Multi-Technical Indicator Trend Following Trading Strategy

Author: ChaoZhang, Date: 2024-12-12 11:00:01Tags: RSIMACDSMATPSLTS

Overview

This strategy is a trend-following trading system that combines multiple technical indicators. It integrates RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and SMA (Simple Moving Average) to execute trades when market trends are clearly defined. The strategy also incorporates take profit, stop loss, and trailing stop mechanisms for better risk management.

Strategy Principles

The strategy executes trades based on the following core conditions: 1. MACD shows a golden cross (MACD line crosses above the signal line) 2. RSI is below 70, avoiding overbought territories 3. Price is above the short-term moving average (20-day SMA) 4. Short-term moving average is above the long-term moving average (50-day SMA)

When all these conditions are met simultaneously, the system generates a long signal. Additionally, the strategy sets a 5% take profit target, 3% stop loss limit, and 2% trailing stop to protect accumulated profits. This multi-layered approach to trade conditions helps improve accuracy and security.

Strategy Advantages

- Integration of multiple technical indicators enhances signal reliability

- RSI filtering prevents entries in overbought areas

- Moving average system helps confirm medium to long-term trends

- Comprehensive risk management system including fixed and trailing stops

- Flexible parameter adjustment for different market conditions

- Customizable date range for backtesting and live trading

Strategy Risks

- Multiple indicators may lead to delayed signals

- False signals may occur in ranging markets

- Fixed take profit and stop loss levels may not suit all market conditions

- Trailing stops might exit profitable trades too early in volatile markets Mitigation measures include: adjusting indicator parameters, adapting profit/loss ratios to market characteristics, and adding market environment filters.

Optimization Directions

- Incorporate volatility indicators (like ATR) for adaptive profit/loss levels

- Add volume indicators to validate signal strength

- Implement market condition analysis for parameter adaptation

- Optimize MACD parameters for more timely signals

- Consider adding reversal signals for short positions These optimizations would enhance strategy adaptability and stability.

Summary

This strategy establishes a comprehensive trading system through the combination of multiple technical indicators. It encompasses both trend-following logic and risk management considerations. While there are areas for optimization, the overall framework provides good scalability and adaptability. Successful implementation requires traders to optimize parameters and improve the strategy based on actual market conditions.

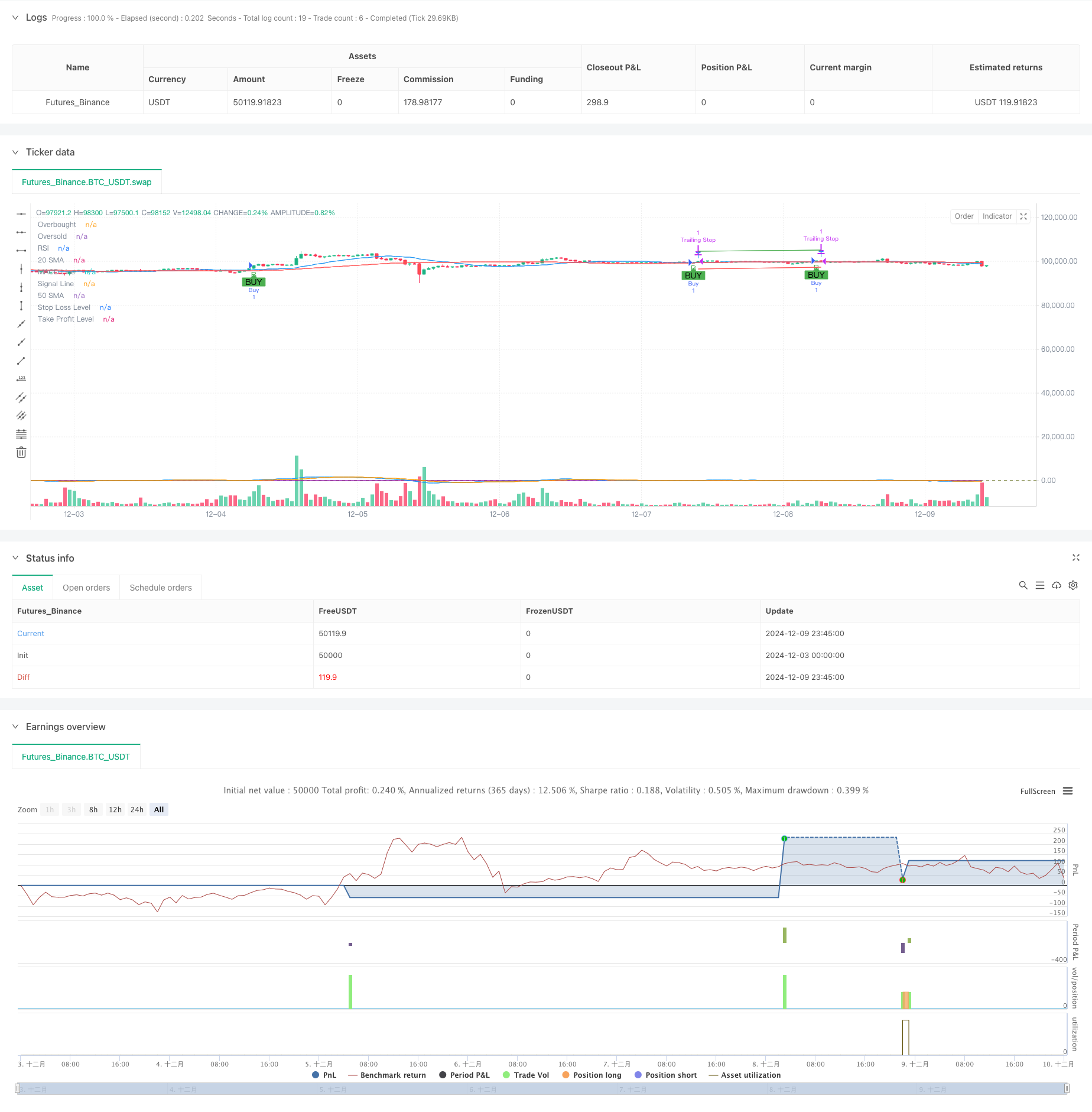

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 45m

basePeriod: 45m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Flexible Swing Trading Strategy with Trailing Stop and Date Range", overlay=true)

