и принимает торговые решения в сочетании с равнолинейной системой.

Стратегический принцип

В основе стратегии лежит Delta-RSI oscillator, который реализуется следующими шагами:

- Сначала вычислите традиционный RSI в качестве базовой информации.

- Сплошная обработка RSI с использованием многомерного приспособления, снижение шума

- Вычислить временную коэффициент RSI, получив дельта-RSI, отражающий скорость изменения RSI

- Сопоставление Делта-РСИ с его движущейся средней дает торговый сигнал

- Оценка и фильтрация качества соответствия с использованием уравненной корневой погрешности (RMSE)

Торговые сигналы могут генерироваться тремя способами:

- Пересечение нулевой линии: Дельта-RSI больше, когда она переходит от отрицательной к положительной, и больше, когда она переходит от положительной к отрицательной

- Пересечение сигнальных линий: Delta-RSI пересекает / пересекает свою движущуюся среднюю вверх / вниз, делая больше / делая меньше

- Изменение направления: Дельта-RSI становится лишним, когда отрицательные зоны начинают расти, и пустым, когда положительные зоны начинают падать

Стратегические преимущества

- Математические основы прочны: использование высокотехнологичных математических методов обработки сигналов, таких как расщепление QR, надежная теоретическая основа

- Сигнал гладкий: многополюсная совместимость эффективно фильтрует рыночный шум и улучшает качество сигнала

- Гибкость: предоставление множества способов генерации сигналов и параметров, адаптированных к различным рыночным условиям

- Управляемый риск: содержит механизм фильтрации RMSE, который позволяет отсеивать сигналы с более высокой надежностью

- Высокая вычислительная эффективность: матричные вычисления используют оптимизированные алгоритмы с высокой эффективностью работы

Стратегический риск

- чувствительные к параметрам: несколько ключевых параметров требуют тщательной настройки, неправильный выбор параметров может серьезно повлиять на эффективность стратегии

- Задержка: плавная обработка сигнала приводит к определенной задержке, может пропустить быстрый ход

- Фальшивые прорывы: возможно создание ложных сигналов и увеличение стоимости торговли в условиях нестабильных рынков

- Комплексные вычисления: включают большое количество матричных операций, в которых могут возникнуть пробелы в высокочастотных сделках

- Оптимизация параметров требует осторожности, чтобы избежать чрезмерного соответствия историческим данным.

Направление оптимизации стратегии

- Самостоятельно адаптируемые параметры: можно регулировать циклы RSI и коэффициенты соответствия в зависимости от динамики рыночных колебаний

- Многочасовой цикл: перекрестная проверка сигналов с большим количеством временных циклов

- Фильтрация частоты колебаний: добавление показателей частоты колебаний, таких как ATR, для фильтрации сигналов

- Классификация рынка: использование различных правил генерации сигналов для различных состояний рынка (тенденции / колебания)

- Оптимизация стоп-убытков: добавление более интеллектуальных механизмов стоп-убытков, таких как динамическая стоп-убытка, основанная на поддержке точек сопротивления

Подвести итог

Это целостная структура, твердая теоретическая основа количественной торговой стратегии. С помощью анализа динамических характеристик RSI, в сочетании с современными математическими методами для обработки сигналов, можно лучше улавливать рыночные тенденции. Несмотря на то, что существует определенная чувствительность к параметрам и проблемы с вычислительной сложностью, эта стратегия имеет хорошую ценность при применении разумного выбора и оптимизации параметров. Рекомендуется обращать внимание на контроль риска при применении на рынке, разумно устанавливать позиции и постоянно контролировать эффективность стратегии.

