概述

本策略是一个基于Tillson T3指标的趋势跟踪交易系统。它利用多重指数移动平均线(EMA)的交叉来生成买卖信号,并在TradingView平台上进行回测。该策略的核心思想是通过Tillson T3指标捕捉市场趋势,在上升趋势中开多仓,下降趋势中开空仓,以实现盈利。

策略原理

Tillson T3指标计算:

- 首先计算(高+低+2*收盘)/4的EMA

- 然后连续计算5次EMA,得到e1到e6

- 最后根据特定系数计算T3值

信号生成:

- 多头信号:当T3值上穿其前一个值时

- 空头信号:当T3值下穿其前一个值时

交易执行:

- 出现多头信号时,开多仓

- 出现空头信号时,开空仓

可视化:

- 多头信号:图表下方绿色向上箭头

- 空头信号:图表上方红色向下箭头

策略优势

趋势跟踪:Tillson T3指标能有效捕捉市场趋势,减少假突破。

灵活性:通过调整长度和成交量因子,可适应不同市场环境。

视觉反馈:清晰的图形信号有助于交易决策。

自动化:可在TradingView平台上实现自动交易。

风险管理:使用资金百分比进行头寸管理。

策略风险

趋势反转:在震荡市场可能产生频繁假信号。

滞后性:作为滞后指标,可能错过趋势初期机会。

过度交易:频繁信号可能导致过度交易,增加成本。

参数敏感:性能高度依赖于参数设置。

单一指标:仅依赖Tillson T3可能忽视其他重要市场信息。

策略优化方向

多指标结合:引入RSI、MACD等指标进行信号确认。

止损优化:加入动态止损,如跟踪止损,提高风险管理能力。

时间框架分析:结合多个时间框架分析,提高信号可靠性。

波动率调整:根据市场波动调整仓位大小,优化风险收益比。

市场状态识别:加入市场状态判断逻辑,在不同市场环境下采用不同策略。

总结

多重均线交叉趋势跟踪策略是一个基于Tillson T3指标的自动化交易系统。它通过捕捉市场趋势来生成交易信号,具有趋势跟踪能力强、操作简单明确的优势。然而,该策略也面临着震荡市场假信号频繁、信号滞后等风险。通过多指标结合、优化止损策略、引入多时间框架分析等方式,可以进一步提升策略的稳定性和盈利能力。总的来说,这是一个具有良好基础的策略框架,通过持续优化和实盘测试,有望成为一个可靠的自动化交易系统。