// Input parameters

rsiPeriod = input.int(14, title="RSI Period")

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

smaShortPeriod = input.int(20, title="Short-term SMA Period")

smaLongPeriod = input.int(50, title="Long-term SMA Period")

takeProfitPercent = input.float(5.0, title="Take Profit Percentage")

stopLossPercent = input.float(3.0, title="Stop Loss Percentage")

trailingStopPercent = input.float(2.0, title="Trailing Stop Percentage")

// Date range inputs

startDate = input(timestamp("2023-01-01 00:00"), title="Start Date")

endDate = input(timestamp("2023-12-31 23:59"), title="End Date")

// Calculate RSI

rsi = ta.rsi(close, rsiPeriod)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

// Calculate SMAs

smaShort = ta.sma(close, smaShortPeriod)

smaLong = ta.sma(close, smaLongPeriod)

// Buy condition

buyCondition = ta.crossover(macdLine, signalLine) and rsi < 70 and close > smaShort and smaShort > smaLong

// Execute buy orders within the date range

if (buyCondition )

strategy.entry("Buy", strategy.long)

// Calculate take profit and stop loss levels

takeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercent / 100)

stopLossLevel = strategy.position_avg_price * (1 - stopLossPercent / 100)

// Set take profit, stop loss, and trailing stop

strategy.exit("Take Profit", "Buy", limit=takeProfitLevel)

strategy.exit("Stop Loss", "Buy", stop=stopLossLevel)

strategy.exit("Trailing Stop", "Buy", trail_price=close * (1 - trailingStopPercent / 100), trail_offset=trailingStopPercent / 100)

// Plot Buy signals

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

// Plot SMAs

plot(smaShort, color=color.blue, title="20 SMA")

plot(smaLong, color=color.red, title="50 SMA")

// Plot MACD and Signal Line

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="Signal Line")

// Plot RSI

hline(70, "Overbought", color=color.red)

hline(30, "Oversold", color=color.green)

plot(rsi, color=color.purple, title="RSI")

// Debugging plots

plotchar(buyCondition , char='B', location=location.belowbar, color=color.green, size=size.small)

plotchar(strategy.opentrades > 0, char='T', location=location.abovebar, color=color.blue, size=size.small)

plot(stopLossLevel, color=color.red, title="Stop Loss Level")

plot(takeProfitLevel, color=color.green, title="Take Profit Level")

- Volume-based Dynamic DCA Strategy

- Multi-Target Intelligent Volume Momentum Trading Strategy

- Dual Moving Average Trend Following Strategy with RSI Filter

- Dual Moving Average-RSI Synergy Options Quantitative Trading Strategy

- Moving Average Crossover with RSI Trend Momentum Tracking Strategy

- Multi-MA Crossover with RSI Dynamic Trailing Stop Loss Quantitative Trading Strategy

- Trend Following RSI and Moving Average Combined Quantitative Trading Strategy

- OBV-SMA Crossover with RSI Filter Multi-Dimensional Momentum Trading Strategy

- Multi-Indicator Dynamic Trading Strategy

- Dynamic ATR Stop-Loss RSI Oversold Rebound Quantitative Strategy

- Adaptive Trailing Drawdown Balanced Trading Strategy with Take-Profit and Stop-Loss

- Enhanced Trend Following System: Dynamic Trend Identification Based on ADX and Parabolic SAR

- Dual Timeframe Stochastic Momentum Trading Strategy

- Adaptive Bollinger Bands Dynamic Position Management Strategy

- Dynamic RSI Smart Timing Swing Trading Strategy

- Bidirectional Trading Strategy Based on Candlestick Absorption Pattern Analysis

- Bollinger Breakout with Mean Reversion 4H Quantitative Trading Strategy

- Trend Following Dynamic Grid Position Sizing Strategy

- Dual BBI (Bulls and Bears Index) Crossover Strategy

- Dynamic Long/Short Swing Trading Strategy with Moving Average Crossover Signal System

- Advanced Volatility Mean Reversion Trading Strategy: Multi-Dimensional Quantitative Trading System Based on VIX and Moving Average

- Gold Trend Channel Reversal Momentum Strategy

- Advanced EMA Momentum Trend Trading Strategy

- Multi-MA Trend Intensity Trading Strategy - A Flexible Smart Trading System Based on MA Deviation

- Volume-Weighted Dual Trend Detection System

- Multi-Factor Counter-Trend Trading Strategy

- Enhanced Momentum Oscillator and Stochastic Divergence Quantitative Trading Strategy

- Multi-Timeframe Fibonacci Retracement with Trend Breakout Trading Strategy

- Multi-Indicator Trend Following Strategy with Profit Optimization

- Fractal Breakout Momentum Trading Strategy with Take Profit Optimization