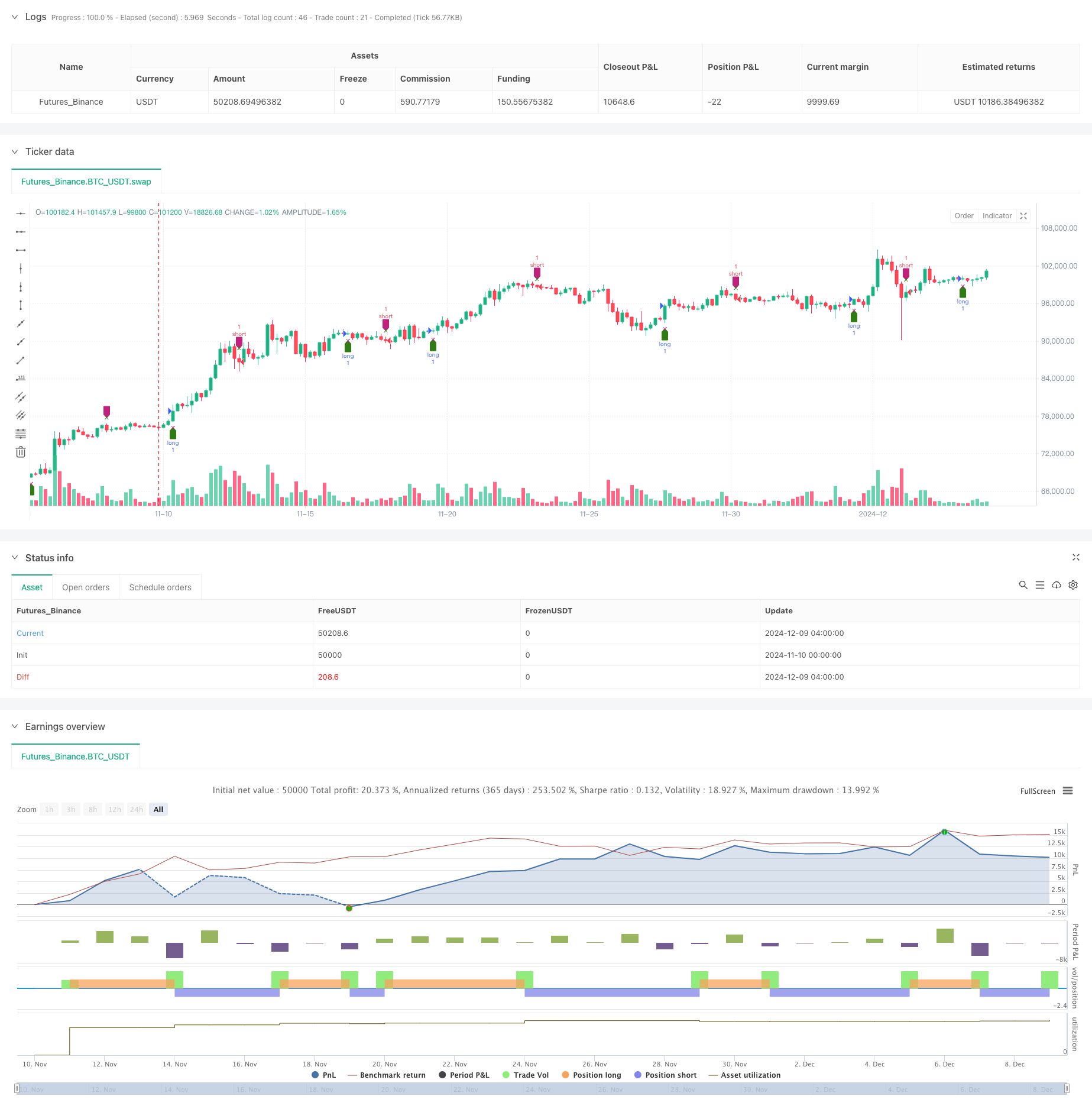

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 4h

basePeriod: 4h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tbiktag

//

// Delta-RSI Oscillator Strategy

//

// A strategy that uses Delta-RSI Oscillator (© tbiktag) as a stand-alone indicator:

// https://www.tradingview.com/script/OXQVFTQD-Delta-RSI-Oscillator/

//

// Delta-RSI is a smoothed time derivative of the RSI, plotted as a histogram

// and serving as a momentum indicator.

//

// Input parameters:

// RSI Length: The timeframe of the RSI that serves as an input to D-RSI.

// Length: The length of the lookback frame used for local regression.

// Polynomial Order: The order of the local polynomial function used to interpolate the RSI.

// Signal Length: The length of a EMA of the D-RSI series that is used as a signal line.

// Trade signals are generated based on three optional conditions:

// - Zero-crossing: bullish when D-RSI crosses zero from negative to positive values (bearish otherwise)

// - Signal Line Crossing: bullish when D-RSI crosses from below to above the signal line (bearish otherwise)

// - Direction Change: bullish when D-RSI was negative and starts ascending (bearish otherwise)

//

// Since D-RSI oscillator is based on polynomial fitting of the RSI curve, there is also an option

// to filter trade signal by means of the root mean-square error of the fit (normalized by the sample average).