策略源码

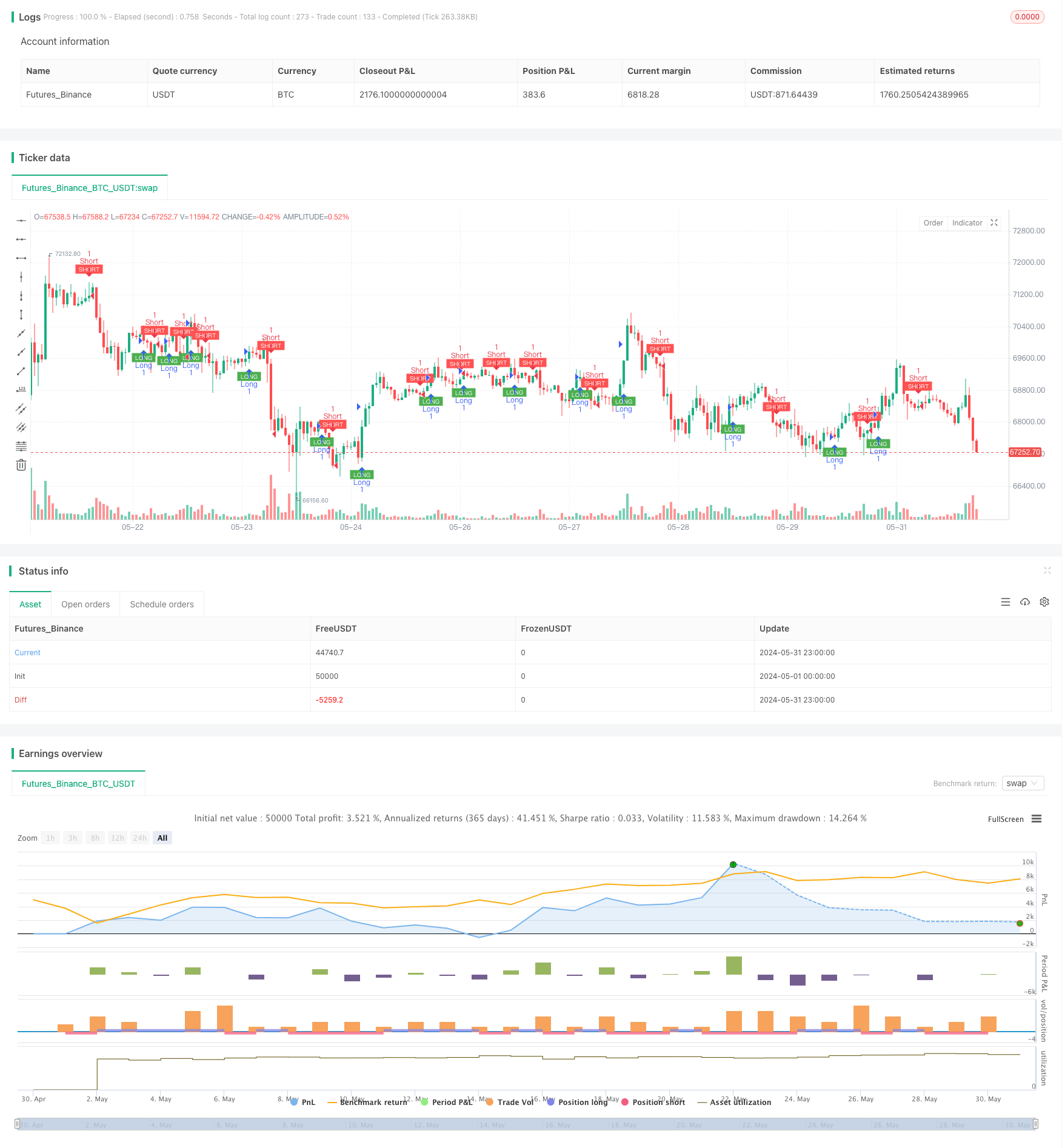

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hashtag Signals and Backtest", overlay=true)

// Input parameters for indicators

length1 = input(8, "T3 Length")

a1 = input(0.7, "Volume Factor")

// Tillson T3 Calculation

e1 = ema((high + low + 2 * close) / 4, length1)

e2 = ema(e1, length1)

e3 = ema(e2, length1)

e4 = ema(e3, length1)

e5 = ema(e4, length1)

e6 = ema(e5, length1)

c1 = -a1 * a1 * a1

c2 = 3 * a1 * a1 + 3 * a1 * a1 * a1

c3 = -6 * a1 * a1 - 3 * a1 - 3 * a1 * a1 * a1

c4 = 1 + 3 * a1 + a1 * a1 * a1 + 3 * a1 * a1

T3 = c1 * e6 + c2 * e5 + c3 * e4 + c4 * e3

// Signal conditions

longSignal = crossover(T3, T3[1])

shortSignal = crossunder(T3, T3[1])

// Plotting signals

plotshape(series=longSignal, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="LONG", textcolor=color.white, size=size.tiny)

plotshape(series=shortSignal, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SHORT", textcolor=color.white, size=size.tiny)

// Strategy Entries for Backtest

if (longSignal)

strategy.entry("Long", strategy.long)

if (shortSignal)

strategy.entry("Short", strategy.short)

// Alerts

alertcondition(longSignal, title="BUY", message="BUY!")

alertcondition(shortSignal, title="SELL", message="SELL!")

相关推荐