//

//@version=5

strategy(title='Delta-RSI Oscillator Strategy-QuangVersion', shorttitle='D-RSI-Q', overlay=true)

// ---Subroutines---

matrix_get(_A, _i, _j, _nrows) =>

// Get the value of the element of an implied 2d matrix

//input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _i :: integer: row number

// _j :: integer: column number

// _nrows :: integer: number of rows in the implied 2d matrix

array.get(_A, _i + _nrows * _j)

matrix_set(_A, _value, _i, _j, _nrows) =>

// Set a value to the element of an implied 2d matrix

//input:

// _A :: array, changed on output: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _value :: float: the new value to be set

// _i :: integer: row number

// _j :: integer: column number

// _nrows :: integer: number of rows in the implied 2d matrix

array.set(_A, _i + _nrows * _j, _value)

transpose(_A, _nrows, _ncolumns) =>

// Transpose an implied 2d matrix

// input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _nrows :: integer: number of rows in _A

// _ncolumns :: integer: number of columns in _A

// output:

// _AT :: array: pseudo 2d matrix with implied dimensions: _ncolums x _nrows

var _AT = array.new_float(_nrows * _ncolumns, 0)

for i = 0 to _nrows - 1 by 1

for j = 0 to _ncolumns - 1 by 1

matrix_set(_AT, matrix_get(_A, i, j, _nrows), j, i, _ncolumns)

_AT

multiply(_A, _B, _nrowsA, _ncolumnsA, _ncolumnsB) =>

// Calculate scalar product of two matrices

// input:

// _A :: array: pseudo 2d matrix

// _B :: array: pseudo 2d matrix

// _nrowsA :: integer: number of rows in _A

// _ncolumnsA :: integer: number of columns in _A

// _ncolumnsB :: integer: number of columns in _B

// output:

// _C:: array: pseudo 2d matrix with implied dimensions _nrowsA x _ncolumnsB

var _C = array.new_float(_nrowsA * _ncolumnsB, 0)

int _nrowsB = _ncolumnsA

float elementC = 0.0

for i = 0 to _nrowsA - 1 by 1

for j = 0 to _ncolumnsB - 1 by 1

elementC := 0

for k = 0 to _ncolumnsA - 1 by 1

elementC += matrix_get(_A, i, k, _nrowsA) * matrix_get(_B, k, j, _nrowsB)

elementC

matrix_set(_C, elementC, i, j, _nrowsA)

_C

vnorm(_X, _n) =>

//Square norm of vector _X with size _n

float _norm = 0.0

for i = 0 to _n - 1 by 1

_norm += math.pow(array.get(_X, i), 2)

_norm

math.sqrt(_norm)

qr_diag(_A, _nrows, _ncolumns) =>

//QR Decomposition with Modified Gram-Schmidt Algorithm (Column-Oriented)

// input:

// _A :: array: pseudo 2d matrix _A = [[column_0],[column_1],...,[column_(n-1)]]

// _nrows :: integer: number of rows in _A

// _ncolumns :: integer: number of columns in _A

// output:

// _Q: unitary matrix, implied dimenstions _nrows x _ncolumns

// _R: upper triangular matrix, implied dimansions _ncolumns x _ncolumns

var _Q = array.new_float(_nrows * _ncolumns, 0)

var _R = array.new_float(_ncolumns * _ncolumns, 0)

var _a = array.new_float(_nrows, 0)

var _q = array.new_float(_nrows, 0)

float _r = 0.0

float _aux = 0.0

//get first column of _A and its norm:

for i = 0 to _nrows - 1 by 1

array.set(_a, i, matrix_get(_A, i, 0, _nrows))

_r := vnorm(_a, _nrows)

//assign first diagonal element of R and first column of Q

matrix_set(_R, _r, 0, 0, _ncolumns)

for i = 0 to _nrows - 1 by 1

matrix_set(_Q, array.get(_a, i) / _r, i, 0, _nrows)

if _ncolumns != 1

//repeat for the rest of the columns

for k = 1 to _ncolumns - 1 by 1

for i = 0 to _nrows - 1 by 1

array.set(_a, i, matrix_get(_A, i, k, _nrows))

for j = 0 to k - 1 by 1

//get R_jk as scalar product of Q_j column and A_k column:

_r := 0

for i = 0 to _nrows - 1 by 1

_r += matrix_get(_Q, i, j, _nrows) * array.get(_a, i)

_r

matrix_set(_R, _r, j, k, _ncolumns)

//update vector _a

for i = 0 to _nrows - 1 by 1

_aux := array.get(_a, i) - _r * matrix_get(_Q, i, j, _nrows)

array.set(_a, i, _aux)

//get diagonal R_kk and Q_k column

_r := vnorm(_a, _nrows)

matrix_set(_R, _r, k, k, _ncolumns)

for i = 0 to _nrows - 1 by 1

matrix_set(_Q, array.get(_a, i) / _r, i, k, _nrows)

[_Q, _R]

pinv(_A, _nrows, _ncolumns) =>

//Pseudoinverse of matrix _A calculated using QR decomposition

// Input:

// _A:: array: implied as a (_nrows x _ncolumns) matrix _A = [[column_0],[column_1],...,[column_(_ncolumns-1)]]

// Output:

// _Ainv:: array implied as a (_ncolumns x _nrows) matrix _A = [[row_0],[row_1],...,[row_(_nrows-1)]]

// ----

// First find the QR factorization of A: A = QR,

// where R is upper triangular matrix.

// Then _Ainv = R^-1*Q^T.

// ----

[_Q, _R] = qr_diag(_A, _nrows, _ncolumns)

_QT = transpose(_Q, _nrows, _ncolumns)

// Calculate Rinv:

var _Rinv = array.new_float(_ncolumns * _ncolumns, 0)

float _r = 0.0

matrix_set(_Rinv, 1 / matrix_get(_R, 0, 0, _ncolumns), 0, 0, _ncolumns)

if _ncolumns != 1

for j = 1 to _ncolumns - 1 by 1

for i = 0 to j - 1 by 1

_r := 0.0

for k = i to j - 1 by 1

_r += matrix_get(_Rinv, i, k, _ncolumns) * matrix_get(_R, k, j, _ncolumns)

_r

matrix_set(_Rinv, _r, i, j, _ncolumns)

for k = 0 to j - 1 by 1

matrix_set(_Rinv, -matrix_get(_Rinv, k, j, _ncolumns) / matrix_get(_R, j, j, _ncolumns), k, j, _ncolumns)

matrix_set(_Rinv, 1 / matrix_get(_R, j, j, _ncolumns), j, j, _ncolumns)

//

_Ainv = multiply(_Rinv, _QT, _ncolumns, _ncolumns, _nrows)

_Ainv

norm_rmse(_x, _xhat) =>

// Root Mean Square Error normalized to the sample mean

// _x. :: array float, original data

// _xhat :: array float, model estimate

// output

// _nrmse:: float

float _nrmse = 0.0

if array.size(_x) != array.size(_xhat)

_nrmse := na

_nrmse

else

int _N = array.size(_x)

float _mse = 0.0

for i = 0 to _N - 1 by 1

_mse += math.pow(array.get(_x, i) - array.get(_xhat, i), 2) / _N

_mse

_xmean = array.sum(_x) / _N

_nrmse := math.sqrt(_mse) / _xmean

_nrmse

_nrmse

diff(_src, _window, _degree) =>

// Polynomial differentiator

// input:

// _src:: input series

// _window:: integer: wigth of the moving lookback window

// _degree:: integer: degree of fitting polynomial

// output:

// _diff :: series: time derivative

// _nrmse:: float: normalized root mean square error

//

// Vandermonde matrix with implied dimensions (window x degree+1)

// Linear form: J = [ [z]^0, [z]^1, ... [z]^degree], with z = [ (1-window)/2 to (window-1)/2 ]

var _J = array.new_float(_window * (_degree + 1), 0)

for i = 0 to _window - 1 by 1

for j = 0 to _degree by 1

matrix_set(_J, math.pow(i, j), i, j, _window)

// Vector of raw datapoints:

var _Y_raw = array.new_float(_window, na)

for j = 0 to _window - 1 by 1

array.set(_Y_raw, j, _src[_window - 1 - j])

// Calculate polynomial coefficients which minimize the loss function

_C = pinv(_J, _window, _degree + 1)

_a_coef = multiply(_C, _Y_raw, _degree + 1, _window, 1)

// For first derivative, approximate the last point (i.e. z=window-1) by

float _diff = 0.0

for i = 1 to _degree by 1

_diff += i * array.get(_a_coef, i) * math.pow(_window - 1, i - 1)

_diff

// Calculates data estimate (needed for rmse)

_Y_hat = multiply(_J, _a_coef, _window, _degree + 1, 1)

float _nrmse = norm_rmse(_Y_raw, _Y_hat)

[_diff, _nrmse]

/// --- main ---

degree = input.int(title='Polynomial Order', group='Model Parameters:', inline='linepar1', defval=2, minval=1)

rsi_l = input.int(title='RSI Length', group='Model Parameters:', inline='linepar1', defval=21, minval=1, tooltip='The period length of RSI that is used as input.')

window = input.int(title='Length ( > Order)', group='Model Parameters:', inline='linepar2', defval=21, minval=2)

signalLength = input.int(title='Signal Length', group='Model Parameters:', inline='linepar2', defval=9, tooltip='The signal line is a EMA of the D-RSI time series.')

islong = input.bool(title='Buy', group='Show Signals:', inline='lineent', defval=true)

isshort = input.bool(title='Sell', group='Show Signals:', inline='lineent', defval=true)

showendlabels = input.bool(title='Exit', group='Show Signals:', inline='lineent', defval=true)

buycond = input.string(title='Buy', group='Entry and Exit Conditions:', inline='linecond', defval='Zero-Crossing', options=['Zero-Crossing', 'Signal Line Crossing', 'Direction Change'])

sellcond = input.string(title='Sell', group='Entry and Exit Conditions:', inline='linecond', defval='Zero-Crossing', options=['Zero-Crossing', 'Signal Line Crossing', 'Direction Change'])

endcond = input.string(title='Exit', group='Entry and Exit Conditions:', inline='linecond', defval='Zero-Crossing', options=['Zero-Crossing', 'Signal Line Crossing', 'Direction Change'])

usenrmse = input.bool(title='', group='Filter by Means of Root-Mean-Square Error of RSI Fitting:', inline='linermse', defval=false)

rmse_thrs = input.float(title='RSI fitting Error Threshold, %', group='Filter by Means of Root-Mean-Square Error of RSI Fitting:', inline='linermse', defval=10, minval=0.0) / 100

src = ta.rsi(close, rsi_l)

[drsi, nrmse] = diff(src, window, degree)

signalline = ta.ema(drsi, signalLength)

// Conditions and filters

filter_rmse = usenrmse ? nrmse < rmse_thrs : true

dirchangeup = drsi > drsi[1] and drsi[1] < drsi[2] and drsi[1] < 0.0

dirchangedw = drsi < drsi[1] and drsi[1] > drsi[2] and drsi[1] > 0.0

crossup = ta.crossover(drsi, 0.0)

crossdw = ta.crossunder(drsi, 0.0)

crosssignalup = ta.crossover(drsi, signalline)

crosssignaldw = ta.crossunder(drsi, signalline)

//Signals

golong = (buycond == 'Direction Change' ? dirchangeup : buycond == 'Zero-Crossing' ? crossup : crosssignalup) and filter_rmse

goshort = (sellcond == 'Direction Change' ? dirchangedw : sellcond == 'Zero-Crossing' ? crossdw : crosssignaldw) and filter_rmse

endlong = (endcond == 'Direction Change' ? dirchangedw : endcond == 'Zero-Crossing' ? crossdw : crosssignaldw) and filter_rmse

endshort = (endcond == 'Direction Change' ? dirchangeup : endcond == 'Zero-Crossing' ? crossup : crosssignalup) and filter_rmse

plotshape(golong and islong ? low : na, location=location.belowbar, style=shape.labelup, color=color.new(#2E7C13, 0), size=size.small, title='Buy')

plotshape(goshort and isshort ? high : na, location=location.abovebar, style=shape.labeldown, color=color.new(#BF217C, 0), size=size.small, title='Sell')

plotshape(showendlabels and endlong and islong ? high : na, location=location.abovebar, style=shape.xcross, color=color.new(#2E7C13, 0), size=size.tiny, title='Exit Long')

plotshape(showendlabels and endshort and isshort ? low : na, location=location.belowbar, style=shape.xcross, color=color.new(#BF217C, 0), size=size.tiny, title='Exit Short')

alertcondition(golong, title='Long Signal', message='D-RSI: Long Signal')

alertcondition(goshort, title='Short Signal', message='D-RSI: Short Signal')

alertcondition(endlong, title='Exit Long Signal', message='D-RSI: Exit Long')

alertcondition(endshort, title='Exit Short Signal', message='D-RSI: Exit Short')

strategy.entry('long', strategy.long, when=golong and islong)

strategy.entry('short', strategy.short, when=goshort and isshort)

strategy.close('long', when=endlong and islong)

strategy.close('short', when=endshort and isshort)